An Unforgettable Week For Alzheimer's Treatment Stocks

Screen capture via IGC's healthcare subsidiary Hyalolex. "Drops of Clarity" is their just-patented Alzheimer's treatment.

Two Stocks Spike On Alzheimer's News

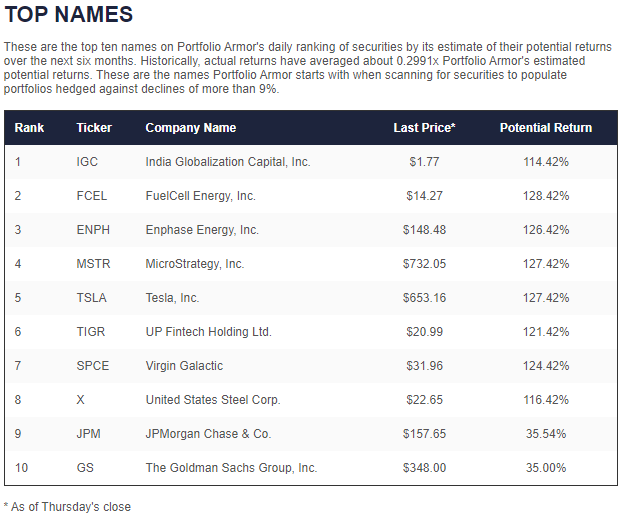

With six million Americans suffering from Alzheimer's disease, their loved ones are desperate for effective treatments. Two of our recent top names, India Globalization Capital, Inc. (IGC) and Cassava Sciences, Inc. (SAVA) spiked on news related to their proposed Alzheimer's treatments. Both are risky stocks, so we'll look at ways investors can hold them while limiting their risk below. Let's look at Cassava Sciences first.

Cassava Sciences

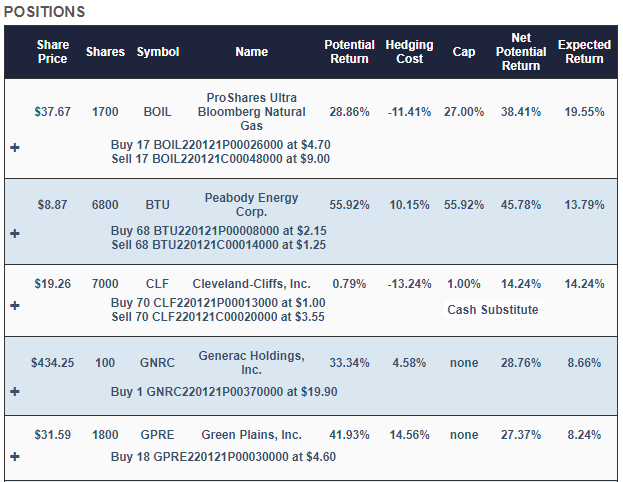

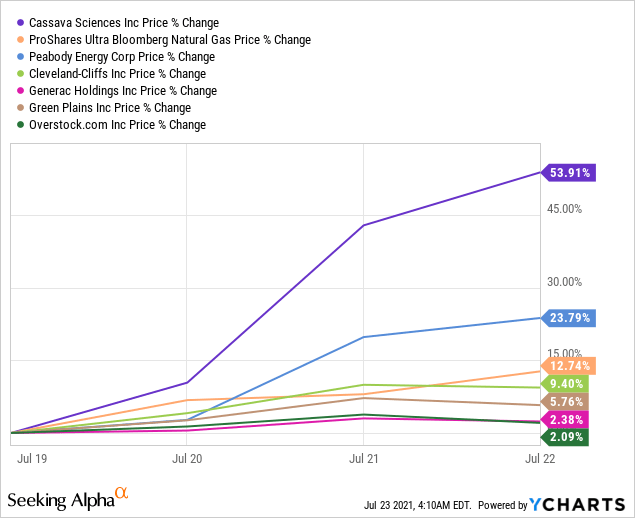

The spike in Cassava Sciences this week suggests some of the desperation surrounding Alzheimer's. Its stock spiked on news that it would share data on its Alzheimer's drug candidate Simufilam at the Alzheimer's Association International Conference next week. Readers may recall Cassava Sciences was one of seven names in the concentrated portfolio we presented in our premarket post on Tuesday, Building A Bear-Proof Portfolio. We also mentioned it at the end of our previous post, A Glide Path To South Africa.

