Options Market Is Expectations For Nvidia Earnings

Options Market is Expectations for Nvidia Earnings

I don’t think I’m prone to hyperbole, but I must admit that this afternoon’s Nvidia (NVDA) earnings report is the most consequential that I can recall for quite some time.

To be frank, this stock has been truly spectacular. It is up over 50% since it reported in May when its stellar guidance ratified and turbocharged investors’ enthusiasm for artificial intelligence (AI). While that fervor, like the overall market, has cooled somewhat, it remains a key driver of the mega-cap tech stocks that dominate our main equity indices. We got a reminder of this phenomenon on Monday when NVDA rose nearly 8.5%. It is highly unusual to see a stock rally so dramatically just ahead of earnings, but NVDA is a highly unusual case.

NVDA is by no means a cheap stock, but by some measures it is not unreasonably expensive – as long as it meets the expectations that were ratcheted drastically higher last quarter. It has an eye-watering trailing P/E of 226, but its forward P/E of 57, which is still quite robust, implies earnings growth of nearly 4x in the coming year. That gives the stock a PEG ratio of 1.1, which is hardly outlandish – again, only if it meets the lofty expectations.

For this quarter, EPS is expected to nearly quadruple to $2.07 from last year’s $0.52, which revenues are expected to nearly double at $11.04 billion vs $6.70 billion. Data center revenues, which are perceived to be the key beneficiary of corporate AI spending, are expected at $7.98 billion, more than double last year’s $3.81 billion.

The heady combination of high expectations and stellar recent performance raises the stakes for today’s report, both for NVDA itself, but also for the numerous stocks that have followed NVDA’s lead in embracing AI. Remember, NVDA took investors on a wild ride not that long-ago when it was a key beneficiary of cryptocurrency enthusiasm. Bear in mind that computer scientists and others have been working on artificial intelligence for years if not decades. The emergence of ChatGPT brought AI into the mainstream, but the challenge remains as to whether the current wave of corporate adoption is persistent or somewhat faddish.

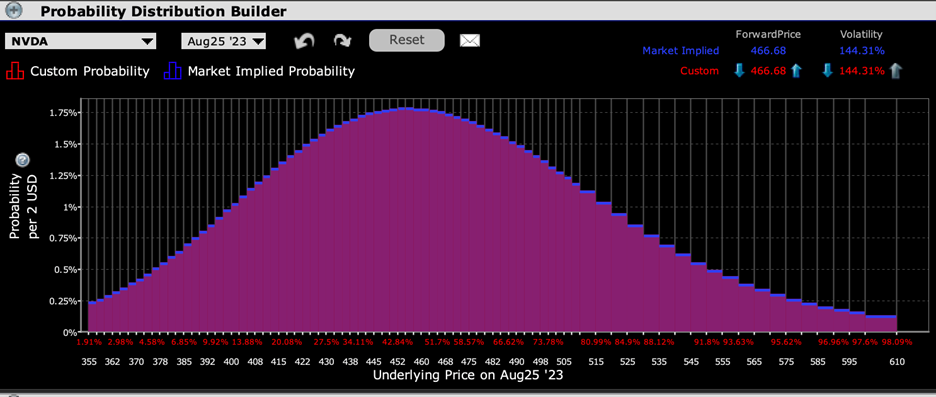

Regarding the options market’s views, we can start with the IBKR Probability Lab. With the stock trading around $467, the peak probability expressed by options expiring on Friday is in the $460 region. That is not particularly surprising, considering those were at-money options just yesterday:

IBKR Probability Lab for NVDA Options Expiring August 25th

(Click on image to enlarge)

Source: Interactive Brokers

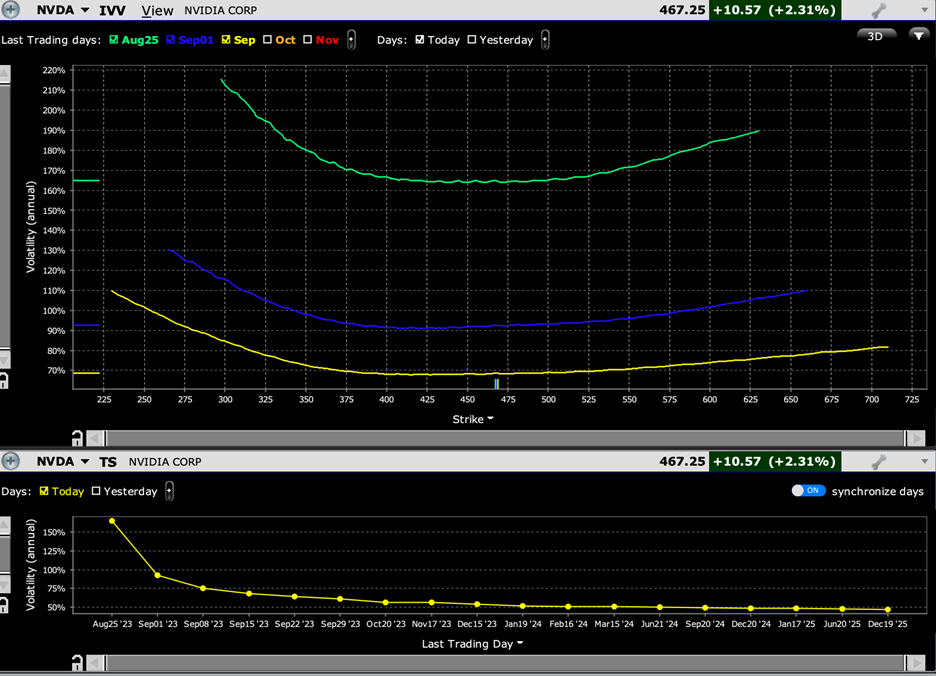

When we look at skews, via the IBKR Implied Volatility Viewer, and the term structure of volatility, we see that options are pricing in a roughly 10% daily move for the rest of the week, and that skews are very flat in throughout a wide range of outcomes, from about $400 through $525.

NVDA – Implied Volatility Viewer for Options Expiring August 25th (green, top graph), September 1st (blue, top), September 15th (yellow, top); Term Structure of Implied Volatility (yellow, bottom)

(Click on image to enlarge)

Source: Interactive Brokers

Considering that the past two post-earnings moves for NVDA have been +24% and +14%, a 10% move seems rather tame. But the question for later today and tomorrow is whether the already lofty expectations are correct. After the recent upswings it seems as though investors expect some incremental boost beyond the already stellar guidance offered by the company. Quite frankly, will a reaffirmation of guidance, or simply meeting the expectations listed above, be enough for investors enamored with the promise of AI riches. We’ll find out soon enough.

More By This Author:

Yikes Or YOLO?

Labor Market Strength Persists While Consumers Trade Down

Back In SPACs

Disclosure: OPTIONS TRADING

Options involve risk and are not suitable for all investors. Multiple leg strategies, including spreads, will incur multiple commission charges. For more ...

more

The article discusses Nvidia's valuation, emphasizing the high forward P/E ratio and the implied expectations for significant earnings growth. The lofty expectations necessitate that Nvidia not only meets but surpasses projected EPS and revenue figures. This suggests that meeting these expectations could be pivotal for sustaining investor confidence.