If Occidental Petroleum Hikes Its Dividend As Expected, OXY Stock Could Rally

by Poetra_ RH via Shutterstock

Occidental Petroleum (OXY) will release Q4 earnings on February 19, and could hike its dividend per share. Investors could see OXY stock move higher. Meanwhile, shorting out-of-the-money OXY puts over the next month provides almost a 1.5% yield.

OXY closed Friday at $42.70, but it could be worth more if the dividend hike goes through. That's up from a recent low of of $38.92 on Dec. 16, 2025.

(Click on image to enlarge)

OXY stock - last 3 months - Barchart - As of Jan. 16, 2026

I discussed this possibility in a December 23, 2025, Barchart article ("Occidental Petroleum Stock Has Tanked - But It May Hike Its Dividend - Time to Buy?"), as well as a prior Nov. 25 Barchart article.

Essentially, OXY stock could be worth $50.00 per share if the company raises its dividend per share (DPS) by just 4.16% to $1.00 per share on Feb. 19. That's still 17% higher than Friday's close.

Here's why.

Why Occidental Could Hike Its Dividend

First, Occidental has raised its DPS each year over the last 4 years, according to Seeking Alpha.

Second, last year it increased the quarterly dividend from 22 cents to 24 cents, representing a 9% annual increase from 88 cents to 96 cents. So, assuming a 4.16% increase to $1.00 this year is very conservative.

Third, the company can afford to do so. For example, analysts expect Occidental to earn at least $2.27 per share this year and $1.43 per share next year. That would more than cover the dividend.

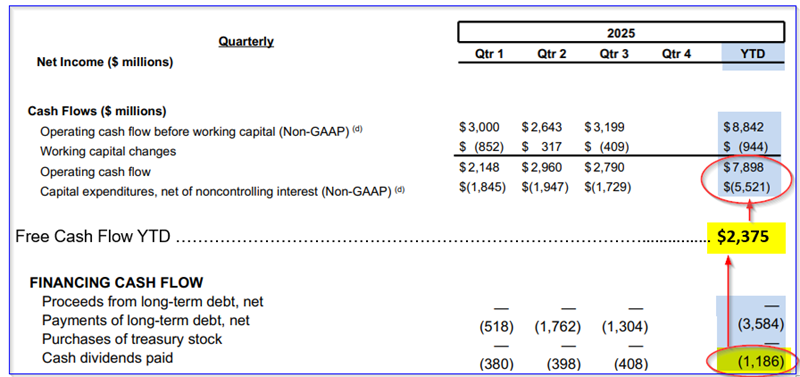

On a cash flow basis, this is even clearer. For example, so far this year, as of Q3, the company's cash flow after capex spending (i.e., its free cash flow or FCF) was $2.375 billion, as seen on page 6 of its Q3 earnings release. On page 12, the company reported that YTD it had paid out $1.186 billion in cash dividends.

(Click on image to enlarge)

Q3 OXY Results YTD Cash Flow and Dividends, pages 6 and 12

In other words, its payout ratio is less than 50% of FCF:

$1.186b dividends / $2.375b FCF = 0.4994 = less than 50% payout

If cash flow increases next year, or if the company decides to increase the payout ratio, it could easily afford a 4.1% increase in the DPS payment to its shareholders.

Target Prices for OXY Stock

Right now, OXY stock has a 2.248% annual dividend yield:

$0.96 / $42.70 = 0.02248

However, its historical average yield is lower. For example, Yahoo! Finance reports that the 5-year average has been 1.12%, and even over the last 12 months (LTM) it's been 2.18%.

Morningstar shows that in 2024 it averaged 1.78% and in 2025 it was 2.33%.

To be conservative, let's assume that the stock could average 2.0% in dividend yield. Here is what that implies about the target price:

$1.00 expected DPS / 0.02 = $50.00 per share

That is close to where other analysts have set their price targets (PTs). For example, Yahoo! Finance reports that the average of 25 analysts is $49.50. Barchart's mean survey PT is $49.08, and AnaChart's survey of 17 analysts is $52.90.

So, it seems reasonable to expect to see OXY stock rise 17% to $50.00 over the coming year if Occidental hikes its annual dividend to $1.00 or higher.

