How To Retire In Your 60s Without Going Broke

Summary

Retirees should not be chasing high yields.

Proven dividend stocks and low-risk REITs make a strong foundation for an investment portfolio.

I will cover a solution to chasing high yields.

REITs are superior to buying and managing real estate.

This idea was discussed in more depth with members of my private investing community, The REIT Forum.

This research report was produced by The REIT Forum with assistance from Big Dog Investments.

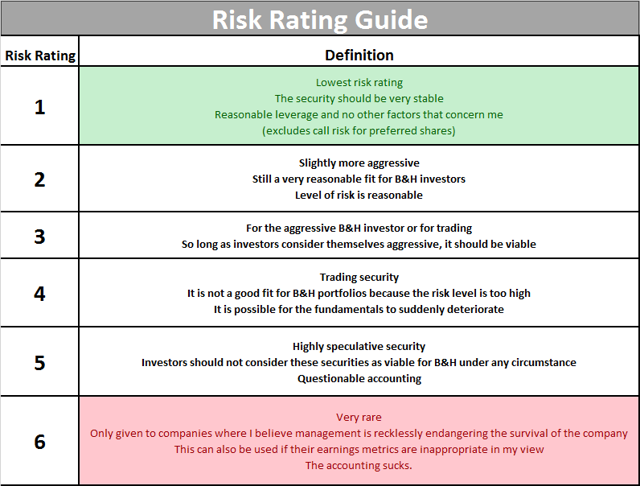

Investors hunting for solid dividend stocks should emphasize dividend growers. Several of the dividend growers carry risk ratings of 2.5 or below. Reference for my risk ratings:

This is a great starting point for investors focusing on a long-term portfolio that should grow dividends faster than inflation.

The Problem

Many retirees face a problem when it comes to picking a strategy to construct their portfolio. In short, not all strategies are created equal. One of the more depressing strategies to hear about is investors demanding an overall yield of around 14%. This is an unreasonable goal and an easy way to enter retirement without enjoying an actual retirement.

The prolonged bull market brings up a major problem when investors are only focusing on the short term. Unreasonable returns seem reasonable if we’re just looking at the recent bull market. When it comes to investing over several decades, a 14% yield is a quick way to go broke.

Investors using this strategy may be tempted to “diversify” their portfolio by investing in several high dividend yield stocks. This results in having a portfolio filled with significantly risky investments. “Diversifying” a large portion of the portfolio in high-yield stocks with very little understanding of the underlying fundamentals is a bad idea. Instead, investors should be looking to build a well-rounded, diversified portfolio.

Continue reading on Seeking Alpha.