10 High-Yield Stocks For Lasting Retirement Income

↵

Image Source: Pixabay

High-yield stocks pay out dividends that are significantly more than market average dividends. For example, the S&P 500’s current yield is only ~1.3%.

High-yield stocks can be very helpful to shore up income after retirement. A $120,000 investment in stocks with an average dividend yield of 5% creates an average of $500 a month in dividends.

We have created a spreadsheet of stocks (and closely related REITs and MLPs, etc.) with dividend yields of 5% or more…

High dividend stocks are naturally appealing for income investors such as retirees. High yield stocks can provide higher levels of retirement income.

Of course, investors always need to do their research, to make sure the underlying stock can sustain its dividend payout.

This article will provide an overview of why dividend stocks are appealing for retirees, as well as a list of 10 high yield stocks for lasting retirement income.

Why Buy High Dividend Stocks?

There are many good reasons why income investors should purchase high dividend stocks with yields above 5%.

First, dividends provide an important boost to a company’s total returns over time. Studies show that going back to 1960, 85% of the cumulative total return of the S&P 500 Index1 can be attributed to reinvested dividends and the power of compounding

Stocks that pay high dividends do not need to see their share prices expand as much as a non-dividend-paying stock in order to achieve the same total return.

Second, dividend stocks, and especially resilient dividend stocks that continue to pay dividends during tough times, can offset market declines during bear markets. While their share prices might dip temporarily, investors will at least still benefit from a steady income stream.

Third, when companies have a track record of paying out dividends, that has a disciplining effect on management.

Therefore, the following 10 high yield stocks could provide lasting retirement income. The 10 stocks below all have current yields above 5%, with Dividend Risk Scores of A or B in the Sure Analysis Research Database.

This combination results in a list of 10 high yield stocks that provide strong income now, with a good chance of maintaining their dividends in a recession.

High Yield Stock For Lasting Retirement Income: UGI Corp (UGI)

- Dividend Yield: 5.4%

UGI Corporation is a gas and electric utility that operates in Pennsylvania, in addition to a large energy distribution business that serves the entire US and other parts of the world.

It was founded in 1882 and has paid consecutive dividends since 1885. Its market capitalization is $6.2 billion. The company operates in four reporting segments: AmeriGas, UGI International, Midstream & Marketing, and UGI Utilities.

On November 22, 2024, UGI Corporation reported record results for fiscal 2024, achieving an all-time high adjusted diluted EPS of $3.06, driven by strong execution of strategic priorities and efficiency improvements.

The company realized a $75 million reduction in operating expenses ahead of schedule, achieving permanent cost savings targeted for fiscal 2025.

UGI also returned $320 million to shareholders through dividends, continuing a 140-year streak of consecutive dividend payments and demonstrating a five-year EPS CAGR of 6%.

Key accomplishments included significant investments in infrastructure, with $500 million allocated to utility improvements and the completion of the Moody RNG project, expected to produce 300 MMCF annually.

Click here to download our most recent Sure Analysis report on UGI (preview of page 1 of 3 shown below):

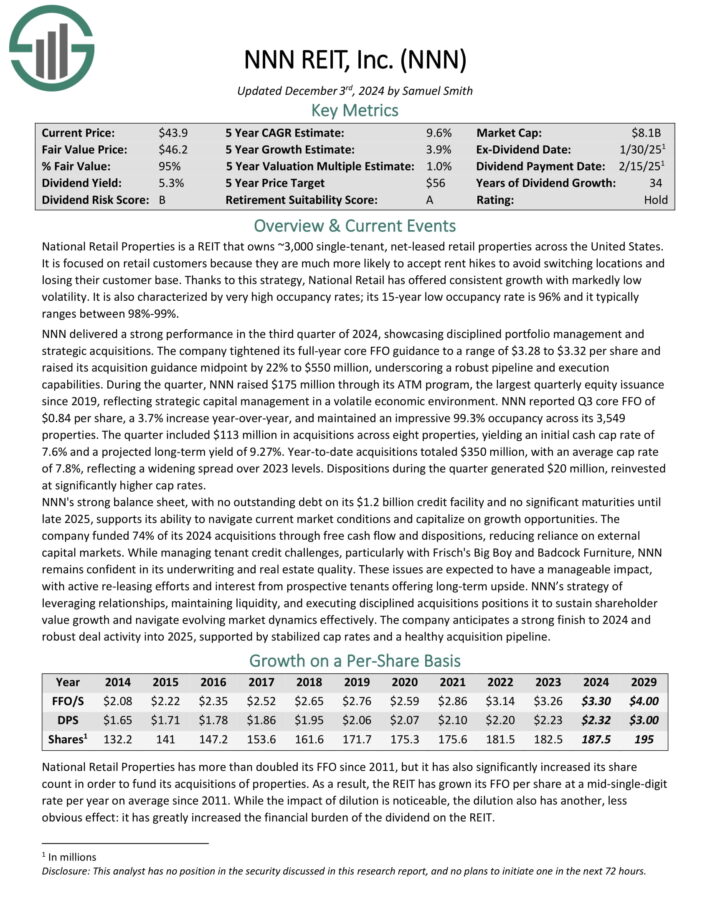

High Yield Stock For Lasting Retirement Income: NNN REIT (NNN)

