3 Keys To Twitter's Turnaround

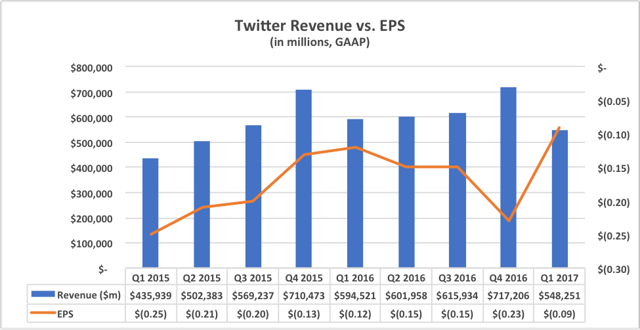

On 26 April 2017, Twitter (NYSE: TWTR) released 1Q FY2017 earnings that exceeded top- and bottom-line consensus expectations. Revenues of $548M (-7.8% y/y) beat by $36.1M, and non-GAAP EPS of $0.11 beat by $0.10. Year-over-year increases in MAUs (Monthly Active Users), average daily active usage, and live streaming hours and viewers also boosted investor confidence. Twitter closed the day +$1.16 to $15.82 (+7.91%).

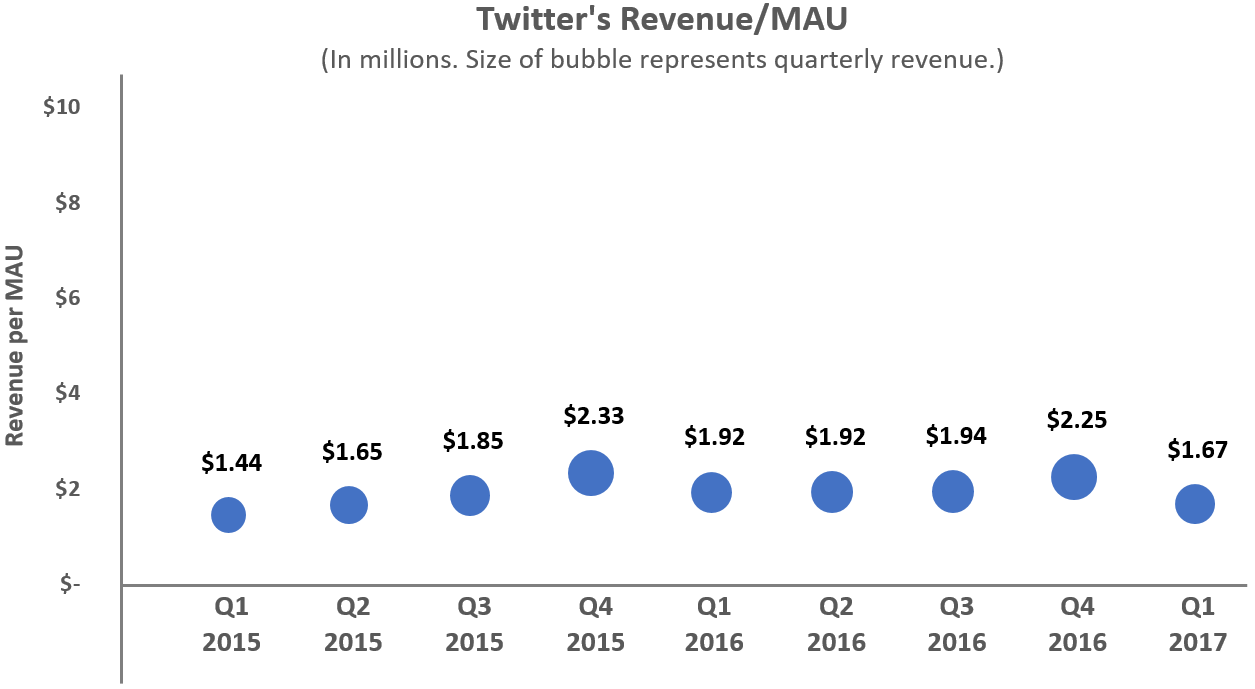

On the bright side, Twitter beat the (already low) consensus estimates for its earnings. On the not-so-bright side, revenue dropped -23.8% vs. the prior quarter, a sign that advertisers are not as enamored with Twitter as they were last year, resulting in a steep drop in ARPU (average revenue per user) from $2.25/MAU to $1.67/MAU - its lowest since 3Q 2015.

(Click on image to enlarge)

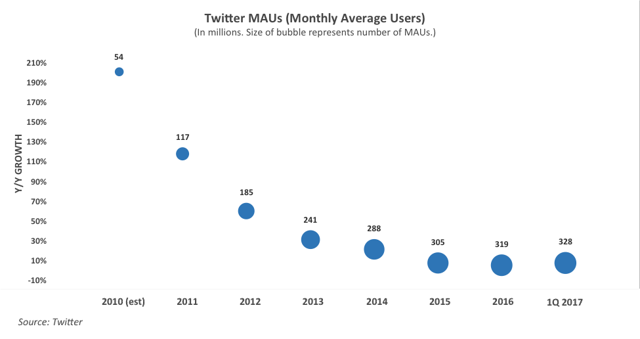

The addition of 9M new MAUs was a slight positive, up +2.82% q/q and +5.8% y/y, with new international MAUs outgrowing US MAUs 3-to-1. Perhaps the biggest boost, however, was the +14% y/y increase in DAUs (Daily Active Users), a number Twitter has released sparingly in the past. Twitter's DAU growth is compelling because it suggests the possibility of daily engagement (and advertising revenue) opportunities.

