Carnival's Free Cash Flow Rises Y/Y - CCL Stock Could Still Be Over 23% Undervalued

/Carnival%20Corp_%20logo%20on%20ship%20by-%20Ihor%20Koptilin%20via%20Shutterstock.jpg)

Ihor Koptilin via Shutterstock

Carnival Corp (CCL) reported strong free cash flow this morning for its Q3 ending Aug. 31. People love taking cruises more and more, and this can be seen in management's guidance. Based on analysts' higher revenue estimates, it's possible CCL stock could be over 23% undervalued.

CCL stock is trading today at 29.14, down from a recent peak of $31.45 on Sept. 18 and $32.49 on Aug. 28.

But that may not last after analysts adjust their revenue estimates. I estimate that, based on its strong free cash flow, CCL could be worth at least $35.84 per share.

(Click on image to enlarge)

CCL stock - last 3 months - Barchart - Sept. 29, 2025

That's higher than my prior estimate of $34.63, based on its Q2 results. This can be seen in the June 24 Barchart article, “Carnival Corp's Free Cash Flow Surges - CCL Stock Looks Deeply Undervalued.”

Let's see why it could be worth more.

Strong Free Cash Flow (FCF) and FCF Margins

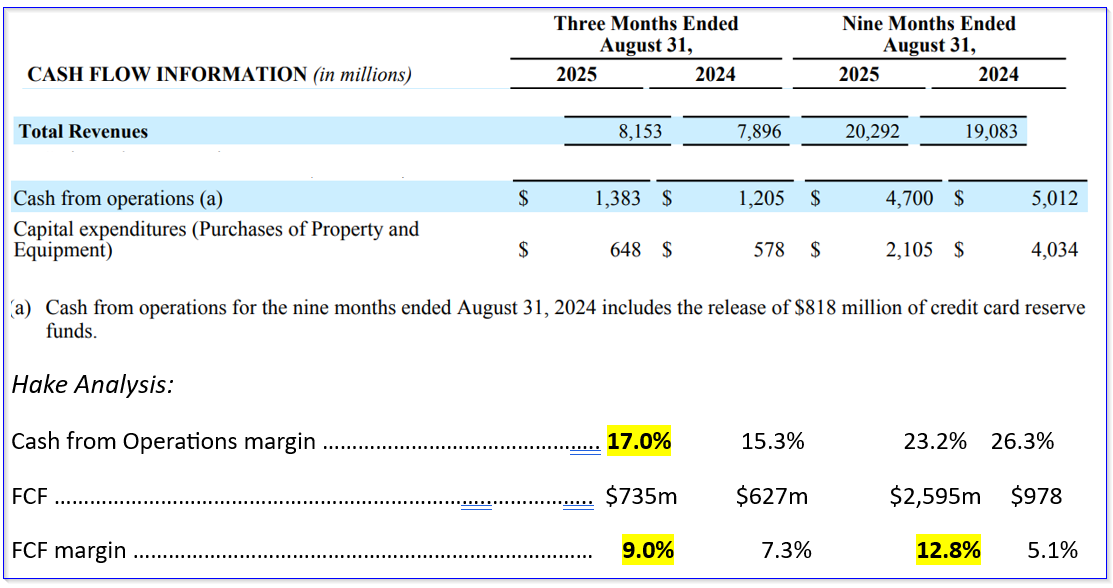

Carnival reported that its revenue increased 3.25% year-over-year (Y/Y) to $8.153 billion and its cash flow from operations rose 14.77% Y/Y to $1.383 billion. Additionally, its 9-month revenue was up +6.34% Y/Y.

However, capital expenditures ("capex") were +12.1% higher in Q2. As a result, FCF margin (i.e., FCF/revenue) was lower than the operating cash flow (OCF) margin. This can be seen below using data from page 10 of Carnival's release:

(Click on image to enlarge)

It shows that the OCF margin was 17% of sales, vs. a lower FCF margin of just 9%, although the latter was higher than last year's 7.3% FCF margin. Nevertheless, for the first 9 months of this fiscal year, the FCF margin was almost 13% (12.8%).

Note that these figures were lower than last quarter, as can be seen in my prior article. The difference could be due to higher bookings set for the summer vacation period during Q2.

However, management has now raised its revenue and yield guidance for the third time. This could lead to higher operating cash flow and OCF margins. Depending on how much the company spends on capex in its fiscal Q4 (ending November 30), FCF margins could be slightly higher.

Capex Spending. For example, management indicates that there is $1.7 billion in new and non-new build capex remaining (i.e., over several years). This is down $600 million from the Q2 guidance of $2.3 billion in total capex remaining. That is equal to the $648 million in capex spending booked during fiscal Q3, which was actually lower than the $850 million capex booked during Q2.

As a result, we can expect that capex will range between $650 million and $850 million per quarter going forward. That will affect our FCF estimates.

Forecasting FCF

Let's assume that its fiscal year and next 12-month (NTM) revenue expectations and FCF margins rise. For example, analysts now expect that FY 2025 revenue will be $26.57 billion. That's up up $26.11 billion as seen in my last article.

We can expect that analysts could raise their FY 25 revenue forecasts to $27 billion. And next year, their forecast could rise to $28 billion, from $27.65 billion today. That brings the NTM forecast to at least $27.75 billion (weighting the FY 26 estimate by 75%).

Moreover, let's assume that the NTM FCF margin will average 14%, up from 13% in its 9-month results. This could be due to flat or lower capex spending, as mentioned above, as revenue rises. As a result, we can forecast FCF:

$27.75 billion revenue x 14% FCF margin = $3.885 billion FCF

That is over 12% higher than a straight-line FCF estimate using its 9-month FCF of $2.595 billion:

$2.595 9-mo FCF / 0.75 = $3.46 billion FCF (straight line est.)

