Crash Protection For AMD

The Formula One Scuderia Ferrari sponsored by AMD (photo via Jisakutech).

Crash Protection For AMD

With recent news of the delayed launch of AMD's Ryzen processor adding to the uncertainty surrounding the stock, I thought some shareholders might want to consider ways to add downside protection while staying long. At the same time, this gives me an opportunity to test drive a new hedging app feature for you, one that can help you decide which - if any - hedge is preferable. As a reminder, before we get to the hedges: hedging is for cautious bull who want to limit their risk in the event that their bullish thesis proves to be wrong, or the market goes against them. If you're not bullish on AMD, rather than hedging it, you should sell the stock.

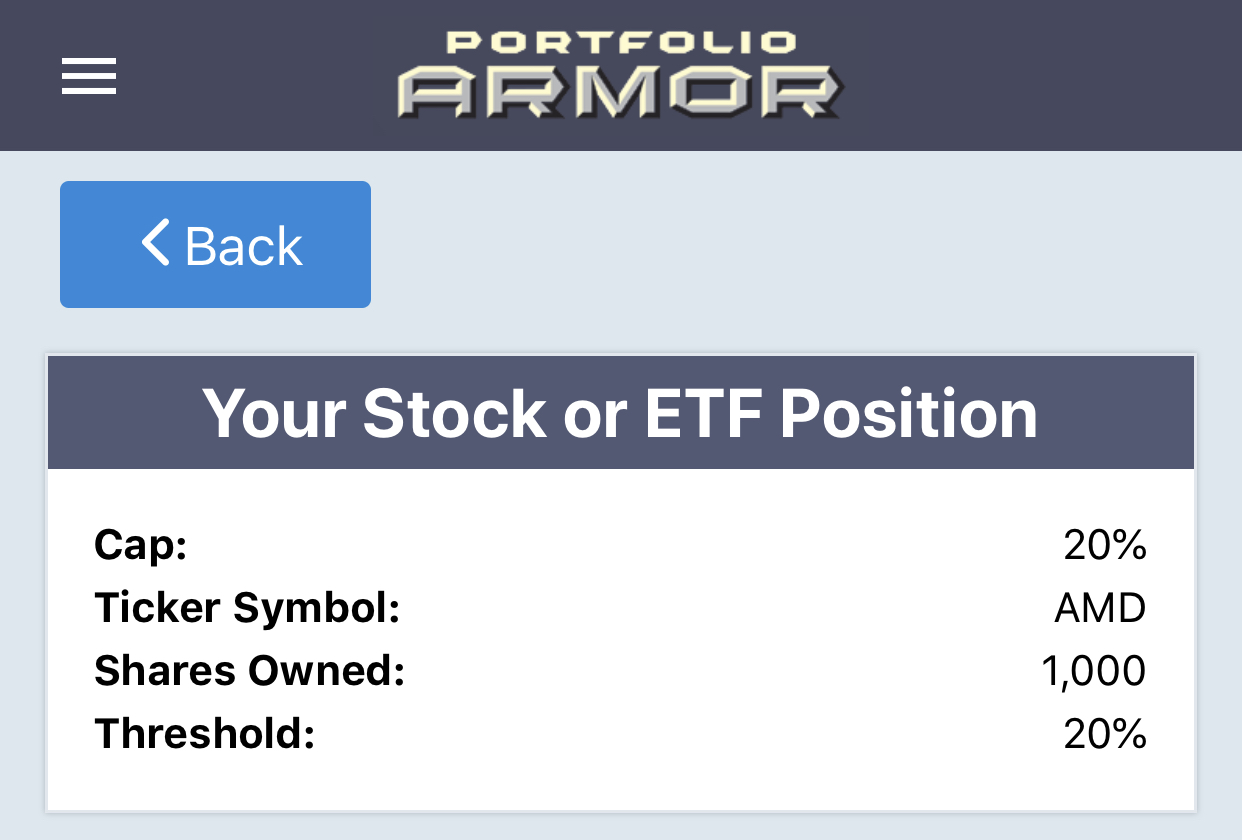

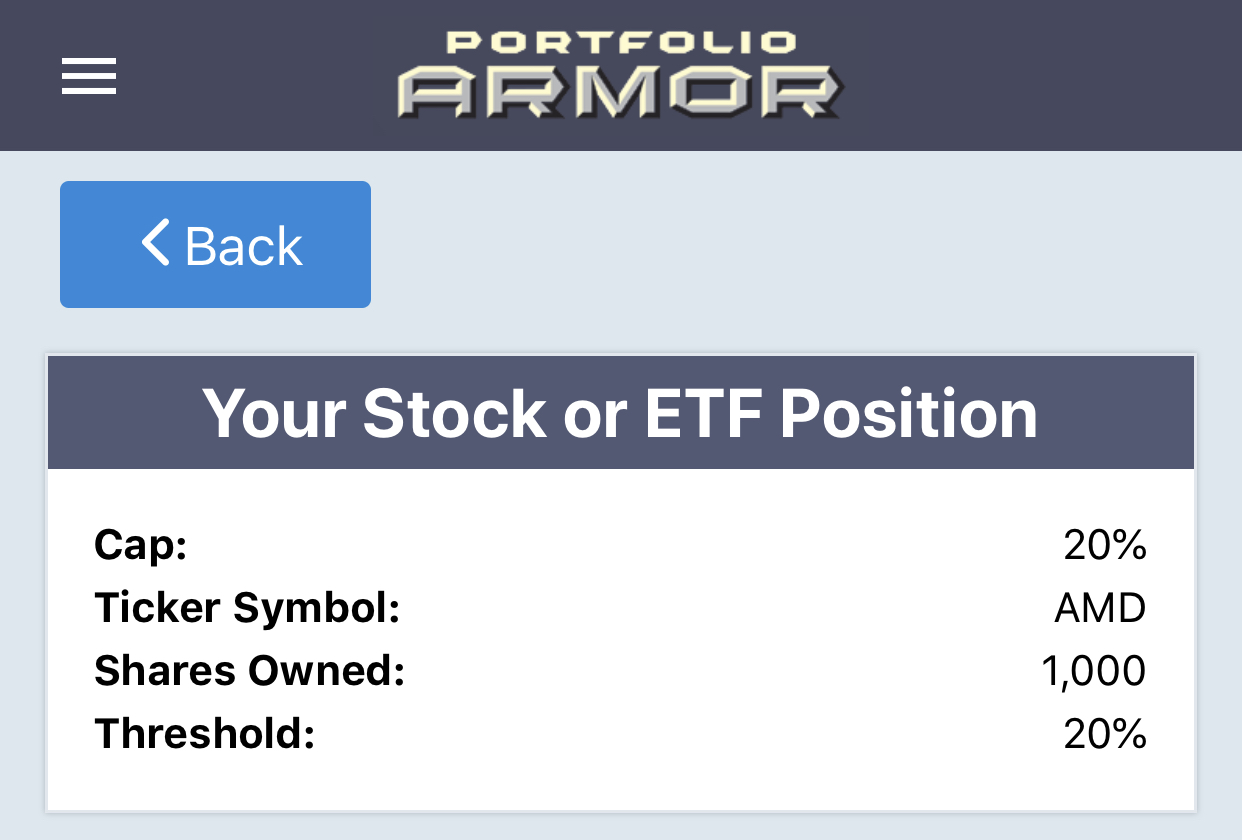

With that said, here are four different ways you can hedge your AMD shares. For these examples, I am assuming you own 1,000 shares of AMD and can tolerate a drawdown of up to 20%, but not one larger than that. Since two of these hedges expire in January and two expire in April, I have circled each hedge's annualized cost as a percentage of position value, to facilitate an apples-to-apples cost comparison.

