Futures Crash, Stocks At 2022 Lows; Yields, Dollar Explode As UK Stimulus Plan Sparks Global Market Panic

One week after stocks suffered their biggest drop since June, futures are in freefall on Friday with the dollar soaring to the now default daily record high...

(Click on image to enlarge)

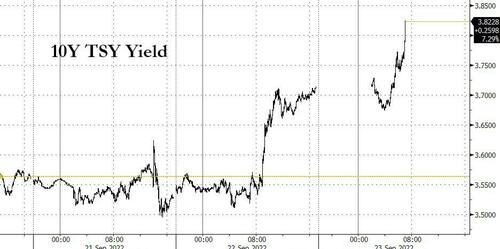

... 10Y yields exploding higher, surging more than 10bps so far today...

(Click on image to enlarge)

... in what appears to be the latest bond market flash smash which has pushed 10Y yields to the highest level since 2010...

(Click on image to enlarge)

... and S&P futures plunging over 1.4%, and the S&P set to open at a fresh 2022 low...

(Click on image to enlarge)

... with futures set to drop nearly 5% (or more) for a 2nd consecutive week, and down 5 of the past 6 weeks!

(Click on image to enlarge)

Besides the soaring dollar, two other drivers contributed to today's widespread market panic:

- first, the shocking UK mini budget saw the country's new administration slash tax rates by the most since 1970s at a time when the country is about to enter recession and is battling with runaway inflation which crashed UK bonds and sent the pound tumbling to a 37 year low as markets priced in a more aggressive pace of tightening to offset the government’s growth plan,

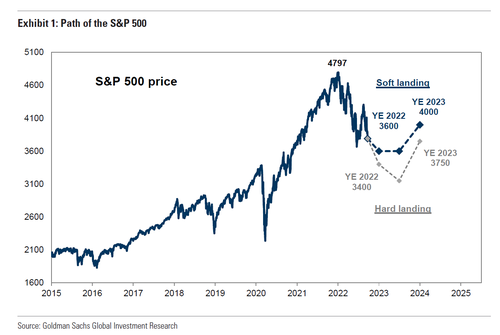

- second, traders also freaked out over a Goldman research report which slashed the bank's S&P price-target to just 3,600 from 4,300, making the bank one of the biggest bears on Wall Street.

(Click on image to enlarge)

In premarket trading, Costco shares declined 3.3% as analysts flagged that volatility may remain high for the company’s shares. Analysts mostly welcomed its report of modest improvements in inflation and supply chains. here are the other notable premarket movers:

- AMD shares dropped 1.5% in premarket trading as Morgan Stanley trimmed price target to $95 from $102, citing a worsening PC end market and headwinds on the client business, including a collapse in gaming GPUs.

- Tritium DCFC shares jumped 4% in postmarket trading, following six straight losing sessions, after the maker of electric-vehicle chargers reported sales orders of $203 million for fiscal year ended June 30, and revenue of $86 million.

- CalAmp gained 3% postmarket after the maker of tracking devices posted fiscal 2Q revenue that beat estimates.

- DocuSign edged higher in postmarket trading after announcing that the board of directors has hired Allan Thygesen as Chief Executive Officer.

Europe's Stoxx 600 dropped more than 1%, declining 20% from January record high, set to enter a new bear market. Energy, miners and real estate are the worst-performing sectors amid broad-based declines. Here are the most notable European movers:

- Credit Suisse shares declined as much as 9.4% to a record low for a second day running, even as the bank denied a report that it was considering an exit from its US operations

- Ericsson falls as much as 6.1% to 2-year lows after a Radio Sweden report saying the communications equipment maker continued to send products to Russia after saying deliveries had been suspended

- Energy is among the worst-performing sectors on Europe’s Stoxx 600 index on Friday, with the subindex falling as much as 2.6% to the lowest since July 27 as oil heads for a fourth weekly loss

- European warehouse firms slide after Barclays issued a review on the sector, cutting target prices on average by 20%, downgrading Tritax Big Box REIT and Warehouses De Pauw to underweight

