Adobe Looks Cheap Ahead Of Earnings - Short Put Yields Are Juicy

/Adobe%20Inc%20logo%20on%20phone%20with%20festive%20background-by%20rafapress%20via%20Shutterstock.jpg)

rafapress via Shutterstock

Adobe Systems (ADBE) is set to release its earnings on Sept. 11 for the fiscal quarter ending Aug. 31, and ADBE stock is down too much. With its strong free cash flow and FCF margins, ADBE stock could be worth 36% more at $485 per share. Short-put yields are very high (4%) for less than 1 month.

ADBE closed at $356.70 on Friday, Aug. 29. That is off almost 14% from June 12 ($413.68), when it released fiscal Q2 earnings.

ADBE stock - last 6 months - Barchart - Aug. 29, 2025

The stock appears undervalued here, particularly given its strong profitability and strong free cash flow (FCF) margins.

Strong and Consistent FCF and FCF Margins

Last quarter, Adobe Systems reported that revenue grew 10.6% year-over-year (YoY) to $5.873 billion. Most of its revenue comes from subscriptions to its software, so it's very consistent and stable.

In addition, its operating cash flow (OCF) increased by 12.9% to $2.19 billion. This means its OCF margin is very high at 37.3% (i.e., $2.19b/$5.873b).

Since the company has very little capex spending, often offset by FX changes, its net FCF came in at $2.144 billion. That represents a net FCF margin of 36.51% according to Stock Analysis. This was higher than the 35.77% net FCF margin a year ago.

That means that over one-third (36%) of sales go right into Adobe's bank account, with no cash expenses associated with it. The higher FCF margin suggests it is doing a great job of squeezing out more cash from its operations.

In fact, over the trailing 12 months (TTM), the average net FCF margin has been 41.75%, according to Stock Analysis. We can use that to help forecast FCF over the next 12 months (NTM) and to set a price target.

Forecasting FCF

Analysts expect revenue this fiscal year ending Nov. 2025 to be up 9.6% to $23.57 billion, and next year (Nov. 2026) it's forecasted to rise by 9.4% to $25.79 billion.

That implies that over the next 12 months (NTM), the average revenue forecast is $24.68 billion. As a result, FCF could be $10.3 billion, using the TTM FCF margin:

$24.68b x .4175 = $10.3 billion NTM FCF

That would be +30.8% higher than the $7.873 billion in net FCF last year, and even +9.1% higher than the trailing 12 months (TTM) FCF of $9.437 billion. Moreover, in the past 6 months, its net FCF has been $4.6 billion, implying a $9.2 billion run-rate FCF. So, this NTM forecast is $1.1 billion higher, or +12% higher.

But this can also be used to help us set an FCF-yield-based price target.

Price Targets for ADBE Stock

For example, Adobe's market cap has a market capitalization of $151.31 billion, according to Yahoo! Finance. That means that it trades on a FCF yield of about 6%:

$9.2 billion run rate FCF / $151.31 billion mkt cap = 0.0608 = 6.08% FCF yield

The market will likely give Adobe stock a much better FCF yield over the next year. That means the FCF yield will fall. One way to understand this is to use a multiple.

For example, a 6.08% FCF yield is the same as a 16.45x multiple of FCF (i.e., 1/0.0608). But if the FCF yield improved to 5%, that means the FCF multiple would be higher at 20x (i.e., 1/0.05).

So, if we assume that the market will value Adobe's NTM FCF forecast at 20x, its market cap will be substantially higher over the next 12 months:

$10.3b NTM FCF x 20 = $206 billion mkt cap

That is +36% higher than today's $151.31 billion market cap. In other words, ADBE stock is worth 36% more:

$356.70 per share x 1.36 = $485.11 target price

This coincides with other analysts' price targets. For example, Yahoo! Finance reports that $480.07 is the average of 39 analysts. However, AnaChart.com reports that 33 analysts have an average of $420.03, which is almost 18% higher than today.

The bottom line is that price targets for ADBE stock are significantly higher. One way to play this now is to set a lower buy-in price by shorting out-of-the-money (OTM) puts. Given the high yields this provides, investors can make good income with this play.

