Making Sense Of Earnings Revisions: Do They Support The Bullish Start To 2023?

Image Source: Pexels

With the bulk of the Q4 earnings season behind us, we can now say confidently that the overall picture that emerged from this reporting cycle is good enough; not great, but not bad either.

Not only has the feared earnings cliff been avoided once again, but we are starting to detect some early signs of stability and resilience in estimates for the current and coming periods.

The longstanding trend on the earnings revisions front still remains on the downside, with the outlook for a number of sectors on the weak side. But the more recent developments indicate a trend shift, likely suggesting that the worst of negative estimate revisions may now be behind us. Perhaps that’s what the ‘soft-landing’ camp had been talking about all along.

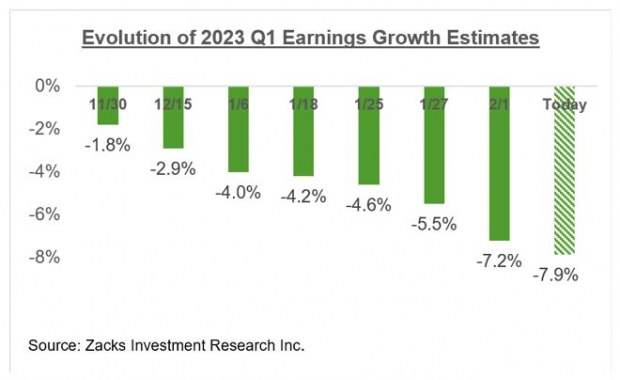

The chart below shows how estimates for the current period (2023 Q1) have evolved in recent weeks.

Image Source: Zacks Investment Research

Please note that while Q1 estimates are coming down, the pace and magnitude of cuts are notably below what we had seen ahead of the start of the last couple of earnings seasons.

The aforementioned stabilization in the revisions trend is more notable for full-year 2023 estimates for the S&P 500 index. The chart below shows the aggregate earnings total for the index since the start of last year.

Image Source: Zacks Investment Research

Please note that the $1.918 trillion in expected aggregate earnings for the index in 2023 is approximate to an index ‘EPS’ of $216.09, down from $216.60 last week and the $216.45 tally we are on track to have seen in 2022.

The chart below shows this 2023 index ‘EPS’ estimate has evolved since the start of 2022.

Image Source: Zacks Investment Research

We will see how the revisions trend unfolds as we go through the remainder of the 2022 Q4 reporting cycle.

Given the evolving macroeconomic environment, it is reasonable to not read too much into the revisions trend of the last few weeks. A definitive read on the revisions front will only emerge once we know for sure the end to the Fed’s tightening cycle and the impact of the cumulative tightening on economic growth. That said, relative to pre-season doom-and-gloom worries, this is a fairly reassuring outcome.

2022 Q4 Earnings Season Scorecard

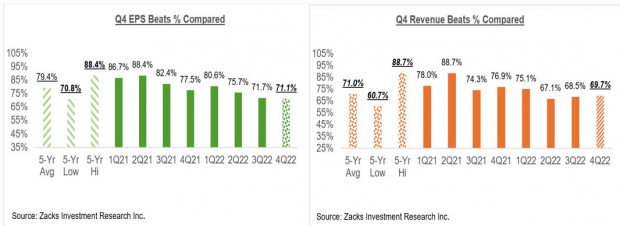

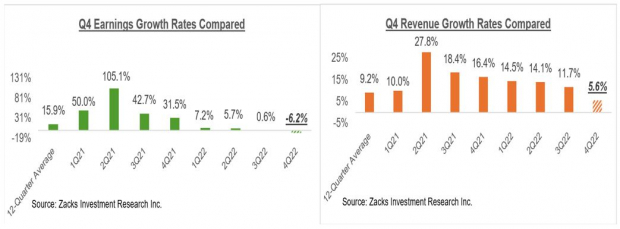

As of Friday, February 10th, we now have Q4 results from 346 S&P 500 members or 69.2% of the index’s total membership. Total earnings for these 346 index members are down -6.2% from the same period last year on +5.6% higher revenues, with 71.1% beating EPS estimates and 69.7% beating revenue estimates.

With 60 index members on deck to report Q4 results this week, we will have seen results from more than 81% of all the index members by the end of the week. The notable companies reporting results this week Coca Cola (KO - Free Report), Cisco (CSCO - Free Report), Applied Materials (AMAT - Free Report), and others.

The comparison charts below put the EPS and revenue beats percentages in Q4 in a historical context.

Image Source: Zacks Investment Research

The comparison charts below put the earnings and revenue growth rates in Q4 in a historical context.

Image Source: Zacks Investment Research

As you can see, there is a notable deceleration in the growth trajectory, both for earnings as well as revenues. Please note that this decelerating growth trend doesn’t change in any meaningful way whether we look at it on an ex-Finance or ex-Tech bases.

The Earnings Big Picture

The chart below shows the expected 2022 Q4 earnings and revenue growth in the context of where growth has been in recent quarters and what is expected in the next few quarters.

Image Source: Zacks Investment Research

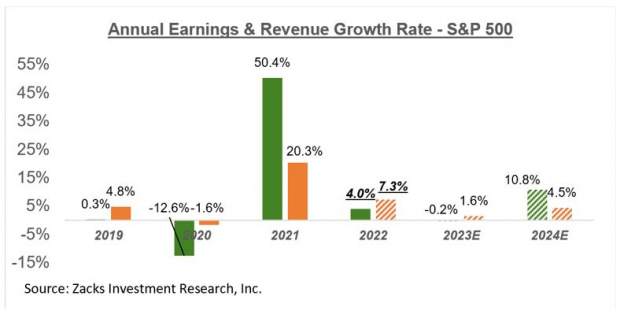

The chart below shows the overall earnings picture on an annual basis.

Image Source: Zacks Investment Research

As you can see here, estimates for 2023 are now a hair below the 2022 level.

More By This Author:

Making Sense Of Apple, Amazon And Big Tech Earnings

Q4 Earnings Season Scorecard And Analyst Reports for Apple, Meta & Mastercard

Will This Week's Big Tech Earnings Be A Train Wreck?

Disclosure: Zacks.com contains statements and statistics that have been obtained from sources believed to be reliable but are not guaranteed as to accuracy or completeness. References to any specific ...

more