ConocoPhillips Has A 3.42% Annual Yield, But Short-Put Investors Can Make 1.5% Monthly

by MattGush via iStock

ConocoPhillips (COP) stock has a 3.42% dividend yield, well below its 5-year average. As a result, its price target is at least 29% higher at $126.65 based on this yield. But, investors can sell short out-of-the-money (OTM) put options and earn about 1.5% monthly.

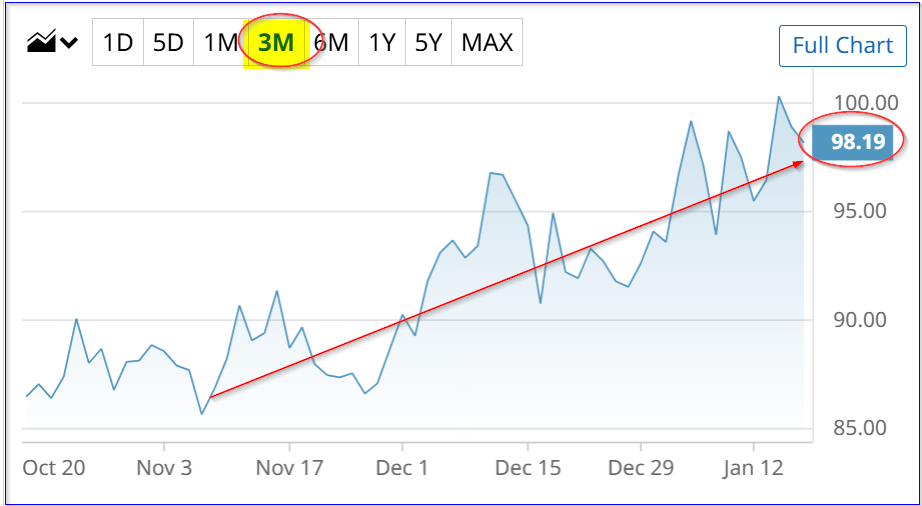

COP closed at $98.19 on Friday, Jan. 16. It has closed as low as $90.16 in the last month (December 16) and generally traded in a range between $90 and $100 for the past 2 months.

(Click on image to enlarge)

COP stock - last 3 months - Barchart - Jan. 16, 2026

However, since Nov. 6, 2025, when ConocoPhillips raised its quarterly dividend by 7.69% to 84 cents from 78 cents (i.e., $3.36 annual dividend per share or DPS), COP stock has been slowly moving higher.

This is likely because its annual dividend yield is still much higher than its historical average. That implies that COP stock has a higher price target.

I discussed this point and the idea of shorting OTM puts in my Dec. 19, 2025, Barchart article ("ConocoPhillips Stock Still Looks 18% Undervalued - How to Play COP Stock?") and a prior Nov. 21, 2025, Barchart article.

Dividend-Yield Based Price Target (PT)

For example, Yahoo! Finance reports that COP has had an average dividend yield of 2.53% over the last 5 years. That is well below today's yield of 3.42% (i.e., $3.36 DPS/$98.19).

In addition, Morningstar says COP has had a 5-year historical average of 2.29%. However, Seeking Alpha says the average has been 3.14%.

So, on average, these surveys show that the 5-year average yield has been 2.653%.

Therefore, if we assume that over time, COP stock will rise and lower its 3.42% yield so that it reaches 2.653%, here is the price target (PT):

$3.36 DPS / 0.02653 = $126.65 PT

That is 29% higher than today's price:

$126.53 PT / $98.19 today = 1.291 -1 = +29.1% upside

In other words, there is still good upside in COP stock, even if oil and gas prices stay flat or fall. This assumes that the market feels that its average yield should be 2.653%.

But, just to be conservative, let's assume the yield approaches 3.0%:

$3.36 DPS / 0.03 = $112.00 PT

That is still 14% higher than today's price. The bottom line is that the COP stock could be undervalued.

One way to play this, to gain extra income and set a lower potential buy-in point, is to sell short out-of-the-money (OTM) cash-secured put options in monthly expiry periods.

Shorting Cash-Secured OTM COP Puts

In my last Barchart article on Dec. 19, I suggested entering an order to “Sell to Open” 1 put contract expiring Jan. 23, 2026, at the $88.00 strike price. That exercise price was 5% lower than the trading price at the time ($92.44).

