Black Swan Protection For Tesla

Astronauts onboard the SpaceX Dragon capsule approach the International Space Station on May 31st (photo via SpaceX).

Tesla Shares Continue Rocket Higher

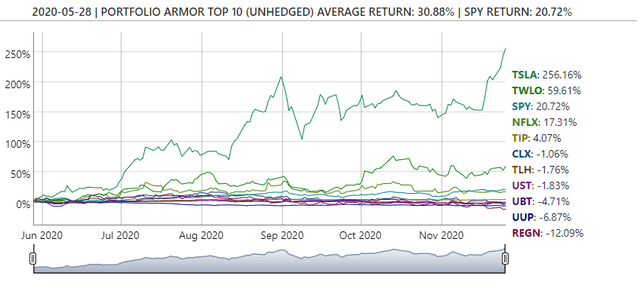

At the end of May, Elon Musk's SpaceX sent two astronauts into space - the first manned launch from U.S. soil in nine years. Also at the end of May, Tesla (TSLA) made our list of top ten names. The stock was up 256% over the next six months.

(Click on image to enlarge)

And it was up about another 25% since the end of November, as of Monday's close.

(Click on image to enlarge)

Still Bullish...

Our system is still bullish on Tesla. According to its analysis of total returns and options market sentiment, Tesla was our #2 ranked name on Monday, in terms of its potential return over the next six months. It was the only name from the May 28th top names cohort to appear in the January 4th cohort.

...But David Mastran Makes Good Points

But in his January 1st post ("Potential Black Swan Event"), New Paradigm FundPresident David B. Mastran warned that a rise in interest rates could be a black swan causing Tesla to follow Qualcomm's (QCOM) trajectory from 1999:

The story of Qualcomm in 1999 is representative of what we are seeing today. QCOM went from $3 to $100 during that year. The company was the preeminent semiconductor firm supplying integrated circuits for cell phones. At its brief peak, the stock was worth $150 billion. It was trading at a p/e of over 300 and at 38X revenues. The story for QCOM was very exciting. They had 90% of the market and were expected to maintain most of that going forward, given all the patents they held.

Cell phones were going to be big! There were going to be “smart phones” able to take pictures and even videos. Cell phones would allow us to “surf the internet.” And someday, when storage caught up, we would even be able to watch movies on our phones. All these predictions seemed akin to flying cars at the time. But the funny thing is that all the predictions that sent QCOM up turned out to be true! And if anything, the predictions were understated. QCOM has owned the integrated circuit market for cell phones for 20+ years. Cell phones are wildly more successful than anyone imagined.

So the analysts got the fundamentals right. But they got the stock price wrong.

Business Success, Stock Sorrow

Mastran goes on to note that Qualcomm dropped from $100 per share at the end of 1999 to $12 per share in 2002 and that Qualcomm shares didn't reach $100 again until last summer. The point Mastran makes here is an excellent one: you can get the investment thesis right, and still lose money on the investment if its valuation has already priced in its rosy future. He suggests this may be the case with Tesla too:

The poster child of today’s technology bull market is Tesla. The market is giving credit to TSLA for not only having their electric vehicles dominate the world, but also their autonomous driving technology, and their battery technology. The key difference between TSLA and QCOM is that TSLA doesn’t have a lock on patents like QCOM did. In fact, Tesla has shared their patents with the world.

Even if Tesla does dominate the electric vehicle market and changes the way the world stores energy, the stock could drop and stay below current prices for 20 years.

We're not convinced Tesla will share Qualcomm's fate, but another good point Mastran makes is undeniable: Tesla has had sharp, short-term pullbacks in the past, including its 63% drop during the COVID crash early last year.

Our Approach To Tesla

We have no idea what Tesla's share price will be in twenty years; we find it easier to look at the future in six-month tranches. Over the next six months, our system estimates Tesla will post a strong return, but we are mindful of the possibility of another sharp pullback. So our approach is to buy and hedge it. Below are a couple of ways Tesla shareholders can do so now. For these examples, we'll assume you have 100 shares of Tesla and are willing to risk a drawdown of up to 25%, but not one larger than that.

Uncapped Upside, Positive Cost

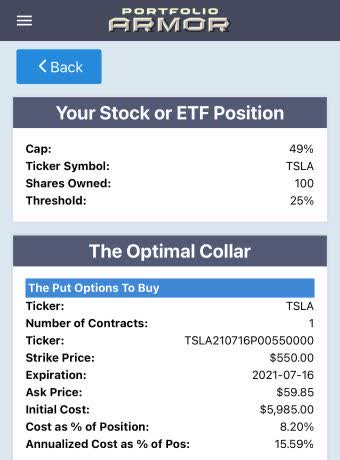

This was the optimal put option contract to hedge 100 shares of Tesla against a >25% drop by mid-July.

This and subsequent screen captures via the Portfolio Armor iOS app.

Here, the cost was $10,960, or 15.02% of position value, calculated conservatively, using the ask price of the puts. In practice, you can often buy and sell options at some price between the bid and ask.

Capped Upside, Negative Cost

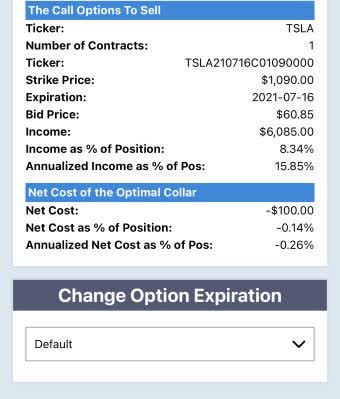

If you were willing to cap your upside at 49% over the same time frame, this was the optimal collar to hedge your Tesla shares against the same, >25% decline.

Here the cost was negative, meaning you would have collected a net credit of $100, or 0.14% of position value, assuming, to be conservative, that you placed both trades at the worst ends of their respective spreads (i.e., buying the calls at the ask and selling the calls at the bid).

If There's A Tesla Crash Before July

If Tesla crashes before these hedges expire, you'll have a few courses of action available to you that you wouldn't have if you weren't hedged:

- You could exit your position a loss of no more than 25%.

- You could buy-to-close the call leg of your collar at a low price to remove your upside cap.

- If you're confident the stock will bounce back, you can sell your appreciated put options and use the proceeds to buy more shares.

In addition to lowering your risk, hedging with options in this way gives you options.

Interesting article. My perception is that Tesla's rise is a testimony to Elon Musk's salesmanship skills. There are folks who are that good, and a few of them may also be honest, I suppose. One thing that is certainly going to smash the bubble flat will be the actual roll-out of computer driven cars, when the reality of "buggy" computer code raises it's very ugly head. The fact is that there certainly will need to be frequent "updates", and that they will be serious safety issues on the level with brake system recalls in importance.

The fact is that the adequate verification of the driving software would be so expensive and time consuming that it will never happen,.That will be the show-stopper.

Good points, William.

Tesla has been on fire lately, but more than it deserves.

I'm sure his salesmanship is part of it. Kind of like Steve Jobs was with Apple.

Exactly right!