The Path Of Least Resistance, Part III - Is The Crash Over?

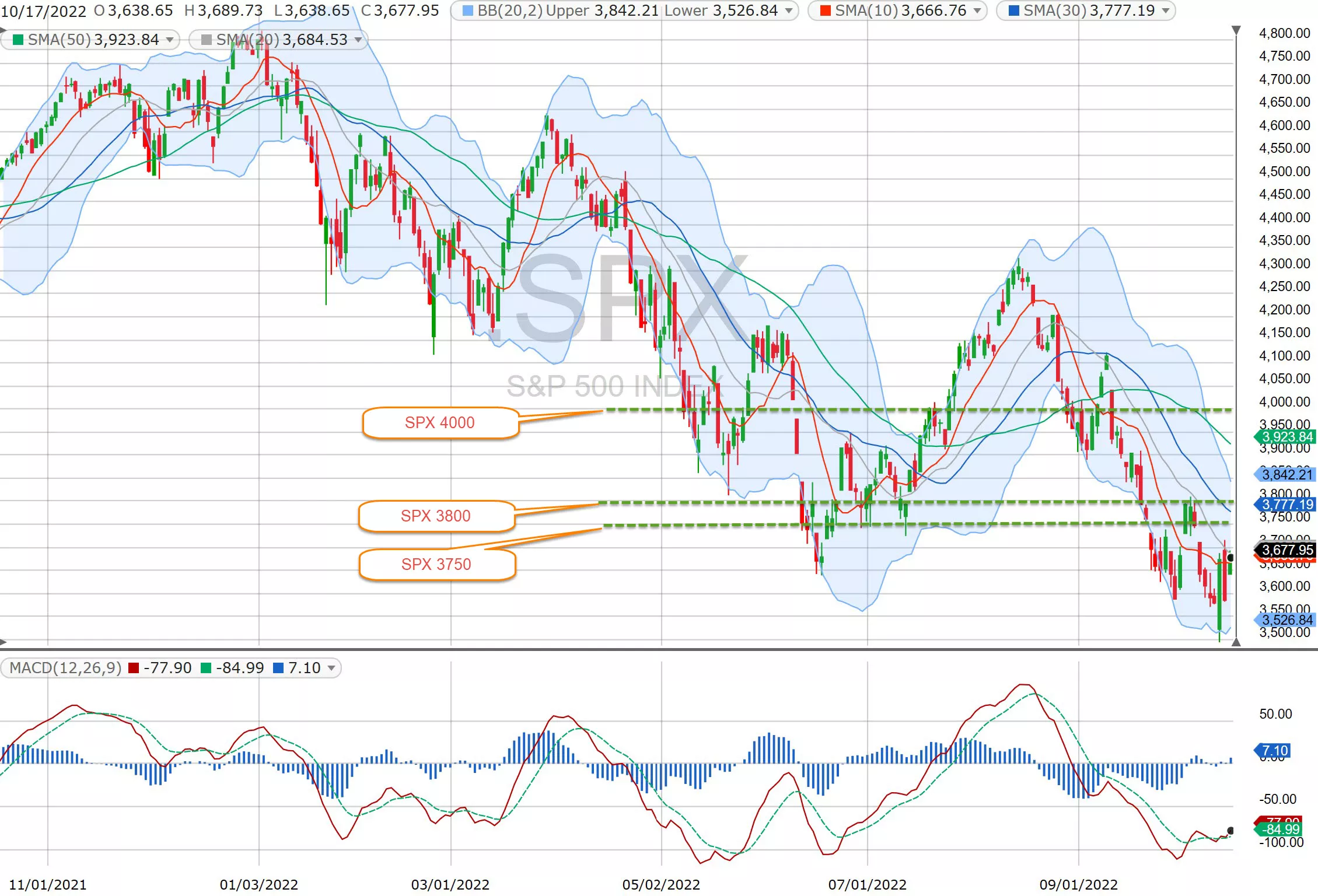

Back in June, in Part "2" of our "market crash watch", I predicted that SPX would drop down to 3500, "there is a gap between 3600-3500; therefore, filling that gap would make a more solid support." Well, 3 months later, we found ourselves there, as SPX visited 3500 last week. As if there was an "automatic BUY button", the market immediately bounced back. As the CPI came in hot again on Thursday last week, at +8.2%, the SPX was down more than 70 points at the open, but, ended the day nearly up 100 points - a 170+ points swing; but, only to lose it all on Friday; and yet, only to gain it all back on Monday. Certainly sounds "volatile" doesn't it? However, VIX didn't go anywhere; in fact, VIX went lower! Since the beginning of 2022, SPX has dropped from 4800+ to 3500-, a whopping 1300 points, or 27%; meanwhile, VIX stayed range-bound and never even made it above 40.