Of concern, however, is that Twitter has never really defined what it means to be an "active" user - is it posting a Tweet? Engaging with an Ad? Or merely logging on?

Three keys to Twitter's value moving forward

As we've written in the past (see TweetDeck Can't Cure Twitter's Zero Growth Problem), Twitter has a growth problem and a management problem: it has not, over its entire lifespan, been consistent and clear about what it wants to be when it grows up. But could that be changing?

With a slight uptick in both MAU and DAU numbers, Twitter may be in a position to better monetize its existing base (it's not totally clear if those user increases are the result of new sign-ups or the result of existing users becoming more active, perhaps in response to better content, video, live streaming, engagement, etc.).

That said, there are three critical steps that we believe Twitter must execute at present in order to keep this momentum moving forward and to bring advertisers back into the fold.

1. Activate the Inactive

We are always looking to see new user growth when evaluating internet companies, as well as their ability to identity and expand into new market opportunities. But Twitter has over 700M users that are NOT in the MAU category - users that have left the flock, so to speak. It must find a way to reactivate those users by demonstrating (i.e., providing) compelling content and value.

Twitter's recent hint that it might try to monetize its "professional" base of business and social marketers is interesting, but nothing at this point compares to increasing the level of engagement of existing registered users (many of whom have either drifted away from social altogether or are now spending more time on Facebook (Nasdaq: FB), Snapchat, Instagram, etc.).

We'd like to see Twitter continue to improve on its number of DAUs as well, increasing growth into the +20% y/y range during 2Q 2017.

2. Verified Channelization (Lists)

Twitter has great raw discovery features, well beyond Facebook and Snapchat - its open follow and global search are unmatched. However, it lacks organized discovery and the ability to easily follow topics, types of content, or even groups of users.

Twitter's list function, where a user can group together individuals to follow, is a good start, but Twitter has never developed the ability for users to easily switch (like a channel) between lists, or to identify verified lists of value. TweetDeck, with its ability to view multiple lists simultaneously on a computer screen (something matched by social marketer Hootsuite), is probably the best bet for trying to curate, aggregate, and search tweets - but even this missed the point.

We'd like to see Twitter implement verified channels and to provide the ability to easily move (e.g., like swiping on Snapchat) between news, entertainment, sports, and politics (and perhaps even customer support, an area where Twitter has great potential but limited offerings). This will be a critical enabler for the next step: live video.

3. Streaming (i.e., Live) Video

Twitter spends close to a billion dollars a year on infrastructure and has experimented with video (including 800 hours of live video in 1Q 2017). It has correspondingly experienced both successes (live gaming events) and failures (live NFL events). But we'd like to see Twitter expand on this effort and formalize both programmed and on-demand video feeds, tied both to users and to verified brands (e.g., Premier League, CNN, FOX, ESPN, etc.).

Video, perhaps more than any other offering, delivers a solid opportunity for embedded advertising. Users can already share video links, just like news stories, but those links connect to external sources. Here, we're talking about channels delivered via Twitter, most likely to mobile users, with the added value of engaging socially (the first AND second screens combined). It's recent announcement with Bloomberg, to offer 24x7 streaming news through Twitter's platform, is a sign they are moving in the right direction (now to see if they effectively channelize the offering and can bring on additional content partners).

Interestingly, Snap (NYSE: SNAP) is going after a similar idea by promoting 3rd-party video content from existing brands and by offering users the ability to follow/subscribe (with the goal of increasing its rev/user - note that video can be a very sticky medium and a great mechanism to introduce short ad content).

Snap's current offerings (including those of investor NBCUniversal) have been well-received and will likely lead to a greater level of live content moving forward. We believe Twitter has the opportunity to get out ahead of Snap (and possibly Facebook), becoming somewhat of an alternative for users looking to cut-the-cable-cord.

If Twitter really does want to be a "platform" when it grows up (a recurring management theme), it needs to start acting like one.

Here's an expanded dive into Twitter's performance and challenges, with Fred McClimans, Samadhi's Head of Research, from Cheddar's Opening Bell at the NYSE (Wed, April 26, 2017):

Audio Length: 00:07:55

Excellent job highlighting #Twitter's possible potential and shortcomings. I think you've hit the nail on the head regarding the problems the company needs to overcome. But being that they've yet to figure it out, despite having more than enough time to do so, makes me wary of $TWTR.

Thanks, Kurt. I'm a bit wary as well, but view the Bloomberg deal (and others) as a sign the team is at least gaining a bit of focus in the right direction. If Twitter can conquer the channelization and video aspects, I would expect the user activity gains to follow (assuming bots & trolls are addressed). It is a big change, but at this point, I believe there are not many other viable options left.