Market Briefing For Wednesday, July 29

Disruptive concerns - threaten to push merely shuffling concerns from the fore, and to the back-burners. How so? Well for the moment it depends on Washington. Widely presumed views that we will get 'a' Bill prevail; but whether its 'the' Bill the nation has need for, is another story.

Yes the nation would scrape by if the sidelined workers get $200 or 400 a week extra beyond regular unemployment insurance, and yes it crossed my mind that $30,000, yearly (rate) while furloughed is more than subsistence to get by. However, that's the extra funding which might just be why 'consumer spending' didn't fall off a cliff like so many suspected. And 'if' we do not salvage the situation almost immediately, not say after the August 'recess' (which should be cancelled), a short-term spending plunge is probably on-tap.

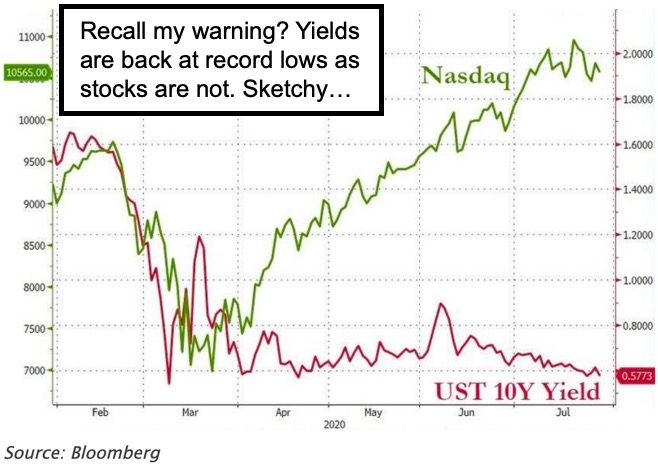

This time the market's response might be different than last time, and aside the Fed meeting comments (which hold back the market), for now the bill is more pertinent.

Executive summary:

- With no therapeutic drug available (serious help and easy to prescribe) 'yet', the only other approach to a solid spending bill might be faster economic reopening.

- I'll make it clear (as if I needed to) that this situation is serious, even if masks do reduce new case level rates, because mortality 'lags', that we must not become accustomed to higher 'morbidity & mortality' levels as somehow 'routine'.

- Also there's not a shred of evidence suggesting this was (as media extremists suggest) a 'plandemic' not 'pandemic', that's pure ignorance of a global scourge, or it's simply normal people who can't comprehend the dire situation's deviation from the 'norm', so (like other issues) imagine it must be some conspiracy.

- Dr. Casadevall from Johns Hopkins just said it will take 'multiple' vaccines and antibody treatments to control this virus because of its complexity.

- That supports our idea not to focus only on major 'big pharma', but believe that early vaccines are (unfortunately) mediocre, so there is room for many pharma or biotech companies to contribute, as we have already outline for months.

- One of these is Sorrento Therapeutics (SRNE), the other day when the announced the acquisition (a very important one as to delivery methods), investors wanted to know how much money's being shelled-out, still pending so no reaction.

- So much skepticism (ours too at the start given the CEO's pension to promote) that even though SRNE may have a 'pill' that ultimately could make vaccines optional or even unnecessary, it's still a single-digit stock, stay tuned.

- By the way Russia claims they have an effective Coronavirus vaccine, and will roll-it-out in about two weeks (without testing or advanced Trials, good luck to all the Russians who 'volunteer' for that experimental vaccine).

- Wednesday may roil 'a bit', because of the Fed, the Tech hearings; the fight over Apple's 'App Store' percentages (which are 30% initially, lower later), or so on (AAPL).

In-sum: Market is defensive ahead of the Fed, earnings and Congress. Giant Tech executives (the companies not the executives) will testify before Congress over their market power or business practices, which have been scrutinized for antitrust issues for some time, and they'll be pummeled from multiple directions I suppose.

That's as these issues were magnified by the pandemic, wiped-out some competitors and pushing business further toward already-strong major techs (FAANG+) as I've consistently outlined, and they're the ones doing the heavy S&P and NASDAQ lifting.

Amid this, our 'pick of the year' for 2019, Advanced Micro Devices (AMD) had more than a stellar quarter to report, and as I've said the trend is up. Expecting 60 as the most recent goal, and now we're in the 70's (up 5 more after-hours to 74) so that's noting less than a quadruple since our 16-17 December of 2018 buy-zone. I won't delve into specifics, because we did in-advance and thank Intel (INTC) for helping our pick along by a delay in 7 nm processors. Others are debating because they want to buy now. Sure, have at it and we'll see you at 90, might even finally sell a bit there..

Speaking of moves, LightPath (LPTH) for the first modern time, briefly surpassed 4 today, but then (almost per usual on lighter volume) retreated to finish at 3.68, which still is another new 52 week closing high. Volume was 2.28 million shares; and while we do not give credence to aftermarket pricing, it shows bid/ask of 3.72/3.87 now. Whether it horses around more or just solidly goes into the 4's that's where we think it goes in the short-run, and traders trying to swing in it (because it does move) should take care not to lose position, given envisioning it at considerably higher levels.

Bottom-line: Probably is the Fed Wednesday. This month's statement should reflect no major changes, with interest rates held at their current near-zero level, while we will listen attentively to Chairman Powell's comments. On Tuesday, the Federal Reserve said it planned to extend several of its emergency lending facilities through year-end 2020, or beyond the previous expiration date of September 30. But it's the subsidies for workers that matters to the market on the very short-term.

Interesting article indeed.

It is not that the plague was planned, is that once the problem became known most governments made wrong choices multiple times. Closing the borders on day one would have reduced the spread, and if it was not the best choice it could have easily been undone. Instead, the borders were kept open and the result was plague everywhere with hundred dying. So we may possibly have learned that bad choices have really unhappy results. And in addition, REALLY bad choices have REALLY bad results.

Agreed, everyone was so afraid of hurting the economy so kept their borders open. So foolish. No every country's economy is getting pummeled.

The economy does not matter one bit to those folks who died. I have it on good authority that they have not even noticed what is happening presently.

It's like the Spanish Flu of 1918-19... suffering and a recession; but it led to the Roaring 20's and that might happen this time too; despite all the belief that monetary policies will inhibit that. I'm compassionate and lost a cousin to this horror last week; but life goes on and might as well be trading markets independent of impulsive or emotional reactions to events; which is often the wrong moves to make. We've nailed this as you know from reading my excerpts here; and I hope you understand that I was in tears hearing back in February from people who said our warnings helped them get PPE and protect families at a time Washington wasn't advising it. And since turning bullish on March 23rd it's been great. Checkout $AMD, $LPTH and $SRNE all of which we owned and own.

As a matter of fact, I have not heard many references to the recovery from that Spanish Flu disaster. Certainly there was a recovery and a growing into the "roaring Twenties", but there was also the end of World WAR 1, which also must have had a large effect on the emotions and the economy. Of course all of that was followed by a rather monumental crash a bit later.

It would be a large benefit if there was enough insight gained by our leaders from looking at that sequence to inspire them to make the choices needed to avoid repeating that sequence of unfortunate events.

Learning from reading about mistakes is much less painful than learning from repeating them.

Indeed... my Sorrento (SRNE) suggestion at 4 is working out great; and their on site testing and a possible 'pill' is really the needed solution. I'll welcome you as a subscriber if you like; as I'm going to have to curtail allowing other websites from quoting more than a paragraph or two of my work (no compensation); heck I enjoy sharing but gotta pay the 'lectric bill (JK).. cheers!