A Forgettable Week For Alzheimer's Treatment Stocks

Screen capture via Cassava Sciences' video for their Simufilam Alzheimer's disease treatment.

Two Alzheimer's Names Come Back To Earth

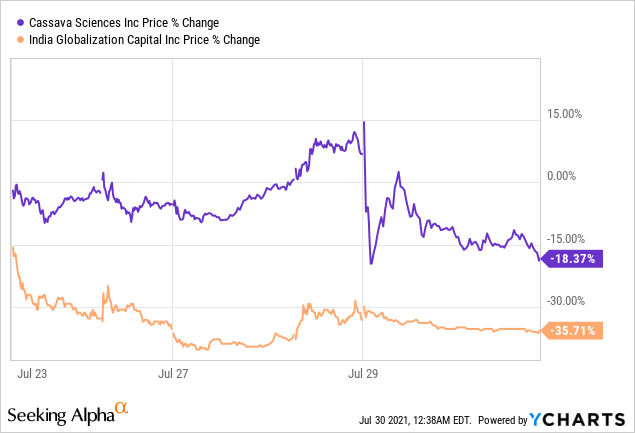

In a post last week (An Unforgettable Week For Alzheimer's Treatment Stocks), we mentioned that two stocks with Alzheimer's disease treatments hit our top names, but both were risky:

With six million Americans suffering from Alzheimer's disease, their loved ones are desperate for effective treatments. Two of our recent top names, India Globalization Capital, Inc. (IGC) and Cassava Sciences, Inc. (SAVA) spiked on news related to their proposed Alzheimer's treatments. Both are risky stocks, so we'll look ways investors can hold them while limiting their risk below.

Since then, both stocks are still above where they were when they first hit our top names, but both are down double digits over the last week.

This is why we suggest hedging. Let's look at how hedging ameliorated these drops in both of these stocks.

Cassava Sciences

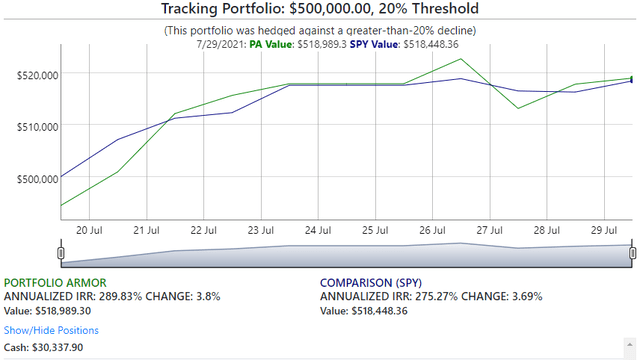

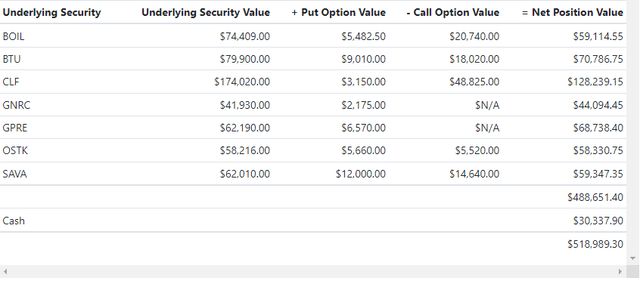

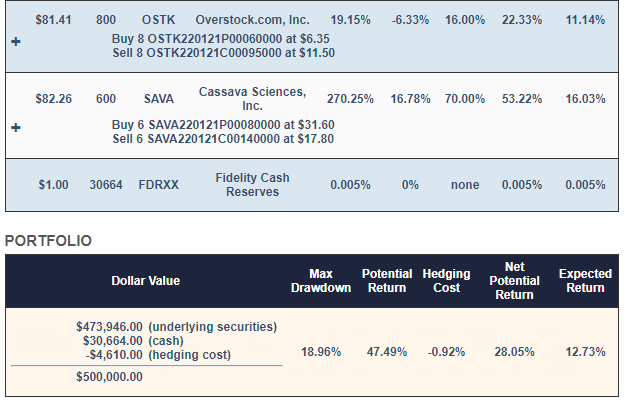

Cassava Sciences was one of seven names in the concentrated portfolio we presented in our premarket post early last week, Building A Bear-Proof Portfolio.