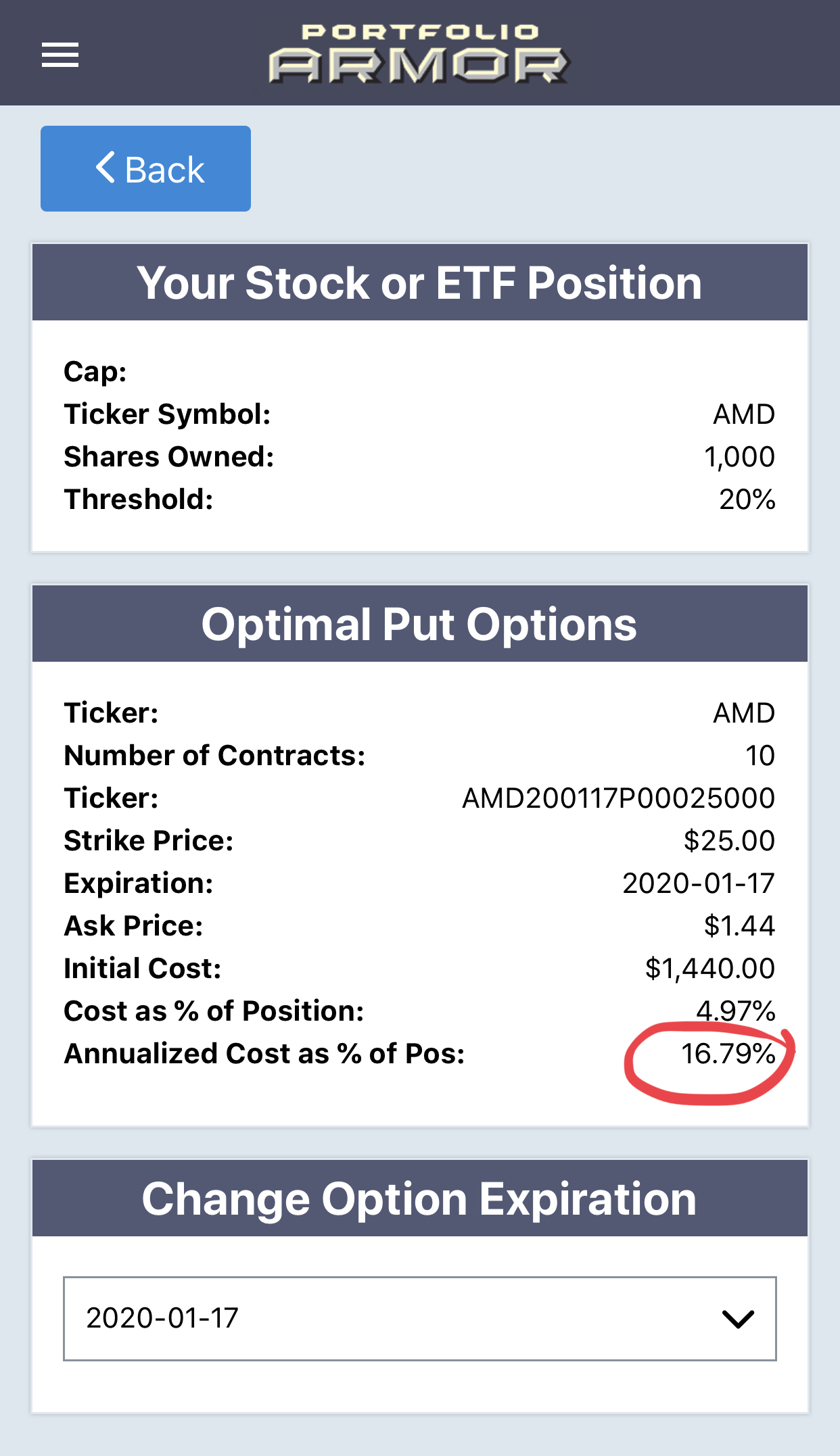

Uncapped Upside, Expiring In January

As of Monday's close, these were the optimal, or least expensive, put options to hedge 1,000 shares of AMD against a >20% decline by mid January.

The cost of this protection was $1,440, or 4.97% of position value, calculated conservatively, using the ask price of the puts (Remember: in practice, you can often buy and sell options at some price between the bid and ask). That worked out to an annualized cost as a percentage of position value of 16.79%.

