Meta Platforms Stock Options - A Follow-Up On Three Ways To Play META

/Meta%20Platforms%20by%20Primakov%20via%20Shutterstock.jpg)

Primakov via Shutterstock

Three weeks ago, we suggested three ways to play META Platforms (META) stock by shorting out-of-the-money puts, buying long-dated in-the-money calls, and shorting near-term out-of-the-money calls. This is an update.

META stock is at $771.29 in midday trading. META stock peaked at $790.06 on Aug. 12.

(Click on image to enlarge)

META stock - last 3 months - Barchart - Sept. 19, 2025

META is up from $754.79 three weeks ago, when I wrote an Aug. 24 Barchart article, “Meta Platforms Stock Is Off Its Highs - Three Ways for Value Investors to Play META With Options.”

I also suggested that META stock was worth $800.85, based on a prior Barchart article from July 31, after the company released its earnings.

So far, without updating the valuation, these options plays have worked out.

Shorting META Puts Works

I had suggested selling short Meta put options expiring on September 26, at the $725.00 exercise price, 34 days from then. This was 4% below the trading price at the time. The midpoint price was $12.40.

That means that the investor doing this short-put play would make an immediate yield of 1.71% (i.e., $12.40/$725.00).

Today, that $725.00 put contract is trading for just $1.10. That means that the investor has made most of the money from this short sale.

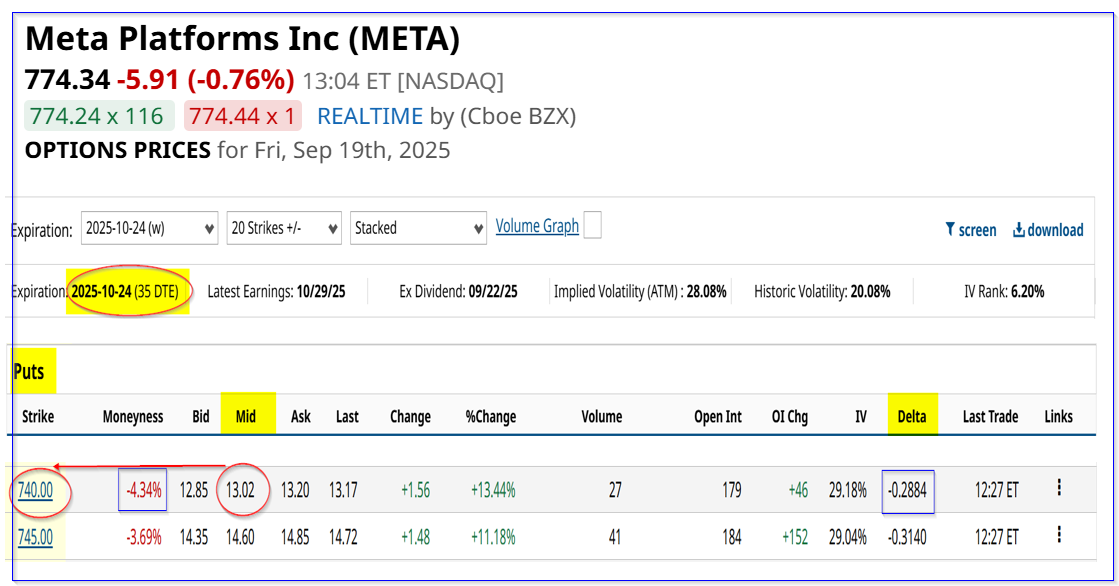

As a result, it makes sense to roll this over. For example, the Oct. 24, the $740 put option contract, 4.3% below today's trading price, has a premium of $13.02.

(Click on image to enlarge)

META puts expiring Oct. 24 - Barchart - As of Sept. 19, 2025

That allows the investor to make a nominal short-put yield of 1.76% (i.e., $13.02/$740.00). And on a rollover basis, the net premium received is $11.92, for a net rollover yield of 1.61% (i.e., $11.92/$740).

Note that this has a low probability of being exercised, as the delta ratio is -28.84%. That might mean that the investor can continue to roll this trade over.

For example, for the two-month period, an investor would have made a net amount of $12.40 +11.92, or $24.32 on an average investment of $732.50. So the two-month yield is:

$24.32/$732.50 = 3.32%

That works out to an expected return on an annualized basis of almost 40%, assuming it can be repeated each month (i.e., 3.32% x 6 = 39.84%).

There is no guarantee this yield can be made each month, but the expectation is there. It might also eventually result in an investor's collateral being assigned to buy META shares, which could result in an unrealized loss.

But, at least each month, the investor has a good expectation of a positive return. However, if META continues to move up, the investor may miss out on unrealized gains.

That is why I also discussed in the Aug. 24 article that investors could buy a poor man's covered call. Let's see how that has worked out.

Poor Man's Covered Call

ITM Call Purchase. I discussed buying in-the-money (ITM) call options expiring on November 21 at either the $720 or $730 call option strike prices.

For example, the $720 call option, which was 4.6% below the trading price at the time ($754.79) had a midpoint premium of $72.55. In other words, the breakeven point was $792.55 (i.e., $720 call option plus the $72.55 premium).

