Do Down Markets Affect Retirement?

Image Source: Unsplash

Do down markets affect retirement? To the majority of people, the answer is an emphatic “yes.” However, this might be the wrong answer. I can tell you may be raising your eyebrows at that sentence. How can you not be affected by a 20% market drop in your portfolio at retirement?

Let’s be honest, if you experience a down market in retirement, it will not be your first, nor will it be your last. Each time, it feels like it’s the end of capitalism itself, yet companies and governments find ways to adapt and thrive.

Let’s go back to 2008. Back then, the market took about four to five years to fully recover. If you retired in early summer of 2008, right before Lehman Brothers went bankrupt, you probably went through a terrible four years. While you were withdrawing money from your portfolio monthly, its value was falling faster and faster.

Now, you must remember two things. First, if you retired in 2008, you were likely investing for at least 30 years before that. Second, you were probably between the ages of 55 and 65 in 2008, which gives you another 30 years or so of investing, assuming your life expectancy is somewhere between 85 and 95. Now, let’s put this in perspective.

Investment Years Prior to Down Market

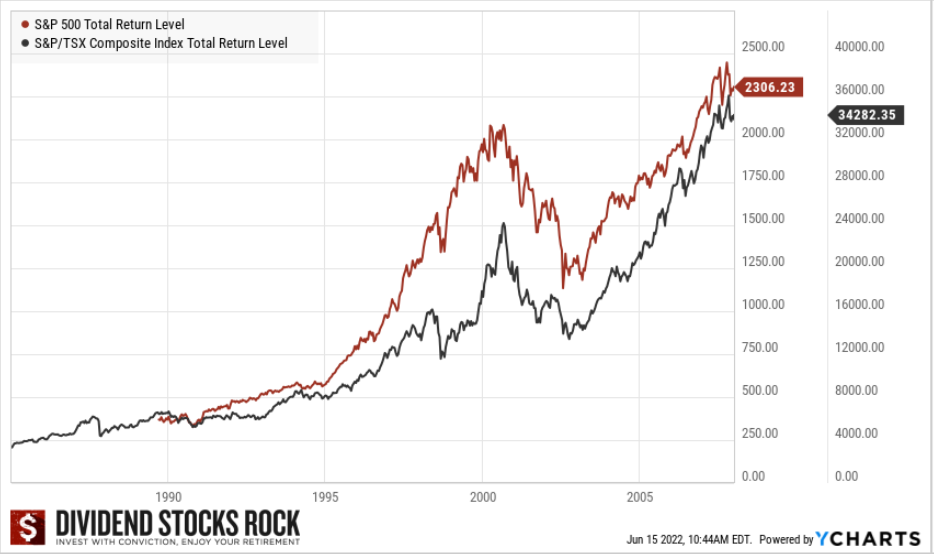

Here is what the market looked like over the 30-year investment period before you may have retired and before the 2008 crash:

(Click on image to enlarge)

Lesson #1: You enjoyed strong bull markets in the past that helped you build this retirement nest egg. Being invested between 1978 and 2008 was a blessing.

It’s the same story I’ll be telling my children and grandchildren in 2041 about investing in 2003. I was fortunate to start investing young (my children have started at an even younger age). What’s so special about 1978 or 2003? Absolutely nothing. They are just the dates when you started investing. It could be 1995, 2015, or 2030, the story will be the same 30 years later.

