Selling Put Options – Getting Paid To Wait And Buy Stocks For Less

How would you like to buy a stock for less than it is currently trading?

By selling put options, you can do just that and get paid to wait for a pullback.

So what’s the catch?

Today we’ll answer that question and more.

We’ll look at various strategies for selling put options as well as some detailed examples to help you understand the entire process.

Introduction

Selling puts is a great strategy for beginners start learning options trading.

When you sell a put option, you’re selling someone the right (but not the obligation) to sell you 100 shares of the underlying security at a certain price (strike price) before a certain date (expiration date).

For selling this right to the buyer, the put seller will receive a premium from the buyer.

That premium is the sellers to keep no matter what happens, but they are now on the hook to buy the shares at the strike price if called upon to do so.

Benefits Of Selling Put Options

Selling put options is essentially an income strategy. It is very similar to covered call trading with similar risks, rewards and profit potential.

By selling puts and investor can:

- Achieve above-average returns while waiting for the stock to come down to a price at which they are happy to buy.

- Gain some downside protection if the stock drops. A 20% drop in a stock may see the put seller suffer only a 10% loss due to the premium received.

- Make effective use of spare cash while waiting to get in to the market.

- Take advantage of high volatility during market corrections. Taking a contrarian approach when there is a lot of fear in the market can see put sellers handsomely rewarded.

Like any option strategy, there are times when selling puts will perform well and times it will underperform.

Selling puts works great in sideways, slightly bullish and even slightly bearish markets.

However, this strategy will underperform during raging bull markets as investors will miss out on the capital gains provided by rapidly rising stock prices.

The Mechanics Of Selling Puts

It’s always easiest to learn through examples, so let’s take a look at the how selling put options works. We’ll work through a theoretical example first to help you grasp the concept before moving on to real examples.

Let’s assume ABC Corporation is trading at $100 and you are happy to buy it in one months’ time for $95.

You, therefore, sell a 1-month, $95 put.

For selling this put, you receive $3 in premium which is $300 in total.

You also have the obligation to buy 100 shares at $95 if called upon to do so which would cost $9,500.

If assigned, your net cost to purchase the shares would be $9,200 due to the $300 premium received.

Here’s how things might work out:

SCENARIO ONE – STOCK STAYS ABOVE THE STRIKE PRICE AT EXPIRATION

In this case, your put expires worthless and the obligation from selling the put is removed from your account.

Your capital is now freed up to make a new trade.

The rate of return would be:

$300 / $9,200 = 3.26%

That’s a pretty handy return for sitting around and waiting for a month.

SCENARIO TWO – STOCK DECLINES BELOW THE STRIKE PRICE AT EXPIRATION

In this scenario, the put buyer is likely to exercise his right to sell the stock at the strike price given he can rebuy in the market at a lower price if he still wants to hold the stock.

You now own 100 shares with a cost basis of $9,200 and hopefully, the stock hasn’t declined too much below $92.

Still, you now own shares at $92 in a company that you liked when it was trading at $100.

What To Look For When Selling Puts

The most important thing to look for is strong companies.

Selling puts is a proxy for buying shares in a company so only look at strong companies that are highly rated.

You want to try and reduce the risk of adverse price moves in a company’s stock, so sticking to solid companies is rule number one.

I like to use Investor’s Business Daily to check out a company before selling a put because they have an excellent rating system, so this is a great sanity check to make sure it’s a strong, highly rated company.

From a technical analysis standpoint, I like to look for stocks that are above their 20, 50 and 200-day moving averages.

This is just another indication that it is a strong stock in an uptrend.

Using these moving averages as stop-loss levels can also be a good idea if the stock starts to head south.

Another factor to consider is a company that displays a sold dividend history.

This can be advantageous because if you do get assigned on the shares, you want to receive extra compensation for holding the shares.

Shares in the Dividend Aristocrats and Dividend Kinds list are good places to start as is the Dogs of the Dow.

Checklist For Selling Puts

When trading, it’s always good to have a plan rather than flying by the seat of your pants.

Below you will find some key criteria to consider before selling puts options on a company.