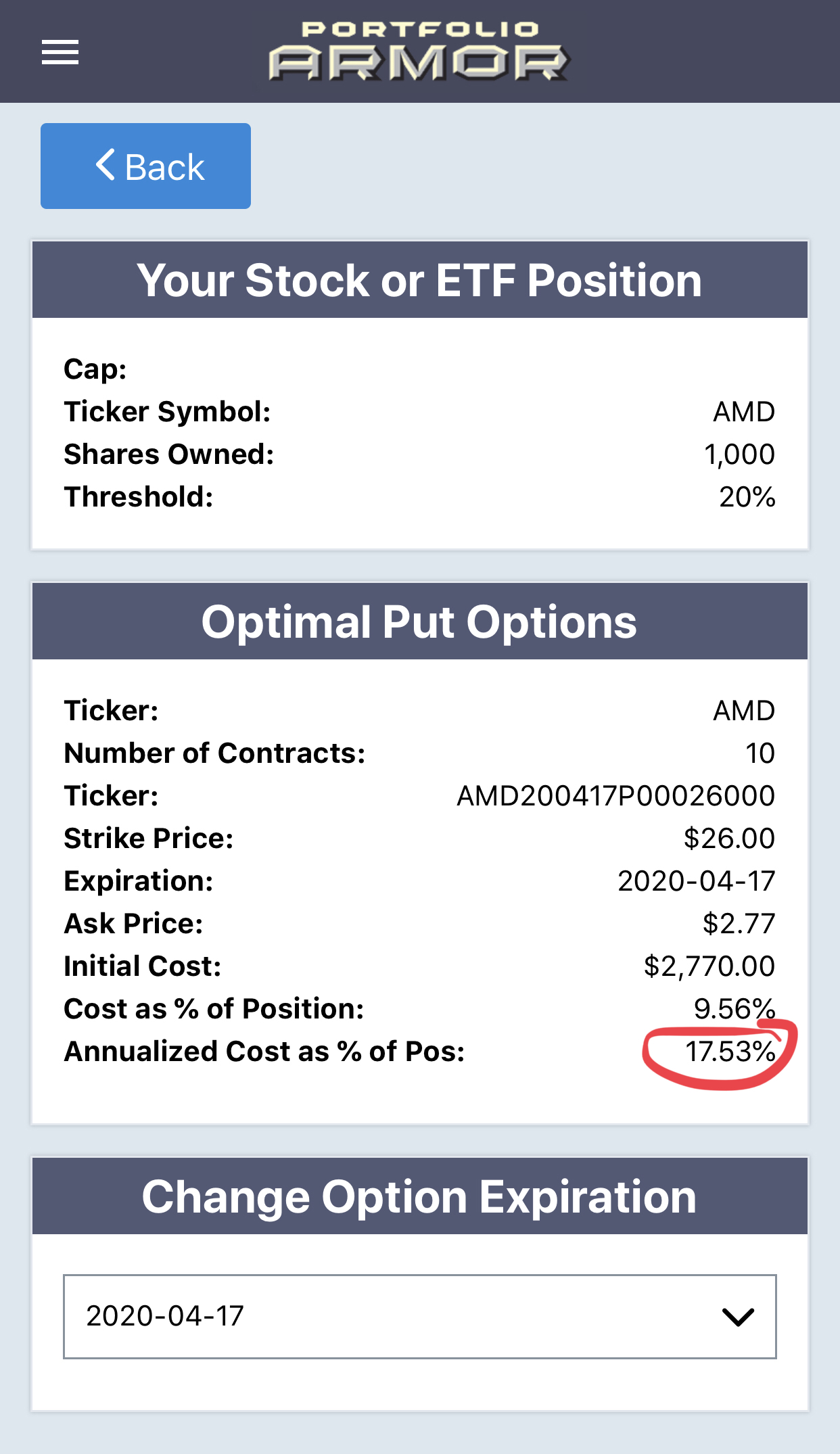

Uncapped Upside, Expiring In April

This hedge uses the same parameters as the previous one, except it expires three months later.

In this case, the cost was higher in absolute terms, as we'd expect, given the longer time to expiration: $2,770, or 9.56% of position value, again calculated conservatively, at the ask. But the annualized cost was a bit higher too: 17.53% of position value. You can use the change option expiration feature in our hedging app to compare the annualized cost across all available option expirations for AMD.

