AMC Goes Parabolic

Moviegoers at an AMC theater waiting for a showing of the last Fast & Furious movie (photo via author).

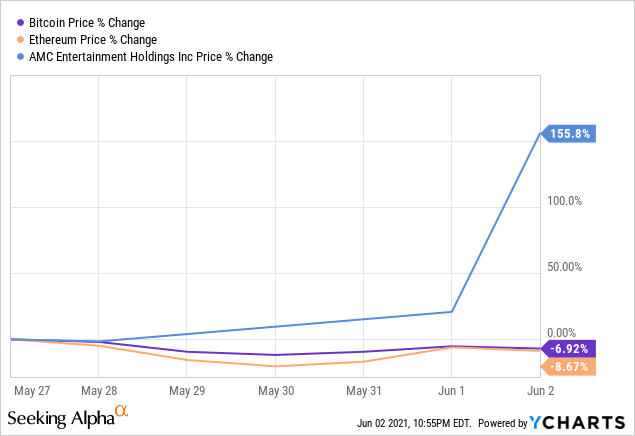

Crypto Crabs While AMC Skyrockets

A point we made last week (AMC: Return Of The Meme Stock), was that the insane rally in crypto this year siphoned some of the speculative fervor from meme stocks, so a sideways market in crypto benefits those stocks. Since we wrote that, the largest cryptocurrencies have continued to cooperate as AMC Entertainment Holdings (AMC) has rocketed higher.

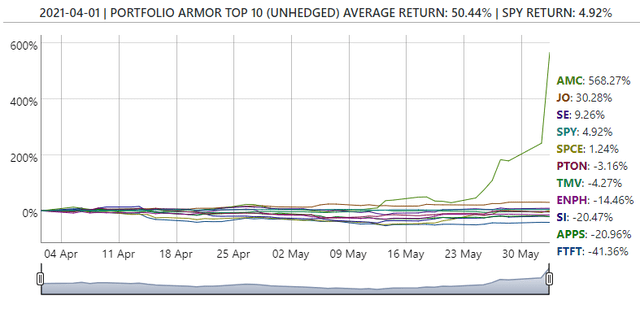

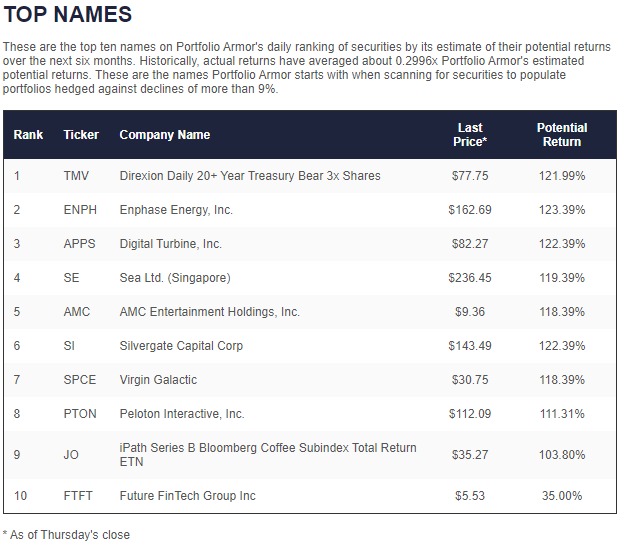

A Top Name From Last Month

As we mentioned last week, AMC was one of our top ten names on April 1st.

Screen capture via Portfolio Armor on 4/1/2021.

Since then, it was up a ludicrous 568% as of Wednesday's close.

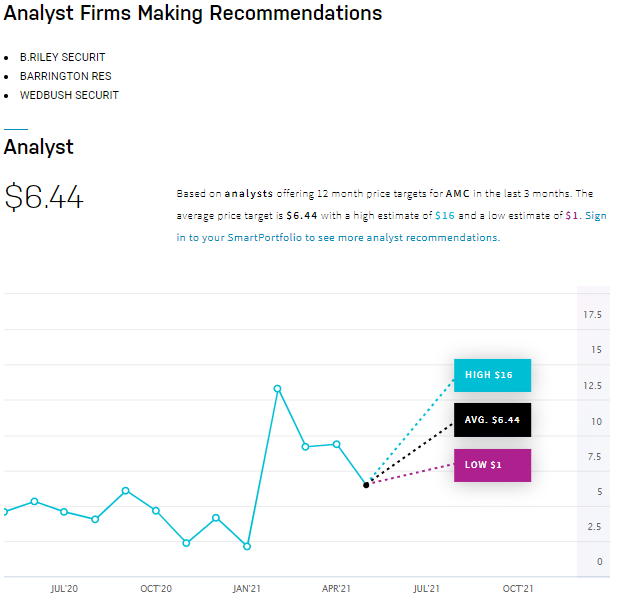

Analyst Bullish On AMC (But Not This Bullish)

At about 6 minutes into Tuesday's episode of Bloomberg's What'd You, Miss, Macquarie analyst Chad Beynon offers a few reasons to be bullish about AMC's business:

- Good numbers from Memorial Day Weekend

- A rise in concession sales industry-wide

- Fears of the decline of industry overstated.