You may choose to use some or all of these, but you should definitely have a similar checklist and full trading plan before getting started.

1. Am I bullish on the stock?

First things first, you need to have a bullish opinion on the stock. There is no point selling put options on a stock just because the premiums are high, or you read a post on Twitter that piqued your interest.

If you’ve done your research, you like the stock and would be happy to hold on to it long-term, then you’re good to go.

2. Is the stock above key moving averages?

This is an important rule for me because I’ve seen many times a stock is oversold and I think it can’t go any lower, only to see it drop another 20 percent.

This happens a lot.

Just because something is oversold, doesn’t mean it can’t get more oversold.

The best rule of thumb is to stick with stocks and ETF’s that are in clear uptrends.

I define an uptrend as being above the 50 and 200-day moving averages.

3. Am I confident the market generally is not overextended and due for a correction?

I also like to consider where the market generally is trading. Is it overextended after a long run and due for a pullback? If so, think about waiting until the extreme levels have been worked off.

A severe correction tends to impact all stocks, even the strongest ones in robust uptrends.

Selling puts right before a correction can ruin a lot of opportunities and put you behind the 8-ball from the outset.

4. Does the stock have good fundamentals?

I tend to be more of a technical trader than a fundamental trader, but it is a good idea to keep an eye on the fundamentals as well.

I like to look for stable companies with a good history of dividend growth.

Checking the recent earnings results is also a good idea as you want to look for companies that have reported increasing earnings and revenues. A good resource for this is Earnings Whispers.

One final check I like to make is to see if the stock is highly rated by IBD. They have a good track record of high ratings on high-quality stocks that have performed well historically.

5. Am I happy taking ownership of the stock at the strike price?

Before selling any put option, think to yourself “Am I happy taking ownership of this stock at the strike price?”

This is an important consideration because it can and will happen.

Still, if you like the stock at the current price, you should definitely like it at an even lower price.

Just be sure that you have the available capital in your account to purchase 100 shares.

If you’re not comfortable taking ownership of the stock, then you should not be writing put options on that company.

Selling Weekly Puts For Income

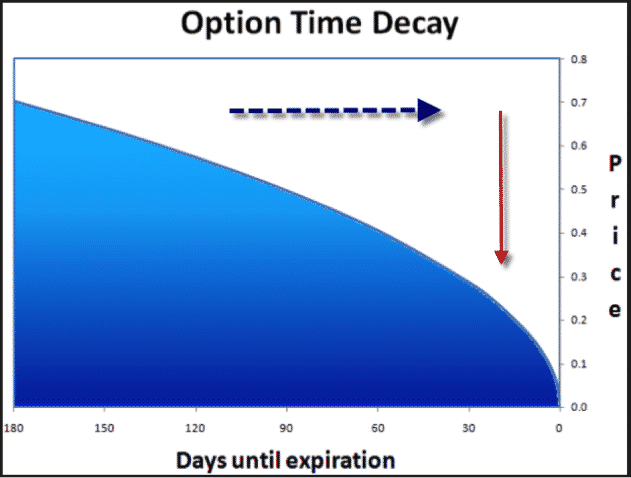

Weekly put options are a favorite of many option sellers because of the high level of time decay.

Investors can generate a much higher rate of return by selling weekly puts compared to monthly or even longer-term puts.

But, there are risks involved. Everything with options trading is a trade-off after all.

When selling weekly put options, the premium received will not be as high as longer-dated options, but the percentage returns on an annualized basis will be higher.

The idea with weekly options is that the time decay is much higher when you get closer to expiry.

Some traders I know are even selling put options, credit spreads, and iron condors on options the day they expire!

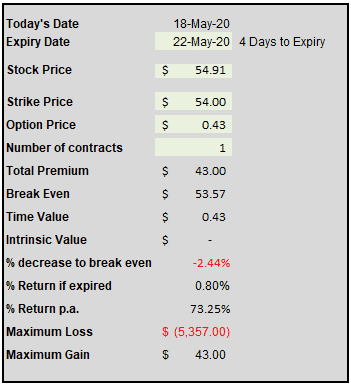

I like to use Verizon as an example because it has been a stable stock for years with a healthy and increasing dividend. This makes it a prime candidate for selling puts.

