Intel Stock Soars Along With Unusual Put Options Activity - Is INTC Stock Overvalued?

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

by jejim via Shutterstock

Intel Corp. (INTC) stock has moved significantly higher on recent news that Nvidia is investing $5 billion in the company. But is INTC stock now overvalued? The heavy put option activity in INTC stock today may imply this.

INTC is trading at $30.61 on Wednesday, Sept. 24. That's up +21.6% from $24.90 on Sept. 17.

(Click on image to enlarge)

INTC stock - last 3 months - Barchart - Sept. 24, 2025

This is likely the result of Nvidia's announcement on Sept. 18 that it will invest $5 billion in INTC stock at $23.28. The company will use the funds to “…jointly develop multiple generations of custom data center and PC products…”

Why Intel May Need Further Investments

The market may be seeing this as a lifeline for Intel. It may imply that Nvidia would continue to invest in INTC if needed, although that was not in the press release.

After all, Intel has had a lousy few quarters. Last quarter it generated -$1.5 billion in free cash flow (FCF). That means its cash balance is declining after all operations, or its debt balance is increasing.

And before that, its FCF has been negative for 6 more quarters. In the last 7 quarters, Intel has had a cash outflow of $23.6 billion since Q3 2023. This can be seen from the Cash Flow tab at Stock Analysis.

In the last year alone, it has generated negative $10.9 billion in free cash flow, according to Stock Analysis.

So, until Intel starts generating positive cash flow, it may need to continue to raise cash. It has just $21.2 billion in cash and investments on its balance sheet, but $46 billion in short-term and long-term debt.

In other words, with only $21 billion in cash, and an outflow of $11 billion, it has less than 2 years of cash left, without raising more debt.

That's why Nvidia's investment may be seen as a lifeline.

However, some may see this as a potential downside for Intel, especially if more funds have to be raised until it becomes FCF positive. That could be why the an impetus for today's huge volume of put options activity.

Unusual Put Options Activity in INTC

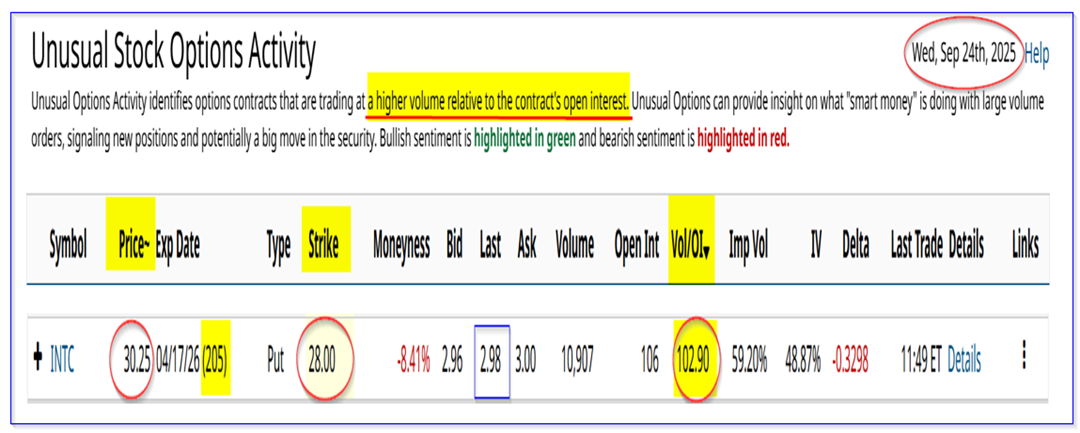

This can be seen in Barchart's report today on Unusual Stock Options Activity. It shows large out-of-the-money (OTM) put options trading in INTC stock.

There have been over 10,900 put option contracts expiring 205 days from now on April 17, 2026, traded at the $28.00 exercise price. That is $2.61 below today's price of $30.61.

(Click on image to enlarge)

INTC puts expiring Apri 17, 2026 - Barchart Unusual Stock Options Activity Report - Sept. 24, 2025

In other words, this strike price is 8.5% below the trading price, i.e., out-of-the-money (OTM). (It's OTM since the put option has no value until the trading price falls below the strike price).

Why Investors Are Playing This Put Option

The premium paid on average is $2.98 for these puts. As a result, institutional investors buying these puts are taking a long-term view that INTC stock will fall by over 18% in the next 6.8 months:

$28.00-$2.98 = $25.02 breakeven for put buyers

Breakeven downside = ($25.02 / $30.61) -1 = 0.817 - 1 = -18.3%

These put buyers likely expect that Intel can't begin generating positive free cash flow over the next 2 quarters. They expect Intel will have to raise more debt or equity. That could push INTC lower.

On the other hand, short-sellers of these puts are making a good yield:

$2.98 / $28.00 = 0.1064 = 10.64% over 6.8 months

That works out to a monthly yield of 1.565% / month (i.e., $0.1064/6.8). That's not a bad income return.

Moreover, even if INTC falls to $28.00, their only obligation is to buy INTC shares at that price. As a result, their breakeven is just $25.02 per share.

Unless INTC falls significantly below $25, they won't have an unrealized loss. However, there is a good risk that this will happen. For example, the delta ratio is about 33% that the stock will fall to $28.00.

Moreover, these short-sellers may not lose 100% of their investment (i.e., INTC won't likely fall to zero), whereas the put buyer has a much higher chance of this.

The bottom line is that there are good arguments to both buy these puts and short them.

I don't like to buy shares in companies that have negative free cash flow (FCF). I suspect that the put option buyers may eventually make money on their investment.

That doesn't necessarily mean that the INTC will fall to below $28.00. It just means that the put price may eventually rise over the next 6 months, especially if Intel keeps generating negative free cash flow.

Be careful in evaluating the downside risks if you intend to copy this trade.

More By This Author:

Palantir Stock Could Still Be 20% Undervalued As Analysts Raise Their ForecastsNvidia Stock Is Slowly Moving Higher - Short Put Plays Could Work Here

Analysts Push Cisco's Target Price Higher - Shorting CSCO Puts Works Here