Options Time Decay

Image Source: Pexels

There are a few things in life that are constant, and time is one of them. Though when it comes to the options world, not all time is created equal. This article will discuss options time decay and explore the relationship between theta and gamma.

Theta refers to the decline in an options price due to the passage of time. Options have both intrinsic and extrinsic value. The intrinsic value of the option is the value the option would have if it were exercised today. The extrinsic value is the price of the option minus the intrinsic value. This is our time component.

For beginners, it is easy to think of theta as constant. This is incorrect. As long as an option has extrinsic value, it is true that time decay will occur. Yet the rate of that time decay varies drastically, as shown in the graph below.

In this chart, we have the values for three options with one month to expiry. The blue line represents an ATM (at-the-money) option, the red line for an OTM (out-the-money) option, and the green line is an even further OTM option.

We may notice a few things. We will begin by looking at the blue line. The theta decay will continue to accelerate until the day of expiration where, if the option is still ATM, the theta will be at its greatest (red circle). Conversely, we may notice that the green line for the far OTM option has the opposite shape. It is also downward sloping, but the slope flattens over time.

Theta decay is at its highest initially and then steadily declines as the option loses value. At the black arrow, theta decay is minimal. The reason for this being that the option has already lost almost all of its value and is trading for pennies. Theta decay is highest for options ATM close to expiration and highest for far OTM options furthest from expiration.

Theta vs. Gamma

If we are selling options, we are initially drawn to the shorter-dated ATM options. These have the highest theta decay. Yet time decay is not a free lunch. The theta decay is what we collect if the stock doesn’t move, and gamma is what we pay when it does.

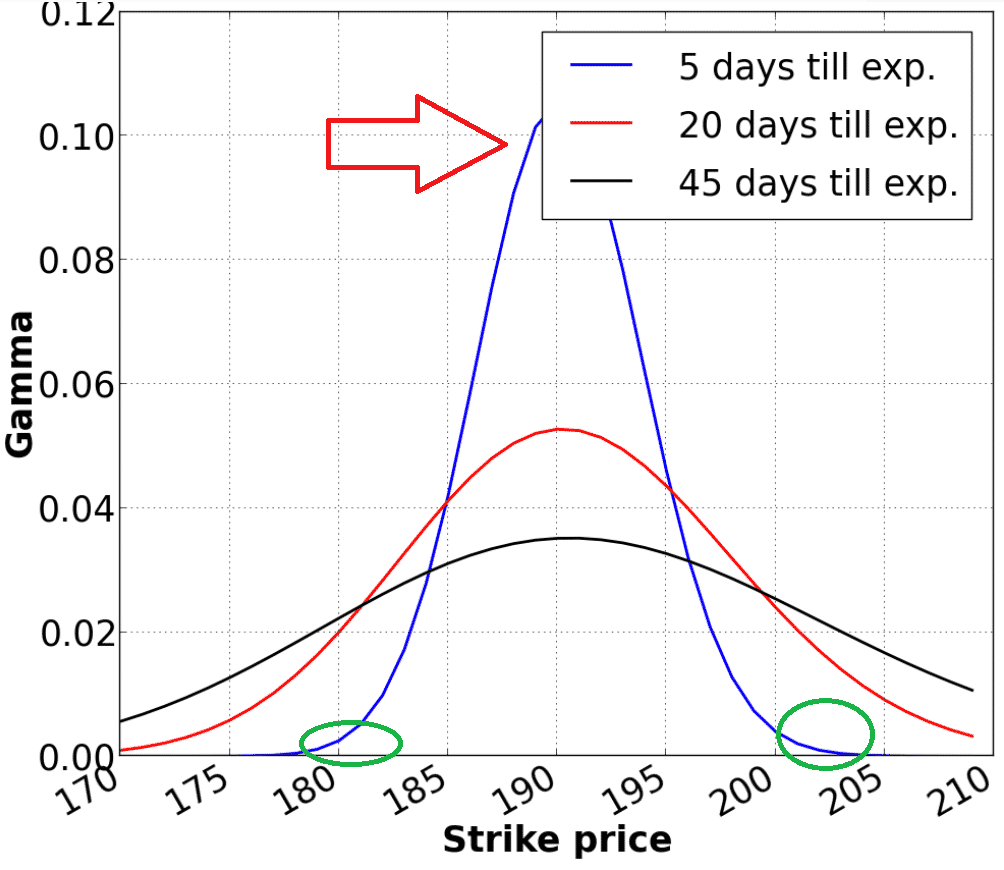

This graph depicts the changing gamma for an option over time. We may notice that at the red arrow, we have the most gamma. These are the short-dated ATM options. At the green circles, we have the least gamma for the short-dated far OTM options.