- Dividend Yield: 5.7%

National Retail Properties is a REIT that owns ~3,000 single-tenant, net-leased retail properties across the United States.

It is focused on retail customers because they are much more likely to accept rent hikes to avoid switching locations and losing their customer base. Its 15-year low occupancy rate is 96% and it typically ranges between 98%-99%.

NNN delivered a strong performance in the third quarter of 2024, showcasing disciplined portfolio management and strategic acquisitions.

The company tightened its full-year core FFO guidance to a range of $3.28 to $3.32 per share and raised its acquisition guidance midpoint by 22% to $550 million, underscoring a robust pipeline and execution capabilities.

NNN reported Q3 core FFO of $0.84 per share, a 3.7% increase year-over-year, and maintained an impressive 99.3% occupancy across its 3,549 properties.

Click here to download our most recent Sure Analysis report on NNN (preview of page 1 of 3 shown below):

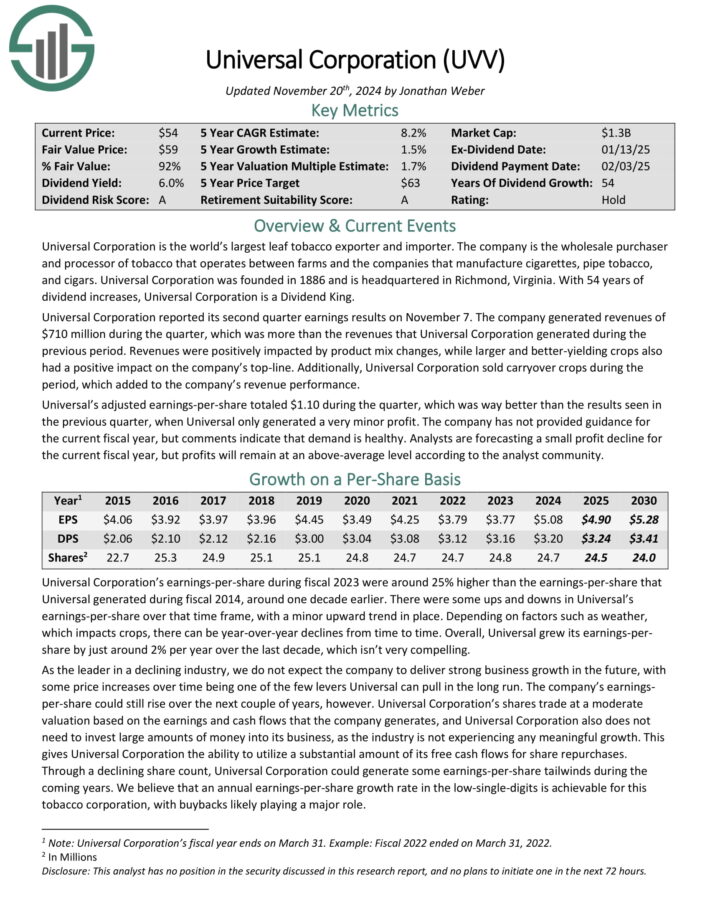

High Yield Stock For Lasting Retirement Income: Universal Corp. (UVV)

- Dividend Yield: 5.9%

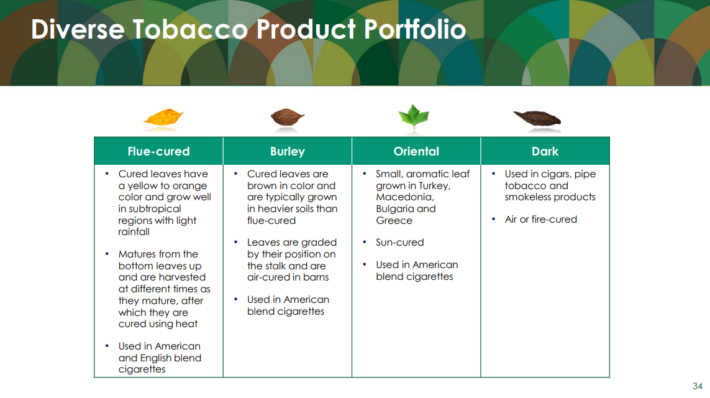

Universal Corporation is a market leader in supplying leaf tobacco and other plant-based inputs to consumer product manufacturers.