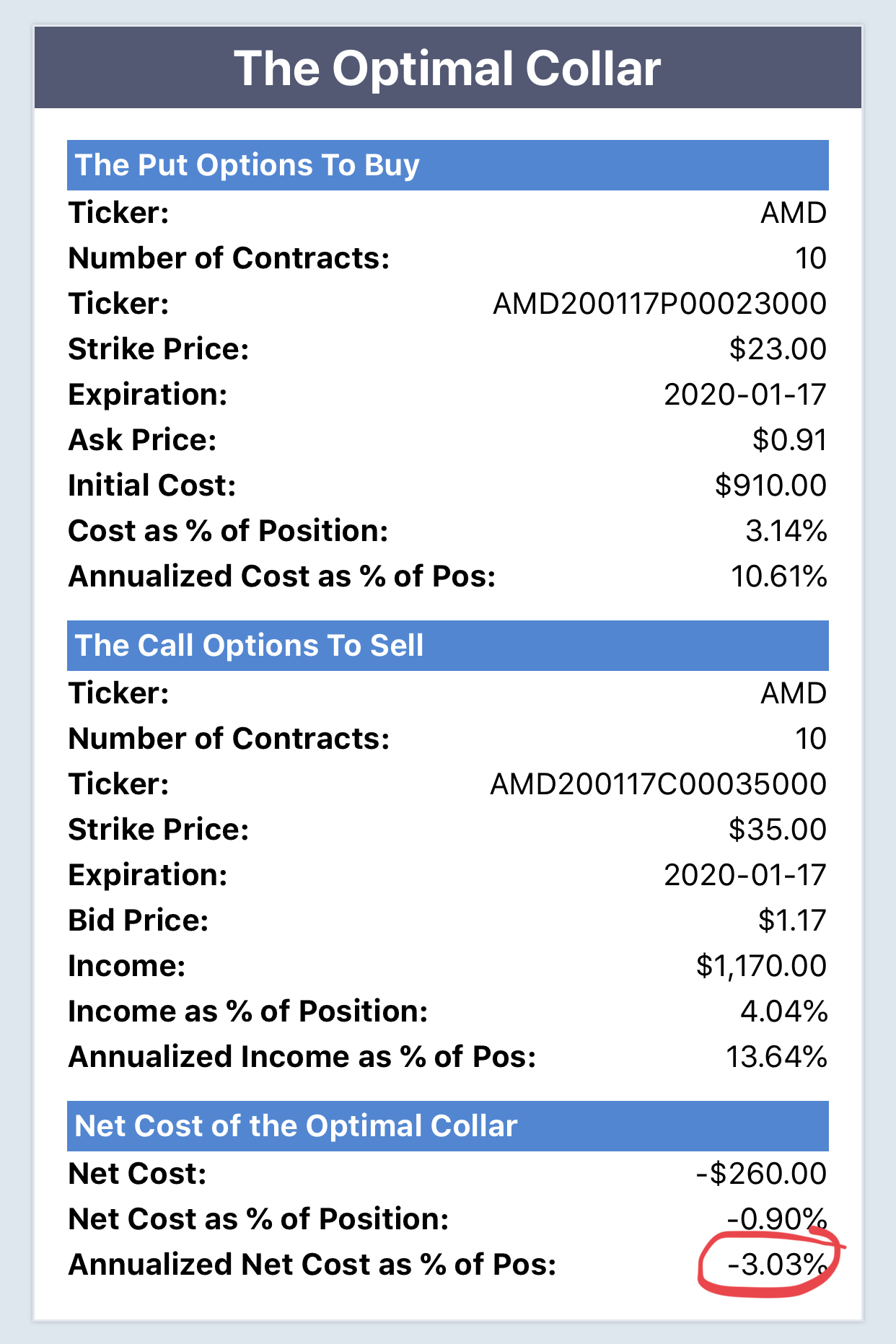

Capped Upside, Expires In January

If you were willing to cap your possible upside at 20% by then, this was the optimal, or least expensive, collar to give you protection against the same, >20% decline by mid-January.

Here the cost was negative, meaning you would have collected a net credit of $260, or 0.9% of position value, when opening this collar, assuming you placed both trades (buying the puts and selling the calls) at the worst ends of their respective spreads. That worked out to an annualized cost of -3.03% of position value.

