Prediction Consensus: What The Experts See Coming In 2026

(Click on image to enlarge)

For the seventh straight year, we’ve sifted through the forecast landscape to bring you the Prediction Consensus, a synthesis of what analysts, thought leaders, and industry experts expect for the year ahead.

This year, we analyzed over 2,000 individual predictions from a wide variety of sources including Morgan Stanley, Goldman Sachs, the IMF, The Economist, Deloitte, Microsoft, Gartner, and dozens more.

By mapping where these forecasts overlap, we’ve distilled the noise into 25 high-conviction themes displayed in our “Bingo Card” format, with the number of dabs reflecting the volume of supporting predictions.

The General Vibe of 2026

If 2025 was a year of adjustment—markets recalibrating to higher rates, geopolitics reshuffling around a second Trump administration and tariffs, and AI moving from hype to deployment—then 2026 is shaping up as a year of consolidation and consequence.

The consensus mood is cautiously optimistic but shot through with uncertainty. Morgan Stanley describes 2026 as “The Year of Risk Reboot,” a period where market focus shifts from macro anxieties to micro fundamentals, creating fertile ground for risk assets. The policy backdrop is unusually supportive: fiscal stimulus, continued (if slower) monetary easing, and deregulation form what analysts call a “policy triumvirate” rarely seen outside of recessions.

Yet The Economist strikes a more sober tone, warning that 2026 will be defined by uncertainty as Trump’s reshaping of geopolitical norms continues to ripple worldwide. The old rules-based order is drifting further, and the line between war and peace grows ever more blurred through gray-zone provocations, cyber incursions, and an ambient rivalry between nations.

In short: risk assets may thrive, but the world beneath them remains turbulent.

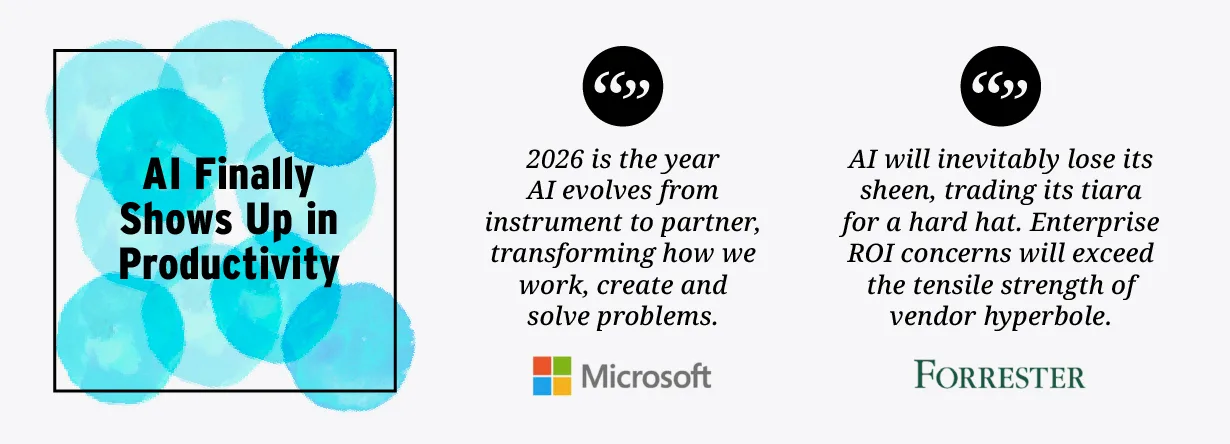

AI: Once Again, the Big Story

For the third consecutive year, artificial intelligence dominates the prediction landscape, but the narrative has evolved. Where 2024 forecasts centered on whether AI hype was justified and 2025 focused on deployment at scale, the 2026 conversation is about integration and consequences.

From Tool to Partner

Across industries, AI is moving beyond answering questions to actively collaborating with people and amplifying their expertise.

This is the year of the agentic AI build-out. Deloitte predicts that by year-end 2026, as many as 75% of companies may be investing in agentic AI (autonomous systems that can plan, act, and adapt with limited human oversight). These AI agents are set to become “digital colleagues,” helping small teams punch above their weight. Microsoft envisions a future where a three-person marketing team can launch a global campaign in days, with AI handling data crunching and content generation while humans steer strategy.

After years of anticipation, productivity gains from AI are finally expected to materialize in measurable ways. Morgan Stanley points to AI-driven efficiency as one of six key drivers of their bullish earnings outlook. Software and internet companies are expected to see generative AI revenue grow more than 20-fold over the next three years.

