3 Bullish And 3 Risky Forces Shaping American Express Stock Into 2026

Image Source: Unsplash

American Express is often viewed as a mature, well understood credit card company, but its role in the financial system is broader than many investors realize.

It sits at the center of consumer spending, business payments, travel, credit risk, and data driven decision making. As these areas evolve, the dynamics shaping American Express stock are becoming more complex and, in some cases, less obvious.

Premium consumer behavior, business spending patterns, regulatory scrutiny, and technological change are all influencing how payment companies operate and compete.

While American Express stock may appear stable on the surface, there are multiple forces working in parallel that could meaningfully shape its trajectory over the next few years. Some of these forces support the business model, while others introduce new risks that deserve careful attention.

This combination of stability and tension is what makes American Express an interesting company to analyze today. Rather than focusing on short term price movements or headlines, this analysis aims to understand the underlying drivers that could influence the stock into 2026. To do that, a structured framework is used to separate signal from noise and assess the company from multiple angles.

The IDDA Analysis framework is used to analyze companies and determine which are right for you. There are five steps to the process:

- Capital Analysis – Your personal risk tolerance.

- Intentional Analysis – Your unique financial goals and timelines based on your age, health, and lifestyle.

- Fundamental Analysis – The viability of the asset based on company performance, financial health, and market position.

- Sentimental Analysis – The current emotions of Wall Street and other market participants.

- Technical Analysis – Historical price action to identify key psychological levels and market patterns.

Let’s dive into the IDDA analysis to assess American Express (AXP)’s fundamental, sentimental, and technical outlook.

IDDA Point 1&2: Capital & Intentional

The capital and intentional analysis need to be conducted by you.

Select your assets in alignment with your financial goals. Listen to your intuition about each asset, but remember to invest based on your own values, not just because of recommendations from others.

IDDA Point 3: Fundamental

Revenue and earnings growth remain positive but are normalizing

Across the first three quarters of 2025, American Express continued to grow both revenue and earnings compared to 2024. Growth is supported by card member spending, interest income, and fee revenue. While growth is slower than the post-pandemic rebound years, it remains steady and more resilient than many consumer finance peers, suggesting a shift toward more sustainable long-term growth.

Strong profitability reflects a high-quality business model

American Express remains highly profitable, generating strong returns from the money shareholders invest in the company. In Q3 2025, return on equity was around 34 percent, showing that the company is efficient at turning capital into profit. This level of profitability supports continued investment in technology, rewards, and customer experience.

Margins show early signs of pressure

Although profits remain strong, the company is keeping slightly less of each dollar it earns compared to earlier in the year. Net margins declined modestly in 2025, which may reflect higher operating costs, increased rewards spending, or competitive pressure. This is not a major concern yet, but it is an early signal worth watching.

Business expansion beyond traditional credit cards

American Express continues to expand into business services such as expense management and payment solutions. The acquisition of Center and increased focus on small and mid-sized businesses signal a strategy to build deeper relationships beyond card usage. These initiatives aim to increase customer loyalty and long-term value rather than drive short-term revenue spikes.

Stable and disciplined debt management

Debt levels have remained stable through 2025, which is important for a financial company that relies on borrowing to fund lending. American Express also improved its ability to cover interest payments, meaning it generates enough income to comfortably service its debt. This reduces financial risk and supports balance sheet stability.

Industry competition and regulatory uncertainty

The payments and credit card industry is becoming more competitive, especially in premium products. At the same time, ongoing discussions around fees and consumer protection regulations create uncertainty. While American Express is well positioned, these industry-level pressures could affect growth and profitability over time.

Fundamental risk: Medium

American Express shows solid fundamentals with steady growth, strong profitability, and disciplined risk management. However, margin pressure, competitive intensity, and regulatory uncertainty remain important factors to monitor.

IDDA Point 4: Sentimental

Overall sentiment is bullish for American Express.

Strengths

Investors generally view American Express as a high quality and defensive name within the financial sector, supported by its premium brand and affluent customer base.

Management commentary has remained confident, with leadership emphasizing resilient spending trends, disciplined credit management, and continued investment in long term growth initiatives.

The stock benefits from optimism around premium consumer behavior, as higher income cardholders are perceived to be more resilient during economic slowdowns.

