2023 Q1 Earnings Preview: What Are Estimates Telling Us?

The 2022 Q4 earnings reports displayed that contrary to fears of an impending earnings cliff, companies were largely able to protect their bottom lines.

We are not suggesting that the earnings picture that came out through the preceding reporting cycle was great, but rather that it proved to be much more stable and resilient than many had been willing to give credit to.

Actual Q4 results came in better than expected, but that didn’t mean much in terms of earnings growth. Not much of a surprise on that count either, given where we are in the economic cycle and the multitude of headwinds facing corporate profitability.

We all know that the lagged effect of the extraordinary tightening already implemented and the incremental rate hikes ahead, including in this month’s Fed meeting, will at least slow down the economy, if not push into a recession as many have started to fear.

In fact, many in the market fear that the unusual strength in the U.S. economy, as reconfirmed by Friday’s February jobs report, will force the Fed to stay in the tightening mode longer than would have been the case otherwise. This is showing up in the market’s evolving expectations of the Fed Funds ‘exit rate’, the final level at which the central bank concludes the ongoing tightening cycle. Many are now penciling in an exit rate of 6% or higher, up from their earlier projections of about 5.5%.

All of this has direct earnings implications for the U.S. economy’s growth trajectory and the health of corporate profitability.

To get a sense of what is currently expected, look at the chart below that shows current earnings and revenue growth expectations for the S&P 500 index for 2023 Q1 and the following three quarters.

Image Source: Zacks Investment Research

As you can see here, 2023 Q1 earnings are expected to be down -9.4% on +1.8% higher revenues. This would follow the -5.7% earnings decline in the preceding period (2022 Q4) on +5.6% higher revenues.

Embedded in these 2023 Q1 earnings and revenue growth projections is the expectation of continued margin pressures, which has been a recurring theme in recent quarters. The chart below shows net income margins for the S&P 500 index.

Image Source: Zacks Investment Research

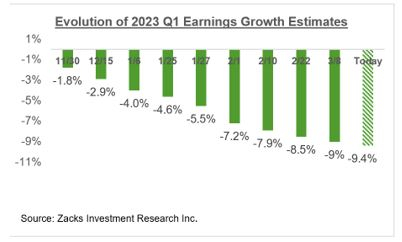

Analysts have been steadily lowering their estimates for Q1, a trend that we saw ahead of the start of the last few reporting cycles as well. To give full context, this behavior of negative estimate revisions just ahead of the beginning of the reporting cycle for that period is far from the course, historically speaking. We saw this shift during Covid when estimates started going up for some time. But that trend ‘normalized’ last year and hence the negative revisions to 2023 Q1 estimates, as the chart below shows.

Image Source: Zacks Investment Research

Please note that while 2023 Q1 estimates have come down, the magnitude of negative revisions compares favorably to what we saw in the comparable periods to the preceding couple of quarters. In other words, estimates haven’t fallen as much as they did in the last few quarters.

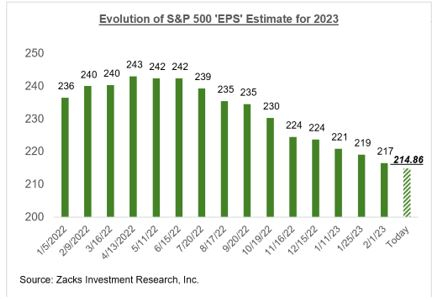

Estimates for full-year 2023 have also been coming down, as we have consistently pointed out in these pages. The chart below shows how the aggregate 2023 S&P 500 earnings.

Image Source: Zacks Investment Research

As we have been pointing out all along, 2023 earnings estimates peaked in April 2022 and have been coming down ever since. Since the mid-April peak, aggregate earnings have declined by -12.6% for the index as a whole and -14.5% for the index on an ex-Energy basis, with the declines far bigger in a number of major sectors.

You have likely read about the roughly -20% cuts to S&P 500 earnings estimates, on average, in response to recessions.

Many in the market interpret this to mean that estimates still have plenty to fall in the days ahead. But as the aforementioned magnitude of negative revisions at -11.7% on an ex-Energy basis shows, we have already traveled a fair distance in that direction. Importantly, some key sectors in the path of the Fed’s tightening cycle, like Construction, Retail, Discretionary, and even Technology, have already gotten their 2023 estimates shaved off by a fifth since mid-April.

We are not saying that estimates don’t need to fall any further. But rather that the bulk of the cuts are likely behind us, particularly if the coming economic downturn is a lot less problematic than many seem to assume or fear.

Please note that the $1.903 trillion aggregate earnings estimate for the index in 2023 approximates to an index ‘EPS’ of $114.86, down from $221.22 in 2022. The chart below shows how this 2023 index ‘EPS’ estimate has evolved over time.

Image Source: Zacks Investment Research

The chart below shows the earnings and revenue growth picture on an annual basis.

Image Source: Zacks Investment Research

This Week’s Reporting Docket

The reality of an earning season is that it never ends completely. In fact, every quarter has this one period when the older reporting cycle hasn’t completely ended yet, but the new one has gotten underway.

We are in such an overlapping period at present, with a couple of 2022 Q4 results still awaited while the 2023 Q1 earnings season has gotten underway. Quarterly results in recent days from three S&P 500 members, Oracle (ORCL - Free Report), AutoZone (AZO - Free Report), and Costco (COST - Free Report), for their respective fiscal periods ending in February, form part of our 2023 Q1 tally. We have another four index members on deck to report fiscal February quarter results this week, including FedEx (FDX - Free Report), Adobe (ADBE - Free Report), and Lennar (LEN - Free Report).

The Q1 reporting cycle will really pick up steam when the big banks come out with their quarterly results on April 14th.

More By This Author:

Breaking Down Retail Earnings And Consumer Spending Trends

Previewing Walmart, Target And Retail Sector Earnings

Making Sense Of Earnings Revisions: Do They Support The Bullish Start To 2023?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more