- AMC leveraging the enthusiasm of shareholders with announced special screenings, discounts on popcorn, etc.

- The prospect of raising more equity to retire debt or buy competitors.

Would be nice if they invested in a fleet of Roombas to clean up the popcorn on the carpets in our view. In any case, despite those positives he cited, Beynon mentioned a $6 price target. That's in line with the price targets Nasdaq shows from three other shops.

Screen capture via Nasdaq.

Safety First

We continue to suggest AMC longs who haven't hedged consider doing so. You can refer to this video for the general approach, though obviously, you'll need updated hedges given the stock's run over the last week.

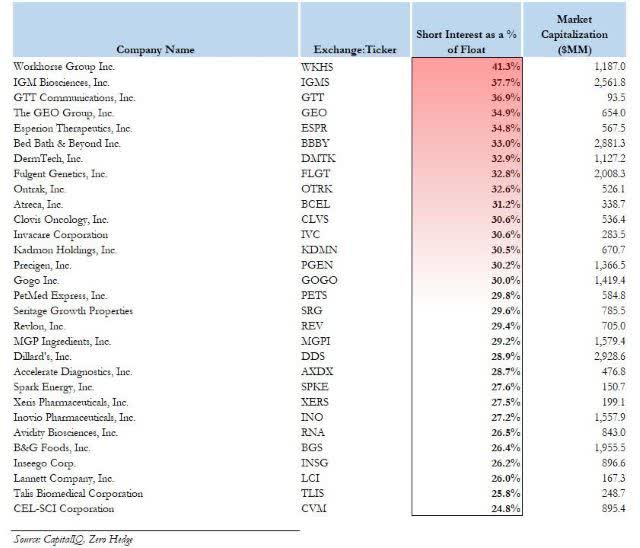

Looking For The Next Short Squeeze Candidate

On Wednesday, ZeroHedge posted this list of the most shorted stocks.

Screen capture via ZeroHedge.

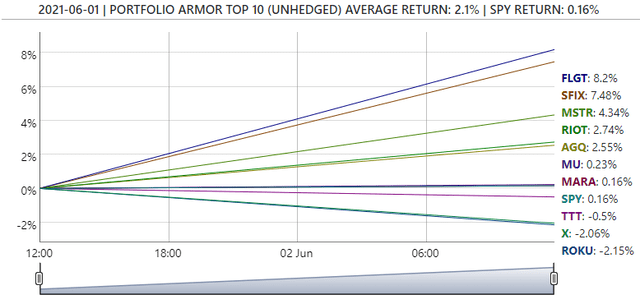

One of those names, Fulgent Genetics, Inc. (FLGT), was one of our site's top names on Tuesday. It's the top performer from Tuesday's top names cohort so far.

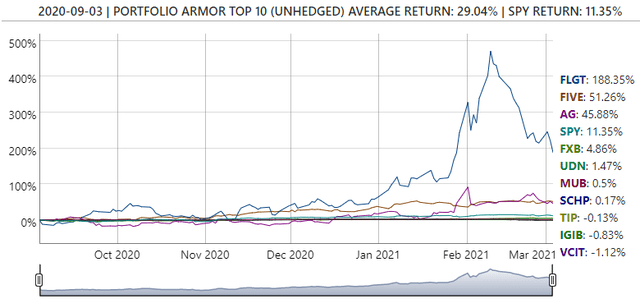

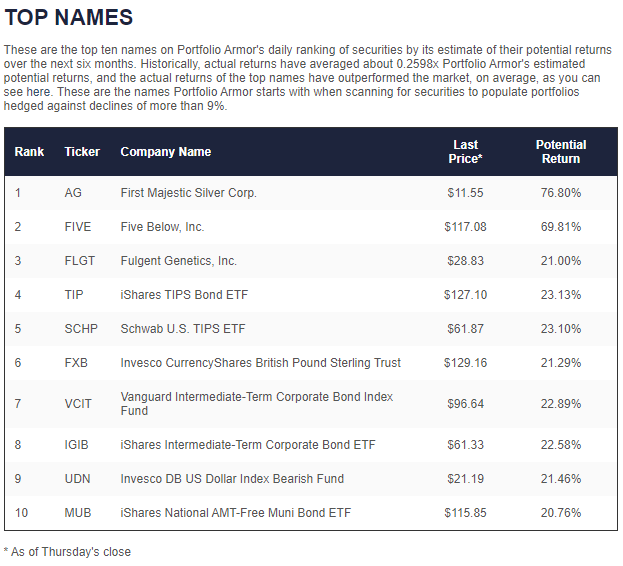

It's not the first time Fulgent has been one of our top names. It was also a top name last September.

Screen capture via Portfolio Armor as of 9/3/2020.

It nearly tripled over the next six months, though it had briefly spiked even higher in early February.

So it might be worth keeping an eye on Fulgent. If you do buy it, consider hedging it. As the chart above suggests, it's been pretty volatile.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more