PayPal Could Still Be 20% Too Cheap - Use Options To Play The Stock

/PayPal%20Holdings%20Inc%20sign%20on%20building-%20by%20Sundry%20Photography%20via%20Shutterstock.jpg)

PayPal Holdings Inc sign on building by Sundry Photography via Shutterstock

PayPal Holdings (PYPL) stock could be worth 20% more than its recent price, based on management's free cash flow (FCF) guidance and an average FCF yield metric. Investors can short out-of-the-money puts and calls, as well as buy long-dated in-the-money calls to play the stock.

PayPal closed at $67.30 on Friday, Sept. 26, but it's well off a recent peak of $78.22 on July 28. However, it could be worth $81.00 per share. This is based on PayPal's own free cash flow guidance in its Q2 earnings release on July 29.

(Click on image to enlarge)

Image Source: Barchart - PayPal stock over the last three months as of Sept. 26, 2025

I previously discussed this in an Aug. 4 article. I had suggested that it was worth $88.35. This article will update that price target. At the time, PayPal was at $67.75, so it has remained flat. But, I also recommended shorting out-of-the-money (OTM) puts for income. That worked out well, and I will update that play.

Price Target for PayPal Based on Free Cash Flow

FCF Margin. Management forecasted on page 14 of its Q2 earnings deck that its 2025 free cash flow will be between $6 and $7 billion. Based on analysts' revenue estimates for 2025 of $33.09 billion, its FCF margin will be about 20%:

- $6.5 billion (midpoint FCF estimate) / $33.09 billion revenue estimate = 0.1964 = 19.64% FCF margin

That compares with 2024's 21.3% FCF margin: (i.e., $6.767 billion FCF / $31.797 billion revenue). Moreover, analysts now project that 2026 revenue could reach $35.06 billion. So, using a 20% FCF margin, FCF could rise by 7.9%:

- $35.06 x 0.20 = $7.012 billion FCF 2026

- $7.012 billion / $6.5 billion = 1.0788-1 = +7.88%

In other words, PayPal's value could rise. Let's see by how much.

FCF Yield

Based on PayPal's trailing 12-month (TTM) FCF of $5.3 billion, and its present market cap of $64.3 billion, its FCF yield is 8.24%:

- $5.3 billion FCF / $64.3 billion market cap = 0.0824 = 8.24% FCF yield

That is equal to a FCF multiple of 12x (i.e., 1/0.0824 =12.13). But, using management's $6.5 billion FCF midpoint guidance, the FCF yield is 10% (i.e., $6.5 billion / $64.3 billion = 0.101). That is equal to a 10x multiple (i.e, 1/0.10 = 10).

So, let's use an average 11x multiple to value PayPal's 2026 estimated FCF:

- $7.012 billion x 11x = $77.13 billion market cap estimate

That is 20% higher than today's market cap of $64.3 billion (i.e., $77.13 billion /$64.3 billion = 1.20). In other words, PayPal stock is worth 20% more than its price today:

- $67.30 x 1.20 = $80.76 per share target price

Analysts Agree

Yahoo! Finance reports that the average price target of 42 analysts on Wall Street is $82.56. That is close to my $80.76 target. In addition, AnaChart.com's survey shows an average of $87.58 from 35 analysts.

Using Options to Play PayPal

Discussed below are various strategies one can use to play PayPal stock.

