What Is The Options Market Expecting For Tesla Earnings?

Earnings season has been underway for a few days now, but this afternoon marks the kickoff of the rarified list of mega-cap tech stocks. Even though Netflix (NFLX) reported yesterday, its status as a “FAANG” stock is largely vestigial. It is currently the 17th highest weighted stock in the NASDAQ 100 (NDX) and #48 in the S&P 500 (SPX).To put this into perspective, Johnson & Johnson (JNJ), which reported yesterday, and JPMorgan (JPM), which reported on Friday are #12 and #13 respectively in SPX (they are NYSE-listed, and thus not included in NDX). Tesla (TSLA), by comparison, is #8 in SPX and NDX.

Beyond even TSLA’s mathematical importance in key indices is its outsized role in investors’ psyche. It is perpetually the most active stock and options class at our firm, with many ardently faithful holders. Its founder and Chairman was a lightning rod even before his recent foray into social media mogul-dom. Even modest blips can create ripples throughout the broader market, as we noted just over two weeks ago. At that time, TSLA reported deliveries that may or may not have beaten published estimates, but certainly failed to impress investors after a sharp rally ahead of that release.

It is unusual for a company to release major news just prior to earnings, but we all know by now that TSLA is nothing if not unusual. TSLA announced another round of price cuts this morning – its sixth this year – which has caused a modest decline in the share price. The move highlights the various moving pieces that investors need to reckon with. Are the price cuts being rewarded with volume boosts? How have the price cuts affected their industry-leading margins? Does it appear that Elon Musk is devoting sufficient time to TSLA, or is his attention being compromised by his active Twitter ownership, the recent attempted SpaceX launch, and his proposed foray into artificial intelligence? And of course, are they meeting revenue and earnings expectations?

As of this morning, options traders do not seem particularly concerned that TSLA will disappoint – despite the very mixed responses to its past few earnings reports. The stock’s average post-earnings move is 7.41%, which is roughly what at-money, near-term options are currently pricing. But the last five moves were +10.97%, -6.65%, +9.78%, +3.23%, and -11.55%. In short, we’ve alternated between larger and smaller-than-average moves. Perhaps the options market is expected that it’s the turn for a smaller move.

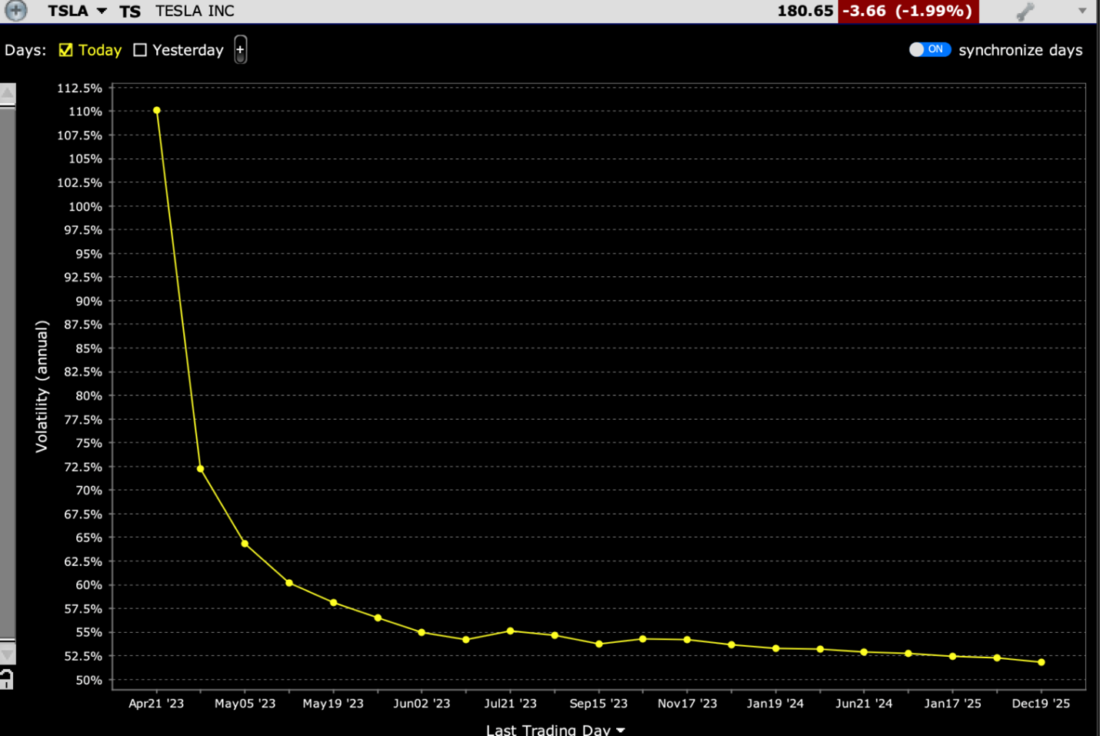

Volatility Term Structure for TSLA Options

(Click on image to enlarge)