- Bureau Veritas falls as much as 5% after Oddo cuts to underperform, saying the valuation gap with peers and recent stock performance seems to leave more downside than upside in relative terms

- Nordic Semiconductor shares rise after DNB said it had found a component from the firm in the latest version of Apple’s AirPods Pro earphones which were released today. Varta, meanwhile drops as much as 13% after DNB found batteries from its rival Samsung in the new earphones

- UK homebuilders, retailers and banks get a boost as Chancellor of the Exchequer Kwasi Kwarteng announces several tax relief measures, with much of the sector trimming earlier losses

As reported earlier, UK stocks, bonds and the cable all plunged as traders ramped up their bets on Bank of England rate hikes, betting on a 50% chance of a 100-basis-point increase from the central bank at its next rate decision in November, as the government set out its most radical package of debt-financed tax cuts since 1972 and the Debt Management Office increased its gilt sales plan more than expected. “The markets will do what they will,” said Chancellor of the Exchequer Kwasi Kwarteng, when challenged in parliament on the mayhem in markets.

The European Central Bank will also forge ahead with increases in borrowing costs, according to Governing Council member Martins Kazaks, even as recession risks rise across the continent.

Earlier in the session, Asian stocks fell, with investors continuing to flee riskier assets as Treasury yields surged following the Fed’s rate hike that increased recession fears. The MSCI Asia Pacific Excluding Japan Index slipped as much as 1.6% while the broader MSCI Asia Pacific Index was on course for its sixth weekly retreat, the longest losing streak since May. TSMC and Tencent were the biggest drags on both gauges as the tech sector led declines. All markets in the region dropped, with several hitting grim milestones. Hong Kong’s Hang Seng Index fell to the lowest in more than a decade, while South Korea’s Kospi finished at its lowest since Oct. 2020. Australia’s benchmark fell nearly 2% as the country resumed trading after a holiday. Japan was closed.

“The intense tightening by the Federal Reserve to go all-out against inflation heightened fears that it could destroy demand and cause a recession,” said Han Jiyoung, an analyst at Kiwoom Securities in Seoul. The MSCI Asia Pacific Index has lost about a third of its value from a 2021 peak as the Fed’s rate-hike campaign and the strengthening US dollar prompted an exodus of funds from emerging markets. China’s regulatory crackdowns and its strict Covid lockdown policies have also weighed on sentiment. Hong Kong stocks ended in the red even as the city scrapped hotel quarantine for inbound travelers, the most substantial move yet in the city’s push to revive its status as a global financial center. “It’s optimistic to think a recession can be avoided and in our opinion any chance of a soft landing has evaporated,” said George Brown, an economist at Schroders. “We believe a recession will be needed to bring inflation under control.”

In rates, the yield on 10- year Treasuries exploded higher as bonds briefly flash crashed, sending the 10Y yields as low as 3.82% in a bear-flattening move that lifted front-end yields more than 10bp; 2-year and 3-year yields peak above 4.25% with all tenors reaching multiyear highs. Move follows soaring gilt yields where belly of the UK curve is cheaper by 50bp on the day into early US session, while the UK pound drops to a fresh 27-year low as mounting fiscal stimulus threatens to undermine Bank of England’s control on inflation. US yields are cheaper by 12bp to 5bp across the curve with front-end led losses flattening 2s10s by 3.5bp, 5s30s by 7.5bp on the day; 10-year yields around 3.80%, outperforming gilts by ~20bp in the sector.

In FX, the dollar rallied broadly, hitting a new all-time high against a currency basket and pushing the euro to a 20-year low wjhile the pound plunged to a fresh 35 year low just above 1.10 after the new UK government unveiled a massive fiscal stimulus plan to boost economic growth, which is sure to send inflation soaring even higher and force the BOE to do even more QT and so on. Safe-haven demand also boosted the greenback amid more signs of a slowing Chinese economy, which raised concerns about the outlook for global economic growth.