The Tobacco Operations segment buys and sells tobacco used to make cigarettes, cigars, pipe tobacco, and smokeless products.

Universal buys tobacco from its suppliers, processes it, and sells it to large tobacco companies in the US and internationally.

Source: Investor Presentation

The Ingredient Operations deal mainly with vegetables and fruits but is significantly smaller than the tobacco operations. Universal has been growing this business through acquisitions starting in 2020.

Universal Corporation reported its second quarter earnings results on November 7. The company generated revenues of $710 million during the quarter.

Additionally, Universal Corporation sold carryover crops during the period, which added to the company’s revenue performance.

Click here to download our most recent Sure Analysis report on Universal (preview of page 1 of 3 shown below):

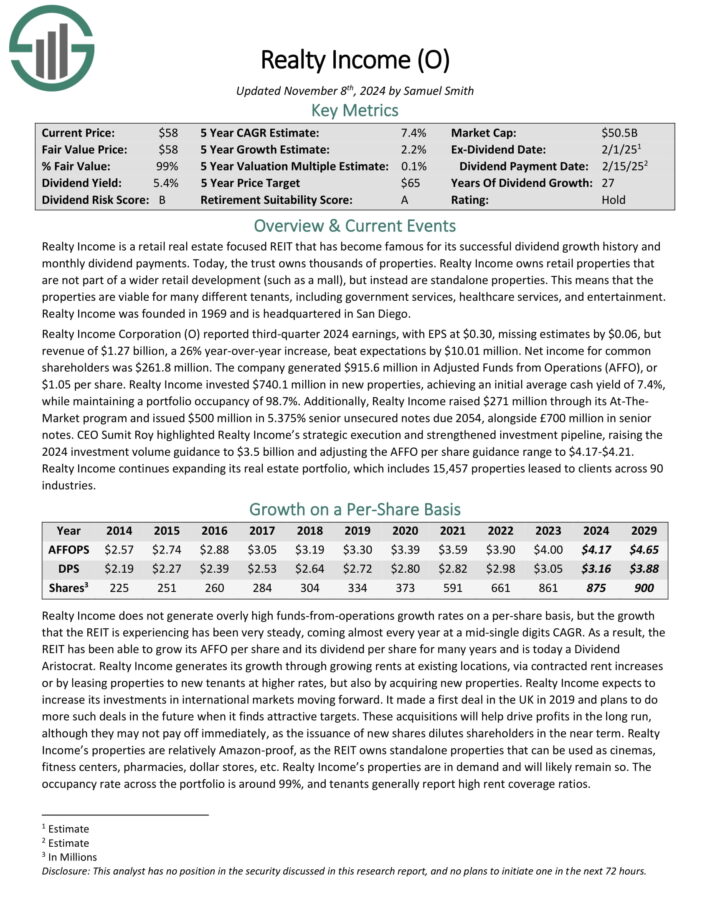

High Yield Stock For Lasting Retirement Income: Realty Income (O)

- Dividend Yield: 6.0%

Realty Income is a retail real estate focused REIT that has become famous for its successful dividend growth history and monthly dividend payments.

Realty Income owns retail properties that are not part of a wider retail development (such as a mall), but instead are standalone properties. This means that the properties are viable for many different tenants, including government services, healthcare services, and entertainment.

Realty Income reported third-quarter 2024 earnings, with EPS at $0.30, missing estimates by $0.06, but revenue of $1.27 billion, a 26% year-over-year increase, beat expectations by $10.01 million. Net income for common shareholders was $261.8 million.

The company generated $915.6 million in Adjusted Funds from Operations (AFFO), or $1.05 per share. Realty Income invested $740.1 million in new properties, achieving an initial average cash yield of 7.4%, while maintaining a portfolio occupancy of 98.7%.

Click here to download our most recent Sure Analysis report on Realty Income (preview of page 1 of 3 shown below):