American Express is often grouped with stronger financial franchises rather than mass market lenders, which supports relative investor confidence.

Risks

Broader market concerns about consumer credit quality create ongoing caution toward all financial stocks, even those with stronger customer profiles.

Economic uncertainty and interest rate expectations can quickly shift sentiment, leading to volatility regardless of company specific performance.

Regulatory discussions around payment fees and consumer protection continue to create headline risk, which can weigh on sentiment even before any concrete changes occur.

Increased competition in premium credit cards raises concerns about the sustainability of rewards, pricing power, and long term margins.

Sentimental risk: Medium

Investor sentiment toward American Express is generally positive but remains sensitive to macroeconomic data, regulatory headlines, and shifts in the broader financial sector narrative.

IDDA Point 5: Technical

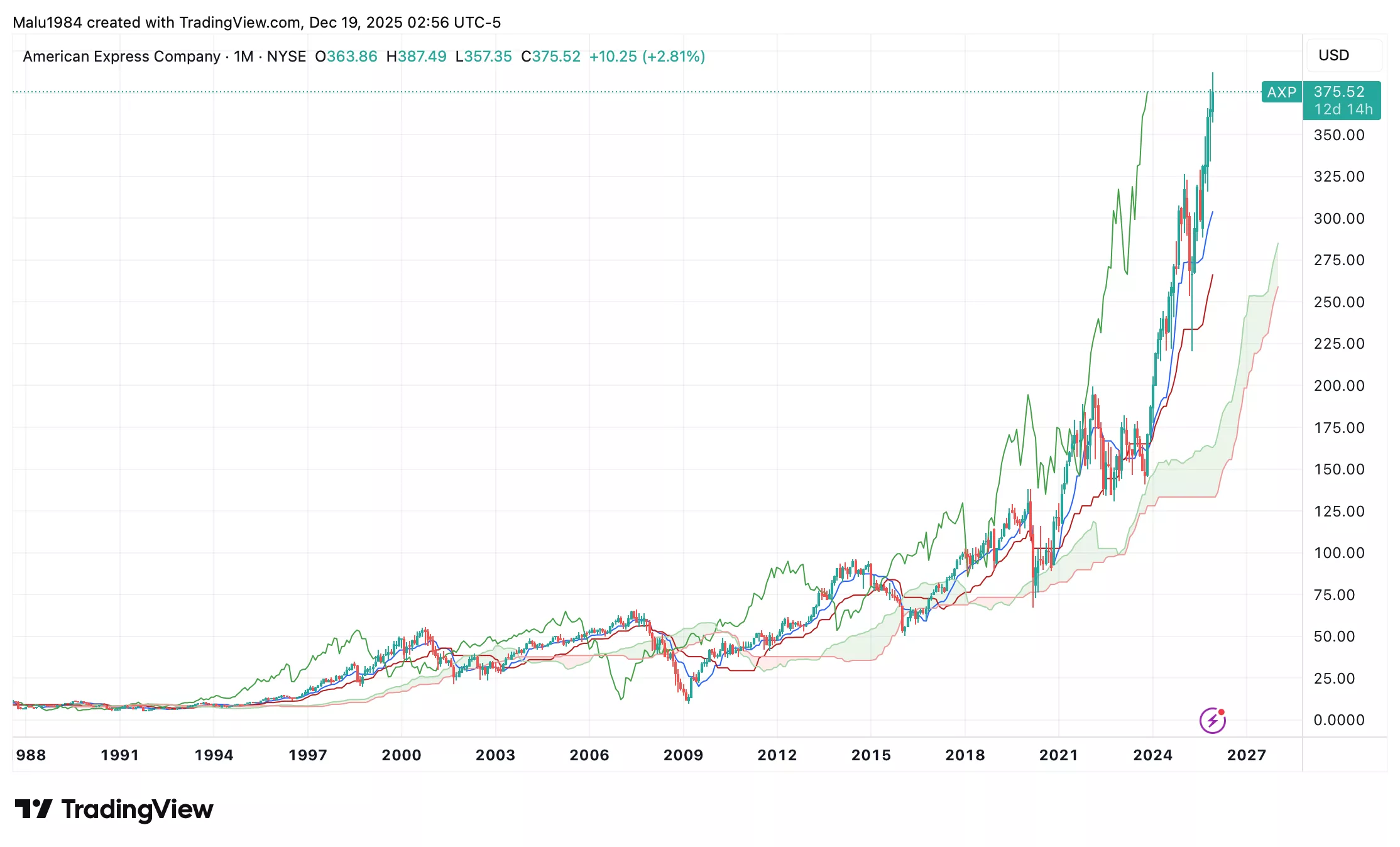

Monthly Chart

Price remains in a strong long term uptrend

The monthly chart shows American Express trading well above the Ichimoku Cloud, which confirms a strong and established long term bullish trend. When price stays far above the cloud, it usually signals long term strength rather than short term speculation.

Bullish Ichimoku structure remains intact

The conversion line is above the baseline, which is known as a bullish crossover or golden cross. This indicates upward momentum is still dominant on a long term basis. The future cloud is green and sloping upward, suggesting the trend remains supported ahead.

No major bearish reversal patterns visible

There are no clear topping patterns such as head and shoulders or long term distribution structures on the monthly chart. This suggests the broader trend remains intact rather than nearing exhaustion.

(Click on image to enlarge)