Screen captures via Portfolio Armor as of July 19th's close.

Here's how that portfolio has done since.

Steady as she goes for this hedged portfolio, despite SAVA dropping nearly 24% on Thursday. The hedges smoothed things out.

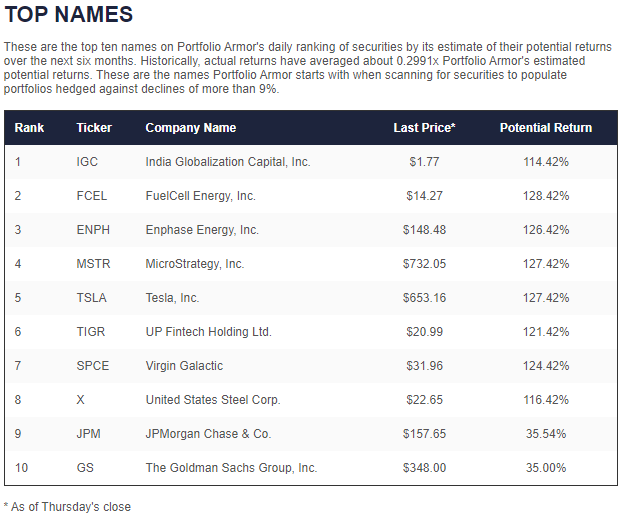

India Globalization Capital

This was our number one name on March 18th.

Screen capture via Portfolio Armor on 3/18/2021.

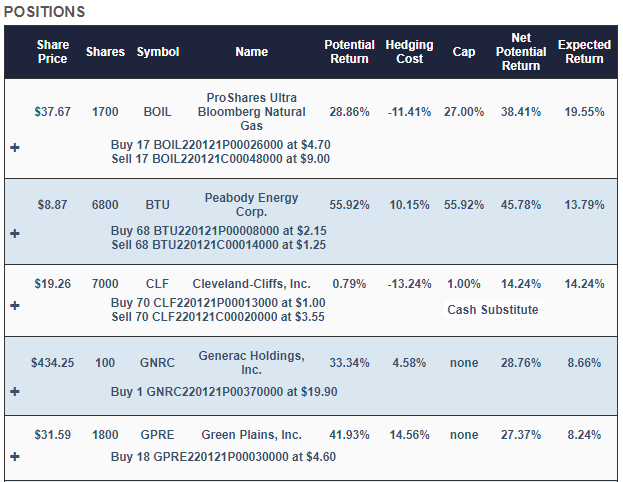

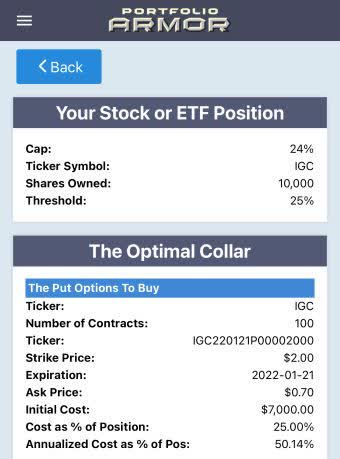

Last week, we presented this hedge for it.

Screen captures via the Portfolio Armor iPhone app on July 19th.

Since then, IGC is down 36%, unhedged. How much would you be down if you were hedged with the collar above? Let's work it out:

What you started with

10,000 shares of IGC at $2.80 for $28,000

+ $7,000 in IGC puts

- $9,000 in IGC calls (i.e., you would have had to pay that much to buy-to-close the short call leg of the collar).

= $26,000

What you had as of Thursday's close

10,000 shares of IGC at $1.80 for $18,000

+ $7,750 in IGC puts (using the midpoint of the bid-ask at Thursday's close).

- $3,750 in IGC calls (using the midpoint of the spread again)

= $22,000

The bottom line

The stock dropped from $28,000 to $18,000, a drop of about 36%, but your hedged position dropped from $28,000 to $22,000, a drop of about 21%. Remember, the hedge was designed to protect against a >25% decline, so this is more protection than promised.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more