Snowflake Is On A Tear - Its Massive Free Cash Flow Could Push SNOW Even Higher

/An%20image%20of%20the%20Snowflake%20logo%20on%20a%20corporate%20office_%20Image%20by%20Grand%20Warszawski%20via%20Shutterstock_.jpg)

Grand Warszawski via Shutterstock

Snowflake Inc. (SNOW) stock spiked after the company reported strong revenue growth on August 27 for the Q2 FY26 period, ending July 27. The stock is up +19% in the past two days.

SNOW closed at $238.66, up from $200.39 on Aug. 27 before the results were released. My target price is now $337.47, or +41.4% higher. This article will show why.

(Click on image to enlarge)

SNOW stock - last 6 months - Barchart - Aug. 29, 2025

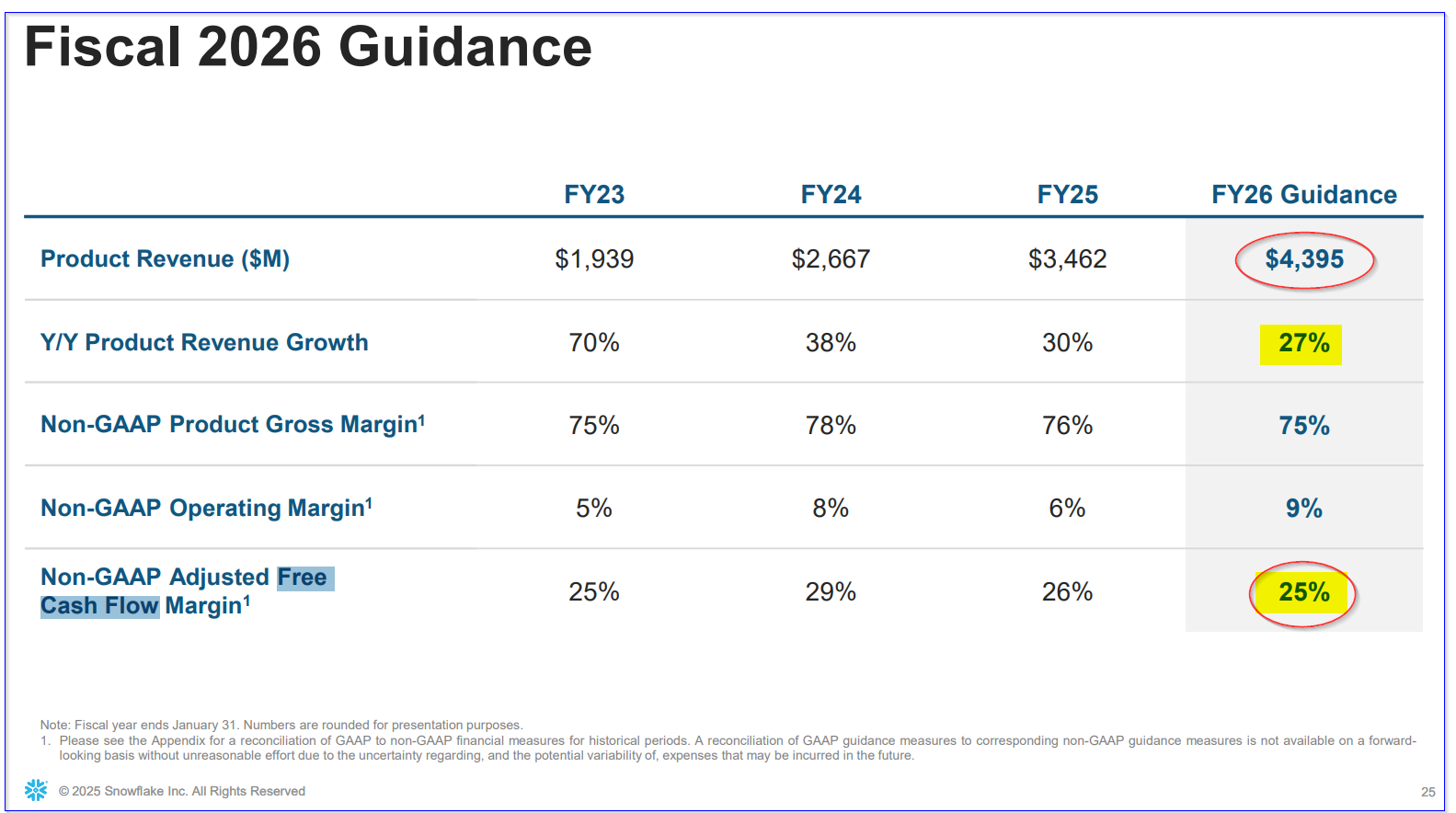

Management says revenue will be 27% higher YoY, along with a 25% adjusted free cash flow (FCF) margin. What's key here is that management forecasted its FCF margin for the year, a projection that almost no company does.

That shows strong confidence in its recurring free cash flow (FCF).

It also allows us to project a target price for SNOW stock that is over 44% higher, even after its recent run-up. Here's how that works out.

Strong Revenue and FCF

Snowflake, a Bozeman, Montana-based company, provides data analysis and data cloud management products. It has four product lines: data engineering, analytics, AI (artificial intelligence), and applications/collaboration.

If your business needs to analyze a massive amount of data queries on datasets and LLM (large language models) or anything close to that, Snowflake can probably help. Essentially, its growth is being fueled by a convergence of data cloud growth and the need for software to analyze the data, including AI data.

For example, last quarter Snowflake's revenue was up +31.8% year-over-year (Y/Y) to $1.145 billion. Moreover, management projects its FY 2026 revenue (ending Jan. 31, 2026), will rise at least 27% (i.e., product revenue, not including professional services).

Based on this, analysts now estimate that its FY 2026 revenue will be $4.61 billion. Next year, they forecast $5.69 billion, or +23.4% more.

But here is the key point. Management now estimates its FCF margin will be 25% for FY 2026. (Again, almost no company ever projects its FCF margin). This can be seen on page 25 of its Q2 deck (see below):

(Click on image to enlarge)

Snowflake, Inc. Q2 deck - page 25

