The Old Man's Still Got It

Berkshire Hathaway Hits An All-Time High

Back in June of 2020, Dave Portnoy was a few months into his day trading career. Portnoy had started trading after COVID lockdowns shut down sporting events, keeping him from sports betting (his company, Barstool Sports, has a sportsbook betting app). At the time, Portnoy compared Warren Buffett's investing acumen invidiously to his own.

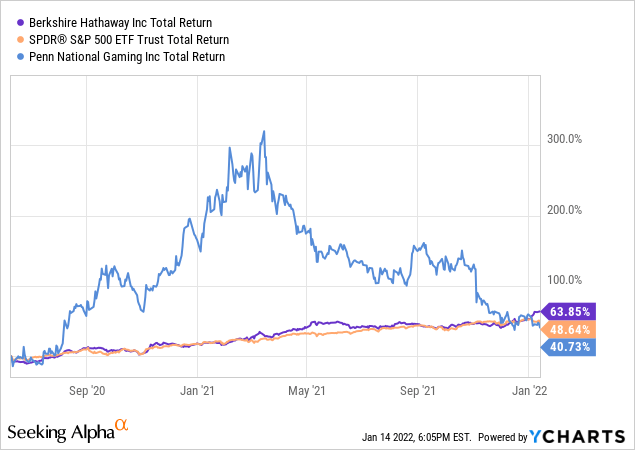

Since then, shares of Buffett's holding company, Berkshire Hathaway (BRK-A), (BRK-B) have handily outpaced the SPDR S&P 500 Trust (SPY) and Barstool's parent company Penn National Gaming (PENN), on their way to a new all-time high.

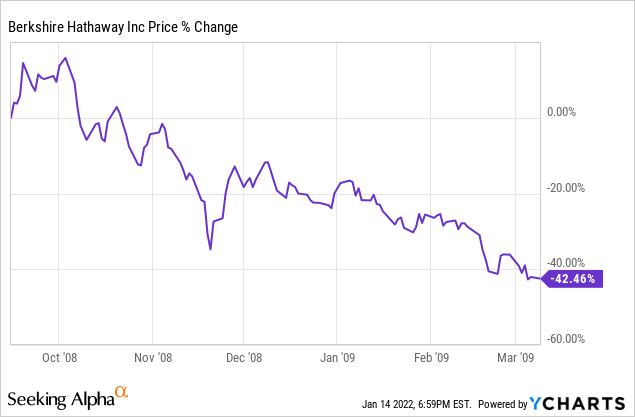

Berkshire Isn't Bear-Market-Proof, Though

After Lehman Brothers went bankrupt on September 9th of 2008, Berkshire Hathaway shares rallied for a couple of weeks before joining in the 2008-2009 bear market.

Although bear market warnings have vastly outnumbered actual bear markets over the years, the current market environment of high valuations combined with high inflation and rising interest rates suggests that stock market investors ought to be concerned about downside risk now. Below are a couple of ways of staying long Berkshire while limiting your downside risk in the event we head into a bear market over the next several months.

Downside Protection For Berkshire Hathaway

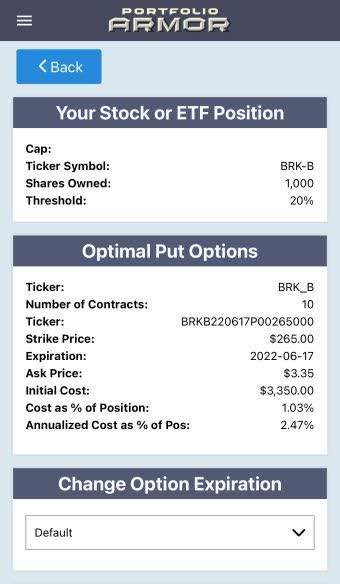

Let's say you own a thousand shares of Berkshire Hathaway Class B and you can tolerate a 20% drawdown over the next several months, but not one larger than that. Here are two ways of doing that.

Uncapped Upside, Positive Cost

As of Friday's close, these were the optimal puts to hedge against a >20% drop in BRK-B by mid-June.

This and the subsequent screen captures are via the Portfolio Armor iPhone app, but you can also scan for optional hedges with our website.

The cost here was $3,350, or 1.03% of position value (calculated conservatively, using the ask price; you can often buy and sell options at some price between the bid and ask). That cost is pretty low. By way of comparison, the cost of hedging SPY against the same decline threshold over the same time frame was 1.25% of position value.

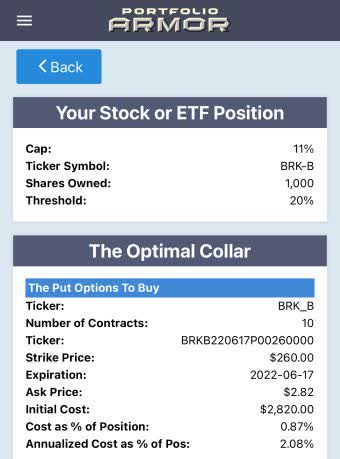

Capped Upside, Negative Cost

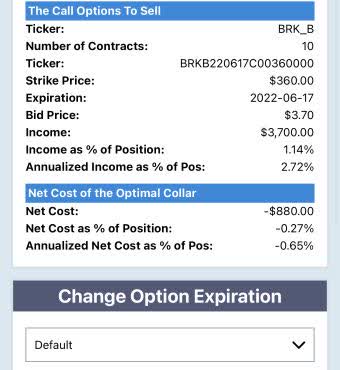

If you were willing to cap your possible upside at 11%, this was the optimal collar to protect against a >20% drop over the same time frame.

Here, the cost was negative, meaning you would have collected a net credit of $880 when opening this collar, assuming you placed both trades at the worst ends of their respective spreads (buying the puts at the ask and selling the calls at the bid).

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more