Today, META is at $771.29, so, it's still below the breakeven point. But the premium is now $78.93. So, the new breakeven point is $798.93, but the investor has made a good return:

$78.93/$72.55 = 1.0879 -1 = +8.79%

However, META stock has risen from $754.79 to $771.29, a gain of +2.19% over the past 3 weeks.

So, the investor has made a 4x greater return, although it's still below the original breakeven point. This is because the investor was able to control 100 shares through the call purchase at a much lower outlay cost than buying 100 META shares.

Investors only had to outlay $7,255 to control 100 shares, instead of over $71K at today's stock price. That

This also allows an investor to sell covered calls. This is why it's called a poor man's covered call play.

Covered Short-Call. I recommended on Aug. 26 that an investor who bought the ITM calls could short covered calls for the period ending Sept. 26.

For example, I discussed shorting the $800.00 call options expiring Sept. 26, for a midpoint premium of $8.73 per call contract. That represented a covered call yield of 1.106% on a breakeven basis.

Today, the midpoint premium is $2.59 for the $800.00 call options expiring Sept. 26. In other words, the short-seller has made a good return ($8.73 - $2.59) over the past 3 weeks. If META stays below $800, the calls will expire worthless, and the investor has no obligation to surrender the ITM calls to cover the short-call sale.

Moreover, the investor can repeat this trade over the next month. This will continue to help pay for the ITM call purchase.

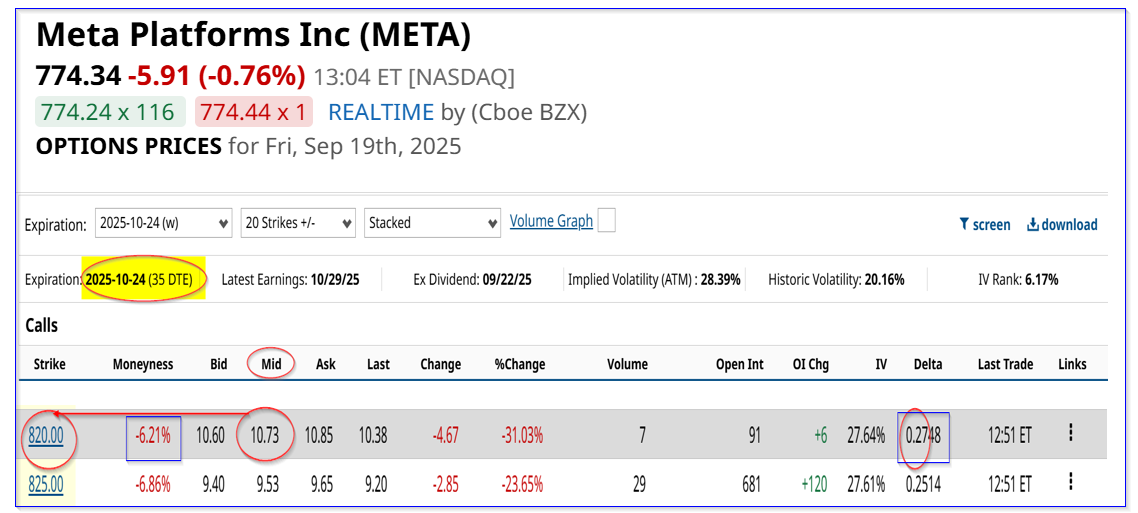

For example, the covered call midpoint premium for the Oct. 24 period at the $820.00 strike price is $10.73. That call option is over 6.2% higher than today.

(Click on image to enlarge)

META calls expiring Oct. 24 - Barchart - As of Sept. 19, 2025

This provides an immediate call yield of $10.73/$771.29, or 1.39%, although it's slightly lower on a breakeven basis (using the breakeven point from buying ITM calls).

Note that there is a low delta ratio, or just a 27.5% chance that META stock will rise to $820 over the next month.

The idea here is that the investor can use the $10.73 this month and the $8.73 received last month to help pay for the original $72.55 purchase of ITM calls at $720.00.

It effectively lowers the breakeven point to just $773.09

$720.00 +$72.55 -$8.73-$10.73 = $773.09

That is only slightly higher than today's price at $771.29. This means that the total yield received for the past two months is now $19.46 on an investment breakeven point of $773.09, or a yield of 2.517%.

In other words, if the investor can continue this next month, the expected return is likely to be positive (i.e., $773.09 - $10.73, or $762.36 breakeven), if META stays flat:

$771.71 today's price /$762.36 = 1.01226 -1 = 1.226%

In other words, a poor man's covered call play in META has a positive expected return.

The bottom line is that shorting out-of-the-money (OTM) short-dated META puts, buying in-the-money (ITM) long-dated calls, and shorting near-term out-of-the-money calls are three ways to profitably play META.

More By This Author:

Heavy Out-Of-The-Money Put Options Activity In Amazon - Setting A Lower AMZN Buy-In Point

GameStop Stock Is Moving Higher As Its Free Cash Flow Grows Stronger

Chewy Stock Is Down After Strong FCF Results - CHWY Is Worth 15%+ More