Chevron Hikes Its Dividend - But It's Less Than Expected - Is The Stock Fully Valued?

Chevron Corp_ HQ photo- by jewsyte via iStock

Chevron Corp (CVX) announced a 4.0% dividend per share (DPS) hike to $7.12 annually on Jan. 30, slightly lower than my expectation of a 5% hike to $7.18. Chevron stock has risen 20% since mid-December. It could be fully valued, as it has reached my price target. This article will discuss how shareholders can play the stock.

Chevron closed at $176.90 on Friday, Jan. 30, up $5.71 (+3.34%), and up $24.39 or+16.1% year-to-date from $152.41 on Dec. 31, 2025.

(Click on image to enlarge)

Image Source: Barchart - Chevron stock over the last three months

Moreover, since its recent low point of $146.75 on Dec. 16, 2025, the stock is up $30.05, a 20.5% gain in just a month and a half.

Why Investors Might Have Expected a Higher DPS Increase

Clearly, investors have been anticipating a dividend per share hike. But just a 4.09% quarterly DPS hike from $1.71 (i.e., $6.84 annually) to $1.78 ($7.12)?

I previously wrote an article on Dec. 21, 2025, discussing why I thought Chevron would increase the DPS by 5% to $7.18. After all, last year, it hiked the DPS by 8 cents per share, or 4.9% from $1.63 quarterly to $1.71. So, expecting a 5% increase to almost $1.80 (i.e., $1.795, or an increase of about 8 cents) seemed likely.

Moreover, Chevron had made a statement in its Nov. 12, 2025, investor day presentation that “Chevron has led its peers in dividend per share growth over the last 25 years with an average annual increase of 7%.”

I discussed Chevron stock in my Nov. 23, 2025 article as well.

Lower-Than-Expected Free Cash Flow (FCF)

So, what happened? Reality happened. Cash flow was lower than expected. So, management kept the dividend hike at the low end of expectations. That could have big ramifications for the stock.

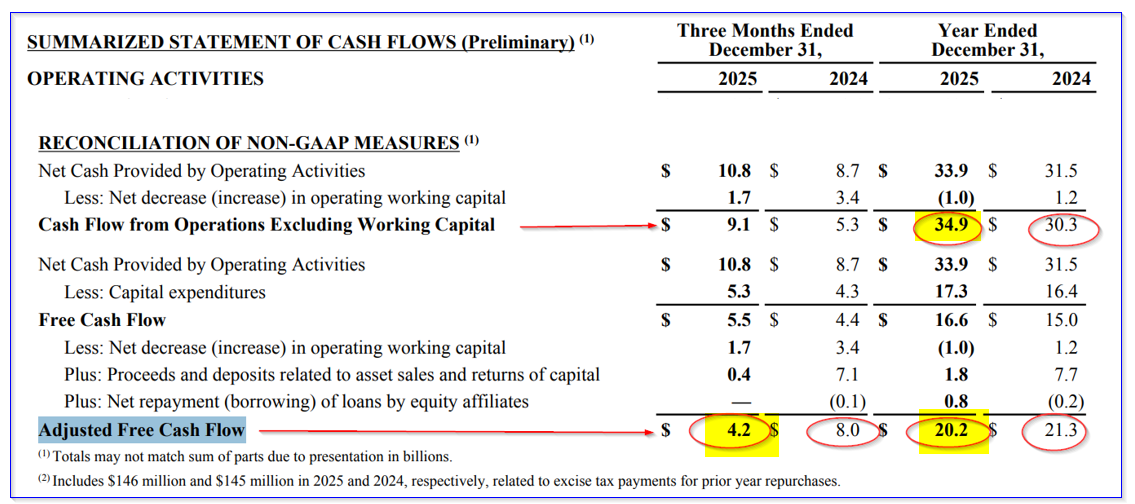

Excluding working capital changes, operating cash flow was 15.2% higher at $34.9 billion vs. $30.3 billion for the full year. However, adjusted free cash flow, after capex and other adjustments, was 5.2% lower at $20.2 billion vs. $21.3 billion.

This decline was worse for Q4. Adj. FCF was $4.2 billion, vs. $8.0 billion last year, down 47.5% year-over-year. This can be seen on page 10 of the Q4 release.