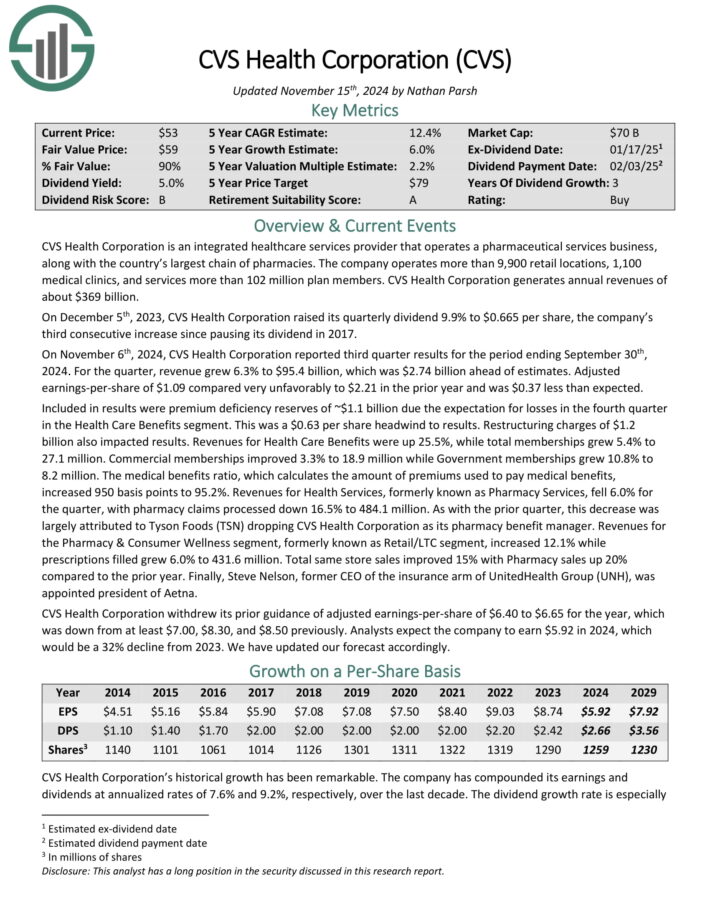

High Yield Stock For Lasting Retirement Income: CVS Health (CVS)

- Dividend Yield: 6.0%

CVS Health Corporation is an integrated healthcare services provider that operates a pharmaceutical services business, along with the country’s largest chain of pharmacies.

The company operates more than 9,900 retail locations, 1,100 medical clinics, and services more than 102 million plan members. CVS Health Corporation generates annual revenues of about $369 billion.

On November 6th, 2024, CVS Health Corporation reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue grew 6.3% to $95.4 billion, which was $2.74 billion ahead of estimates. Adjusted earnings-per-share of $1.09 compared very unfavorably to $2.21 in the prior year and was $0.37 less than expected.

Included in results were premium deficiency reserves of ~$1.1 billion due the expectation for losses in the fourth quarter in the Health Care Benefits segment.

This was a $0.63 per share headwind to results. Restructuring charges of $1.2 billion also impacted results. Revenues for Health Care Benefits were up 25.5%, while total memberships grew 5.4% to 27.1 million.

Click here to download our most recent Sure Analysis report on CVS (preview of page 1 of 3 shown below):

