Heavy Out-Of-The-Money Put Options Activity In Amazon - Setting A Lower AMZN Buy-In Point

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

bluestork via Shutterstock

Heavy, unusual out-of-the-money (OTM) put options activity in Amazon, Inc. (AMZN) highlights a potentially attractive buy-in play for short sellers of AMZN puts. This is seen in today's Barchart Unusual Stock Options Activity Report.

AMZN is at $230.84 in midday trading today. That is off from a recent peak of $238.24 on Sept. 9.

(Click on image to enlarge)

AMZN stock - last 3 months - Barchart - Sept. 17, 2025

However, today investors are flooding into the $200.00 put option exercise price contract expiring Oct. 31, or 44 days from now.

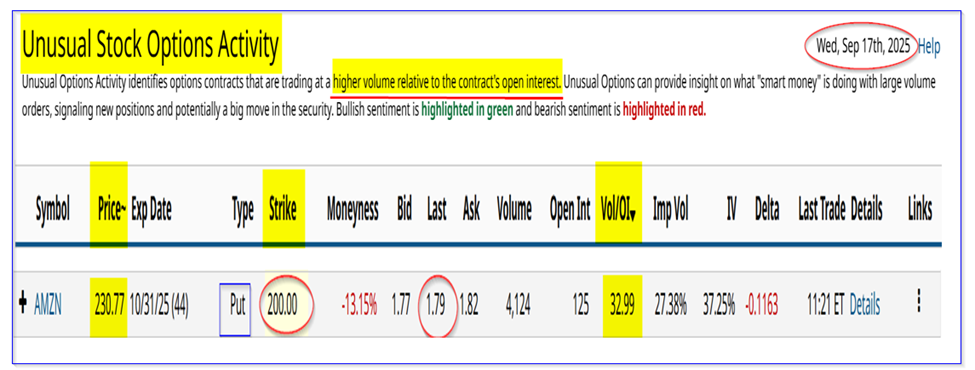

This can be seen in one of Barchart's regular options reports today: Unusual Stock Options Activity Report (Sept. 17, 2025).

It shows that over 4,100 put contracts have traded at this strike price - almost 33x the prior number of put contracts outstanding. That is very unusual.

(Click on image to enlarge)

AMZN puts expiring Oct. 31 - Barchart Unusual Stock Options Activity Report - Sept. 17, 2025

