Performance Update Newsletter For April 2023

Image source: Pixabay

Emotion vs. Reality

Although March was marred by news of failing banks, the threat of regional bank runs, and predictions of hyperinflation, the numbers reveal a different story. Despite these concerns, March was a month of significant investment growth in financial markets, with the SPY up 3.7%, TLT up 4.8%, and GLD up 7.9%.

In contrast to fears of economic collapse, these cold, hard numbers suggest that one needs to be defensive but still participate in the markets. Markets are complex and often react to bad news in a positive way. In this case, it may be reacting to billions of liquidity flows into the system.

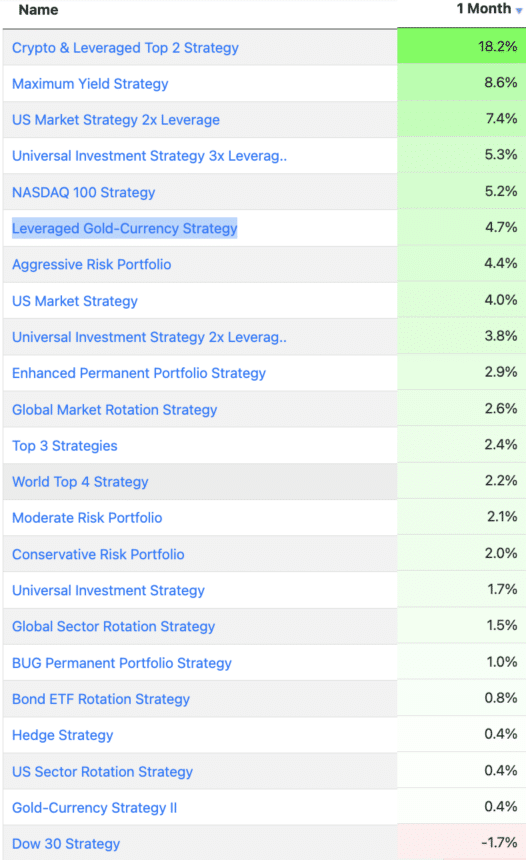

Our strategies were positive for the month. Our maximum yield strategy returned 8.6%, our US market strategy 2x leverage returned 7.4%, while the leveraged gold currency strategy returned 4.7%.

The Cost of Hiking Rates

The unprecedented and aggressive rate hikes by the Federal Reserve and the European Central Bank are now starting to reveal their costs. We can see the effects in the form of the collapse of three U.S. banks and the Swiss government’s rescue of Credit Suisse, which is one of the 30 systematically important banks in the world. These examples serve as crucial illustrations of the consequences of these rate hikes.

Liquidity to the Rescue

Despite the casualties along the way, both the Federal Reserve and the European Central Bank remain committed to fighting inflation. It’s interesting to note that the ECB raised rates one day after the collapse of Credit Suisse and amidst rumors of an imminent failure of Deutsche Bank.

This demonstrates that central banks are determined to keep rates higher in order to fight inflation and are trying to avoid using interest rates as a tool to prevent a recession.

Instead, they have committed significant amounts of liquidity to ensure the banking sector survives. The numbers so far are staggering. According to CNN Business, direct support exceeding $400 billion has been provided thus far, which is nearly half of what was provided during the global financial crisis.

More By This Author:

The Logical-Invest Newsletter For March 2023January 2023 Thoughts

Performance Update Newsletter For November 2022

Disclaimer: Logical-Invest.com is not a registered investment advisor and does not provide professional financial investment advice specific to your life situation. Logical Invest is solely an ...

more