One way to play this, while waiting over the next month, is to sell short out-of-the-money (OTM) puts.

Shorting OTM OXY Puts

Last month, I suggested shorting the $38.00 strike price put contract expiring on Jan. 23. The premium received was $0.48, giving a short-seller a 1.26% 1-month yield (i.e., $0.48/38.00 = 0.0126).

As of Friday, that put premium had fallen to just 2 cents, making this a very successful trade. Doing a similar play for next month could be just as profitable.

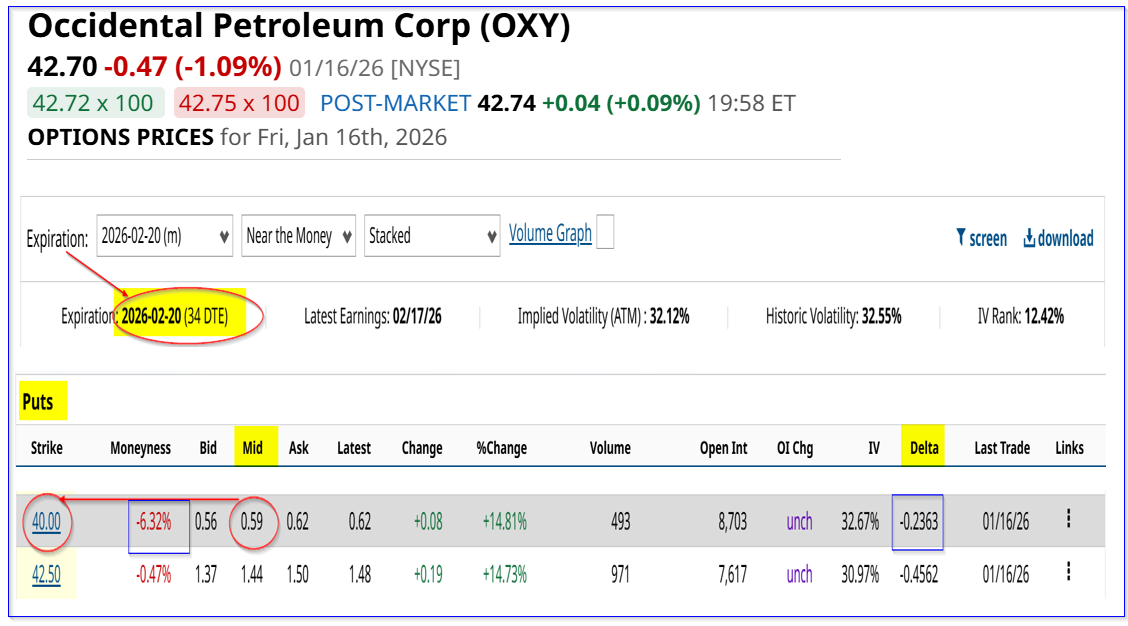

For example, the Feb. 20, 2026, expiry $40.00 put contract has a midpoint premium of 59 cents. That gives the short-seller a 1-month yield of 1.475% (i.e., $0.59/$40.00 = 0.01475).

(Click on image to enlarge)

OXY puts expiring Feb. 20, 2026 - Barchart - As of Jan. 16, 2026

This expiration is one day after Occidental is expected to announce a dividend hike. So it makes sense to both buy the shares and short these puts, assuming you have enough capital.

The worst that could happen here is that the investor has to buy 100 more shares at $40.00 rather than $42.70 today. However, the breakeven point is $39.41 (i.e., $40.00 - $0.59), or 7.70% below Friday's close.

Moreover, at that breakeven cost, the investor has an attractive expected annual dividend yield of 2.537% (i.e., $1.00 / $39.41). Moreover, the investor could sell out-of-the-money (OTM) calls at a higher price to help cover any unrealized loss.

The bottom line here is that OXY stock looks cheap based on its expected yield and analyst price targets. One way to safely play it is to sell short OTM puts in one-month expiry periods.

More By This Author:

ConocoPhillips Has A 3.42% Annual Yield, But Short-Put Investors Can Make 1.5% Monthly

McDonald's Is Worth Even More, Say Analysts - MCD Stock Looks Cheap Ahead Of Earnings

Devon Energy Unusual Call Option Activity - Investors Expecting A Dividend Hike?

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual ...

more