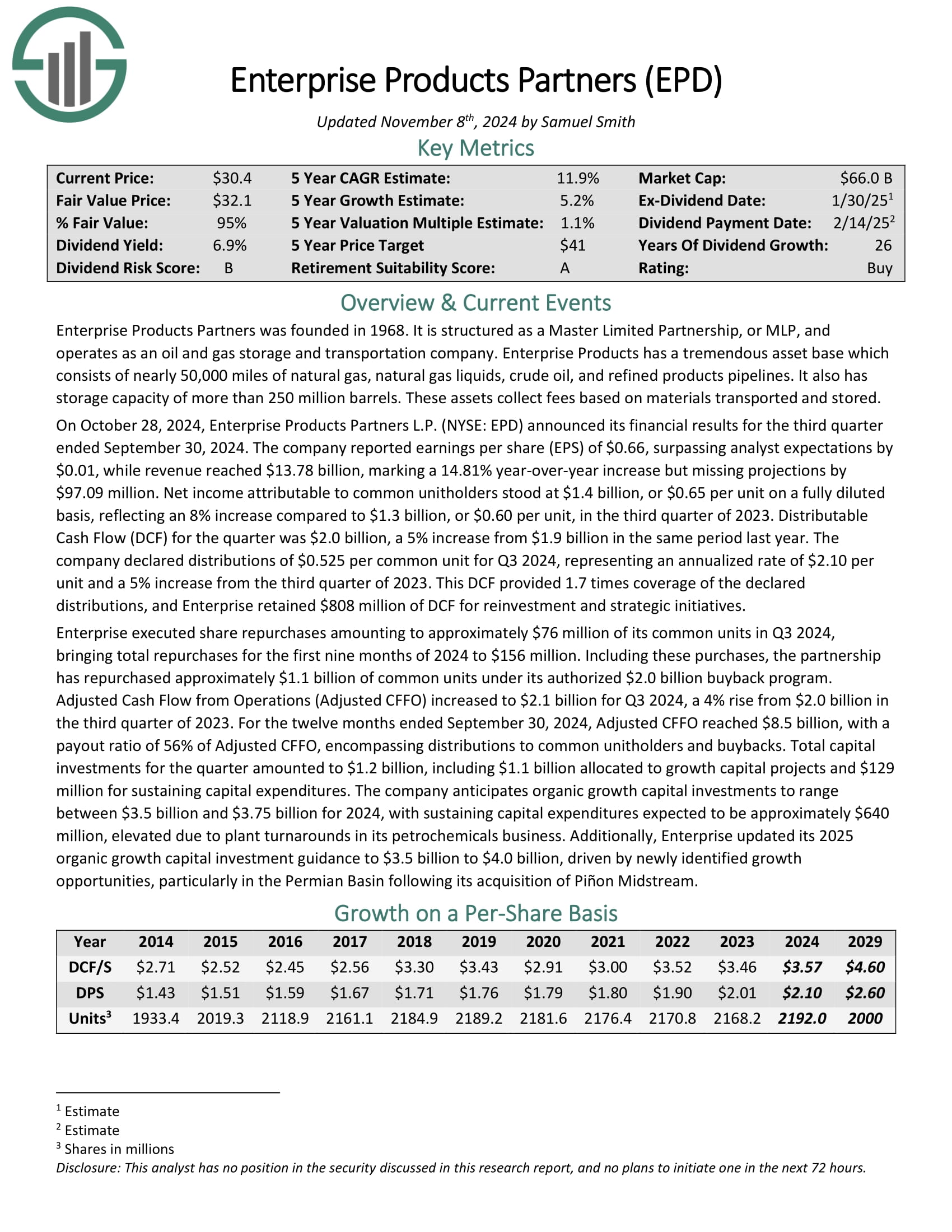

High Yield Stock For Lasting Retirement Income: Enterprise Products Partners (EPD)

- Dividend Yield: 6.7%

Enterprise Products Partners was founded in 1968. It is structured as a Master Limited Partnership, or MLP, and operates as an oil and gas storage and transportation company.

Enterprise Products has a large asset base which consists of more than 50,000 miles of natural gas, natural gas liquids, crude oil, and refined products pipelines.

It also has storage capacity of more than 300 million barrels. These assets collect fees based on volumes of materials transported and stored.

Source: Investor Presentation

On October 28, 2024, Enterprise Products Partners announced its financial results for the third quarter ended September 30, 2024. Revenue reached $13.78 billion, marking a 14.81% year-over-year increase.

Distributable Cash Flow (DCF) for the quarter was $2.0 billion, a 5% increase from $1.9 billion in the same period last year.

The company declared distributions of $0.525 per common unit for Q3 2024, representing an annualized rate of $2.10 per unit and a 5% increase from the third quarter of 2023. DCF provided 1.7 times coverage of the declared distributions.

Click here to download our most recent Sure Analysis report on EPD (preview of page 1 of 3 shown below):