Below is an example from my put selling calculator which shows the potential to earn a 73.25% annualized return by selling a $54 put on Verizon (VZ) when the stock was trading at $54.91.

That’s a great return no doubt about it, but the trade-off is the reduced downside protection as the trade is only protected against a 2.44% decline.

Selling Monthly Puts For Income

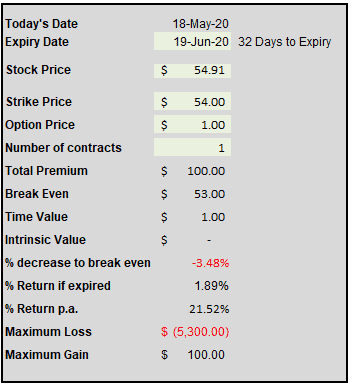

Let’s use VZ again and compare what the numbers look like when selling a monthly put instead.

If we sell a 32-day put option we generate a 1.89% return if the put expires worthless which is equivalent to 21.52% per annum.

The absolute return is higher, but the per annum return is a lot lower.

By generating more premium we also have slightly more margin for error until the breakeven price.

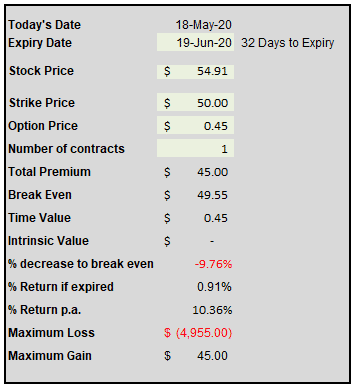

Alternatively, if a trader was only looking to generate the same amount of premium ($0.45) then they could sell the put at a much lower price.

For the monthly trade, the $50 put would generate the same premium as the weekly trade.

That gives a much higher 9.76% margin to the breakeven price.

However, the trade-off is the much lower annualized return at only 10.36%.

Options is all about risk and return.

Would you prefer the short-dated trade with a much higher annualized return but less downside protection?

Or would you prefer the monthly trader with a lower annualized return but higher downside protection?

Or maybe something in the middle?

Find a style and risk/reward ratio that works for you and develop a trading plan around those preferences.

Selling Leap Puts

One final style is to sell really long-dated puts known as LEAPs (Long-Term Equity Anticipation).

Selling LEAP puts is an entirely different strategy with a much different risk to reward ratio, particularly when compared with selling weekly puts.

In this example using VZ again, you can see the trade is generating a huge amount of premium, but the downside is we have to wait 613 days for the option to expire (if VZ finishes above $52.50).

For this reason, the trade only generates an 8.45% return per annum with a decrease to breakeven of 17.96%.

An 8.45% return is still a lot better than you would get on a term deposit but that may not be high enough for some investors.

Also, with this style of put trading, you would be exposed to multiple earnings announcements which could potentially have an adverse effect on the stock price.

Selling LEAP puts is a great strategy on companies that have a long history of dividend increases.

Verizon for example has been steadily lifting dividends for years.

If you think about it this way – if we bought VZ today for 54.91 the dividend yield would be around 4.48% with an annual dividend payment of $2.46.

Assuming VZ stays true to form a raises its dividend by around 2% in September 2020 and September 2021 (big assumption in the current environment, I know), the annual dividend will be around $2.56 by the expiration of the January 2022 put option.

If that option gets assigned, the effective purchase price would be the strike price of 52.50 less the 7.45 premium received, which equates to $45.05 per share.

With an annual dividend payment of $2.56 that gives us a yield on invested capital of 5.68% which is quite a bit better than the 4.48% currently available.

I’m making a few assumptions here but hopefully, you get the idea.

If you stick to strong companies that have a history of raising dividends that will give you a good chance of success.

Nothing is ever guaranteed of course and during recessions and bear markets there is also the risk of a sharp drop in stock price or a company cutting their dividend.

Wheel Trades

If you really want to take your put selling to the next level, you can start doing wheel trades.

Here is a diagram showing how it works, or you can read the post above for full details.