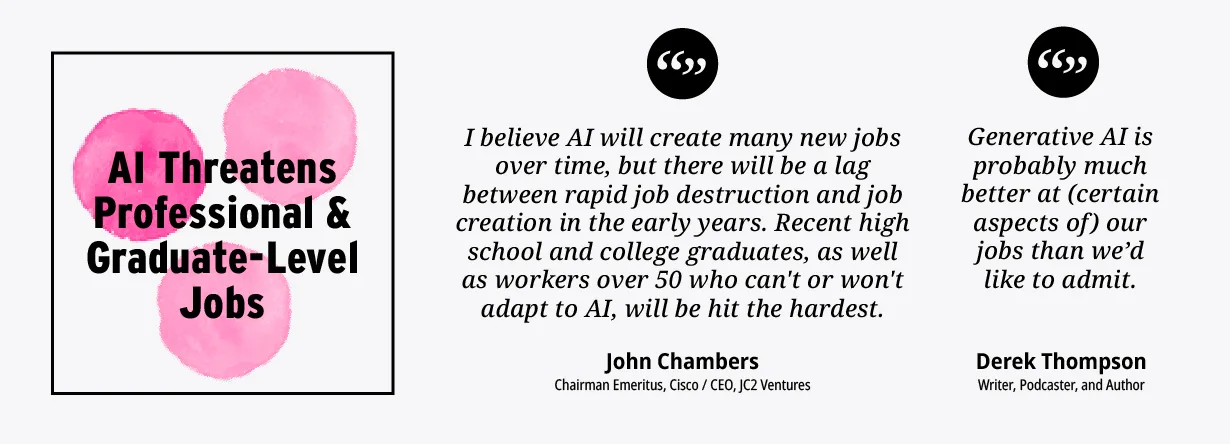

Of course, AI will impact the job market in other ways as well. Professional and knowledge-worker classes that previously felt insulated are now beginning to feel anxiety around job security.

Market Predictions: Riding the AI Wave

Conveniently, AI also dominates the market story. The consensus is unmistakably bullish, though tempered by valuation concerns and awareness of concentration risks.

S&P 500: Double-Digit Gains Expected

Wall Street strategists are clustered in a tight range for year-end 2026 S&P 500 targets:

| Firm | Target | Implied Upside |

|---|---|---|

| Morgan Stanley | 7,800 | 15% |

| JPMorgan | 7,500 | 11% |

| UBS | 7,500 | 11% |

| CFRA | 7,400 | 10% |

| Bank of America | 7,100 | 5% |

The bull case from JPMorgan sees the index potentially topping 8,000 if the Fed eases more than expected. Morgan Stanley calls it their most bullish outlook in years, driven by returning operating leverage, AI efficiency gains, accommodative tax and regulatory policy, and contained interest rates.

Importantly, analysts expect earnings to do the heavy lifting in 2026. Bank of America’s Savita Subramanian projects 14% EPS growth but notes that P/E multiples may actually contract by 10 points, meaning the market climbs a wall of valuation skepticism. Morgan Stanley forecasts S&P 500 EPS of $317 in 2026 (17% growth).

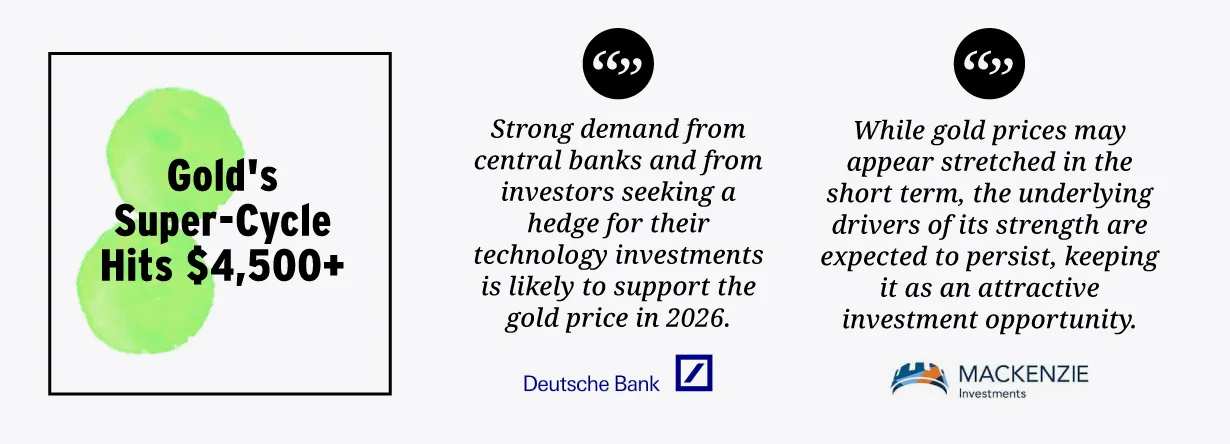

Gold’s Super-Cycle Continues

Gold remains a favorite. Morgan Stanley targets $4,500 per ounce—about 9% upside from current levels. The World Gold Council notes that gold achieved over 50 all-time highs in 2025 and may post its fourth-strongest annual return since 1971.

The drivers are structural: central bank buying, geopolitical hedging, and concerns about fiscal sustainability. In a “doom loop” scenario of accelerating fiscal deterioration, gold could surge 15-30% from current levels.