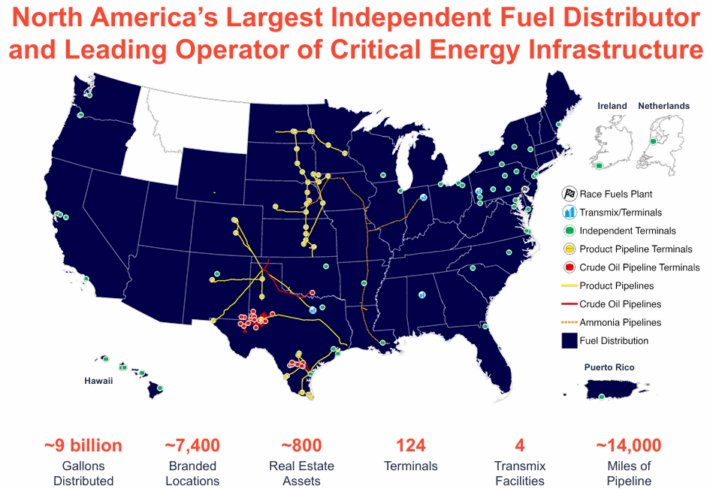

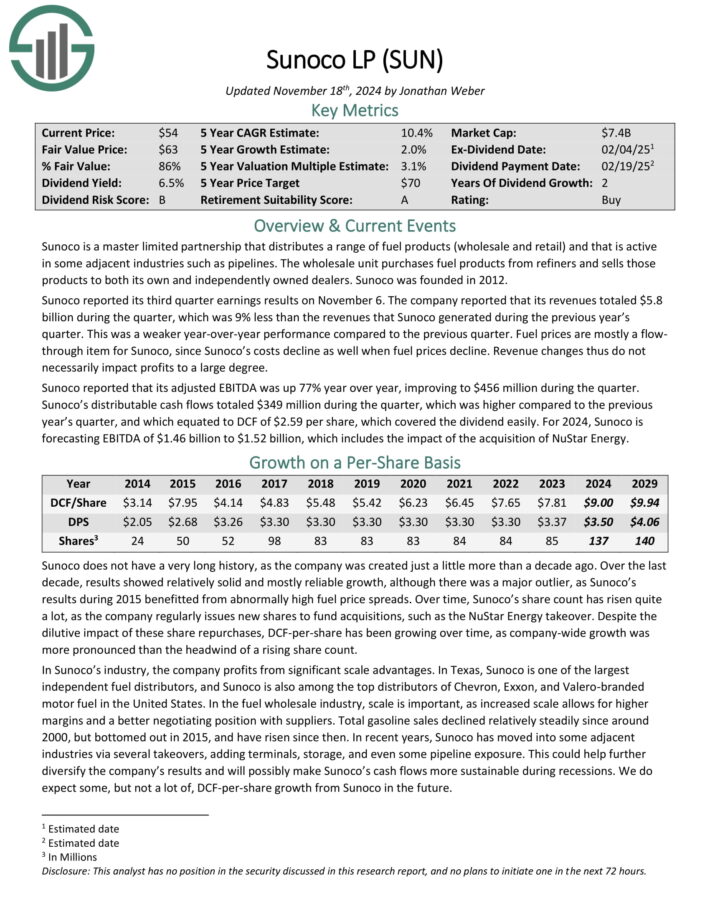

High Yield Stock For Lasting Retirement Income: Sunoco LP (SUN)

- Dividend Yield: 6.7%

Sunoco is a master limited partnership that distributes a range of fuel products (wholesale and retail) and that is active in some adjacent industries such as pipelines.

The wholesale unit purchases fuel products from refiners and sells those products to both its own and independently owned dealers.

Source: Investor Presentation

Sunoco reported its third quarter earnings results on November 6. The company reported that its revenues totaled $5.8 billion during the quarter, which was 9% less than the revenues that Sunoco generated during the previous year’s quarter.

Sunoco reported that its adjusted EBITDA was up 77% year over year, improving to $456 million during the quarter. Distributable cash flows totaled $349 million during the quarter, which was higher compared to the previous year’s quarter, and which equated to DCF of $2.59 per share, which covered the dividend easily.

For 2024, Sunoco is forecasting EBITDA of $1.46 billion to $1.52 billion, which includes the impact of the acquisition of NuStar Energy.

Click here to download our most recent Sure Analysis report on SUN (preview of page 1 of 3 shown below):

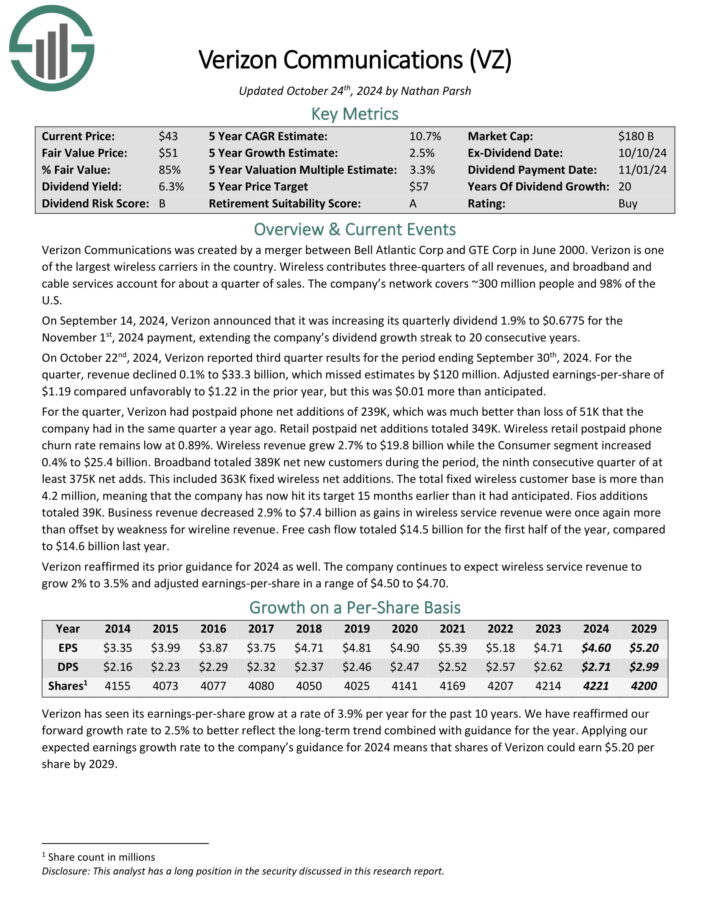

High Yield Stock For Lasting Retirement Income: Verizon Communications (VZ)

- Dividend Yield: 6.8%

Verizon is one of the largest wireless carriers in the country. Wireless contributes three-quarters of all revenues, and broadband and cable services account for about a quarter of sales. The company’s network covers ~300 million people and 98% of the U.S.