The basic idea is that if you are assigned on a stock you then sell a covered call until the stock eventually gets called away and collect the dividend while you wait.

If you’re willing and able to purchase 200 shares, you can sell another put option at the same time.

At the right side of the above diagram, if you end up being assigned 200 shares, then you will have also collected five lots of option premium from selling puts and calls.

You can then sit back, collect the dividends and keep selling two calls every month (or week, etc.) until the shares are called away.

When To Sell Put Options

A great time to sell put options is during a bull market when the market is undergoing a correction.

When the stock market undergoes a correction, implied volatility rises as investors start to panic and pay more for protection in the form of buying put options.

As we’re taking the opposite side of that trade and selling those puts options, this is great for us because we are selling the puts at inflated prices.

You know the old saying “Buy when there is blood in the streets”? Well, we could change it to “Sell puts when there is blood in the streets”.

Of course, you need to be careful because sometimes a correction turns in to a full-blown bear market which can result in big losses for share investors and put sellers alike.

During the height of the coronavirus selloff, fear was high and implied volatility went through the roof.

Take a look at what selling a monthly put around that time looks like compared to the examples above:

This example had the potential to generate a 5.51% compared to a 1.85% return in the earlier example when selling a similar put.

Risk Profile For Selling Puts

A short put is a bullish strategy with upside potential limited to the premium received with unlimited downside until the stock hits $0.

The risk profile is identical to a covered call position.

When comparing a short put with a long stock position we can see some obvious differences.

- A short put will lose less than a long stock position thanks to the premium received

- The breakeven point of a short put is lower than a long stock position by the amount of the premium received

- The upside of a short put is limited so the strategy will underperform in a strong bull market

As you can see from the risk profile below, the only situation where a short put will underperform a long stock position is a strong bull market.

The trade will still have negative returns in a bear market, but the return will be less negative thanks to the premium.

Break Even Price For Sold Puts

Calculating the break even price for a sold put is quite simple, just use the strike price and take away the premium.

So if a trader sells a $50 put option for $2, then the breakeven price is $48.

In the example above risk profile shows a $110 put option that was sold for $8 with the profit line crossing through the x-axis at $102.

I have a handy little calculator that you can download which will give you information such as the breakeven price, percentage decrease to break even and the return if expired.

Don’t Get Sucked In By High Premiums

One important point to mention is not to get sucked in by high premiums. I’ve seen it many times where traders will sell puts on a company purely because it has high option premium.

Usually a stock has high volatility and therefore high premiums for a reason, because the stock moves A LOT!

Yes, you can make money on these companies, but it can be more of a wild ride.

Maybe that’s your style and that’s fine, but a lot of times these are not the steady, stable companies that you should be looking for.

Selling puts should be boring not a roller coaster ride!

It’s much better to focus on high quality, dividend-paying companies and companies that have a competitive advantage in their industry.

Look for companies with a long track record of selling products and services that people can’t live without

New entrants to an industry might be better suited to other option strategies.

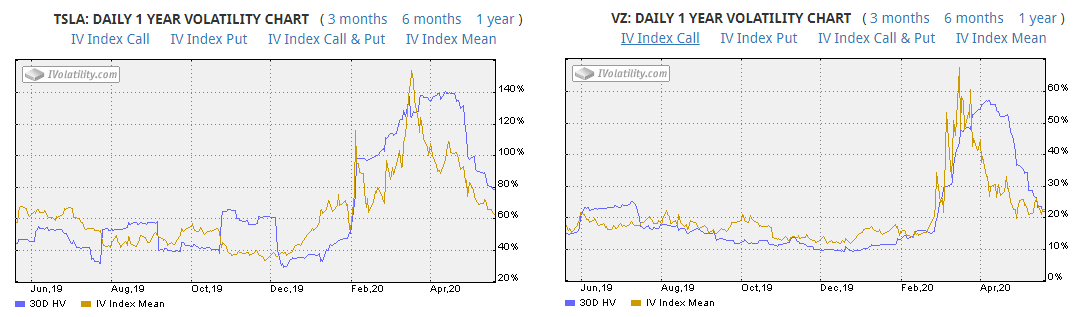

Taking TSLA as an example, implied volatility typically trades in the 40-60% range.