- Broad dollar strength pushed the Bloomberg Dollar Spot Index as much as 0.6% higher, hitting its highest on record going back to 2005

- The euro fell as much as 0.9% to 0.9751, its weakest level since 2002. The single currency extended losses after sizable stop-loss orders were triggered below 0.9800 and 0.9780, a Europe-based trader says. Options-related bids at $0.9750 and $0.9700 were seen offering near-term support.

- The pound sank more than 2% to 1.105, a 35-year low, pushing the Bloomberg UK Pound Index to its a lifetime high. The UK currency trimmed losses as the UK government announced a massive fiscal stimulus plan to boost economic growth.

- China’s onshore yuan is headed for the worst weekly fall versus the dollar since April. The yuan weakened the most among Asian currencies on Friday as traders continued to test the PBOC’s tolerance for a weaker yuan after Japan intervened to support the yen for the first time since 1998.

“For the USD to weaken meaningfully, the Fed has to get more concerned about growth than inflation-and we are not there yet.” Bank of America analysts write in a note. It adds that, for the euro to start appreciating, “the ECB needs not only to act, but also to communicate forcefully.”

In commodities, WTI drops more than 2% lower to trade just above $80, a level where OPEC+ production cuts are expected. Spot gold falls roughly $9 to trade near $1,662/oz. Spot silver loses 1.1% near $19.

Looking to the day ahead now, data releases include the September flash PMIs for Europe and the US. Otherwise, central bank speakers include Fed Chair Powell, as well as the ECB’s Kazaks and Nagel. Remember the Italian election on Sunday.