Retiring in a Down Market

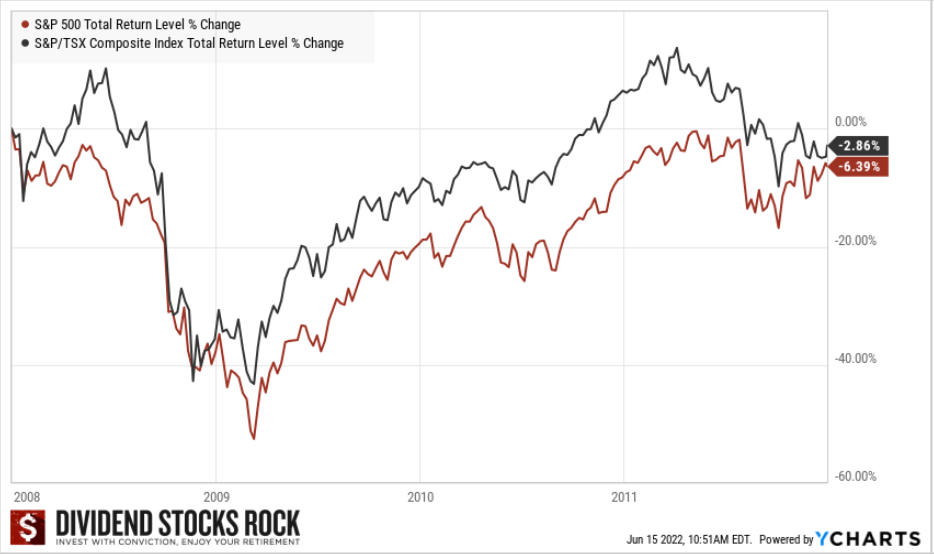

You may be asking, what if you retired in 2008 and were still in the red four years later? That is a fair point. If you retired in 2008 and you started withdrawing 2% of your portfolio by making your “own dividend” by selling shares here and then, you were likely in the red at the start of 2012. That is not a good feeling.

(Click on image to enlarge)

However, the possibility of such an event should have been factored into your investment plan by using strategies like the one explained in Retirement Cash Reserve: Surf the Market’s Waves.

As someone who served as a financial planner in early 2008, I remember all my investment products showing double-digit returns over the previous five years. Many investors thought that was the norm. However, a double-digit return portfolio is not sustainable over a 30-year period.

After a Down Market

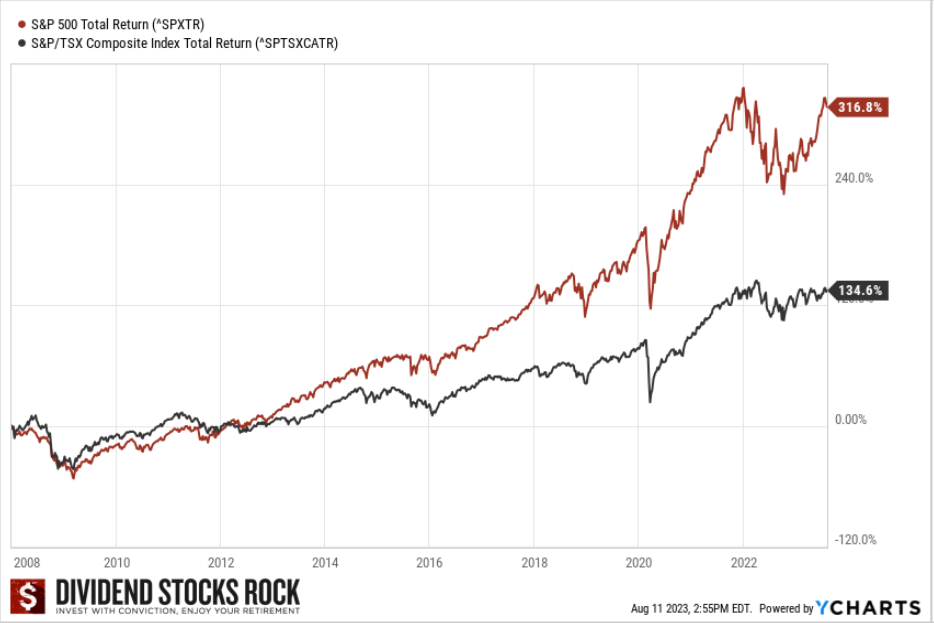

So, what happened after that four-year dark period? Here’s how the market evolved from 2008 until the end of 2022:

(Click on image to enlarge)

You can see that even if you retired just before the toughest bear market of the past 20 years, your portfolio would have more than recovered over the following 15 years. It would have doubled, perhaps even tripled, for the U.S. market, providing you with more money than ever to keep up with a comfortable retirement lifestyle.

Lesson #2: Staying true to your investment strategy during a bear market will reward you in the long-term.

Main Takeaway

When you consider your retirement plan, it should include a ~30-year period of accumulation and a ~30-year period of decumulation. Through roughly 60 years of investing, you will go through many market cycles.

Do down markets affect retirement? Well, not if you stick to your strategy. The keys are always the same: good sector diversification, a solid investment thesis for all your holdings, and a focus on dividend growers.

More By This Author:

What Makes A Hold-Forever-StockBuy List Stock For July 2023: Equinix

Lessons Learned From Inflation And High-Interest Rates