Yes, that means high premiums for selling puts, but the stock also has a history of making 10% moves in a day.

Would you be strong enough to hold your position through that sort of drawdown?

These are the things you need to consider when selling puts on high volatility stocks.

Compare that to stock like Verizon which typical has implied volatility in the 10-20% range.

Risks

The risk in selling puts is very similar to owning shares in a company. If the stock price drops, sold puts may suffer losses.

These losses can be quite large if the stock makes a big drop.

Generating a 5% premium is not going to help you much if the stock drops 60%.

Selling puts is slightly more conservative than buying stocks outright, but you still need to pick quality companies.

Put Selling Examples

Let’s backtest all this theory using an example. In order to maintain the integrity of the back test I used a random number generator to choose a Dow Jones stock and a date from 2019 to sell the initial put.

This way I can’t be influence by the chart and cherry-pick a nice entry point.

Realistically when selling puts, you would have defined entry criteria in terms of the technical and fundamental criteria but for this example, I wanted to pick a random entry.

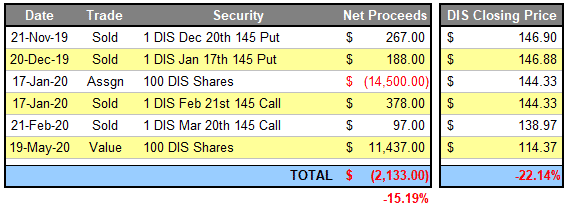

So the result from the random number generator was DIS stock on Nov 21st, 2019, and I’ll use Option Net Explorer to do the back test.

To keep it simple, the plan will be to sell a 40 delta put each month and if the put gets assigned, hold the shares until a monthly call can be sold slightly above the cost basis for around $1.00.

Here is the first trade:

Date: November 21st 2019

Current Price: $146.90

Trade Set Up:

Sell 1 DIS Dec 20th, 145 put @ $2.67

Premium: $267 Net Credit

Breakeven Price: $142.63

DIS closed at 146.88 on December 20th so the first put expired worthless.

We then sell another 40 delta put for January expiration.

Date: December 20th 2019

Current Price: $146.88

Trade Set Up:

Sell 1 DIS Jan 17th, 145 put @ $1.88

On January 17th, DIS closed at 144.33 so the 145 put would have been assigned.

At that point, we could sell a 145 February 21st call for 3.78.

DIS closed at 138.97 at February expiration so the 145 call expired worthless and we still held 100 shares with a cost basis of 136.67.

That is calculated as the 145 strike less the three premiums received – 2.67, 1.88, and 3.78.

At this point, we can sell a March 145 call for 0.97 which is close enough to 1.00.

DIS took a tumble in March, like most stocks, and finished at 85.98 on the expiration date.

The March call expired worthless and at this point, it’s not really possible to sell 145 calls, so we’re stuck holding the shares.

Let’s fast forward to May 19th and DIS is trading at 114.37.

With our cost basis of 136.67 we are still underwater, but let’s summarize the position

From the above table you can see that our put selling backtest has lost money to the tune of $2,133.

However, if we had bought 100 shares on November 21st at 146.90, we would be sitting with a loss of $3,253.

Our initial capital at risk was the $14,500 less the two put premiums received:

Capital at risk: 14,500 – 267 – 188 = $14,045

Our percentage return is: -2,133 / 14,045 = -15.19%

Whereas the return for buying 100 shares was -22.14%.

You can see that in this example, even though selling puts has lost money, it has lost less than simply buying the shares on both an absolute and relative basis.

Conclusion

Selling put options is a popular strategy for option traders and an easy place for beginners to get started.

Put selling is considered slightly more conservative than owning stocks.

Selling puts gives some downside protection and will display slight outperformance compared to stock ownership in a falling market.

During a strong bull market, selling puts will underperform stocks given that the gains are limited to the premium received.

I hope you enjoyed this post, if you did please share it on social media and let me know if you have any questions.

Disclaimer: The information above is for educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are ...

more