As a result, we can estimate that its FCF will be over 22% higher than last year:

$4.61 billion revenue FY26 x 0.25 = $1.1525 billion FCF vs. $941.5 million last FY (i.e., +22.4%)

This means that its strong FCF growth will continue. But even if we use the $4.4 billion product revenue figure from page 25, the FCF estimate is at least $1.1 billion. So, on average, we can expect at least a $1.1263 billion FCF figure for FY 26, or +20% higher than last year.

Target Price for SNOW Stock

Right now, SNOW stock has a market value of $79.63 billion, according to Yahoo! Finance. Its adjusted FCF over the last 12 months was $784 million. This can be seen from the quarterly adj. FCF figures on page 33 of the company's Q2 deck.

As a result, the stock is trading on a trailing 12-month (TTM) FCF yield of about 1.0%:

$784 million/$79.63 billion mkt cap =0.0098 = 0.985%, or about 1%

Therefore, using our projection of $1.1263 billion in adj. FCF for FY26, the market value in six months could rise to $112.63 billion:

$1.1263/0.01 = $112.63 billion target mkt value

That is 41.4% higher than today's market cap of $79.63 billion. In other words, SNOW stock is worth at least 41.4% more than its price today of $238.66:

1.414 x $238.66 = $337.47 price target

Analysts Equivocate

Analysts tend to be behind the curve with fast-growing and hugely profitable companies. This is even when they project their own FCF margins.

For example, Yahoo! Finance shows that 51 analysts have an average price target of $260.62 per share, or only +9.2% higher. I suspect that after new analyst reports come out, this average price will rise.

However, AnaChart, which covers recent analyst write-ups and recommendations, shows that 40 analysts have an average of $270.34. That is +13.2% higher, but, again, I suspect this number will rise soon as more analyst reports emerge.

The bottom line here is that Snowflake is experiencing strong growth and very reliable free cash flow and FCF margins. That could lead to a price target between 13% and 41% above Friday's closing price.

More By This Author:

Nvidia's Free Cash Flow Falters From Higher Capex - Is NVDA Stock Fully Valued?

Unusual Put Option Activity In Pfizer Stock - Have Investors Turned Bearish?

Zoom Stock Is Up Big On Huge Free Cash Flow - Has ZM Stock Peaked?

Disclosure: On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and ...

more