On October 22nd, 2024, Verizon reported third quarter results for the period ending September 30th, 2024. For the quarter, revenue declined 0.1% to $33.3 billion, which missed estimates by $120 million.

Source: Investor Presentation

Adjusted earnings-per-share of $1.19 compared unfavorably to $1.22 in the prior year, but this was $0.01 more than anticipated.

For the quarter, Verizon had postpaid phone net additions of 239K, which was much better than loss of 51K that the company had in the same quarter a year ago. Retail postpaid net additions totaled 349K.

Wireless retail postpaid phone churn rate remains low at 0.89%. Wireless revenue grew 2.7% to $19.8 billion while the Consumer segment increased 0.4% to $25.4 billion.

Click here to download our most recent Sure Analysis report on VZ (preview of page 1 of 3 shown below):

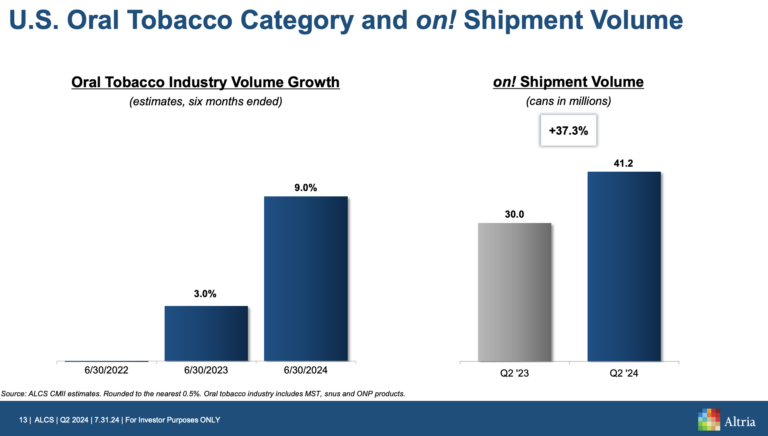

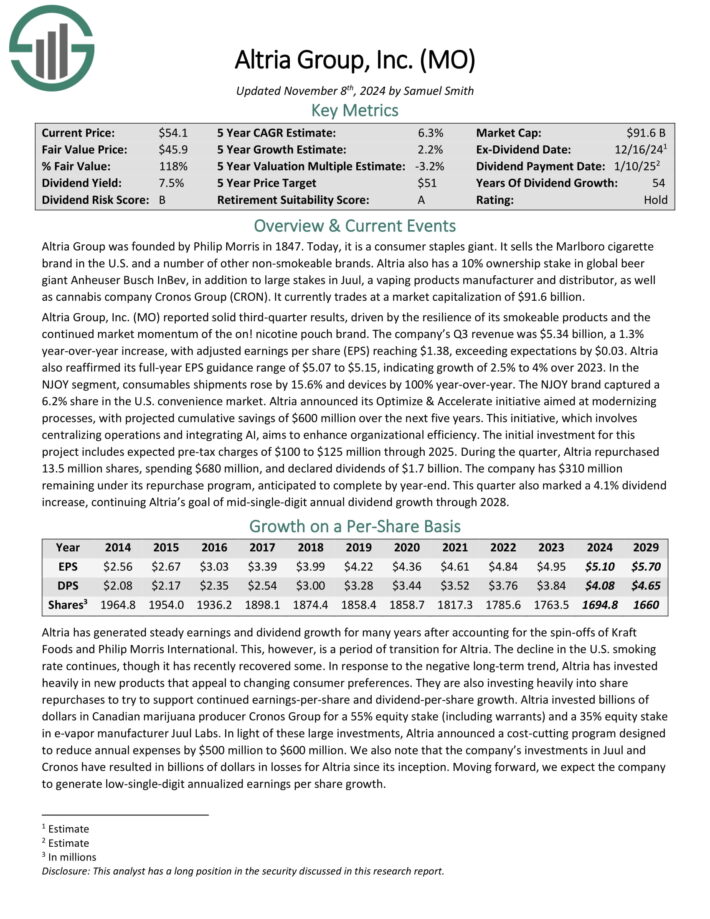

High Yield Stock For Lasting Retirement Income: Altria Group (MO)

- Dividend Yield: 7.6%

Altria is a tobacco stock that sells cigarettes, chewing tobacco, cigars, e-cigarettes, and more under a variety of brands, including Marlboro, Skoal, and Copenhagen, among others.

