Stocks Coming Back Down

Well, summer is about to end, even though there is plenty of heat all around the world.

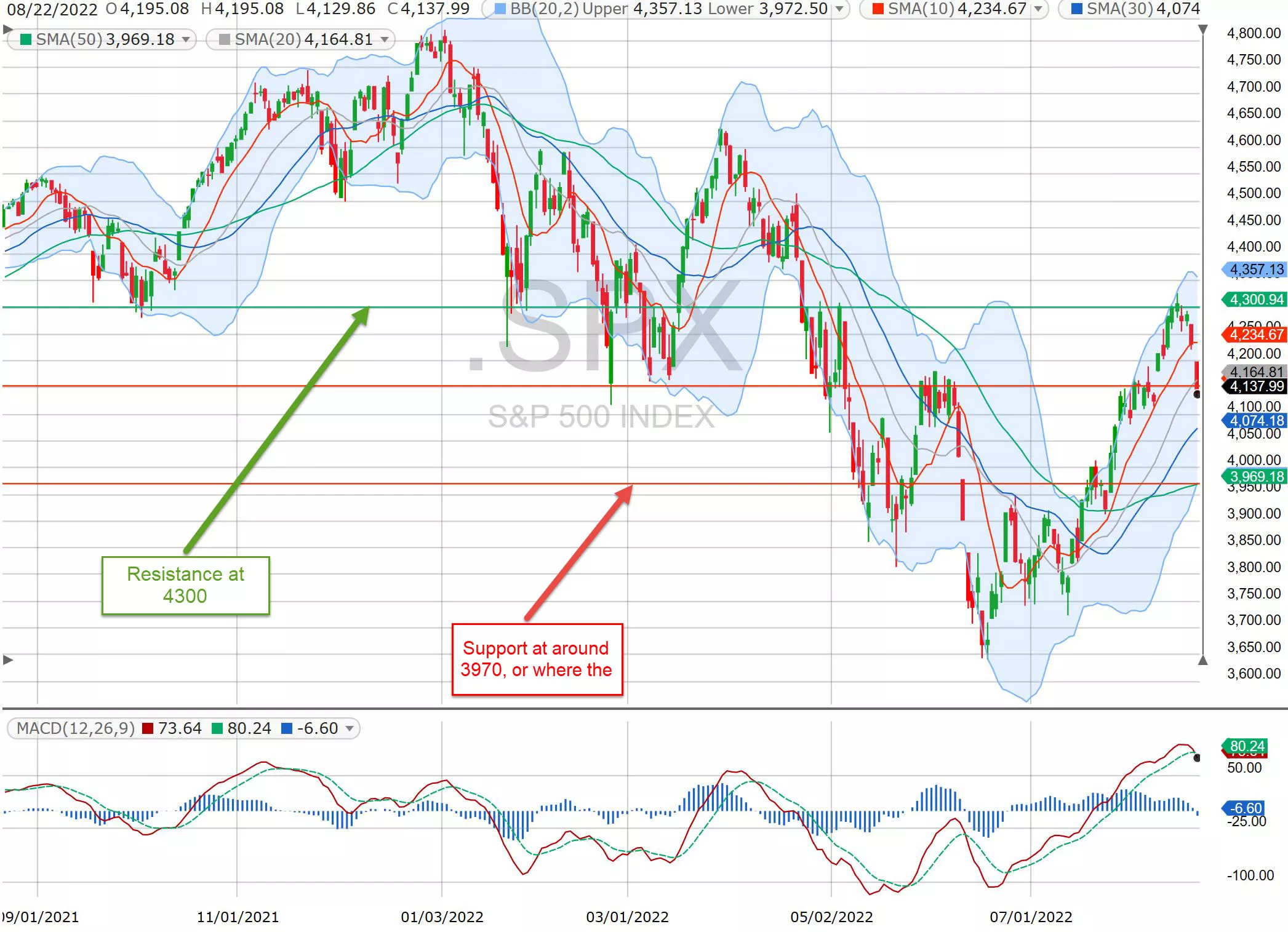

We've had about 6 weeks of rally, and it looks like stocks are coming back down. On Monday, SPX fell more than 90 points (-2.14%), Nasdaq (NDX) dropped 323.64 points (-2.55%), and the Dow (DIA) slide 643.13 points (-1.91%). Semiconductors and financials were really weak, with SMH falling -3.49% and FAS tumbling -6.65%. Here's were the SPX ended up:

SPX

SPX now has a resistance at around 4300. There are a couple of support levels below this, but, I think near-term we can look for SPX to test the 50-day MA, which is around 3970 right now.

On Wednesday this week, we get earnings from NVDA, SNOW, CRM, and SPLK, which could help shake the markets again. The recent rally in solar stocks took a breather with the rest of the market. Overall, energy stocks held on pretty well, and we could see buyers eyeing energy stocks again. However, with people locking in profits over the past month, I think stocks have limited upside from here.

Down-Side Trades

Last checked, market future were all lower. I'm looking at CAT, GS, and TSLA for downside trades. TGT rallied last week, even though its earnings were good at all; it could come back down to below $150 again, soon. VMC and MLM, DG, DLTR, and COST have all been really strong. In a bearish environment, we will likely see people lock in their fat profits.

Up-Side Trades

China trims lending rates over the weekend, prompting some buyers to take a gamble on badly beaten Chinese ADRs. We see JD and XPEV earnings report on Tuesday morning. Let's see if buyers can really find a bottom in these stocks.

Good morning and HappyTrading! ™

More By This Author:

Still No Global Warming?

Stocks Ready For A Bounce

Short-Term Bottom, Really?

Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no ...

more