At the time, the premium received was $1.13 per put contract, providing an immediate yield of 1.284% (i.e., $1.13/$88.00). As of Jan. 16, this put premium has fallen to $0.12 at the midpoint and is likely to expire worthless. So, this has been a successful trade.

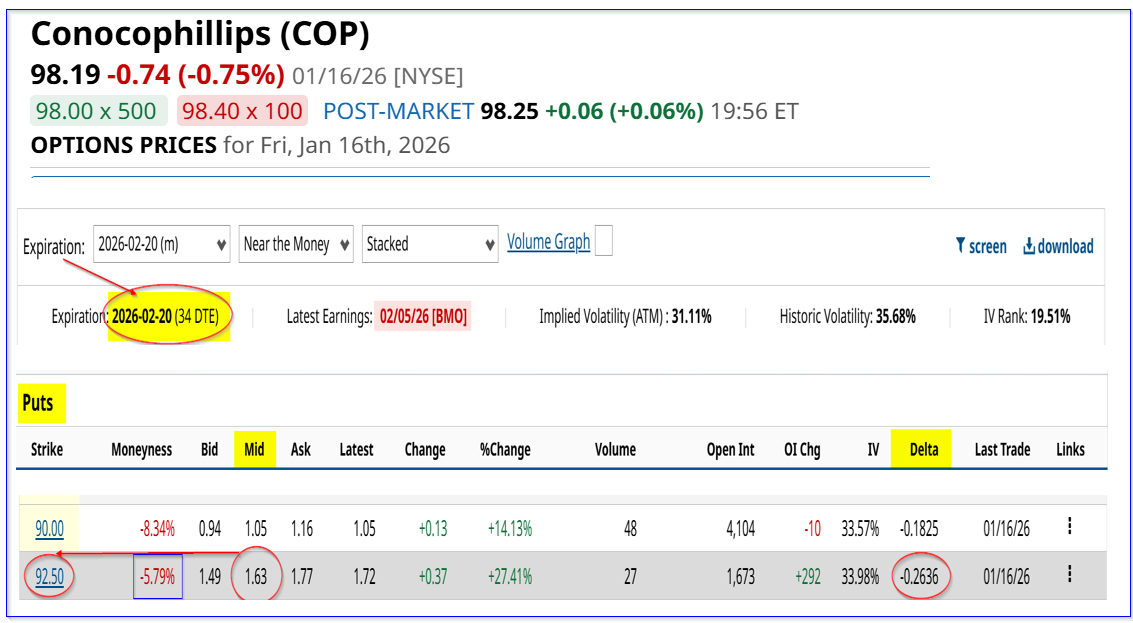

Investors can make similar income going forward. For example, the Feb. 20, 2026, expiry period shows that the $92.50 exercise price put contract has a midpoint premium of $1.63. This strike is 5.79% lower than Friday's close.

Therefore, an investor shorting the $92.50 put contract expiring on February 20 earns an immediate yield of 1.762% (i.e., $1.63/$92.50).

(Click on image to enlarge)

COP puts expiring Feb. 20, 2026 - Barchart - As of Jan. 16, 2026

But, just to be conservative, look at the $90.00 strike price expiring Feb. 20. It has a midpoint premium of $1.05. That provides a short-seller of this put makes a 1-month yield of 1.167% (i.e., $1.05/$90.00).

The point is that a conservative investor (who shorts both contracts) can earn a relatively safe average yield of almost 1.50% over the next month:

1.167% ($90 short-put play) + 1.762% = 1.4645%

Given that both contracts have relatively low delta ratios (i.e., between -0.18 and -0.26), there is only about a 22% chance that COP will fall to between $90 and $92.50.

Nevertheless, the risk is that COP falls below $90.00 on or before Feb. 20. That could potentially result in an unrealized capital loss. But at least the investor has received income that lowers the breakeven point.

The bottom line is that COP still looks undervalued. One way to play this is to sell short out-of-the-money (OTM) puts in 1 month expiry periods.

More By This Author:

McDonald's Is Worth Even More, Say Analysts - MCD Stock Looks Cheap Ahead Of Earnings

Devon Energy Unusual Call Option Activity - Investors Expecting A Dividend Hike?

Alphabet Stock Is Still Undervalued According To Analysts - 1 Month GOOGL Puts Yield 2.50%

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual ...

more