Retirement Withdrawal Strategy: Avoid Panic, Enjoy Life

Image Source: Pixabay

Here is my simple yet effective retirement withdrawal strategy; it ensures I always have enough money to enjoy my retirement. It might fit well with your own situation, or it might not. Regardless, it may give you a good starting point to elaborate on your own strategy.

Here’s what I intend to do: have between 12 and 24-months worth of my retirement budget in cash on day one of my “new life.” This is enough cash to never panic when the market drops and never be forced to sell stock at a bad time. With this cushion on hand, I’ll combine my dividend payments with small withdrawals from this cash reserve.

Let’s put numbers to this strategy. I retire at 65 with a $1 million portfolio generating 2% in dividends, my current average yield. Let’s say I need 4% of that $1 million, or $40,000/year in retirement income.

This means that to create my reserve, I’ll have let the 2% dividend pile up in cash starting two to four years before retirement. I don’t want to be forced to sell stocks at 65 during the next financial crisis crushing the stock market.

So, at age 65, my $1 million portfolio generates $20,000 in dividends and I have $40,000 in cash. Then, I’ll review my financial situation every six months to determine if it’s the right time to sell some shares.

Six Months into Retirement

After the first six months, I would have spent about $20,000, half of which comes from my dividends and half from the cash account, so my cash account would have decreased to $30,000. If the market is good at that time, i.e., no crash is happening, I would sell a few shares to increase my cash account back to $40,000.

If the market is in “crash mode,” as in what was seen in 2022, I could easily wait another six months and see where the market is at that time. By then, I spent another $20,000 (half dividends, half cash) and my cash account is at 20,000; my portfolio still generates the same $20,000 in dividends. In fact, since I focus on dividend growth stocks, chances are it generates a bit more than that.

A market crash won’t drop my portfolio’s value permanently. Most crashes happen over a few months or a year, and then the recovery period begins. If the market is still in bad shape after one year of bearish returns, I still have the luxury to wait another six months using the same technique.

Ultimately, this strategy gives me up to two years without having to touch my portfolio.

Protecting the Cash Account for More Than Two Years

Two-year protection is enough to cover many bear markets, but not all of them. Therefore, it’s preferable to have two years' worth of retirement budget to cover about four years of a bear market. If you don’t want ~$80,000 sitting in a cash account, there is something else you can do: improve your yield.

Smart Ways to Improve Your Yield

A 2% dividend yield isn’t much. It’s quite easy to transform your 2% yield to the 3%-3.5% range, without having putting your retirement in jeopardy. How? By replacing your low-yield stocks with higher yield stocks in the same sectors and adjusting your portfolio’s sector allocation.

Replace Low Yield Stocks

While many low-yield stock provide great growth opportunities, think Apple (AAPL) and Alimentation Couche-Tard (ANCTF), if you want to improve your portfolio yield, you can replace some of them with higher yielding stocks in the same sector, e.g., Broadcom (AVGO) and Coca-Cola (KO).

In the DSR portfolio builder, I sort my stocks by yield to identify those that “hurt” my yield. Then, I use the DSR stock screener to find great replacement candidates in the same sectors.

Sector Allocation

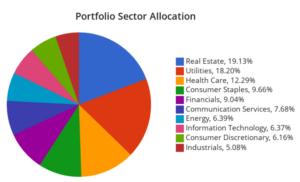

While you can find great businesses in all sectors, some sectors are more generous than others. Focus on these to build your “core portfolio.”

It’s no secret that utilities, REITs, and communications companies, especially telcos, are generous dividend providers. Utilities and telcos are usually mature businesses with stable streams of income, making wealth distribution logical.

REITs are obligated to distribute most of their income. Add a few Canadian banks in the mix, and you’d already have enough sectors to invest easily 60% of your portfolio while complying with the “don’t exceed 20% in one sector” rule.

DSR US Retirement Portfolio Model – Sector Allocation

On the DSR site, retirement portfolio models show ~20 US and ~20 Canadian positions that offer generous yields without neglecting dividend growth. They are a great starting point when looking for a sector allocation models (we ensure they are well-diversified) and for stock-picking ideas. “Mike’s buy list” offers 10 retirement stock ideas, five US and five Canadian, updated monthly.

Knowing Which Stocks to Sell

Knowing which stock to sell, to either improve yield or replenish your cash reserve, is important. I’ve established a clear order in which to sell shares.

- Stocks that don’t fit in my portfolio.

During my portfolio review, I sell stocks with a weak dividend triangle or that don’t meet my investment thesis anymore.

- Overweight stocks

I trim my winners to avoid being over-exposed to one stock. I limit each position to represent at most 10% of my portfolio. When one goes above 10%, I trim a few percentage points to avoid putting my retirement at risk.

- Sector balance

After cleaning my portfolio of bad stocks and trimming my winners, I take a look at my sector allocation. Similar to my stock allocation, if I’m overweight in a specific sector, I’ll sell a few percentage points to rebalance my portfolio.

Retirement Withdrawal Strategy in a Nutshell

There are two valid scenarios in which to implement this strategy:

- Portfolio yield of 2% + cash reserve of 18 to 24 months.

- Portfolio yield of 3%-4% + cash reserve of about 12 months.

Since I’ve always focused more on growth than income, I’d pick the first scenario, which means my retirement plan is more exposed to volatility in a severe market crash. The second scenario allows your portfolio to recover fully from almost any bear market while you enjoy a stronger income from your portfolio. It’s a personal choice between growth and income. Both are good options if you don’t switch from one to the other repetitively.

An easy plan for your retirement withdrawals is as follows:

- Build your portfolio and cash reserve according to the scenario you prefer.

- Write down a tax optimization plan with a tax expert.

- Sell bad stocks first, then overweighted stocks, then a little bit of several positions to maintain your sector allocation.

- Enjoy your retirement.

More By This Author:

Do Down Markets Affect Retirement?What Makes A Hold-Forever-Stock

Buy List Stock For July 2023: Equinix