Prospects For The Pre-Earnings Apple Trade

Apple (AAPL) reports earnings on July 30th after the market closes. Perhaps only the Federal Reserve's announcement on monetary policy the next day stands taller as a marquee market event for the week.

Last week, I made the case for betting bullishly on AAPL earnings. Soon after that post, the long side of my trade hit its initial profit target and left me with my put spread hedge and the need for a new strategy. Last Friday, CNBC Options Action presented its own bullish case for Apple's earnings, but I disagree with the proposed positioning.

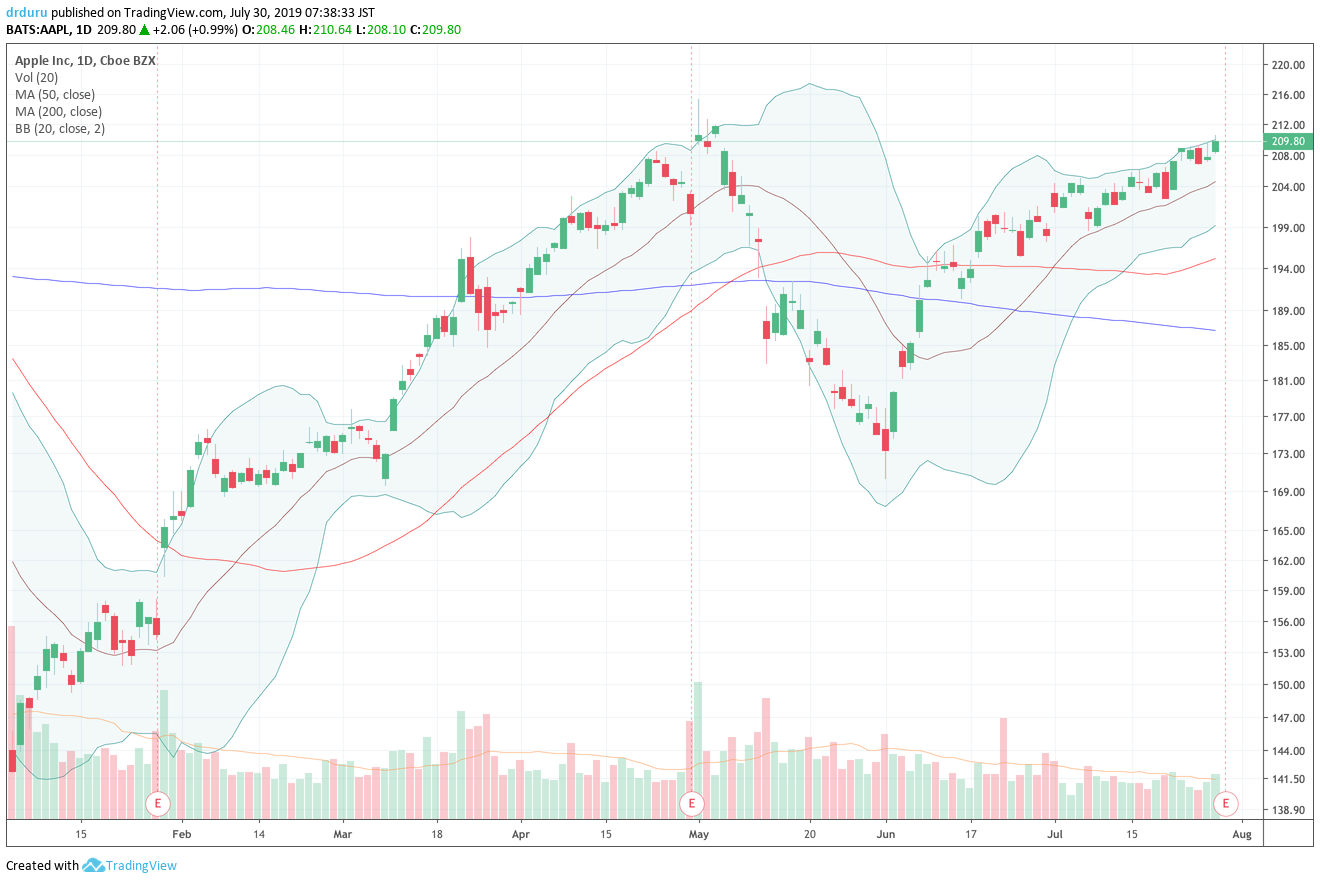

The CNBC Options Action panel presented an interesting mix of observations. Dan Nathan focused on the bullish case for traders who expect Apple to deliver the same kind of incremental upside surprise that Google (GOOGL) delivered in generating a 10.3% post-earnings gain. A combination of recent big post-earnings moves and low expectations has Dan anticipating a strong breakout above AAPL's $215 resistance level. Carter Worth was skeptical about a breakout given the market faded from $215 after what was reportedly good earnings results. Carter's unspoken question: can earnings improve enough to push through that last post-earnings intraday high (3.5% higher than Friday's close)?

Michael Khouw agreed with Dan that the market is under-pricing the options with an estimated +/- 4.5% move by August 2nd expiration (the first post-earnings expiration), so he noted that the call options are a way to risk a lot less in betting to the long side. Dan concluded by recommending investors already long AAPL buy some downside protection because the options are "cheap."

Apple is up 20% from its June low. Here’s how @RiskReversal is trading the tech giant ahead of earnings next week pic.twitter.com/IsPxYOL1jD

— Options Action (@OptionsAction) July 26, 2019

I am also bullish on Apple's post-earnings prospects. I am focused on leaning contrary to the historic level of bearishness of analysts and riding the favorable seasonal post-earnings pattern for the stock. However, I think the options are correctly priced and perhaps a little over-priced. My valuation estimate goes beyond the +/- 6% earnings moves in AAPL over 3 of the