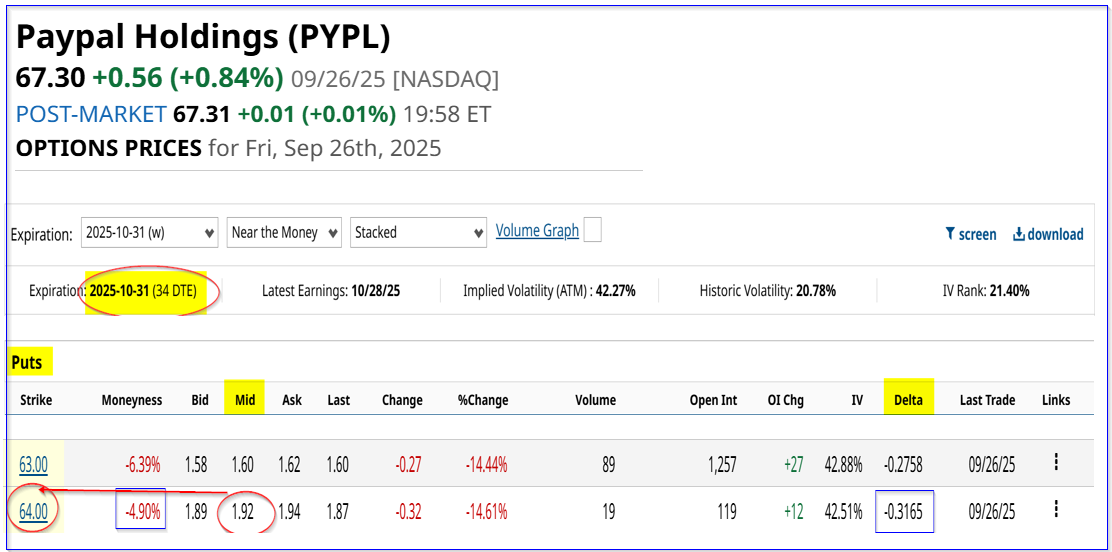

Short OTM Puts

The key here is to short near-term puts that are out-of-the-money (OTM) with a relatively low delta ratio (i.e., chance of getting exercised).

For example, the Oct. 31, 2025 expiry period, which is just over a month away, $64.00 strike price put option contract, 5% below Friday's close, has a $1.92 midpoint premium. That means the short-seller can make an immediate yield of 3.0% for one month:

- $1.92/$64.00 = 0.03 = 3.0% short-put yield

(Click on image to enlarge)

Image Source: Barchart - PayPal puts expiring Oct. 31 as of Sept. 26, 2025

Note that the delta ratio is 31%, which implies a 31% chance PayPal could fall to $64.00 in the next 34 days, based on past trading volatility.

Some investors may want to have less risk. Note that the $63.00 put option is 6.39% out-of-the-money (OTM) and has a lower yield (i.e., $1.60/$63.00 = 0.02539 = 2.539%). However, the delta ratio is lower at 27.58%, implying a lower assignment risk.

Either way, these two puts offer attractive one-month yields, and on average, an investor could make a 2.7695% one-month yield with a 50/50 mix shorting both put contracts. Note that the average 'moneyness' is -5.645% out-of-the-money, and the average delta ratio is about -30% (i.e., -0.2965%).

Assuming this play can be repeated for three months, the expected return (ER) is over 8.30% (i.e., 2.77% x 3), and for six months, it's +16.62%. That is almost equal to just buying and holding PayPal based on my +20% upside price target.

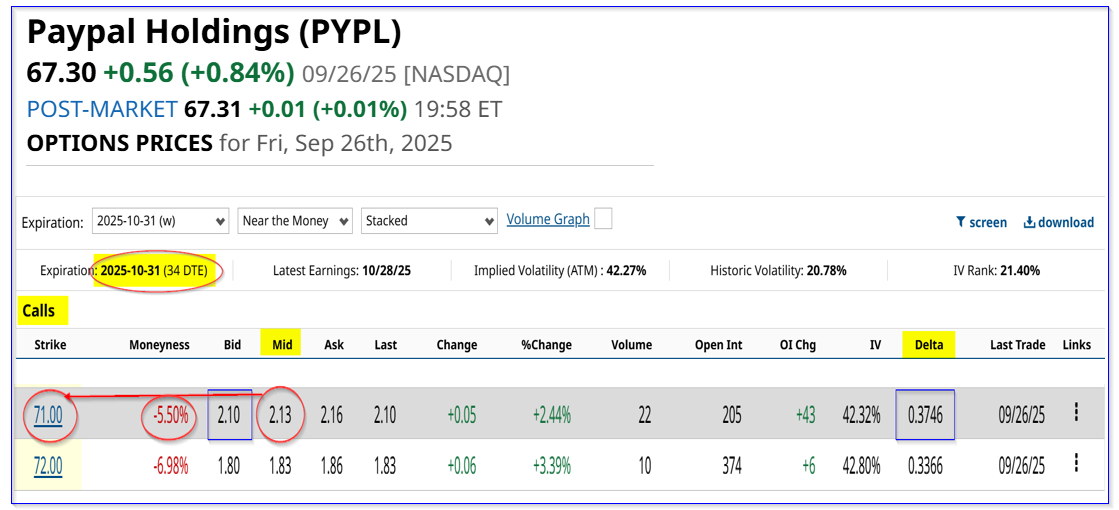

Short OTM Calls

This play is similar to the short put play, but the yield is slightly higher. For example, the Oct. 31, 2025 $71.00 call option contract has a midpoint premium of $2.13.

