Friday Was The Highest Put Option Volume Session In History

Image Source: Pixabay

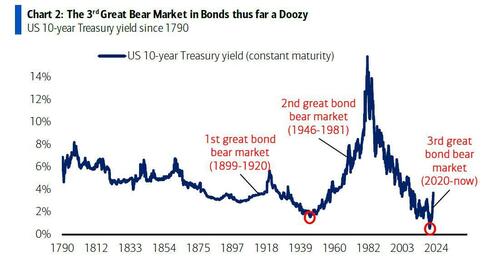

Friday was a bad day for stocks, and while S&P 500 futures managed to stage a tiny end-of-day bounce to avoid sliding below the 2022 June closing low of 3,666, one can only describe Friday's action as a crash, which is what we did, especially in the bond world where things are starting to break, as Michael Hartnett explained in "The Bond Crash of 2022."

But even just looking at equities, it was a full-blown capitulation. As Goldman's flow trader John Flood observed, the last day of trading saw continued Long Only (L/O) derisking in broken names (Goldman's asset manager's sell skew peaked at 21% on Friday, which was the 91st percentile vs. the 52-week look back), at the same time as Goldman saw meaningful supply in growth complex.

Away from L/Os, hedge funds added to macro shorts (this dynamic keeping grossing higher than expected in this tape). And while stocks remain in a buyback blackout until the start of earnings season in roughly three weeks' time, the month-end pension rebalance sees a modest $7 billion for sale.

This is while CTAs are now at -100% net shorts, and are mostly done shorting here (Goldman calculates some -$1 billion a day for the next week, but this doesn't get much bigger even if the market breaks lower).

Still, the lack of major forced selling is hardly sufficient to bring buyers back into the market, especially ahead of another low-liquidity week where ascendant bears will once again set the market tone - as a reminder, with Rosh Hashanah on Monday and Tuesday, attendance will be light and liquidity will be tough to come by.

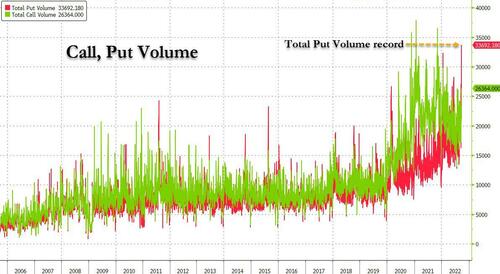

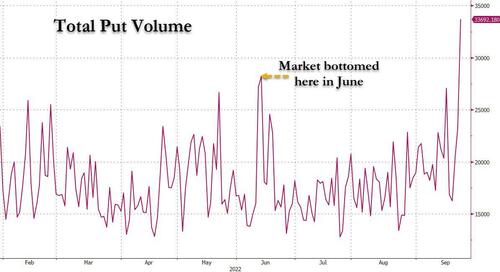

However, what was perhaps the most notable market feature of Friday's (orderly) selloff is the record surge in hedging. While call buying has collapsed, Friday saw the highest put option volume in history, at just shy of 34 million contracts.

Of course, the last time put buying soared to a fresh high was June 13, which also marked the market's lows for the year.

That's why as Goldman's Flood writes, "we are now officially primed for a nasty move higher at some point next week that will promptly be re-shorted."

Still, absent a dovish pivot by the Fed, the broader market trend into year-end still points lower as neither depressed sentiment nor positioning alone can push the market higher for a sustained period of time.

Meanwhile, as we noted extensively on Friday, the move higher in yields - both in the US and across the pond - is starting to get some real attention, as the "market is sniffing out that these European Governments are between a rock and a hard place: adding fiscal support to safeguard from higher energy prices is making inflation problem worse and leading CB's to be more aggressive."

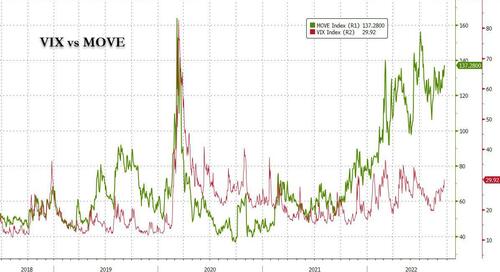

And while the VIX will likely stay below 30 next week, especially if those who just bought puts in record amounts are forced to monetize (i.e., sell) should we avoid another trapdoor move lower, the real volatility these days is in the "bond VIX," the MOVE, which is about to take out its March 16, 2020 all-time highs, even as the VIX simply refuses to move above 30 in any sustained move.

Still, an eventual convergence between these two series is the only option. Either the VIX will explode to the 60-80 zone in the coming days, or else yields will have to tumble down on either recession fears or a hint by central banks that QE is coming back, even as rate hikes persist for a few more months.

More By This Author:

Amazon Walks Back Bonus Emails, Tells Employees They 'Miscalculated' CompensationFutures Crash, Stocks At 2022 Lows; Yields, Dollar Explode As UK Stimulus Plan Sparks Global Market Panic

Hertz To Buy 175,000 EVs From General Motors Over Five Years

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more