Performance Update Newsletter For November 2022

Image Source: Pexels

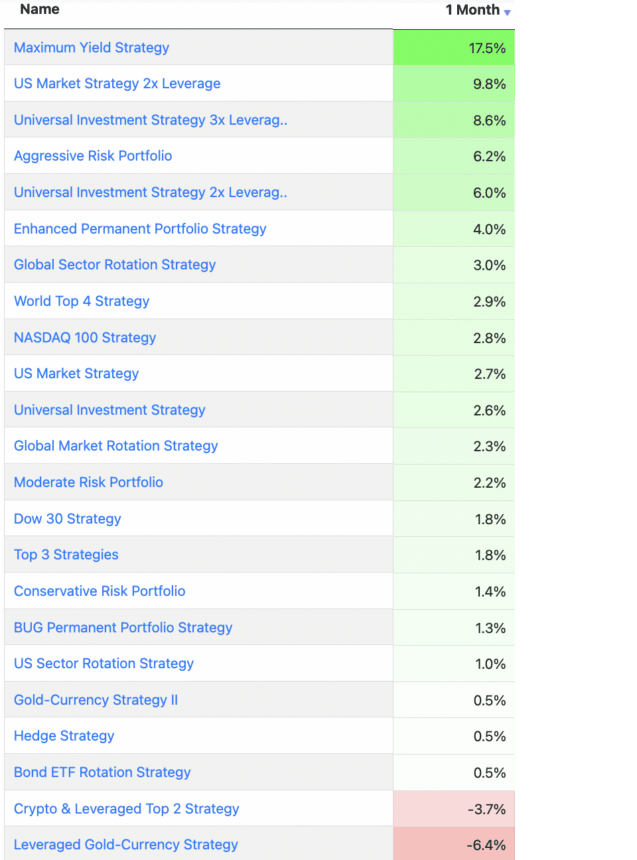

Performances

Best performers for the month were the Maximum Yield Strategy (+17.5%), followed by the US Market strategy 2x.

End of Year Performance

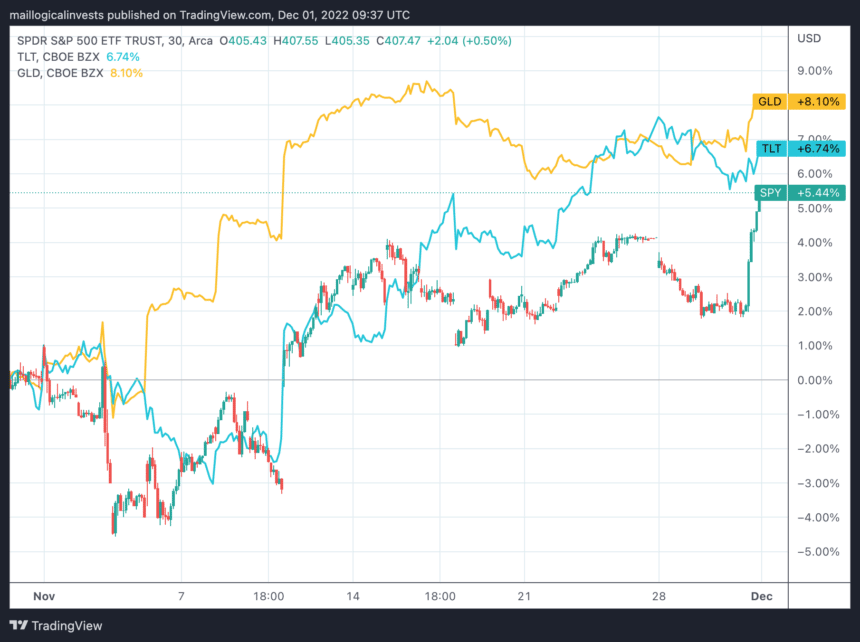

November ended on a good note as the S&P 500 added 3% on Wednesday, closing the month at +5.4%. The 30-Year Treasury ETF (TLT) rose an impressive +6.7%. Gold was up 8.1%.

How is it that all three asset classes were up during that same month? The answer is in the dollar index. When the price of DXY falls, it is common that the three, usually non-correlated asset classes will rise in tandem.

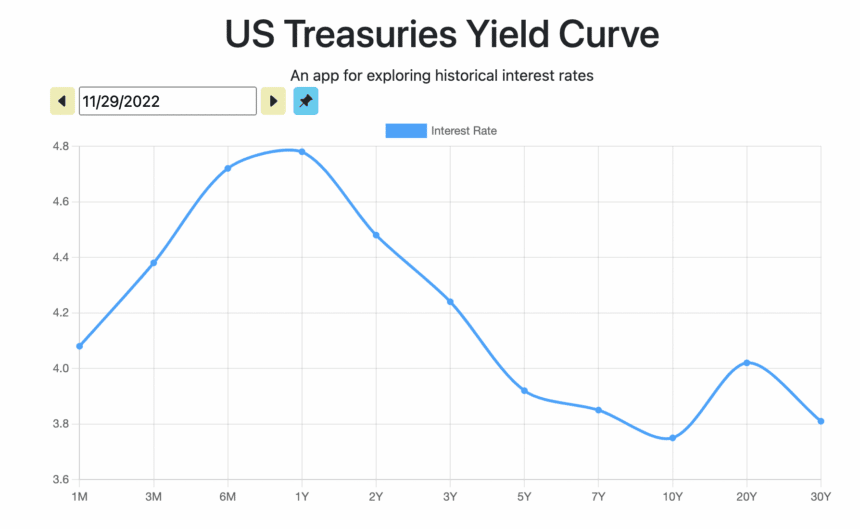

We should note that although 30-year yields fell to 3.8%, 1-year Treasury yields did not follow and instead remained at 4.8%. You can see this resulted in a highly inverted yield curve.

Courtesy of ustreasuryyieldcurve.com

What that means is up to interpretation. Let’s not forget we are moving into an equity-bullish Christmas season.

More By This Author:

October Report - Navingating Through Uncharted Economic Waters

The Logical-Invest Newsletter For August 2022

The Logical-Invest Newsletter For July 2022

Disclaimer: Logical-Invest.com is not a registered investment advisor and does not provide professional financial investment advice specific to your life situation. Logical Invest is solely an ...

more