(Click on image to enlarge)

Image Source: Chevron release page 10 - Q4 and 2025 adj. FCF

It was also 40% lower than the $7.0 billion in adj. FCF last quarter (see page 9 of the Q3 release). In other words, this decline, if it continues, could make a higher dividend increase take up a larger portion of free cash flow.

For example, assuming about 2 billion shares outstanding (the company has not yet filed its 10-Q filing), the new $7.12 annual DPS will cost Chevron $14.24 billion. That's 16.7% higher than the $12.8 billion the company paid in 2025 (which included at least 1 quarter at a lower $1.63 quarterly DPS rate).

Moreover, compared to the run rate of $3.4 billion paid in Q4 (i.e., $13.6 billion), the $14.24 billion in cash dividends would be 4.7% higher. And, the $3.4 billion in Q4 payments took up 80% of the $4.2 billion in adj. FCF. So, a 4.09% increase in payments (before share repurchases) could increase that payout ratio.

That may affect the company's ability to increase its dividend going forward. As a result, Chevron stock could be at a near-term peak. Here's why.

Price Targets for Chevron Stock

I wrote in December that the average dividend yield for Chevron stock had been 4.2168%. Based on my expectation of a $7.18 annual DPS, I expected a price target (PT) of $170.21 per share:

-

$7.18 DPS / 0.042168 = $170.27 PT

But, the average yield five-year dividend yield metric is now slightly lower, at 4.1833%:

That lower yield average could help push the price target higher. However, the forward DPS rate is lower than the prior expectation, so the new PT is slightly lower:

-

$7.12 DPS / 0.041833 = $170.20

The problem is that the stock is now $176.90, and it has a forward dividend yield of 4.02% (i.e., $7.12 / $176.90). That could imply that the price is overvalued, based on its historical dividend yield average. In addition, it has moved up significantly in a short period to this PT.

Moreover, Chevron is now close to analysts' price targets. For example, Yahoo! Finance's survey of 26 analysts is $177.67 per share, Barchart's mean PT is $175.25, and AnaChart's survey of 19 analysts is $208.78.

One way for existing shareholders to play this is sell short out-of-the-money call and put options, to collect income, and potentially benefit if the stock stays in a trading range.

Shorting OTM Chevron Puts and Calls

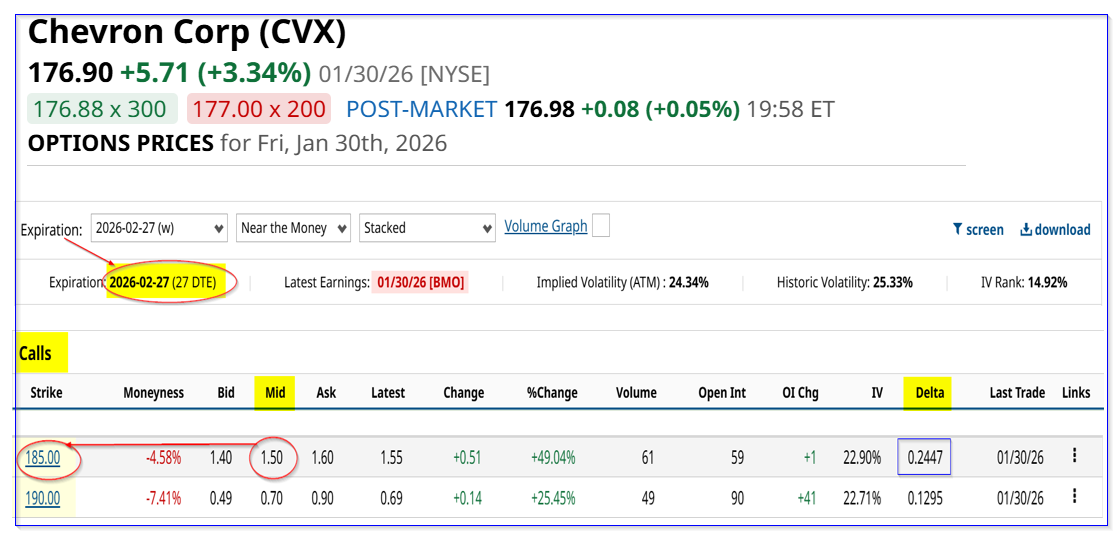

For example, look at the Feb. 27, 2026, expiry period. The $185.00 call option strike price has a midpoint premium of $1.50. That provides a covered call seller a 27-day yield of 0.85% (i.e., $1.50 / $176.90).

