Who Won In Realty Income And Spirit Realty Merger?

Image Source: Unsplash

Realty Income (O) announced the acquisition of Spirit Realty Capital (SRC) this morning. We will review all the math, my assessment of the deal, and what it means for the attractiveness of Realty Income as an investment.

Boosting FFO

I don’t see the deal as moving the needle materially. Shareholders in SRC will own about 13% of the combined company. The move is accretive to normalized FFO per share for Realty Income, but that’s hardly sufficient analysis for a deal. Remember before CBL (CBL) went bankrupt? Anyone could’ve bought that thing, and it would’ve been accretive to normalized FFO in the first year. A bad investment, but it would’ve been accretive.

Of course, that’s not fair to SRC. SRC is absolutely not a pile of trash like CBL. They are a legitimate triple net lease REIT and a good fit for Realty Income. Shareholders in SRC should be quite happy. They could claim that they are being “forced to sell” at a low price, but this buyout is in shares of stock.

Accretion

Realty Income says the deal should deliver over 2.5% accretion to AFFO per share. Part of that is simply because SRC traded at a lower multiple (which was justified). Part of it is from savings in G&A. The savings in G&A are a reason that the market should appreciate this deal. However, it clearly doesn’t.

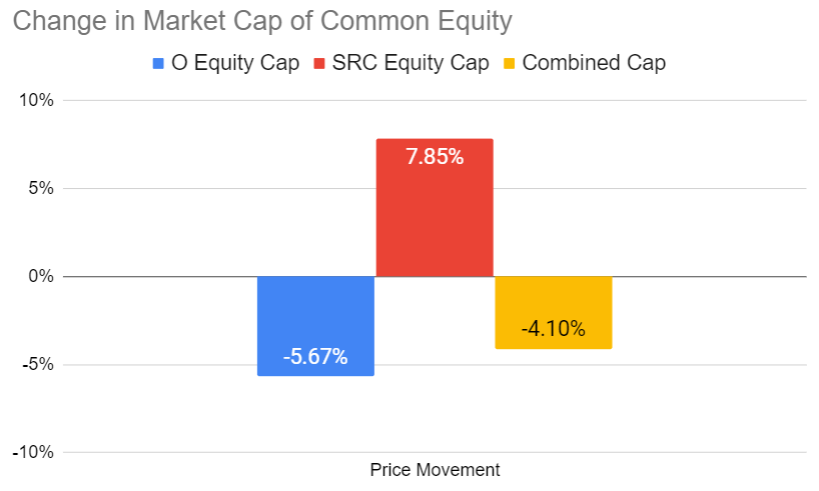

The combined equity value of the two REITs is down over 4%

Because Realty Income represents about 87% of the combined entity, it has a much stronger impact on the valuation.

Best Exchange Ratio

Investors in SRC are extremely close to the record for the best exchange ratio:

(Click on image to enlarge)

Notice that at the very right side, there is an abrupt shot higher. It’s only about 1 pixel wide. If your resolution is too low, you might not even see it. That is today’s swing in relative prices.

There was about 1 day when the market exchange ratio was even higher, but only by a rounding error.

If we adjust for SRC’s bigger dividend payout, then this is the best exchange offered to investors. This is an outstanding deal for SRC shareholders. Anyone holding SRC before the announcement effectively has an exceptionally low price on O.

Debt

SRC technically had a lower weighted-average rate on their outstanding debt. That was just getting lucky with timing. However, the difference wasn’t really material. Realty Income points out that the rate on debt was below market. That’s true. 3.48% is below market.

Realty Income’s average rate on debt (including floating debt) was about 3.76% as of Q2 2023. That was also below market. Since Realty Income is paying with their own shares, they are paying with part of a REIT (themselves) that also has debt at below-market rates.

Can we pause for a moment? If a REIT has any fixed-rate debt and it isn’t “below-market”, that REIT is trash. Why? Because rates just ran higher. Which REIT borrowed most of their debt above 5%? If you find it, that’s a bad REIT. The weighted-average rate should be below 5%.