Shorting OTM ADBE Put Options

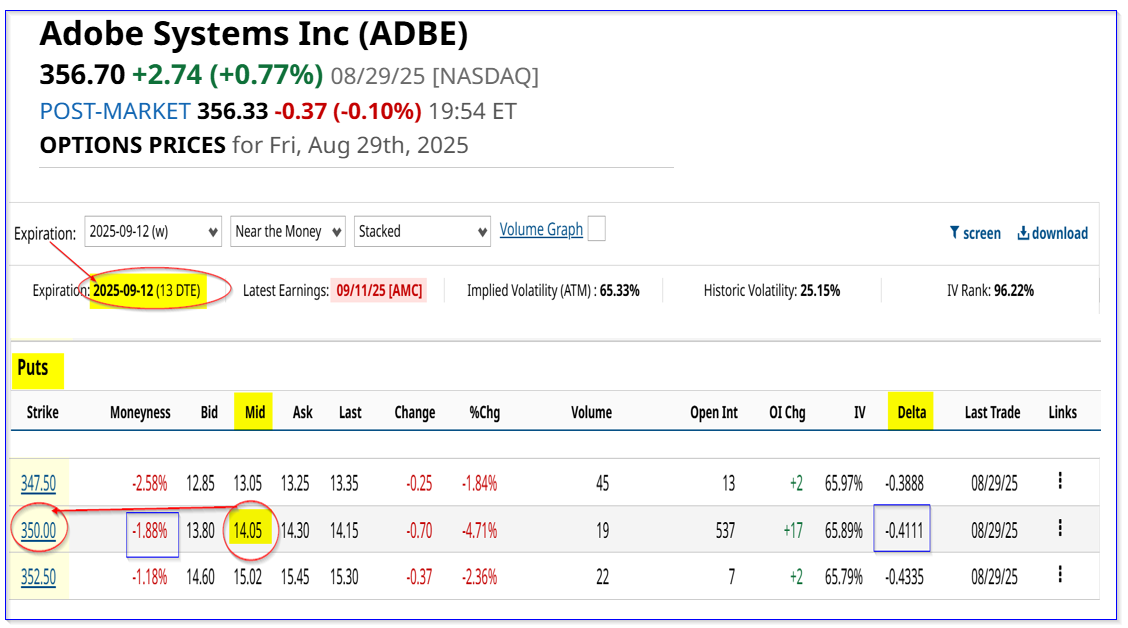

For example, look at the Sept. 12 expiry put option chain (which is just after the Sept. 11 expected fiscal Q3 earnings release date). The yield potential is very juicy!

It shows that the $350.00 strike price put, almost 2% lower and a good buy-in point, has a midpoint premium of $14.05 per share. That means that it provides a short-seller an immediate short-put yield of 4.0% (i.e., $14.05/$350.00 = 0.0401).

(Click on image to enlarge)

ADBE puts expiring Sept. 12 - Barchart - As of Aug. 29, 2025

This also provides an even lower breakeven point, should the stock fall to $350 and the investor's account is assigned to buy shares at $350:

$350.00-$14.05 = $335.95, i.e., 5.8% lower than Friday's trading price ($356.70)

Note that there is a high chance, given the 0.41 delta ratio, that ADBE could fall to $350.00 in the next two weeks. That would mean the investor would effectively have a much lower buy-in point, with much better upside than just buying the stock.

For example, at the AnaChart price target average of $420.03 (see above), the investor's potential gain is +25%:

$420.03/$335.95 breakeven = 1.250 -1 = +25% upside

This would also be more profitable than just buying ADBE, as long it doesn't drop almost 6% in the next two weeks ahead of earnings, which doesn't seem likely. However, if it does, the investor may have a short-term unrealized capital loss (study Barchart's Option Education Center about the risks).

The bottom line here is that shorting OTM puts is a great way to play this undervalued stock.

More By This Author:

Uber Technologies Stock Looks CheapSnowflake Is On A Tear - Its Massive Free Cash Flow Could Push SNOW Even Higher

Nvidia's Free Cash Flow Falters From Higher Capex - Is NVDA Stock Fully Valued?

Disclosure: On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and ...

more