Market Snapshot

- S&P 500 futures down 0.5% to 3,752.25

- MXAP down 1.2% to 145.59

- MXAPJ down 1.6% to 470.98

- Nikkei down 0.6% to 27,153.83

- Topix down 0.2% to 1,916.12

- Hang Seng Index down 1.2% to 17,933.27

- Shanghai Composite down 0.7% to 3,088.37

- Sensex down 1.6% to 58,191.14

- Australia S&P/ASX 200 down 1.9% to 6,574.73

- Kospi down 1.8% to 2,290.00

- STOXX Europe 600 down 0.9% to 396.36

- German 10Y yield little changed at 1.93%

- Euro down 0.8% to $0.9756

- Brent Futures down 1.9% to $88.75/bbl

- Gold spot down 0.4% to $1,664.46

- U.S. Dollar Index up 0.60% to 112.03

Top Overnight News from Bloomberg

- BofA Says Cash is King as Investor Pessimism Hits 2008-Era High

- Goldman Slashes S&P 500 Target Citing Higher Fed Rates Path

- UK Sets Out Biggest Tax Cuts Since 1988 to Boost Economic Growth

- Era of Inflation Has Ended -- for Asset Prices on Wall Street

- Oil Set for Fourth Weekly Loss With Rate Hikes Darkening Outlook

- Goldman to BofA Throw in the Towel on a Year-End Rally in Europe

- Treasury Selloff Drives SOFR Spread Toward Record One-Day Drop

- Wall Street’s Top Banks Are Backing Oil to Stage a Recovery

- Nasdaq Increases Scrutiny of Small-Cap IPOs After Big Swings

- Japan Has a Pile of Dollars It Can Tap Before Selling Treasuries

- Chinese Money Pours Into Offshore Debt After Rare Yield Reversal

- China Compares Taiwan Independence Push to Charging Rhino

- China’s Most Locked-Down City Shows Perils of Endless Covid Zero

- Crypto Outperforms Stocks for a Change as Correlation Breaks

- Raytheon Beats Lockheed, Boeing on $1 Billion Hypersonic Job

- Zelle Emerges as Lawmakers’ Surprise Foe at Bank Hearings

- Alex Jones Renews ‘Deep State’ Claim at Defamation Trial

- It’s Every Nation for Itself as Dollar Batters Global Currencies

- Nikola Investor Lost $160,000 on Milton’s Hype, He Tells Jury

- FedEx to Cut Costs, Hike Rates in Battle Against Flagging Demand

- With Shelters Overflowing, NYC to Put Up Tents for Migrants

- Senior-Care Provider Cano Health Said to Weigh Sale

- Banks Dust Off Lockdown Plans to Beat Possible Power Blackouts

A more detailed look at global markets courtesy of Newsquawk

Asian stocks were negative in the aftermath of the rush of global central bank rate hikes during 'Super Thursday' and with risk appetite not helped by the absence of participants in Japan for the Autumnal Equinox Day. ASX 200 was heavily pressured on return from yesterday’s national day of mourning closure and took its first opportunity to react to the hawkish FOMC with the tech and consumer-related sectors the worst hit. KOSPI declined with the recent flurry of central bank rate hikes adding to the arguments for the BoK to continue on its hiking cycle as South Korean officials look to avert one-sided currency moves. Hang Seng and Shanghai Comp slightly deteriorated throughout the session as the early support from reports regarding Hong Kong and Macau potentially easing restrictions for arrivals gradually waned, while US audit watchdog officials recently arrived in Hong Kong for audit inspections as firms seek to avoid delisting from US exchanges.

Top Asian News

- White House Indo-Pacific coordinator said China clearly has ambitions in the Pacific which have caused concerns among Pacific Island leaders, according to Reuters.

- Hong Kong will announce today the end of mandatory hotel quarantine for overseas arrivals, according to SCMP.

- Japan PM Kishida said excessive yen movement repeatedly caused by speculation cannot be overlooked and they will take action should there be any excessive volatility in the yen, according to Reuters.

- Yuan Weakens to Near Trading Band Limit as Pressure Mounts

- China Junk Debt Ends Longest Rally of Year as Distress Mounts

- Times China Told Bondholders It Hasn’t Paid Interest Due Thurs

- Peak Pessimism Setting in for Chinese Stocks Ahead of Congress

- Iron Ore Fluctuates as China Steel Hub Tangshan Lifts Lockdowns

- JPM Analysts Liken UK Bank Deposit Speculation to Windfall Tax

European bourses are pressured across the board after the Flash PMI releases for the region indicate a contraction; Euro Stoxx 50 -1.5% Pressure that was exacerbated, particularly in the UK, on the mini-Budget and subsequent Gilt/BoE pricing, despite the measures being designed to stimulate the economy. Stateside, futures are lower in sympathy and continuing APAC performance awaiting their own PMI metrics and Fed commentary.

Top European News

- ECB's Kazaks says they will continue to hike rates, via Bloomberg; adds, faster Fed hikes have weakened the EUR. His choice for the October ECB hike is either 50bps or 75bps.

- UK COVID-19 hospitalisations rose 17% in a week which is the first significant increase since July and is sparking fears of a new wave, according to The Telegraph.

- Credit Suisse Hits Fresh Low; Denies Report of Looming US Exit

- UK Probably in Recession as Pound’s Weakness Boosts Inflation

- UK Bonds Plunge as Debt Office Plans More Sales Than Expected

- VW Warns of Production Shift From Germany Over Gas Shortage

- Ericsson Governance Worries Mount After Russia Sales Debacle

- European Watchdog Backs New Trading Halts for Energy Market

FX

- DXY has surged to a fresh 112.3+ peak to the detriment of peers across the board with the Yuan taking the strain.

- GBP dented post-PMIs/budget despite initial support from BoE pricing as the USD's surge continues.

- Amidst this, EUR has been hit on the flash-PMIs and accompanying commentary around recession fears and a resurgence in price pressures.

Fixed Income

- Gilts decimated to sub-99.00 from the 102.30 region in wake of the budget and accompanying fund consideration and potential inflationary implications

- Action that has sparked a surge in BoE pricing with markets now implying a 50/50 chance of a 100bp increase in November.

- More broadly, EGBs and USTs are dragged down in tandem though seem to have reached a 'floor' ahead of the afternoon's events.

