What The Options Market Is Expecting For Microsoft And Alphabet Earnings

This afternoon has the potential to be a market mover. We are expecting earnings from Microsoft (MSFT) and Alphabet (GOOG, GOOGL) after the close. These two companies (three stocks) represent about 10% of the weight of the S&P 500 Index (SPX) and over 20% of the NASDAQ 100 (NDX). Like it or not, if these two companies move in synch, there is a strong likelihood that they could push the whole market up or down with them.

There is more that binds these companies than simply timing and size. They are #1 and a distant #2 in search, and both have attracted extra attention during the recent focus on artificial intelligence (AI). MSFT jumped out to the lead with a splashy purchase of a stake in ChatGPT.That led to a significant bump in the stock price – pushing MSFT’s market cap up by far more than their investment – and causing it to outperform GOOGL in the time period since.

3-Months, MSFT (red/green bars), GOOGL (blue line)

(Click on image to enlarge)

Source: Interactive Brokers

Thanks to the AI enthusiasm contributing to both companies’ solid performance, as of now, there are many traders willing to speculate that the next move is up. The most active MSFT contract in yesterday’s trading was the 300 calls expiring Friday. Today’s most active contract in either Alphabet class is GOOGL 110 calls expiring Friday, followed closely by the 111 calls with the same expiry. Traders seem particularly hopeful that both stocks can rise over 6% from current levels.

Yet there is much more to both of these behemoths than hope about AI, and those factors should be highly relevant to a wide range of technology companies. We should be learning about trends in ad spending, cloud computing, and software and hardware purchasing. For that reason, what we hear from MSFT and GOOGL has the potential to spill well beyond just these two companies and the indices that they dominate.

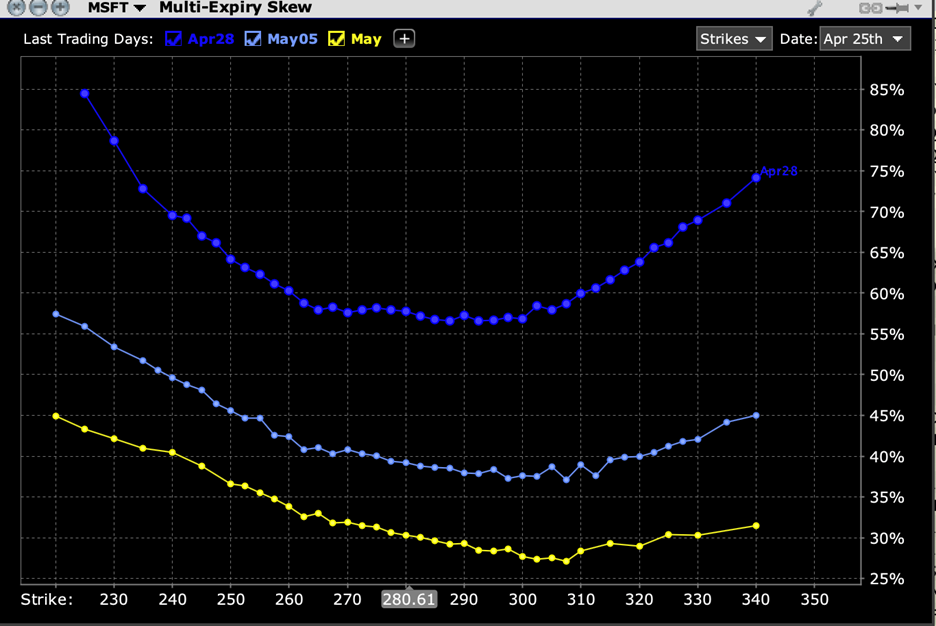

Not surprisingly, based upon the enthusiasm for upside calls, we see a very symmetrical skew in MSFT options expiring this week along with implied volatilities that are generally in line with historical results.

MSFT Skew, April 28 (dark blue), May 5th (light blue), May 19th (yellow) Expirations

(Click on image to enlarge)

Source: Interactive Brokers

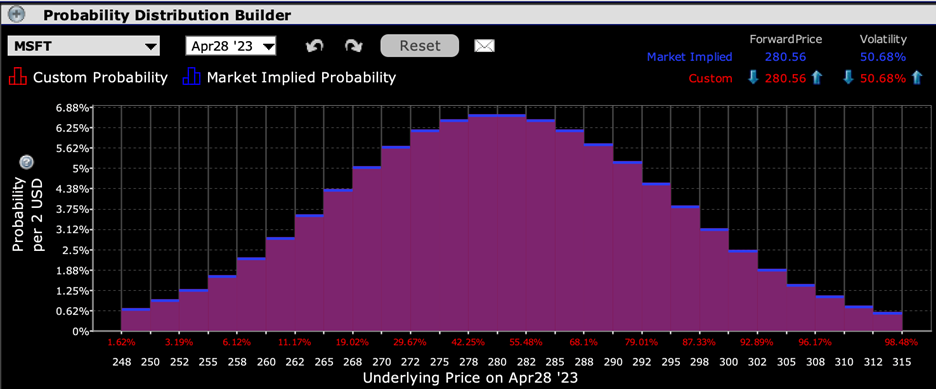

According to Bloomberg data, MSFT averages 3.68% post-earnings moves. Yet that is dragged down by a -0.59% response last quarter. Prior to then, we had -7.72%, +6.69%, and +4.81% moves. The roughly 80% annualized implied volatilities for near-money options are of course well above MSFT’s but are also broadly consistent with historical data. The symmetrical skew is also echoed in the symmetrical view shown by the IBKR Probability Lab:

IBKR Probability Lab for MSFT Options Expiring April 28th

(Click on image to enlarge)

Source: Interactive Brokers

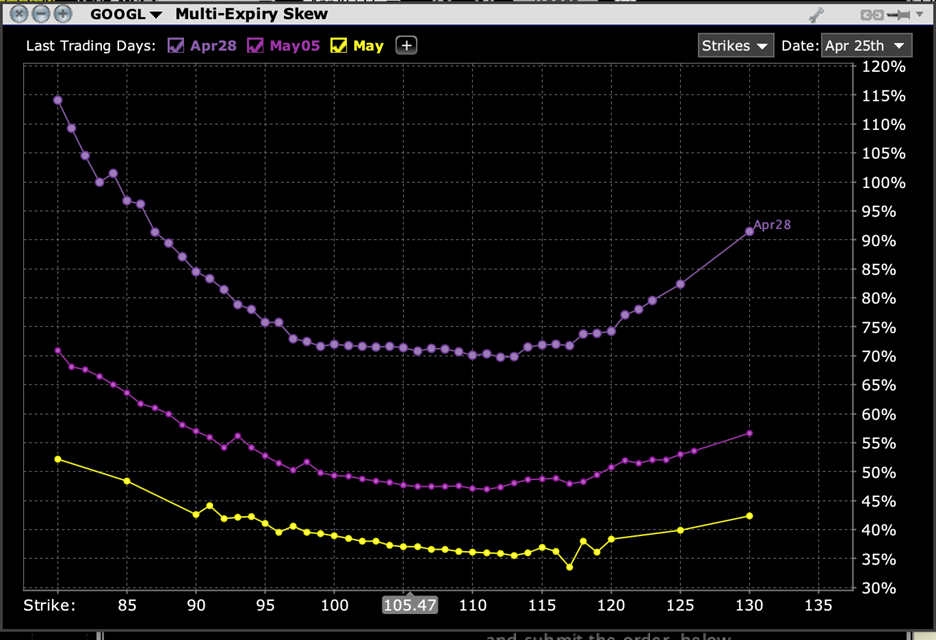

GOOGL options reflect something similar to MSFT with symmetrical skew and implied volatilities in line with prior outcomes.

GOOGL Skew, April 28 (lilac), May 5th (purple), May 19th (yellow) Expirations

(Click on image to enlarge)

Source: Interactive Brokers

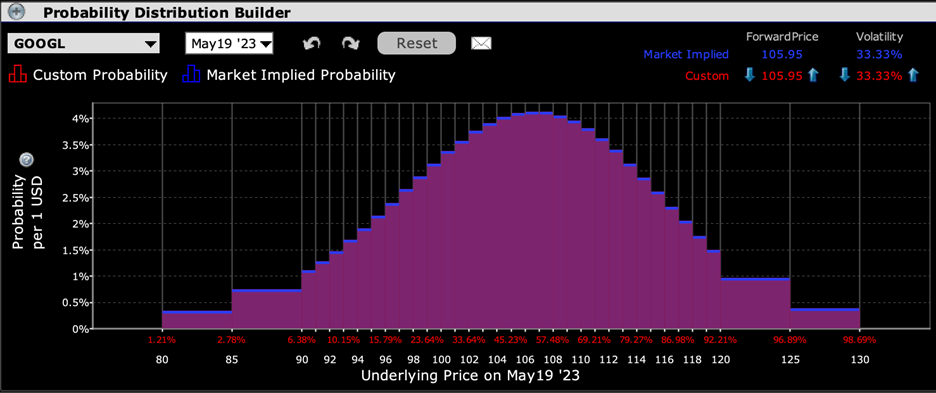

According to Bloomberg data, GOOGL averages 4.65% post-earnings moves, and like MSFT, that figure is pushed down by a -2.75% response last quarter. Prior to then, we had -9.14%, +7.66%, -3.67%, and +7.52% moves. The roughly 60% annualized implied volatilities that we see for near-money options are consistent with those results. Meanwhile, the symmetrical skew is echoed in the symmetrical view shown by the IBKR Probability Lab:

IBKR Probability Lab for GOOGL Options Expiring April 28th

(Click on image to enlarge)

Source: Interactive Brokers

Bottom line, investors are taking both MSFT and GOOGL earnings roughly in stride. They are not so sanguine that they are pushing implied volatilities below the levels that one might expect from these companies’ recent reactions to earnings, but there is a general absence of risk aversion as well to a large extent, that echoes the lack of concern shown by the market as a whole, as evidenced by persistently low levels of major volatility measures like the Cboe Volatility Index (VIX). This afternoon we will take a key step to learn whether the recent complacency and lack of volatility remains justified.

More By This Author:

Bed, Bath And The Great Beyond

Tesla Beats On A Key Metric/What Expiration?

What Is The Options Market Expecting For Tesla Earnings?

Disclosure: OPTIONS (WITH MULTIPLE LEGS)

Options involve risk and are not suitable for all investors. For information on the uses and risks of options, you can obtain a copy of the Options ...

more