This strike price is +4.578% higher than Friday's close (i.e., out-of-the-money, or OTM). So the investor could potentially make this as an additional capital gain (although the upside is limited to $185.00).

(Click on image to enlarge)

Image Source: Barchart - Chevron calls expiring Feb. 27, 2026, as of Jan. 30, 2026

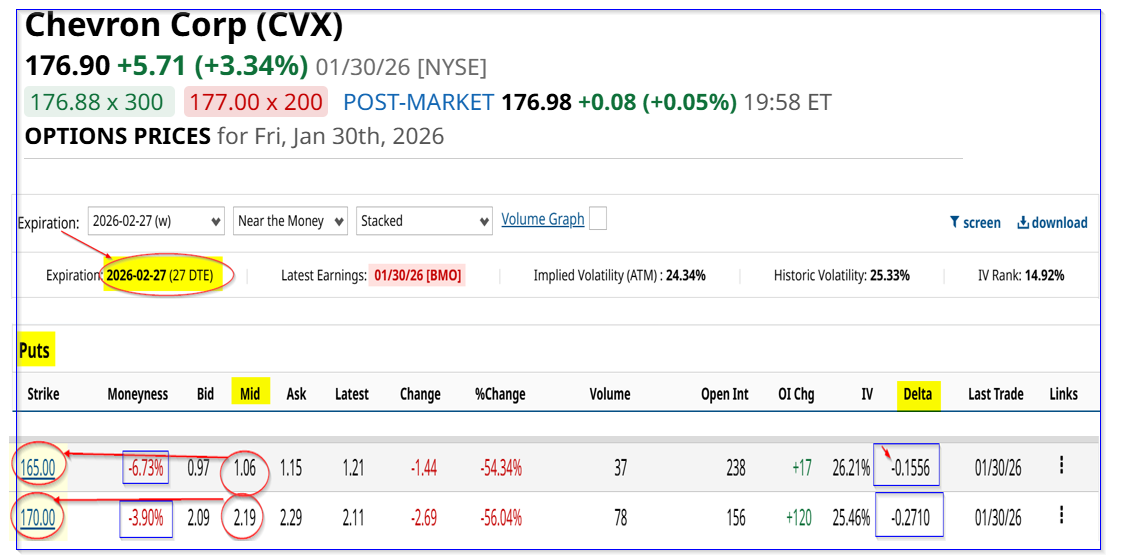

Similarly, out-of-the-money (OTM) put options in this expiry period have good yields. The $170.00 put, i.e., with a 3.90% distance away) has a $2.19 midpoint premium, providing a 1.288% yield (i.e., $2.19 / $170.00). In addition, the $165 put strike price (6.73% OTM) has a $1.06 midpoint premium.

(Click on image to enlarge)

Image Source: Barchart - Chevron puts expiring Feb. 27, 2026, as of Jan. 30, 2026

Moreover, an investor could short the $170.00 put and buy the $165.00 strike price put for a net credit of $1.13. This provides some downside protection for the put seller to protect against any downside if the stock falls below $165.00.

The net credit would be $2.19 - $1.06, or $1.13, providing a net yield of 0.665% (i.e., $1.13 / $170.00). Moreover, if Chevron appears to be stable, the investor could later sell to close the put option purchase leg to increase the total return.

The bottom line is that, by using options strategies, existing Chevron stock investors can provide some income protection in case the stock is near a peak.

More By This Author:

Microsoft's Free Cash Flow Crashes Due to High Capex - But Is MSFT Stock's Dip Overdone?

Unusual Put Options Activity In Micron Technology After MU Stock Doubles In 2 Months

Raytheon's Strong Free Cash Flow And FCF Margin Could Push RTX Stock Higher

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual ...

more