The company also has a 35% investment stake in e-cigarette maker JUUL, and a 45% stake in the cannabis company Cronos Group (CRON).

Altria reported solid third-quarter results, driven by the resilience of its smokeable products and the continued market momentum of the on! nicotine pouch brand.

Source: Investor Presentation

The company’s Q3 revenue was $5.34 billion, a 1.3% year-over-year increase, with adjusted earnings per share (EPS) reaching $1.38, exceeding expectations by $0.03.

Altria also reaffirmed its full-year EPS guidance range of $5.07 to $5.15, indicating growth of 2.5% to 4% over 2023.

During the quarter, Altria repurchased 13.5 million shares, spending $680 million, and declared dividends of $1.7 billion. The company has $310 million remaining under its repurchase program, anticipated to complete by year-end.

Click here to download our most recent Sure Analysis report on Altria (preview of page 1 of 3 shown below):

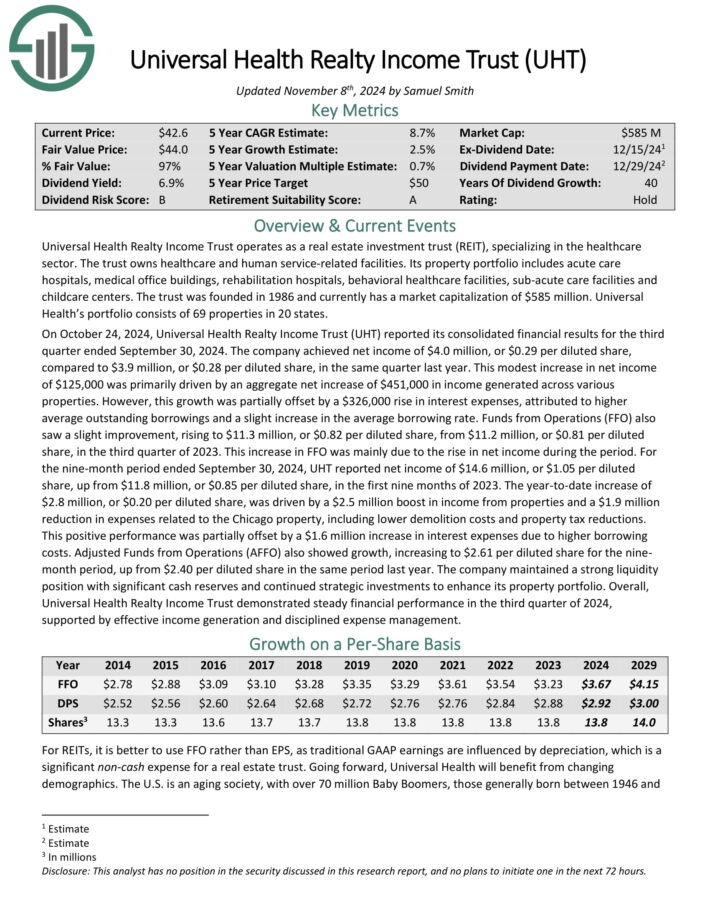

High Yield Stock For Lasting Retirement Income: Universal Health Retirement Income Trust (UHT)

- Dividend Yield: 7.9%

Universal Health Realty Income Trust operates as a real estate investment trust (REIT), specializing in the healthcare sector. The trust owns healthcare and human service-related facilities.

Its property portfolio includes acute care hospitals, medical office buildings, rehabilitation hospitals, behavioral healthcare facilities, sub-acute care facilities and childcare centers. Universal Health’s portfolio consists of 69 properties in 20 states.

On October 24, 2024, UHT reported its third quarter results. Funds from Operations (FFO) saw a slight improvement, rising to $11.3 million, or $0.82 per diluted share, from $11.2 million, or $0.81 per diluted share, in the third quarter of 2023. This increase in FFO was mainly due to the rise in net income during the period.

The company maintained a strong liquidity position with significant cash reserves and continued strategic investments to enhance its property portfolio.

Click here to download our most recent Sure Analysis report on UHT (preview of page 1 of 3 shown below):

Final Thoughts

All of the above stocks have strong business models that generate high levels of cash flow. In turn, high dividend stocks can provide high dividend payouts to shareholders.

With our highest Dividend Risk Scores along with high current yields, the 10 stocks in this article could be attractive investments for income investors, such as retirees.

More By This Author:

Earn More Retirement Income With These 3 High Dividend Stocks10 Buy And Hold Forever Dividend Stocks

Top 10 Dividend Champions

Disclaimer: SureDividend is published as an information service. It includes opinions as to buying, selling and holding various stocks and other securities. However, the publishers of Sure ...

more