Unusual Put Options Activity In Micron Technology After MU Stock Doubles In 2 Months

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

by vzphotos vis iStock

Micron Technology, Inc. (MU) stock has more than doubled from its low point a little over two months ago. That could be why there is unusual option activity in out-of-the-money MU puts expiring in just over 3 months.

MU is at $430.28 in midday trading, up another 4.89%. MU stock hit a low of $201.37 on Nov. 20, 2025, so it's now up 114% in just over 2 months. That could explain why there is large put option activity today.

(Click on image to enlarge)

MU stock - last 3 months - Barchart

Investors Expecting Strong Results in 2026

This came after the semiconductor company reported strong fiscal Q1 results on Dec. 17, 2025, including its highest-ever adjusted free cash flow (FCF), according to the company.

Micron said that its revenue for the quarter ending Nov. 27, 2025, was up 20.6% from the prior quarter, driven by strong AI demand. Its adj. FCF rose to $3.9 billion, up from just $803 million in the prior quarter.

More importantly, the CEO said in his prepared remarks that the company expects “substantial new records” in revenue as well as adj. FCF for both fiscal Q2 (ending Feb. 28) and its full FY ending Aug. 31, 2026. Micron is due to release results on March 25.

As a result, analysts have raised their price targets (PTs). But the stock has risen so far that it's now well over the average PT. For example, Yahoo! Finance reports that the average PT from 43 analysts is $356.51.

However, AnaChart's average PT survey from 24 analysts who have written recently about the stock is $433.37.

Historically, analysts have had to revise their price targets on highly volatile stocks like this. That could be one reason for the strong interest in Micron's put options.

Unusual MU Put Options Activity

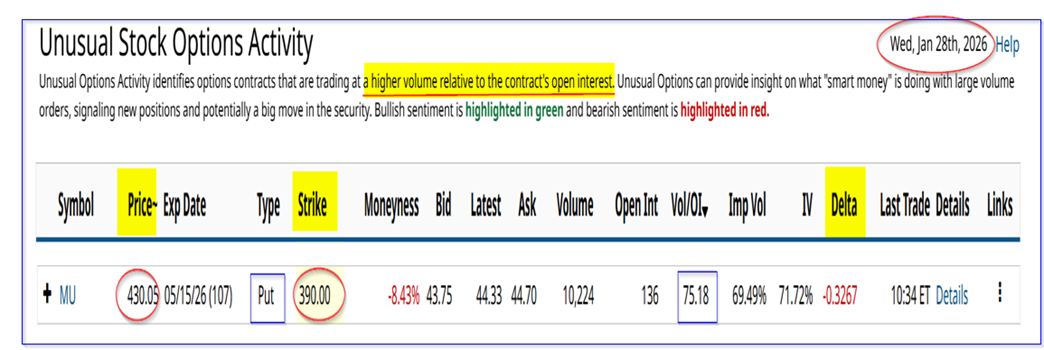

This can be seen in Barchart’s Unusual Stock Options Activity Report today. It shows that over 10,000 put options have traded in the $390.00 strike price expiring May 15, 2026. That is over 75 times the prior number of outstanding contracts for this put contract.

(Click on image to enlarge)

MU puts expiring May 15, 2026 - Barchart Unusual Stock Options Activity Report - Jan. 28, 2026

It shows that the premium for this strike price, which is 9.3% below today’s price, is very high at $44.33.

Short-Sellers of the Puts

That means a short-seller of this put contract can make an immediate yield of 11.367% (i.e., $44.33/$390), over the next 107 days (i.e., 3 and a half months). So, that works out to a monthly-short put yield of 3.248%.

Moreover, this also means that the breakeven point for a short-seller of these puts is $390 - $44.33, or $345.67. That is almost 20% below today's price (-19.67%). So, it provides a good potential entry point for new investors in MU stock, in case it falls after the upcoming results.

Buyers of the Puts

However, put option buyers, on the other side of this put option trade, may be expecting a reversal. After all, the stock has unusually high implied volatility (almost 70%).

The high stock price implies Micron will deliver stellar results. Any hiccup could push MU stock down. That might make it worth buying this put option, despite the high premium.

Moreover, buying these OTM puts could be one way existing shareholders in MU stock can hedge their bets on some of their shares (i.e., an insurance play).

After all, stock analysts have raised their price targets, and MU stock now seems fully valued.

Summary and Conclusion

The bottom line here is that MU stock could be due for a reversal, but the put option premium reflects that possibility. That could be why short-sellers are willing to sell these puts for the income, but buyers also feel justified paying up, as a hedge.

Investors should be very careful here, given the high implied volatility (IV) of this put option and the length (3.5 months) of the expiration date.

More By This Author:

Raytheon's Strong Free Cash Flow And FCF Margin Could Push RTX Stock HigherCostco Stock Has Moved Up Over The Last Month - What Are The Best Plays Now?

Will Diamondback Energy Raise Its Dividend Next Month? If So, FANG Stock Could Rise

Note: The views expressed are solely and strictly my own and not of any current or past employers, colleagues, or affiliated organizations. My writings are simply expressions of my intellectual ...

more