last 4 reports. I look at the median, average, and frequency of big moves since 2007 and since 2014. With either timeframe, the median one-day post-earnings move is about 2.7% and the average is 1.1%. Since 2007, AAPL has reported earnings 50 times and 22 times since 2014. Since 2007, AAPL experienced +/- 4.5% moves 25 times (50%) and 12 times (55%) since 2007. The frequency perspective makes the options look well-priced. The median or average perspective makes the options look expensive using a risk/reward lens.

So while Dan wants to buy the August $210 call option outright, I prefer (now) a call spread. My initial position that triggered its profit target was a calendar call spread using the July 26 weekly and the August monthly calls.

At Friday's close, the August $210 call cost $3.80/$3.90 at the bid/ask. The August $210/$215 call spread cost $1.90/$2.00. If AAPL gaps right to $215 resistance and holds through August expiration, the call spread would deliver up to a $3, 158%, profit while the outright call would deliver up to a $1.10, 29% profit. Because of time premiums, the one-day profit potential at $215 resistance is lower in both cases but still favors the call spread given the sale of premium in the $215 call spread.

For the extremely bullish scenario that Dan likes, I still prefer selling a calendar call spread (this time) using the $215 resistance level as the target. The August 2nd $215 call costs $1.50/$1.54. The August monthly $215 call costs $2.22/$2.28. The calendar call spread would thus cost about $0.75. This configuration offers a better risk/reward setup under the scenario of AAPL gapping higher and taking some time to break free of $215 resistance.

AAPL closed today up two points to $209.88. The costs of the different call options are higher, but I still maintain the same strategic preferences. Note well that given the historical pre/post-earnings patterns, if AAPL looks like it will close with a gain ahead of earnings, I will be a lot less likely to re-establish a bullish trade.

Source for chart: TradingView.com

Disclosure: long GOOG calendar call spread, long AAPL put spread left over from hedge of original pre-earnings AAPL play

Follow Dr. Duru’s commentary on financial markets via more

Gotta love $AAPL!