Labor Market Strength Persists While Consumers Trade Down

Image Source: Pexels

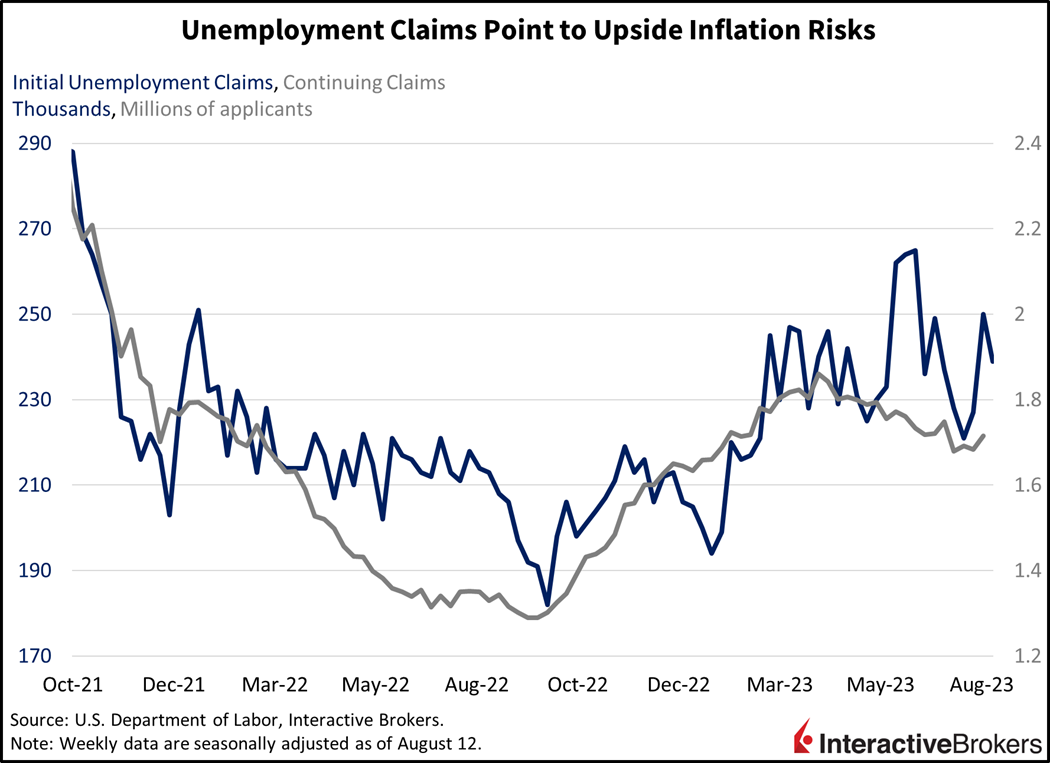

This morning’s unemployment claims data continues to point to a tight labor market while yesterday’s release of minutes from the Federal Reserve’s July meeting reveals policymakers still believe considerable inflation risks exist. Labor conditions and Fed minutes underscore the possibility of an additional increase to the fed funds’ rate at the November meeting while consumers who are stretched thin due to inflation and rising financing costs are increasingly seeking low-cost groceries, clothing and other items.

In a sign of continued strength in the labor market, initial unemployment claims for the week ended August 12 fell by the most in five weeks. The 239,000 unemployment claims nearly met projections of 240,000 and is an improvement from the previous week, in which 250,000 claims were submitted. Continuing claims, which reflect the number of individuals who are still unemployed, rose to the highest level in a month. The 1.716 million claims reported throughout the week ended August 5 was higher than both the 1.7 million expected and the previous week’s 1.684 million. The figure reached the highest level since the week ended July 8, in which 1.749 million continuing claims were recorded.

