Buy List Stock For July 2023: Equinix

Photo by Joshua Mayo on Unsplash

A stock on my buy list now is Equinix (EQIX). Looking for growth? This is one to keep an eye on. A fast-growing REIT trading near its all-time high, EQIX has a lot going for it. Offering a very low yield, its potential is in stock price appreciation. Equinix is the largest provider of collocated data centers in the world, a world in which demand for data continues to increase with 5G, the Internet of Things, and artificial intelligence.

Equinix Business Model

A digital infrastructure company, Equinix’s platform combines:

- A global footprint of International Business Exchange (IBX) data centers in the Americas (AMER), Asia-Pacific (APAC), and Europe, the Middle East and Africa (EMEA) regions

- Interconnection solutions

- Edge services

- Business and digital ecosystems

- Consulting and support

Equinix’s interconnected data centers around the world allow its customers, organizations in finance, manufacturing, retail, transportation, government, healthcare, and education, to bring together and interconnect the infrastructure they need to track their digital advantage.

Equinix interconnection offerings include Equinix Fabric to connect infrastructure and services on demand at software speed through a secure, software-defined interconnection. Equinix lets businesses connect to their choice of thousands of networking, storage, computing, and application service providers in the industry’s global infrastructure ecosystem. Its Cross Connects provides a point-to-point cable link between two Equinix customers in the same data center.

Investment Thesis

The beauty behind the EQIX business model is that it is poised for strong growth that is hard to replicate. EQIX excels in matching customers in the data and cloud service arenas with each other. Its cloud-based global platform, through a distributed infrastructure, is a critical source of differentiation. It makes EQIX the partner of choice for some of the largest technology companies. With over 10,000 customers, including 1,800 networks, EQIX is a well-diversified cash cow.

The acquisition of Packet for $335M should help the deployment and delivery of its interconnected edge services. The Equinix Metal service, which allows companies to deploy the physical infrastructure of their choice at software speed across EQIX’s platform, had another strong quarter in Q1 2023 and we see continued growth in the year.

About EQIX’s Last Quarter

Equinix had a solid first quarter in 2023 with revenue up 16% and FFO per share up 34%, beating analysts’ estimates. It closed around 4,000 deals across more than 3,000 customers in the quarter, with deployments across multiple regions, showing the value of Equinix’s global platform. Equinix’s CEO reiterated the positive outlook, fueled by the overall demand for digital transformation. Equinix has invested in expanding its global platform, with 50 major builds underway in 37 markets.

Potential Risks for Equinix

Seeing a stock trading at sky-high prices, we can’t help but think that some investors will sell their shares to cash out their gains. In early 2015, EQIX traded at $225/share. The stock broke $850 recently and is now trading in the low $800s. This can be attributed to its aggressive growth plan and increased demand for data centers.

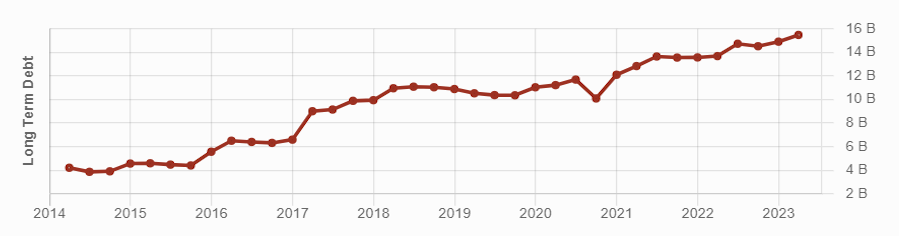

EQIX is growing fast, but so is its debt, going from $9B to close to $13B in the last 5 years. Higher interest rates won’t help EQIX generate stronger FFO per share.

While EQIX is the largest player in this industry, the growing demand for this service hasn’t gone unnoticed. Several competitors are lining up to get their piece of the pie. Customers may soon be able to negotiate a reduced price for their data centers.

EQIX Dividend Growth Perspective

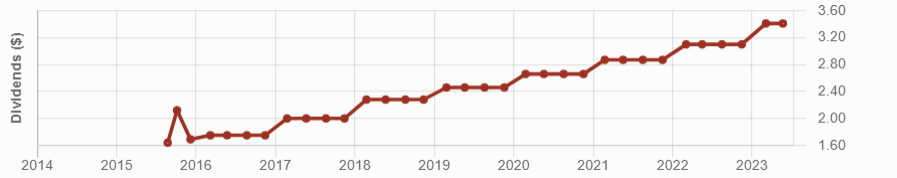

EQIX is in an unusual situation for a REIT, with high growth with a strong dividend triangle. It has increased its dividend yearly since 2016, and the best part is that they have an AFFO payout ratio of approximately 60%. Shareholders should expect a steady 7-8% dividend growth rate for several years.

While the EQIX yield is low and won’t pay an investor’s bills, its capital appreciation potential could boost a portfolio over the long haul. The REIT currently offers a 1.9% yield and recently rewarded shareholders with another generous dividend increase from $3.10/share to $3.41/share (+10%).

Final Thoughts on Equinix

Equinix enjoys a strong dividend triangle showing steady growth in revenue, EPS, and dividends, albeit with a low yield. We expect EQIX’s low dividend yield to grow steadily for several years.

As a well-established leader in a field for which demand is increasing and will increase for the foreseeable future, EQIX is poised for more growth. It is paving the way by investing to expand its global platform. If you’re looking for stock price appreciation to boost your portfolio, you might want to add this one to your watch list.

More By This Author:

Lessons Learned From Inflation And High-Interest Rates

Holding On To Loser Stocks Hurts You More Than You Think

The Best Dividend Achievers