Economic Predictions: Soft Landing, With Caveats

The IMF projects global growth at 3.2% in 2025 and 3.1% in 2026—below the pre-pandemic average of 3.7% but not recessionary. Morgan Stanley expects similar numbers: 3.0% global growth in 2025, 3.2% in 2026 and 2027.

Advanced economies are expected to grow around 1.5-1.6%, while emerging markets hold above 4%. The consensus is a soft landing: growth moderates, inflation continues its gradual descent, and central banks ease policy—but not aggressively.

The “Higher for Longer” Era Fades

Central bank policy is expected to continue normalizing. Morgan Stanley’s base case has the Fed cutting to 3.0-3.25% by mid-year and then pausing for an extended period. The BoE is expected to bring rates to 2.75% before pausing. The ECB, facing below-target inflation and sluggish growth, may cut further than markets currently price.

Japan remains the outlier: the only major developed market central bank potentially hiking, with the BoJ expected to reach 0.75% by December before pausing.

Geopolitical & Trade Predictions: Tariffs and Tensions

Tariffs Become the New Normal

Perhaps no theme generates more consensus than this: the tariff regime is here to stay. Trump’s reciprocal tariffs are bringing in close to $300 billion in revenue annually, and while they may face legal challenges (Barclays expects the Supreme Court to deem them illegal), the effective tariff rate has peaked at 12.1%—the highest since 1934.

The economic impact is being absorbed more gracefully than many feared. UBS expects a “soft patch” in early 2026 as tariffs affect U.S. prices, followed by a broadening and strengthening of growth from Q2 onward. But the structural shift is profound: trade may reroute permanently, supply chains are diversifying, and the U.S. is explicitly using tariffs as a tool of economic leverage.

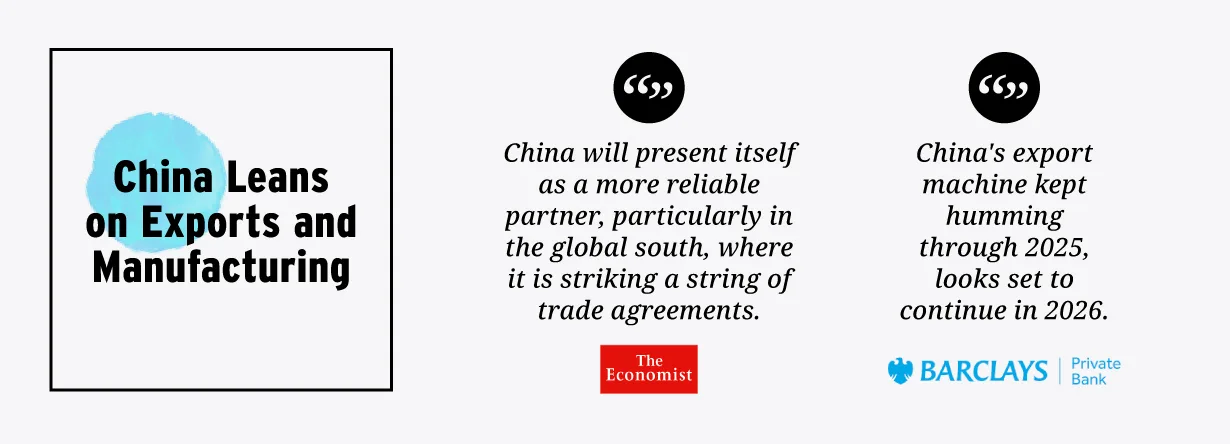

China Leans on Exports and Manufacturing

Facing deflation, a property crisis, and slowing domestic growth, China is pivoting to manufacturing and export dominance. The country is positioning itself as a more reliable partner, particularly in the Global South, striking trade agreements as the U.S. retreats from multilateralism.

Morgan Stanley expects China’s real GDP to expand 5% in 2026, helped by front-loaded government support. But the strategy creates global tensions: industrial overcapacity could flood world markets, and tariff battles may intensify.

Gray-Zone Provocations Increase

The Economist warns that Russia and China will test American commitment to allies through “gray-zone” provocations in northern Europe and the South China Sea. Tensions will rise in the Arctic, in orbit, on the sea floor, and in cyberspace.

This “ambient rivalry” short of outright war but beyond normal peacetime friction is expected to accelerate. Great-power competition will increasingly involve space-based intelligence, drone technology, and AI-powered cyber operations.

Assessing the Consensus

History teaches humility about forecasting. Previous years have contained unforeseen developments, and there’s no reason to expect 2026 to unfold precisely as consensus expects.

What’s valuable isn’t the specific predictions, but themes where informed observers are concentrating their attention. Examples include the transition from AI experimentation to building out infrastructure to support its widespread use. Or stablecoins becoming mainstream financial instruments.

Some of these themes will prove accurate; others will be derailed by events. But taken together, they sketch the landscape that institutions, investors, and policymakers are navigating as they position for the year ahead.

More By This Author:

Mapped: Gas Prices By U.S. State In 2025

Charted: Renters Vs. Homeowners In Every U.S. State

The Global Semiconductor Industry In One Giant Chart