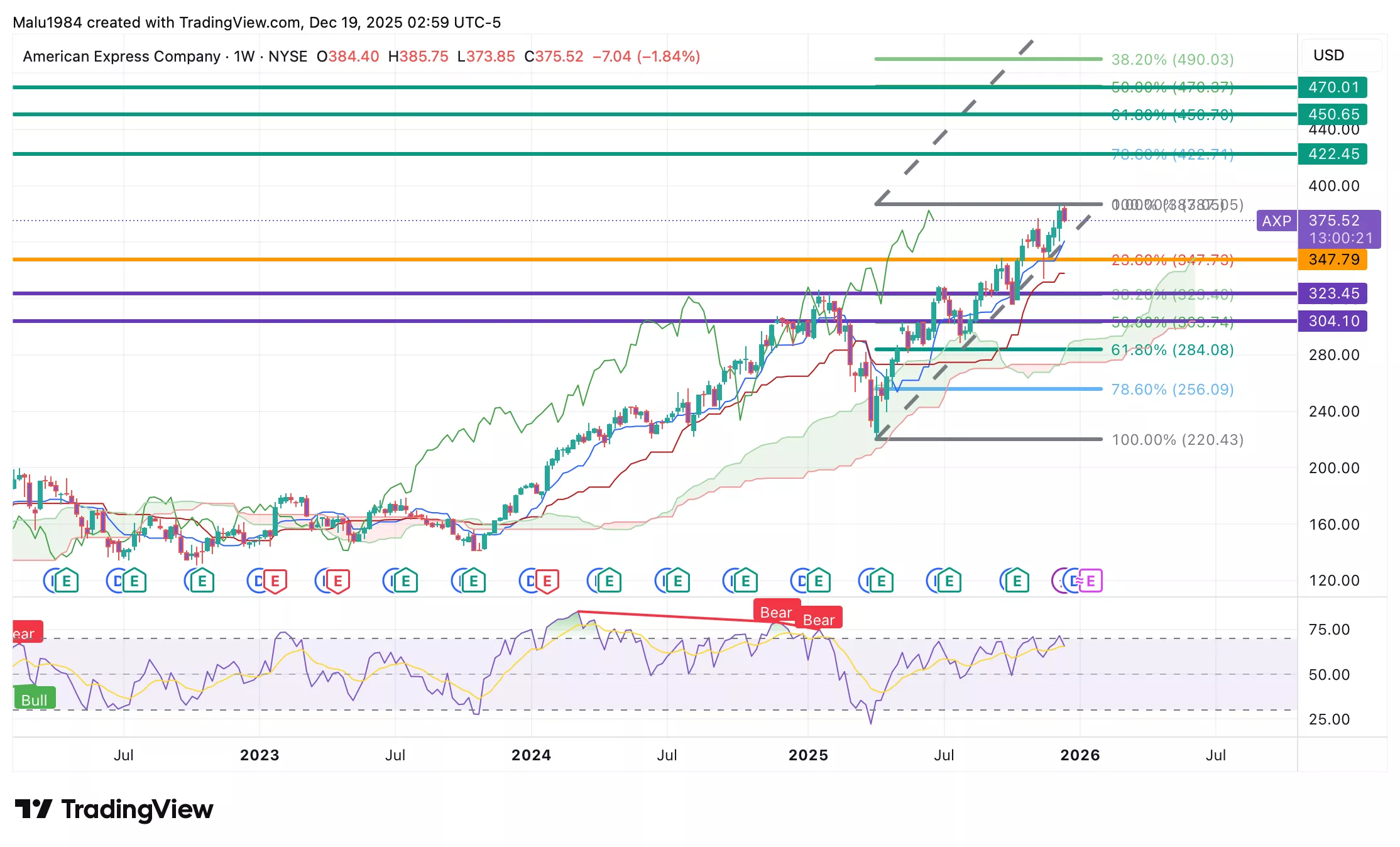

Weekly Chart

Bullish trend confirmed on the weekly timeframe

Price continues to trade above the Ichimoku Cloud on the weekly chart, reinforcing the bullish structure seen on the monthly timeframe. This alignment across timeframes strengthens the overall trend.

Bullish Tenkan and Kijun alignment

The conversion line remains above the baseline, confirming continued bullish momentum. This indicates buyers are still in control, even if the pace of the move has slowed slightly.

RSI shows healthy momentum with mild cooling

The RSI is currently around 65, after recently reaching near 70. This suggests momentum remains strong but is no longer overextended. A small pullback or consolidation would be normal and does not automatically signal weakness.

(Click on image to enlarge)

Technical Summary

Overall, the technical outlook for American Express remains bullish across both monthly and weekly charts. The long term trend is strong, supported by bullish Ichimoku signals and healthy momentum. While short term consolidation is possible as momentum cools slightly, there are no major technical signals suggesting a trend reversal at this stage.

Buy Limit (BL) levels:

$347.79 (High Fill Probability)

$323.45 (Moderate Fill Probability)

$304.10 (Low Fill Probability)

Profit Taking Levels (PTs)

$422.45 (High Fill Probability)

$450.65 (Moderate Fill Probability)

$470.01 (Low Fill Probability)

Here are the Invest Diva ‘Confidence Compass’ questions to ask yourself before buying at each level:

- If I buy at this price and the price drops by another 50%, how would I feel? Would I panic, or would I buy more to dollar-cost average at lower prices? (hint: this question also reveals your CONFIDENCE in the asset you’re planning to invest in).

- If I don’t buy at this price and the stock suddenly turns around and starts going up again, will I beat myself up for not having bought at this level?

