Shorting UBER Put Options Yield 2.3% For One Month Out-Of-The-Money Plays

/Uber%20Technologies%20Inc%20logo%20on%20phone-by%20DenPhotos%20via%20Shutterstock.jpg)

DenPhotos via Shutterstock

Uber Technologies, Inc. (UBER) stock looks very cheap here. One simple way to play UBER is to sell short put options expiring in one month for a 2.3% yield. This is for contracts in 4% out-of-the-money strike prices.

UBER closed at $93.75 on Friday, Aug. 29. The stock is up 5% from Aug. 6 ($89.22), when it released its Q2 earnings. But it's still off from a recent peak of $96.79 on Aug. 22.

UBER stock - Last 3 months - Barchart - Augl 29, 2025

But, as I recently wrote, UBER stock could be worth as much as 27% more at $119.00 per share.

You can read my full thesis on this in a TalkMarkets article, “Uber Technologies Stock Looks Cheap,” published today. I show in my article why Uber's strong free cash flow margins and analysts' revenue estimates could lead to a significantly higher stock price.

But this article will show an easy way to play UBER. This is by selling short out-of-the-money (OTM) puts in nearby expiry periods. That way, investors can get paid income with a good yield, as much as 2.3%, while they wait for the stock to potentially fall to a lower buy-in point.

Shorting OTM Puts

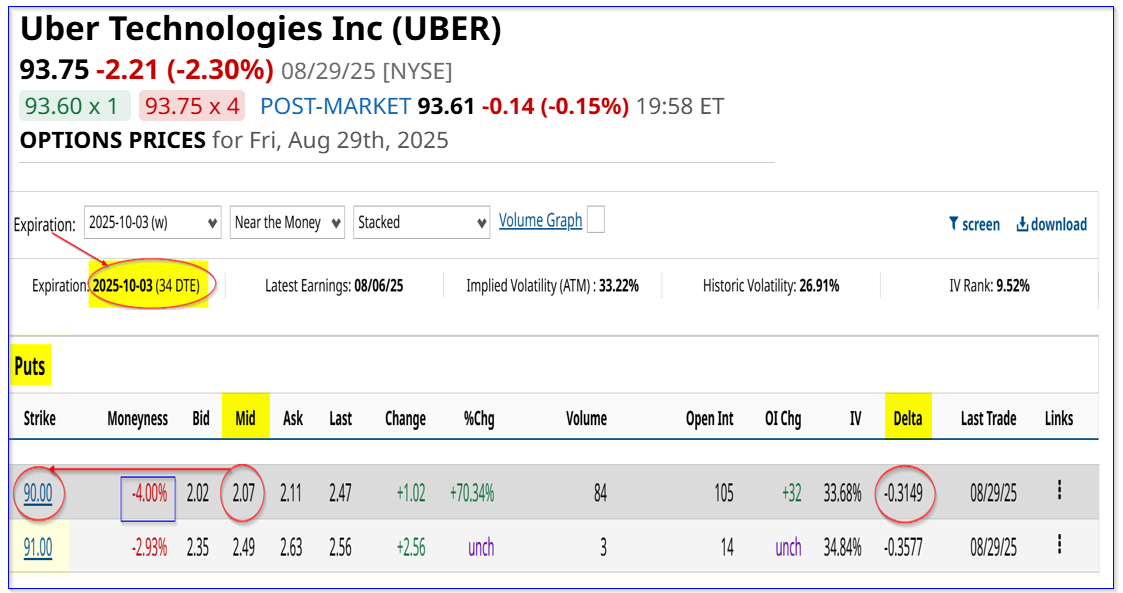

For example, look at the Oct. 3, 2025, expiry period, one month away from today. It shows that the $90.00 put option strike price, which is 4% below Friday's close of $93.75 per share, has a $2.07 midpoint premium. That means it is an “out-of-the-money” (OTM) secured short-put play.

That provides an investor who sells short this contract can make an immediate yield of 2.30% (i.e., $2.07/$90.00). Here is how that works.

(Click on image to enlarge)

UBER puts expiring Oct. 3 - Barchart - As of Aug. 29, 2025

First, an investor secures $9,000 in cash or buying power with their brokerage firm, acting as collateral to buy 100 shares at $90.00.

Next, the investor can gain an immediate credit of $207 in their account by entering an order to “Sell to Open” 1 put contract at $90.00 expiring on Oct. 3.

In other words, the short-put player has invested $9,000, and their account has now earned $207. That makes it a 2.30% ($207/$9,000) one-month yield.

Breakeven Point And Downside Risks

Here is what that means. If UBER stock falls to $90.00 or lower in the next 30 days, the account collateral will be assigned to buy 100 shares. But the investor's account still keeps the $207 credit.

As a result, the potential net buy-in price is $90.00-$2.07, or $87.93. That means the breakeven point is 6.2% lower than Friday's close of $93.75:

$93.75-$87.93 = $5.82

$5.82 / $93.75 = 0.062 = 6.2% downside protection

But that doesn't mean there isn't any downside risk shorting this out-of-the-money put contract. For example, if UBER falls to $86.00 and stays there, the investor will has at least a short-term unrealized loss of $1.93 ($87.93-$86.00).

But there are ways to mitigate this unrealized loss.

Mitigating Potential Losses

For example, some investors may want to limit their downside risk by buying further out-of-the-money (OTM) puts. They can use some of the $2.07 premium to do this. But I would recommend shorting the $91.00 contract instead.

That premium is $2.49 and provides an investor a higher 2.736% one-month yield (i.e., $2.49/91.00). But it also provides more income to buy lower strike price puts.

For example, the $88.00 put strike price expiring Oct. 3 has a midpoint premium of $1.47. That strike price is 6.13% below Friday's close.

In other words, the investor would still gain a net $1.02 ($2.49-$1.47) credit or $102 on the investment of $9,100, or 1.12% ($102/$9,100). And the net breakeven point is 89.98:

$91.00-$1.02 = $89.98 breakeven

The investor would have no unrealized loss if UBER subsequently falls to $86.00. So, there is only a $3.98 interval of risk from $89.98 to $86.00, or 4% to 8.267% below Friday's close.

Another way to mitigate the downside risk is to accept an assignment and then sell out-of-the-money calls. That could potentially bring in more income to cover the unrealized loss from owning UBER shares at a price over the trading price.

Lastly, an investor can always roll forward the short-put play before the expiration period closes. That involves entering an order to “But to Close” the short-put play. This results in a loss. However, the investor may be able to make up for this loss by shorting another month or two forward in OTM puts.

The Bottom Line

Keep in mind that shorting OTM puts is not always a way to buy UBER shares cheaper than at today's price. The stock still has to fall to the strike price and the account assigned to use the collateral secured to buy 100 shares at the OTM strike price.

However, the strategy can be repeated for a very successful expected return (ER). For example, if an investor can make the same OTM short-put 2.30% yield for three months straight, the ER is +6.9%.

That would be the same as buying UBER stock and seeing it rise to $100.22 (i.e., $93.75 x 1.069). So, as long as UBER doesn't rise to $100.22 by Nov. 30, it would be more profitable to short these out-of-the-money puts.

The bottom line here is that UBER stock is very cheap, and shorting out-of-the-money (OTM) puts is one way to play the stock.

More By This Author:

Adobe Looks Cheap Ahead Of Earnings - Short Put Yields Are Juicy

Uber Technologies Stock Looks Cheap

Snowflake Is On A Tear - Its Massive Free Cash Flow Could Push SNOW Even Higher

Disclosure: On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and ...

more