$3.885b / $3.46b = 1.1228 -1 =+12.3% acceleration in FCF

This could lead to at least a 12% higher price target, and even more if the multiple rises.

Price Targets for CCL Stock

One way to value this is to use an FCF yield metric. For example, Carnival's market cap today is $39.368 billion. And using the straight-line FCF estimate of $3.46 billion in FCF, the FCF yield is:

$3.46b FCF / $39.368 b mkt cap = 0.0878 = 8.8% FCF yield

That works out to a FCF multiple of 11.4x (i.e., 1/0.0878 = 11.39). Let's assume that the market will raise the FCF multiple to 12.5x (i.e., an 8.5% FCF yield) with higher NTM FCF:

$3.885 b NTM x 12.5 = $48.56 billion mkt cap

That is +23% higher than today's market valuation of $39.368 billion.

$48.56b NTM mkt cap est. / $39.358b today = 1.2335 = +23.35%

In other words, CCL stock is worth 23% more than today's price of $29.14:

$29.14 x 1.23 = $35.84 price target

Analysts Agree CCL is Still Undervalued

For example, Yahoo! Finance shows that the average of 28 analysts is $34.73 per share, and Barchart's survey shows a mean price of $34.48. In the last 3 months, these analysts have raised their targets from $28.55, and $28.17, respectively, as seen in my last Barchart article.

Similarly, AnaChart, which tracks recent analyst write-ups, shows that the average of 18 analysts is $36.35 per share, up from $30.03 three months ago.

The point is that the analysts are raising their price targets as they see the company's free cash flow and FCF margins continuing to improve.

One way to play this is to sell short out-of-the-money (OTM) puts, to gain income and set a lower buy-in price.

Shorting OTM Puts

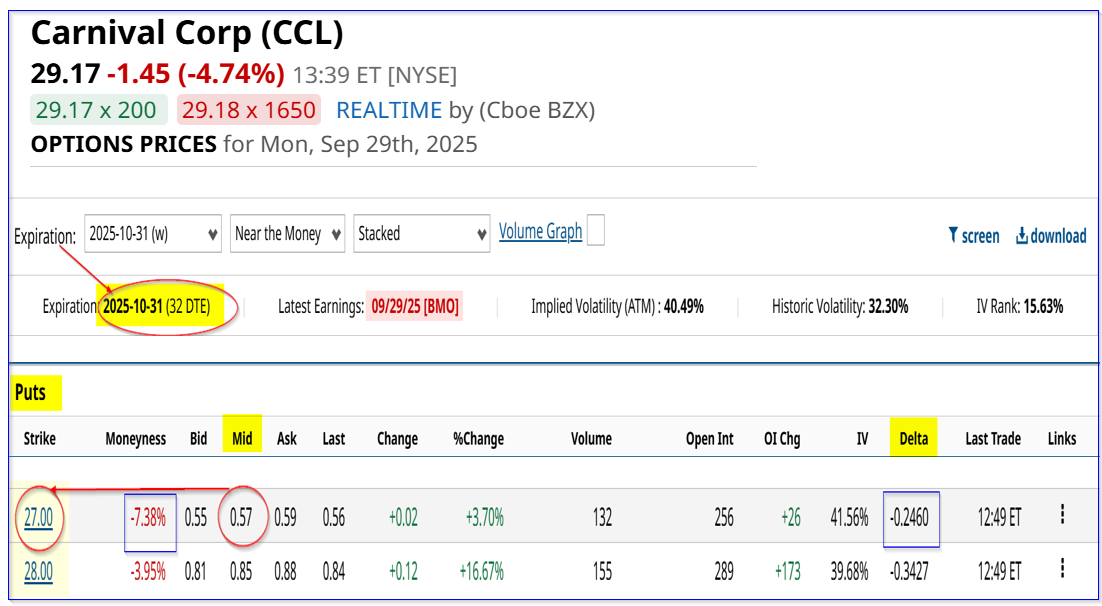

For example, investors can make over a 2.0% one-month yield shorting the 7% out-of-the-money put option expiring Oct. 31. Here's how that works.

The Oct. 31 expiry period shows that the $27.00 strike price put option has a midpoint premium of 57 cents:

$0.57 / $27.00 = 0.0211 = 2.11% put yield for one month.

(Click on image to enlarge)

CCL puts expiring Oct. 31 - Barchart - As of Sept. 29, 2025

An investor who secures $2,700 in cash or buying power with their brokerage firm can enter an order to “Sell to Open” 1 put at $27.00 for expiry on Oct. 31.

The account will then immediately receive $57.00 when the trade fills at the midpoint. That works out to an immediate return on investment or yield of 2.1% (i.e., $57/$2,700).

If CCL falls 7.4% to $27.00, the collateral will be used to buy 100 shares at $27.00. The downside risk is that if CCL falls further, the investor may end up with an unrealized loss.

But, at least, with the income already received, the breakeven point is lower:

$27.00 - $0.57 = $26.43 breakeven point

$26.43 / $29.17 -1 = 9.39% below today's price

That is great downside protection. Moreover, if an investor can repeat this short-put play for 3 months, the expected return (ER) is over +6%:

0.0211 x 3 = 0.633 = +6.33% ER for 3 months

That is the same as holding CCL and seeing it rise to $31.02 per share. In addition, the investor has an increasingly lower breakeven point as well. That is why short put plays are often a great way to set a buy-in point for a stock like this.

More By This Author:

PayPal Could Still Be 20% Too Cheap - Use Options To Play The Stock

Alphabet Stock Off Its Peak - Is It Undervalued? It Could Be If FCF Stays Strong

Intel Stock Soars Along With Unusual Put Options Activity - Is INTC Stock Overvalued?