Commodities

- Crude benchmarks are pressured by pronounced USD strength and risk action amid recessionary fears.

- Additionally, participants are attentive to potential weekend developments with EU member states set to discuss Russian sanctions.

- Russian President Putin spoke to Saudi Crown Prince MBS and discussed the question of coordination to ensure stability in the oil market, while they praised efforts within the OPEC+ framework and confirmed the intention to continue sticking to existing agreements, according to Reuters.

- Metals dented across the board by the USD with base metals in particular hit amid broader sentiment with LME Copper slipping below USD 7.5k/T.

US event calendar

- 09:45: Sept. S&P Global US Composite PMI, est. 46.1, prior 44.6

- 09:45: Sept. S&P Global US Services PMI, est. 45.5, prior 43.7

- 09:45: Sept. S&P Global US Manufacturing PM, est. 51.0, prior 51.5

DB's Jim Reid concludes the overnight wrap

It's a bit of a broken record at the moment as markets have again been reeling over the last 24 hours, with another major selloff for bonds and equities taking place after central bankers showed no sign of letting up on their campaign of rate hikes to tackle inflation. The hawkish Fed decision on Wednesday set the backdrop for the slump, but that was compounded by further hikes yesterday in the UK, Switzerland, Norway, South Africa, Indonesia and the Philippines. Inturn, that led investors to expect an even more aggressive pace of rate hikes over the months ahead, with current market pricing for each of the Fed, ECB and the BoE indicating that a 75bps hike at the next meeting is now considered the most likely outcome for all three.

In terms of those market moves, equities lost ground across the board as the prospect that tighter monetary policy would trigger recessions moved increasingly into view. The S&P displayed a lot of volatility into the close, ultimately falling -0.84% and moving deeper into bear market territory and on track for its worst annual performance since 2008. Under the hood, sector performance had a consistent macro story, where there was an outperformance in defensives (health care led the way up +0.51%) and an underperformance in cyclicals (discretionary lagged at -2.16%).

In Europe the losses were even more severe as they finally got to react to the Fed’s announcement the previous evening, with the STOXX 600 (-2.09%) actually falling beneath its July lows to close at levels unseen in over 20 months. It's fascinating that there's hardly been any wider mention of the Italian election this Sunday even with the centre-right populists ahead in the polls. There are much bigger things to worry about to be fair and it seems that there is limited political appetite in Italy at the moment to deviate too far from EU fiscal rules. See here for our economists' preview.

The declines mentioned above for equities were just as dramatic for sovereign bonds, with yields on 10yr Treasuries surging by +18.4bps to a post-2011 high of 3.71%. That was primarily driven by a rise in real yields, which similarly hit a high for the decade at 1.30%. We did get some positive data on the weekly initial jobless claims, which came in at 213k (vs. 217k expected) for the week ending September 17, and the previous week was revised down -5k. But that just compounded the selloff, since the fact that claims are on a firmly downward trend was seen as giving the Fed even more space to hike rates over the coming months without worrying about a sharp rise in unemployment. Those expectations of additional rate hikes were evident among Fed funds futures, which moved towards the more hawkish FOMC dot plot, with the rate implied by December 2023 up +10.0bps on the day to 4.33%.

Over in Europe it was much the same story, with yields on 10yr bunds (+7.2bps), OATs (+7.8bps) and BTPs (+3.9bps) seeing fresh rises. Gilts were the biggest underperformer however, with 10yr yields up +18.1bps after the Bank of England hiked by 50bps for a second consecutive meeting, taking Bank Rate up to 2.25%. The decision was a 3-way split among policymakers, with 5 of the 9 MPC members in favour of the 50bp hike, 3 members wanting a larger 75bps move, and 1 wanting a smaller 25bps hike. They also voted (unanimously) to reduce the stock of gilts by £80bn over the next 12 months. Our UK economist sees this decision as slightly hawkish (link here), and sees the BoE as having opened the door for a larger rate hike in November. As a result, he now expects that the MPC will deliver a 75bps hike at the next meeting, although this is a very close call, with the terminal rate still reaching 4% in this hiking cycle.