So, where does the market go from here; now that we have bounced nearly 170 points from hitting 3500? Let's take a look at the SPX chart:

(Click on image to enlarge)

The SPX closed up more than 90 points, above its 10-day MA on Monday, as we opened a new earnings season. Since the economy seems still strong and the unemployment rate is low, it seems that the "conditioned eager-buying" is ready to "buy, buy, buy" on any good earnings news. SPX has an initial resistance between 3750-3800. If the bounce is strong, we could potentially see SPX test the 4000 level.

Trades

I have started publishing trades on Stocktwits.com, in addition to Marketfy.com. Amongst our recent trades were:

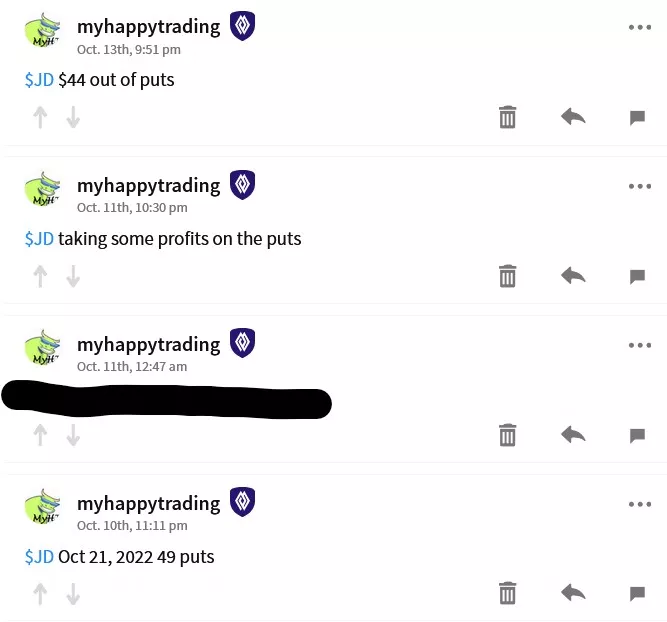

JD Puts

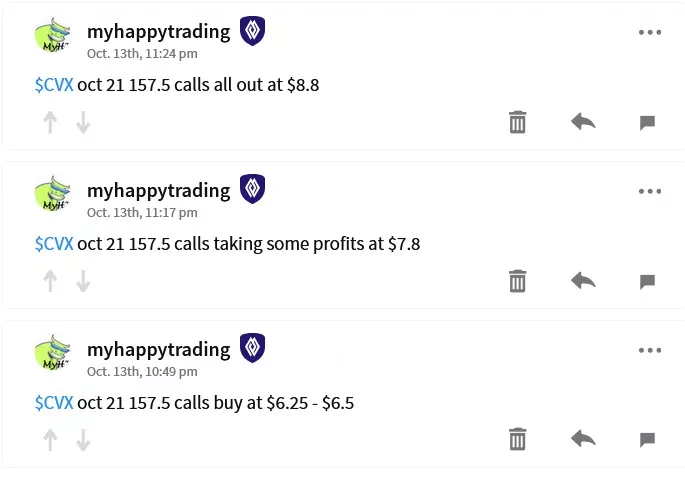

CVX Calls

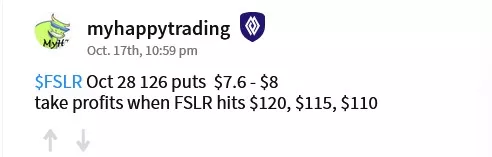

FSLR Puts

Even though the SPX has fallen 1300 points, it really hardly feels like a crash. There has not been a capitulation, as buyers keep coming back strongly. Perhaps this 10-year-old bull market has conditioned investors/traders to jump back in every time the market falls. Perhaps the "conditioned buying" is programmed, literally, led by machines, by computer programs. But, remember, we ARE in a BEAR market now. Things could be different.

I think the bottom is in for now. But, I think in a couple of months, we will revisit and break the lows again. As the stock market continues to bounce and inflation continues to stay high, the Fed will keep raising rates. Perhaps a "surprise" rate hike is needed sometime early next year to finally change the conditioned buying behavior. In the meantime, we will continue to trade on both sides as the market makes its wild swings.

Happy earnings and HappyTrading! ™

More By This Author:

Time To Buy SDS And UVXY

Sell Oil. Buy Solar?

Stocks Coming Back Down

Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no ...

more