Source: Interactive Brokers

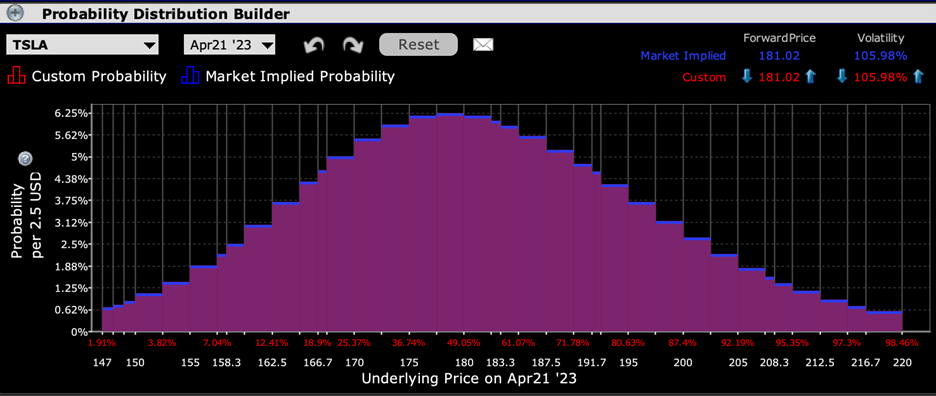

As is customary, we see the highest probability place on outcomes that are around the current price of the stock, but TSLA is unusual in that the cumulative probability of an upward move outweighs that of a downward move. We typically see a bias to the downside as holders purchase protective puts ahead of an earnings report. But remember, there is little that is typical about TSLA.

IBKR Probability Lab for TSLA Options Expiring April 21, 2023

(Click on image to enlarge)

Source: Interactive Brokers

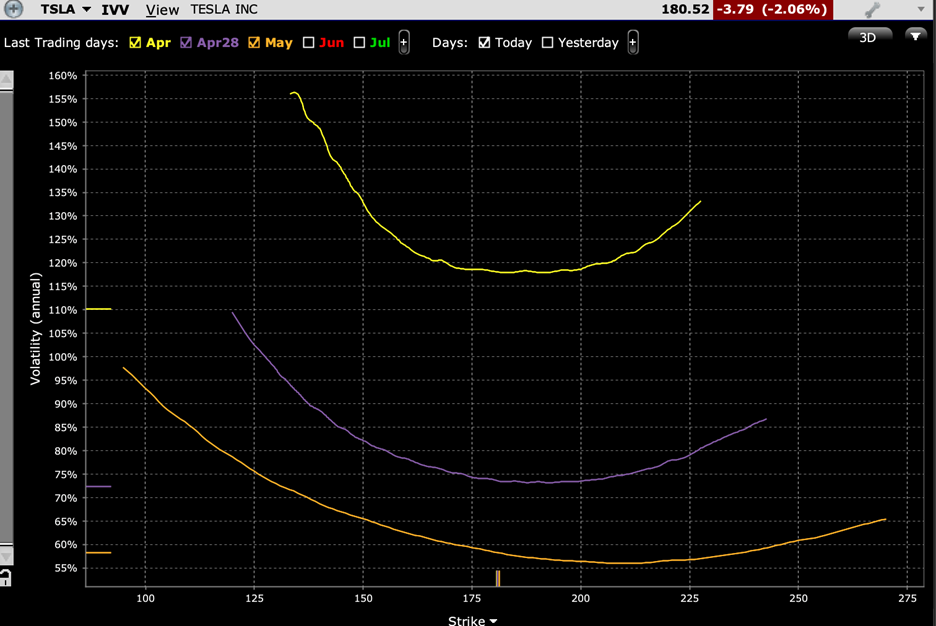

The skews for coming expiration cycles certainly show the lopsided “Elvis smile”, with below-market options showing higher implied volatilities than their above-market counterparts with similar moneyness. That reflects normal caution and hedging activity, but as noted above, the cumulative probabilities are actually greater to the upside.

TSLA Options Skews, April 21 (yellow), April 28 (purple), May 19 (orange)

(Click on image to enlarge)

Source: Interactive Brokers

One might expect a bit more risk aversion for a stock that is closer to the high end of its year-to-date trading range. Perhaps the faithful view the recent 15% pullback from the highs to be a sufficiently low level from which to launch a new rally. We will know soon enough if that faith will be rewarded – again.

More By This Author:

T-Bills Are Handicapping Banks And The Debt Ceiling Debate

Have Zero-Dated Options Broken VIX?

Up In Smoke

Disclosure: OPTIONS TRADING

Options involve risk and are not suitable for all investors. For more information read the “ more