Short-Term Bottom, Really?

Last Friday, the US stock market had a huge rally, with SPX jumping 116 points.

To begin the new week, trading was muted yesterday. SPX closed down -11.63 points, or -0.3%, to close at 3900. It is basically where the market was after the hot May CPI number came out on June 10. So, after such a hot inflation number, are we just going to look pass it and keep rallying, like there is no inflation?

SPX (Daily)

In this chart, we can see that after the hot CPI on June 10, the SPX took a sharp dive down to about 3636. Now it has popped back up to basically where it closed on the day of the last CPI release, at 3900. I think the stock market is going to hang around here for a bit. We might see volatility taking SPX up to about 3980 or so. On Thursday this week, STZ is reporting in the morning, and this stock is making quite a come-back after the recent drop. MU is reporting after the close. We might see some positioning in the semiconductors sector.

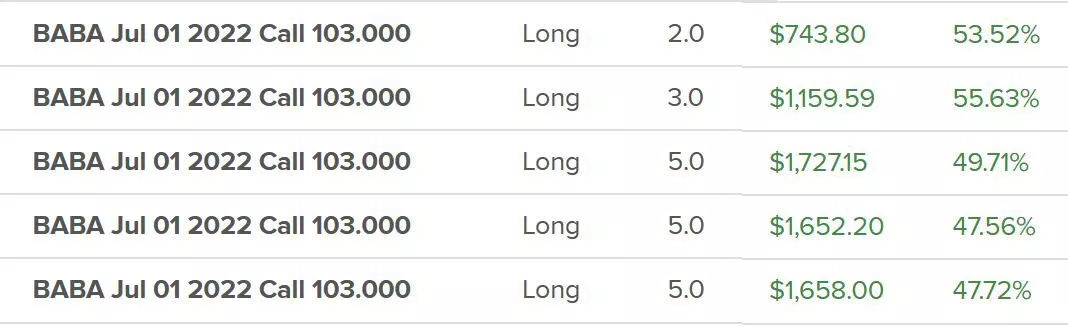

Last week, we made some nice trades on BABA:

(To see details on these trades, Click HERE)

While the US stocks struggle, the Chinese stocks have been establishing a bottom. In the recent weeks, the pandemic situation has gotten better in China, sending its stocks up. Chinese EV-car stocks have done well, especially LI and XPEV. I'm looking for a breakout in NIO.

BABA has not been the strongest perform in the Chinese ADR group. But, it is getting some traction. It is testing the resistance at $120. Breaking above it, will likely take it to $130 or even $140:

Another area that is attracting buyers is the solar stocks. Oil is already very high, which makes solar energy seem more affordable. FSLR, SPWR, CSIQ, ENPH, JKS, DQ are all in rally-mode.

At the time of this writing, US stock futures are higher, financials seem to be taking the lead. Let's watch the 3900-3980 level.

Disclosure: Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no ...

more