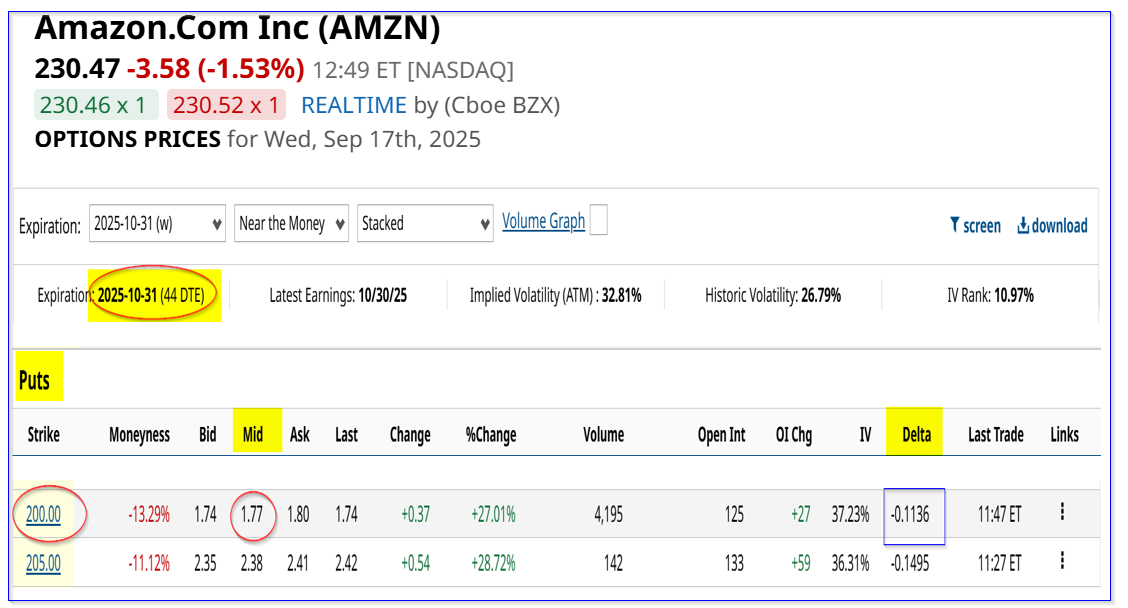

What is even more interesting is that the strike price ($200) is $30.84 below today's price of $230.84. That means it is “out-of-the-money,” since AMZN stock would have to fall by 13.36% just to get to the point where the put has some basic intrinsic value.

Additionally, the midpoint premium paid was $1.79, so buyers of these puts should expect that AMZN stock will fall to $198.21 (i.e., $200 minus $1.79) on or before October 31.

However, short-sellers of these puts are making an attractive yield. They gain $179 after securing $20,000. That works out to 0.895% for just 44 days. That works out to an annualized expected return (ER), assuming it could be repeated eight times a year, of 7.16%.

(Click on image to enlarge)

AMZN puts expiring Oct. 31 - Barchart - As of Sept. 17, 2025

So, what is going on here? Is AMZN stock going to dip from here, or is this a great short-selling play?

AMZN Stock Target Price

I discussed Amazon's recent Q2 results in an Aug. 1 Barchart article, “Amazon's Free Cash Flow and FCF Margins Tumble - Is AMZN Overvalued?”

I suggested that AMZN might only be worth $179.00 per share, based on its free cash flow and FCF margins.

Based on Amazon's heavy capex spending, its free cash flow (FCF) might only reach $19 billion, or just 2.59% of the expected next 12-month (NTM) sales of $730.7 billion.

However, since then, analysts have raised their 2025 and 2026 sales estimates to between $708.05 billion and $779.57 billion. That implies the NTM revenue will be $743.81 billion.

So, using a 2.59% FCF margin, FCF might rise to $19.26 billion - slightly higher than my prior $19.0 billion estimate.

And using a 1.0% FCF yield metric, the market cap could end at $1,926 billion (i.e., a 100x FCF multiple). That is still below today's market cap of $2,463 billion - i.e., a potential decline of 21.8%.

That puts the target price at $180.52 (i.e., (1-0.218) x 230.84 = 0.782 x $230.84 = $180.52.

However, just to be super generous, let's say the market eventually values AMZN stock at a 0.90% FCF yield, or 111.11x multiple. That sets the price target at $19.25 billion, or $2,140 billion.

That is still 13% below today's market cap. In other words, using a very generous multiple, the highest price target would be $200.83.

How These Plays Work

So, you can see that is why some investors may be buying puts at a strike price of $200.00, as seen in today's Unusual Stock Options Activity Report from Barcjhart.

The problem is that this might take a year for investors to come to this target price. On the other hand, Amazon's earnings are likely to come out on Oct. 28, or two days before this option expires.

That might give some hope to buying these $200 strike puts. Alternatively, investors shorting these puts have a potential buy-in point of $198.21, and they can make a yield of 0.895% over the next month and a half.

So, if you think AMZN will fall well below $200 after earnings come out, buy these puts. On the other hand, if you think AMZN will stay over $200.00 by Oct. 31, you might want to short these puts.

Keep in mind that investors shorting these puts only have an obligation to buy 100 shares put 1 put contract shorted. That may or may not result in an unrealized loss, but likely not 100%. On the other hand, investors buying these puts could lose 100% of their investment.

Investors can study Barchart's Options Learn Center and Options Education webinars to better understand these risks.

More By This Author:

GameStop Stock Is Moving Higher As Its Free Cash Flow Grows StrongerChewy Stock Is Down After Strong FCF Results - CHWY Is Worth 15%+ More

Microsoft Stock Is Off Its Highs, But Target Prices For MSFT Are Higher