Valuation Down

The market shouldn’t be valuing these REITs together as 4% less valuable than they were alone. Most net lease REITs were up today. Excluding SRC and O, on average they were up about 1.4%. W.P. Carey (WPC) was down, but that might be because this deal reminded people about the sheer stupidity of WPC’s announcement that they would cut dividends, give investors a tax bill, and create a less efficient structure. That was a really stupid decision by WPC, and I can imagine people remembering it and being upset enough to dump shares.

Turning $5 Billion into $3 Billion

When the combined entity underperforms peers by about 5.5%, that’s pretty surprising.

I don’t like the deal for Realty Income. I think they got the short end of the stick. I think they overpaid. However, SRC was pretty small. So, I want investors to look at this from a different perspective.

We can ignore the fact that most net lease REITs went higher today.

Just look at Realty Income as a stand-alone company.

-

Market cap of Realty Income is down $2 billion.

-

Realty Income is effectively paying about $5 billion.

-

Someone buying the entire REIT (hypothetically) would save $2 billion and spend $5 billion. That is net $3 billion to also own SRC.

What do I think about SRC for $3 billion?

That would be a steal. That would be a great acquisition. That would be an amazing deal for Realty Income.

Exchange Ratio

Let us pretend for a moment that O is buying SRC for $3 billion.

That’s about 40% less than the actual price (implied at today’s closing price for O).

The exchange ratio would be about .46 shares of O per share of SRC.

That would be slightly better than the very best exchange ratio shareholders of O have seen (around 3/16/2020). It would’ve been astounding.

How excited would shareholders be? The smart ones would be thrilled.

SRC wouldn’t have agreed to it, but hypothetically, shareholders in O would’ve been very happy.

If O had acquired SRC at .46 shares of O per share of SRC, then hypothetically:

-

Assume O closes at $49 (flat)

-

SRC market cap falls to $3 billion (about $21.23 per share).

-

Combined market cap is $37.73 billion.

In reality:

-

O closes at $46.22

-

SRC market cap rallies to nearly $5 billion ($34.89 per share).

-

Combined market is $37.69 billion (a tiny bit lower)

Therefore, the plunge in O’s share price means buyers today are getting a deal comparable to buying O at $49 (Friday’s close) with SRC being acquired at $3 billion.

While O didn’t manage to negotiate a great deal in the purchase (credit to the SRC board for getting a great deal for their shareholders), the swing in market price resulted in a much better deal than O’s board could ever have been asked to negotiate.

Unfortunately, that does nothing for shares investors already owned.

Targets

Due to the valuation O’s board negotiated, I expect that to weigh on price targets by about 1% to 2%. Not 5.67%.

There may also be a modest adjustment for the continued movement in Treasury rates. During our prior update to targets, the 10-year Treasury was at 4.66%. Since then, it has climbed to 4.89%. That is another 0.33%. That could create a small amount of pressure on the sector. However, plenty of other equity REITs need their updates for Treasury yields first. Overlapping with earnings season makes the adjustments more challenging.

In my opinion, O is the best choice in the Net Lease sector today.

Buyout Math

In a tax-advantaged account and trying to figure out which share is the cheaper way to own Realty Income? Assuming the merger goes through (very high probability) just divide SRC’s share price by .762.

Here's an example from the day the buyout was announced:

The price to own O via SRC is: $34.89 / .762 = $.45.79.

Realty Income’s share price = $46.22.

Therefore, shares of SRC were still a cheaper way to acquire Realty Income if investors are confident that the deal goes through. If it didn’t go through, investors would be quite disappointed to own SRC instead.

As of 11/10/2023, the market is pricing this deal as a certainty. SRC moved up to $38.17 and Realty Income is at $50.12.

$38.17 / .762 = $50.09. That's only a $.03 spread, which leads me to favor O over SRC.

I’ve adjusted targets in the spreadsheet to assume a 0.5% spread in the price.

Therefore, SRC’s targets have been revised to the following formula:

O’s target * 0.762 * 99.5% = SRC target.

Because mergers can break up, I think investors should demand at least a 0.5% discount to own SRC instead.

Realty Income also announced Q3 2023 earnings recently. I already provided analysis Realty Income's Q3 2023 earnings.

More By This Author:

A Quick Primer On Cell Tower REITs

How To Retire In Your 60s Without Going Broke

Annaly Capital Management Is A Value Trap

No position in O, SRC, WPC, or CBL.