Markets Lack Direction

The investing equivalent of the August blues, which are often viewed as a monthlong version of the Sunday blues, are continuing today as equities sulk. Meanwhile, strong economic data, sticky inflation, high borrowing needs from the U.S. Treasury and the Fed’s balance sheet runoff are pushing long-term yields higher. Equity players are sharpening their pencils, meanwhile, to adjust their discounted cash flow models with higher costs of capital. The result isn’t motivating much incremental buying, with equity prices factoring in nirvana amidst a flat day on the heels of a pair of down days. The Nasdaq Composite Index is down 0.4%, the Dow Jones Industrial Average is up 0.1% while the S&P 500 and Russell 2000 are nearly flat. Healthcare, consumer discretionary, consumer staples, homebuilders, and technology sectors are down while all other sectors are higher. The bear-steepening is continuing across the yield curve, with long-term rates up about 4 basis points (bps) while short-term term rates are down about 1 bp. The 10-year Treasury yield is up to 4.31%, looking to break the cycle high from last October at 4.34% and likely open the door to reaching the next high, which previously occurred way back in 2007. The Dollar Index is subdued alongside short-term yields with investors marching in-line of a Fed pause while they consider the possibility of a final hike in November. WTI crude oil is recovering from yesterday’s sluggishness on the back of continued inventory draws in the U.S. and hopes for further stimulus from China, the world’s largest energy importer. Prices are up 2% to $81.00 per barrel.

Consumers Turn Frugal

Various store operators such as Target (TGT) have lowered their sales guidance for the remainder of this year as consumers tighten their spending because of inflation, higher financing costs and concerns about the economy, but Walmart and off-price retailer TJX have just upgraded their forecasts as shoppers turn to the companies’ stores in pursuit of bargains. Highlights include the following:

- Walmart (WMT), in its second-quarter earnings call, increased its full fiscal-year net sales growth guidance to between 4% and 4.5%, up from its prior 3.5% estimate. It expects earnings to be between $6.36 and $6.46 a share compared to its earlier guidance range of $6.10 to $6.20. Chief Financial Officer John David Rainey says consumers are discerning, but he noted a slight uptick in spending on discretionary items and big-ticket items. Sales of those items have been weak after consumers splurged on home furnishings, computers and other goods during the pandemic and are now facing higher financing costs for high-priced goods. Consumers are also spending more for food and other necessities because of inflation. Walmart’s second-quarter earnings per share (EPS) of $1.84 beat the consensus expectation of $1.71 and its revenue of $161.63 billion exceeded the consensus expectation of $160.27.

- TJX said its sales growth is benefiting from consumers seeking bargains and that its practice of buying unsold items from other retailers and selling the products at discounted prices has benefited from other companies offloading bloated inventories. TJX, operator of T.J. Maxx, Marshalls, HomeGoods, Sierra and Homesense stores, increased its full-year comparable same-store sales growth guidance to a range of 3% to 4% and its EPS guidance to between $3.66 and $3.72, exceeding the consensus expectation of $3.59. For the second quarter, the company generated an EPS of $0.85, substantially above the consensus expectation of $0.77 and its $12.76 billion in revenue exceeded the consensus expectation of $12.45 billion. Sales increased 7.7% year-over-year.

A Tipping Point May Be on The Horizon

Federal Reserve Chairman Jerome Powell’s Jackson Hole presentation next week will be insightful, especially in light of the Fed’s July meeting minutes not conveying policymakers’ views of more recent data released this month such as Jobs, CPI, ISM, retail sales and unemployment claims. Investors will comb through his comments with hopes of ascertaining if another rate hike will occur this year and how long the Fed will keep rates high.

While the labor market remains fairly tight, the real estate industry is already struggling with high interest rates, so an additional fed funds rate increase this year could be a strong headwind for the sector. Consumers, moreover, have been surprisingly resilient and their spending is helping to fuel economic growth. As the difference in second-quarter results of Target compared to Walmart and TJX illustrate, many consumers are struggling to get by so if Powell raises rates again, it could strain already financially overstretched shoppers. Through most of the Fed’s tightening campaign, shoppers have been a central concern and a tipping point in spending resulting from tighter monetary policy would make it harder for the Fed to engineer a soft landing. The moral is to not take consumer spending for granted—it could weaken abruptly.

More By This Author:

Back In SPACs

The State Of The U.S. Consumer Is…

Should U.S. Investors Care About The Rest Of The World?

Disclosure: The analysis in this material is provided for information only and is not and should not be construed as an offer to sell or the solicitation of an offer to buy any security. To the ...

more

The article speculates on the potential consequences of further rate hikes on the real estate industry, which is already grappling with high interest rates. Despite this, consumer spending has remained resilient, acting as a driver of economic growth.