Devon Energy Unusual Call Option Activity - Investors Expecting A Dividend Hike?

by T_Schneider via Shutterstock

Devon Energy (DVN) has had unusual call option activity today, according to a Barchart report. Devon announced it will release Q4 earnings on Feb. 17, so investors may be expecting a dividend hike then.

DVN is trading higher today at $38.15 per share. That is up from a recent low of $34.47 on Jan. 7.

(Click on image to enlarge)

DVN stock - last 3 months - Barchart - Jan. 14, 2026

It may be that investors are now expecting a dividend hike after the Jan. 12 announcement. More on that below.

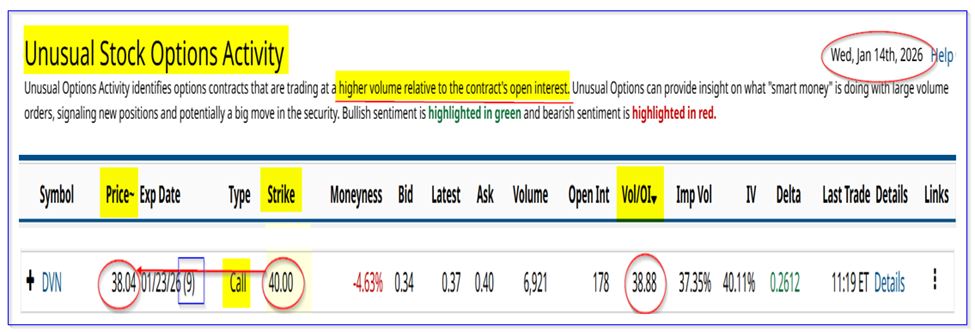

This may be why the Barchart Unusual Stock Options Activity Report today shows huge volume in recent options. It shows that investors have been buying over 6,900 call options contracts in DVN stock that expire in 9 days on Jan. 23.

(Click on image to enlarge)

DVN calls expiring Jan. 23 - Barchart Unusual Stock Options Activity Report - Jan. 14, 2026

Moreover, the strike or exercise price is set at $40.00 per share, or +4.7% higher than today's price at $38.20. That means that the call option exercise price is out-of-the-money - i.e., DVN stock has to rise before the call option will have any intrinsic value.

In other words, the investors on both sides of the trade - buyers and sellers (especially if they are covered call option sellers) may be bullish on DVN stock's prospects.

After all, the premium at the midpoint is 37 cents. That provides almost a 1% yield to covered call sellers (i.e., $0.37/$38/15 = 0.0097 = 0.97%).

Possible Dividend Hike?

Devon Energy has paid out 4 quarterly dividend per share (DPS) payments at 24 cents per share. Last year, the company announced a dividend hike when it released its Q4 earnings.

So, investors may be expecting that the same thing could occur next month when Devon Energy releases earnings on Feb. 17.

Moreover, according to Seeking Alpha, Devon Energy has had 8 consecutive years of DPS growth, including 26 years of consecutive dividend payments.

As a result, it might be possible to see the quarterly DPS rise to 26 cents, up from 24 cents. This is because last year its DPS rose by 2 cents from 22 cents.

That puts its annual DPS payment at $1.04, up from $0.96 in 2025.

What Could DVN Stock Be Worth?

As a result, the potential dividend yield is now:

$1.04 / $38.15 = 0.02726 = 2.73%

Over the last year, DVN stock had an average yield of 2.57%, according to Morningstar.

Therefore, this implies DVN stock has some upside, assuming the stock rises to the point where it has a similar yield:

$1.04 / 0.0257 = $40.47 price target (PT)

That is 6.0% higher than today's price.

In other words, this could be why some investors are buying these out-of-the-money call options.

It may also be an opportunity for existing investors to sell their shares for a 9-day 0.97% yield. That means they could potentially make a total return of almost 6%:

$40.37-$38.15 = $2.22 = $2.22/$38.15 = +5.82%

That could be why there is so much activity in these out-of-the-money DVN call options.

For example, buyers of the calls think DVN stock could be worth over $40. Sellers of the calls are happy to collect the income and potential sale of their shares over $40.

Either way, this is a bullish sign for DVN stock, at least until and if Devon decides to hike its dividend.

More By This Author:

Alphabet Stock Is Still Undervalued According To Analysts - 1 Month GOOGL Puts Yield 2.50%LYFT Stock Has Been Flat For 3 Months - But 1-Month Puts Have Yields Over 5%

Netflix Stock Is Beaten Down - But Short Put Plays Are Attractive

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual ...

more