(Click on image to enlarge)

Image Source: Barchart - PayPal calls expiring Oct. 31 as of Sept. 26, 2025

That strike price is 5.50% over Friday's close (similar to the 5.65% OTM 50/50 mix short-put mix above). But the yield is higher, assuming a covered call play is used:

- $2.13 premium received / $67.30 trading price = 0.03165 = 3.165% one-month yield

However, note that the delta ratio is much higher as well - i.e., 37.46%. As a result, to take on less risk, the $72.00 short-call play yields 2.72% (i.e., $1.83/$67.30), but its delta ratio is only 34%.

This yield will be even higher if, instead of buying 100 shares as collateral for this covered call play, the investor buys an in-the-money call (ITM) option. This is known as a “poor man's covered call.”

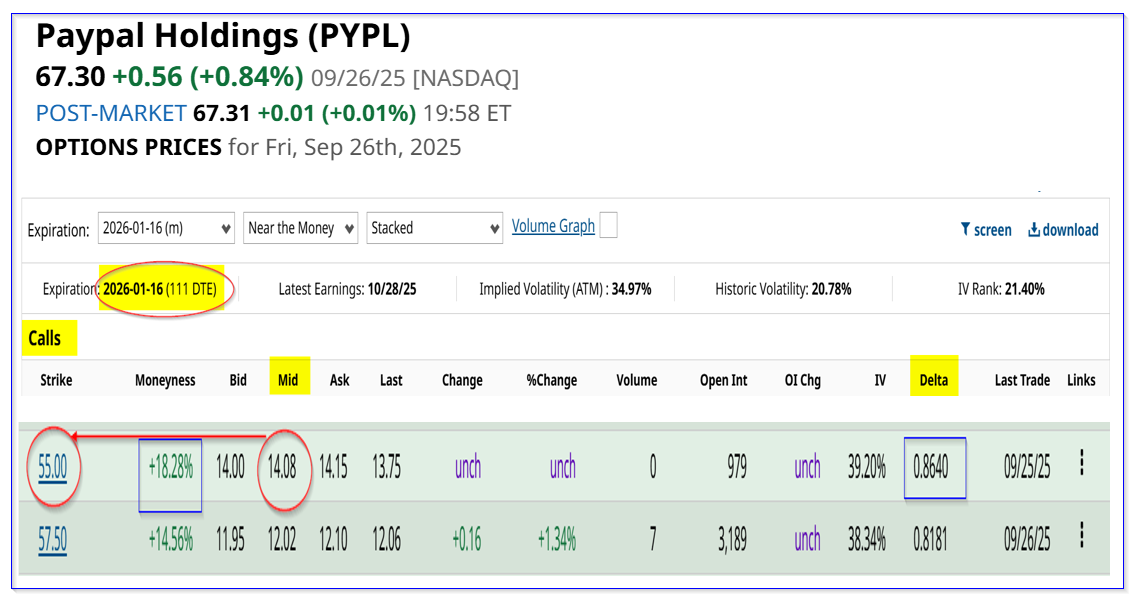

Buy ITM Calls

The trick here is to buy an ITM call for a longer date out in expiration. That way, it mimics the value of owning the equity, except for a much lower price and less cash outlay. That also enhances the yield for this poor man's covered call.

For example, the Jan. 16, 2026 call option period shows that the $55.00 call option has a midpoint premium of $14.08. That is significantly cheaper to implement, and thus it fits a “poor man's” budget.

(Click on image to enlarge)

Image Source: Barchart - PayPal calls expiring Jan. 16, 2026 as of Sept. 26, 2025

In other words, instead of having to pay $6,730 to buy 100 shares as collateral for the covered call play, an investor only has to shell out $1,408 (representing 100 shares from 1 call contract).

That means that the yield is now very high. For example, the investor doing a $72.00 one-month short-call makes the following:

- $183/$1,408 = 13.0% one-month yield

This assumes that PayPal does not rise over $72.00 in one month, i.e., up 7% from Friday's price of $67.30. If it does, the investor will need to roll this short-call over to a later period and/or higher strike price to avoid getting assigned.

And if the investor can repeat this strategy for three months, the expected return is 39% (i.e., 13% x 3).

The bottom line is that PayPal stock is around 20% undervalued here. Investors can take advantage of this by shorting out-of-the-money puts and calls in one-month expiry periods, as well as buying in-the-money long-dated calls.

More By This Author:

Alphabet Stock Off Its Peak - Is It Undervalued? It Could Be If FCF Stays StrongIntel Stock Soars Along With Unusual Put Options Activity - Is INTC Stock Overvalued?

Palantir Stock Could Still Be 20% Undervalued As Analysts Raise Their Forecasts

Investors can study Barchart's Options Education webinars to study how this works and the downside ...

more