Staying on the UK, it’s also an important day on the fiscal side as new Chancellor Kwasi Kwarteng will be unveiling the government’s Growth Plan in the House of Commons this morning. Ahead of that, we got confirmation yesterday that the 1.25pp increase in National Insurance (a payrolls tax) is going to be reversed from 6 November. Otherwise, it’s been widely reported that they’ll confirm that corporation tax will remain frozen at 19%, rather than increasing to 25% as had been planned, and recent days have also seen press speculation about a potential cut to stamp duty (the home purchase tax). Our UK economist has a preview of the event here.

On oil, the EU is apparently working on a new effort to impose a price cap on Russian oil in response to President Putin’s escalation and partial mobilisation announcement yesterday. However, the plan will still face hurdles given the dire energy situation in Europe and the need to arrive at an unanimous decision. Elsewhere, the Nigerian oil minister echoed previous remarks from other cartel members by saying OPEC may need to cut output if prices fell more. Brent crude prices were +0.70% higher, after being as much as +3.31% higher intraday but are back roughly to where they were 24 hours ago this morning in Asia.

Looking elsewhere, there was plenty of other monetary action to digest after Japan intervened to support the Yen for the first time since 1998. That came shortly after the BoJ’s latest decision we mentioned in yesterday’s edition, which saw the yen weaken above 145 per US Dollar initially, before the intervention led to a sharp pullback that saw the yen close at 142.39. Confirmation came from Masato Kanda, Japan’s top currency official, who said that “The government is concerned about excessive moves in the foreign exchange markets, and we took decisive action just now”. In a statement from the US Treasury, a spokesperson said that “We understand Japan’s action, which it states aims to reduce recent heighted volatility of the yen.” George Saravelos writes here that the intervention is unlikely to work and could lead to an unnecessary loss of reserves and credibility.

Asian equity markets are limping towards a sixth weekly loss this morning. The Kospi (-1.59%) is the largest underperformer across the region mirroring Wall Street losses overnight followed by the Shanghai Composite (-1.08%), CSI (-0.96%) and the Hang Seng (-0.91%). Elsewhere, markets in Japan are closed for a holiday with no trading of cash Treasuries in the Asian trading hours. US stock futures are pointing to further declines today with those on the S&P 500 (-0.17%) and NASDAQ 100 (-0.28%) both down.

Early morning data from Australia showed that the flash manufacturing PMI rose slightly to 53.9 in September from 53.8 in August while the services PMI came in at 50.4 compared to 50.2 in August.

In other news, Japan is ending its Covid-19 restrictions and opening the door back up to mass tourism in a move to revive the nation’s tourism industry as the Covid pandemic recedes. The new policies will come into effect on October 11.

In terms of yesterday’s other data, sentiment wasn’t helped after the European Commission’s consumer confidence indicator for the Euro Area fell to a record low of -28.8 in September on the preliminary reading. Bear in mind that series covers both Covid and the GFC so that’s a seriously negative print. Over in the US, the Kansas City Fed’s manufacturing index fell to 1 in September (vs. 5 expected), marking its lowest level since July 2020.

To the day ahead now, and data releases include the September flash PMIs for Europe and the US. Otherwise, central bank speakers include Fed Chair Powell, as well as the ECB’s Kazaks and Nagel. Remember the Italian election on Sunday.

More By This Author:

Hertz To Buy 175,000 EVs From General Motors Over Five YearsEmerging Markets Start Sending Out Warning Signals Against The Soaring Dollar

Futures Slide As Hawkish Rikshock Sends Dollar, Yields Higher Again Ahead Of Fed

Disclosure: Copyright ©2009-2022 ZeroHedge.com/ABC Media, LTD; All Rights Reserved. Zero Hedge is intended for Mature Audiences. Familiarize yourself with our legal and use policies every ...

more