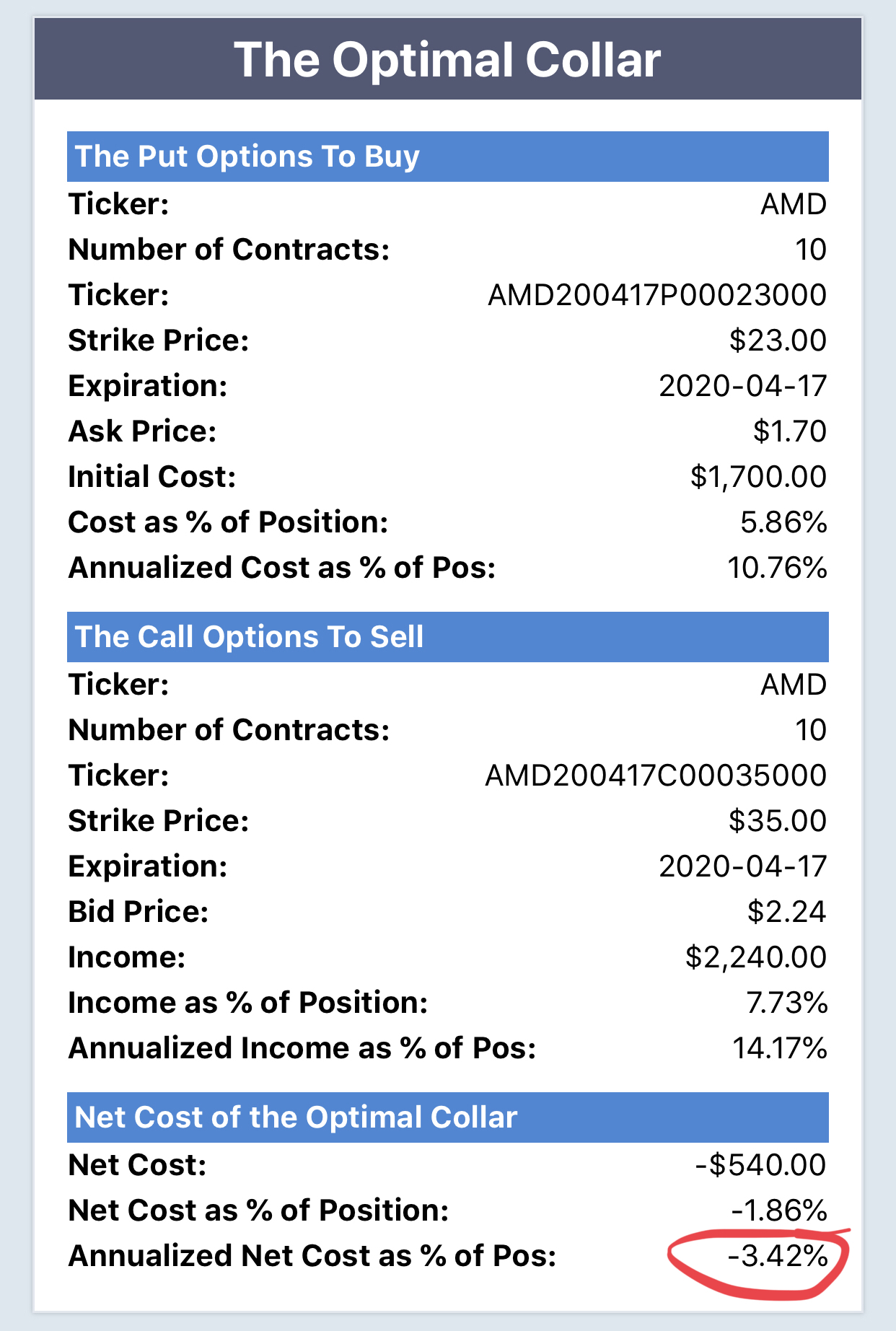

Capped Upside, Expiring In April

This collar has the same parameters as the one above, except that it expires in April.

Here the cost was negative again, but slightly more so: in opening this hedge, you would have had a net credit of $540, or 1.86% of position value, calculated conservatively. That worked out to an annualized cost of -3.42% of position value.

Wrapping Up

Readers looking for less expensive ways of hedging AMD without capping their upside risk can scan for optimal put hedges with closer expirations, such as one month out. At some point, though, there may be trade-offs in terms of convenience with that. For large enough positions, the app may also mention another form of protection that doesn't involve options.