Remember: Investing is personal, and what is right for me might not be right for you. Always do your own due diligence. You should ONLY invest based on your own risk tolerance and your timeframe for reaching your portfolio goals

Technical risk: Low to Medium

The technical structure remains strongly bullish across both monthly and weekly timeframes, with price holding well above the Ichimoku Cloud and bullish crossovers still intact. However, momentum on the weekly chart is cooling slightly as RSI pulls back from overbought levels. This introduces the possibility of short term consolidation or shallow pullbacks, but does not currently threaten the broader uptrend.

Summary: Final Thoughts

American Express stock continues to show strength, but it is not without tension. Fundamentally, the business is supported by a premium customer base, solid profitability, and disciplined risk management, even as growth normalizes and margins face mild pressure.

Sentiment is cautiously positive, though sensitive to macro data, regulatory headlines, and consumer credit trends. Technically, the stock remains in a strong long term uptrend, signaling continued market support.

Three bullish forces stand out: resilient premium spending, expansion beyond cards into business services, and a bullish technical structure. Three key risks remain: rising credit stress, regulatory uncertainty, and intensifying competition.

Overall outlook: Cautiously bullish

Overall risk: Medium

American Express appears well positioned, but execution and macro conditions will matter into 2026.

More By This Author:

Micron Stock Surges After Blowout Earnings: Is MU Still A Buy In 2026?

Marvell Stock: The Hidden AI Powerhouse Wall Street Keeps Underestimating

2 Months Ago Oracle Stock Was Flying And Now… The Mood Has Flipped. Is A Comeback Still On The Table?