If it sounds familiar, it is because it is the same as our time decay graph. Wherever theta and time decay is the highest, gamma is also the highest. We will use the graph above and a stock trading at 190 as an example. A 205 call option expiring in five days is not going to have much value. Perhaps it worth 5 cents.

Theta has to be low because the option is only worth 5 cents and cannot lose more than that. Gamma is also small because it makes almost no difference if the stock moves from 190-191. The option is still next to worthless. Conversely so for the 205 call expiring in 45 days.

It still has some value and thus will experience theta decay while also having some exposure to gamma. After all, there is still a chance the stock could move from 190-205 in 45 days. It is highly unlikely to do so in just five days.

Over/Under on NFL Sunday

Imagine it is NFL Sunday and the over/under for the game between the Chiefs and Bucs is set at 50. That means that there are two choices. Bet on the over if we think more than 50 points will be scored (gamma) or bet on the under (theta). Say that we bet the under. The game starts. Immediately as the game gets underway, we start to notice we are collecting money and the live odds are slowly moving in our favor.

The new over-under is 48. Why? Nothing has happened yet, after all. This is our theta collection in action. As time ticks off the clock, we are collecting theta, albeit slowly. The teams punt a few times but all of a sudden, touchdown. The new over-under is 52 and we are losing money. This is our negative gamma working against us.

Now imagine the game progresses and it is an unmemorable performance. We are late in the fourth quarter and the score is 10-3. At this point, it is irrelevant whether a touchdown is scored because there is simply not enough time for the score to reach 50. Our gamma is reduced to almost nothing, along with our theta. We are thus at the green line and circles on the above graphs.

Let’s look at an alternative scenario. The score is 25-21 with 30 seconds left on the clock. The ball on the 10-yard line. Our bet is still fully on and we are on the edge of our seats. Time decay is at its maximum. Each second is prized. Conversely, gamma and the opportunity for our winner to turn to a loser is only a pass away.

There is No Free Lunch

When we sell volatility, we are betting against the stock moving and we want exposure to theta. When we buy volatility, we are betting on the stock moving and we want exposure to gamma. Neither is a free lunch. Theta and gamma are in a constant battle against each other.

If you have read a little about selling options, it would be tempting to sell these shorter-dated options to maximize your theta decay. Yet In doing so, you are also maximizing your gamma risk. In essence, you are betting on the outcome of the game on the last play.

Time Decay and Systematic Strategies

Theta decay does not equal Variance Risk Premia. Yet it is true that selling options and being long theta has a slight positive expected value in the long run. There is no systematic strategy for taking advantage of this that is better than another.

Ultimately the shorter-dated options will have a higher variance risk premia as they are more difficult to hedge, have more gamma, and therefore variance. Longer-term options have less gamma, but also less theta. Ultimately for systematic strategies, it comes down to investor preference.

For more active investors willing to hedge frequently and embrace more variance, trading shorter-dated options might be more fruitful. For an investor who doesn’t have time to look at their portfolio frequently or would rather hedge infrequently, rolling longer-dated options would be a better fit.

If you are unsure or new to options, I recommend paper trading both an option expiring in one day and one expiring in one month and watch how their deltas and your P&L change over the course of the day. Alternatively, if you like watching sports, watch how the betting odds swing drastically in the final minutes of a close game vs. a blowout.

Time Decay and Systematic Strategies

Time decay, while ever-occurring, is not constant over time. Understanding how theta affects different options can help us visualize both our potential returns and our risks in terms of gamma exposures.

As theta is constantly changing as the price moves, being aware of these moves is paramount as we can have a position that has a lot more theta and gamma then at inception. Understanding these changes can leave us in a better position in understanding our P&L and ultimately our trading in general.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more

In trading, options time decay describes how value slowly slips away as an option approaches its expiration date. Every moment counts — hesitation costs, and timing determines profit or loss. It’s a constant race against the clock.