Screen captures via Portfolio Armor as of Monday's close.

Since then, SAVA was up nearly 54%, as of Thursday's close.

Adding Downside Protection To SAVA

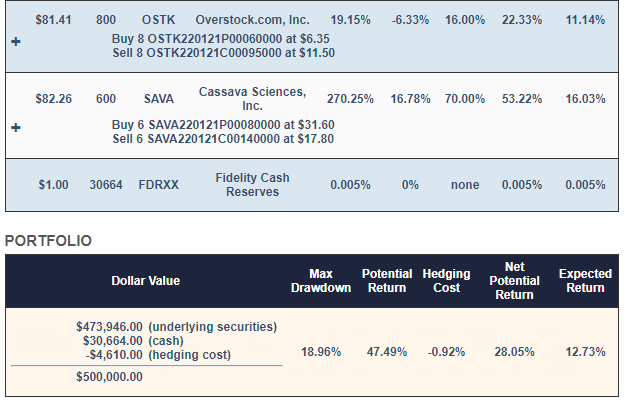

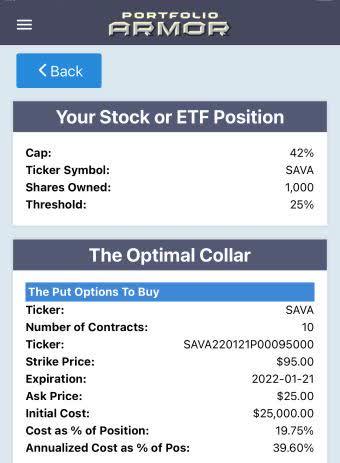

SAVA was too expensive to hedge against a greater-than-25% decline with optimal puts on Thursday: the cost of those puts would have been more than 25% of your position value, so it wouldn't have been optimal to buy them. It was possible to cost-effectively hedge the stock with an optimal collar though.

As of Thursday's close, this was the optimal collar to hedge 1,000 shares of SAVA against a >25% decline by January 21st while not capping your possible upside at less than 42% over the same time frame.

Screen captures via the Portfolio Armor iPhone app.

Here, the net cost was negative, meaning you would have collected a net credit of $600 when opening the hedge, assuming, to be conservative, that you bought the puts at the ask and sold the calls at the bid. More likely, you would have been able to place both trades within their respective spreads, and you would have collected more than $600 when opening the hedge.

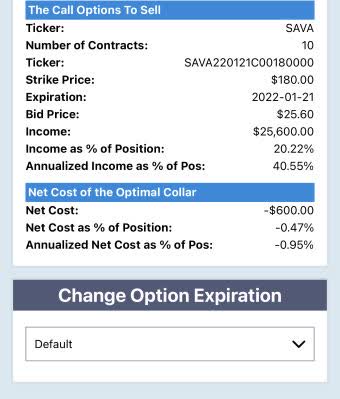

India Globalization Capital

India Globalization Capital was our number one stock on March 18th.

Screen capture via Portfolio Armor on 3/18/2021.

IGC closed up 89% on Thursday after it announced it had been awarded U.S. patent #11,065,225 for the treatment of Alzheimer’s disease (“Ultra-Low dose THC as a potential therapeutic and prophylactic agent for Alzheimer’s Disease.”). THC, the principal psychoactive component of cannabis, is one of three ingredients in IGC's "Drops of Clarity" Alzheimer's treatment.

Image via IGC.

Whether this treatment will work well enough to justify the stock price gain remains to be seen. In the event that it doesn't, we'll look at a way of hedging IGC below.

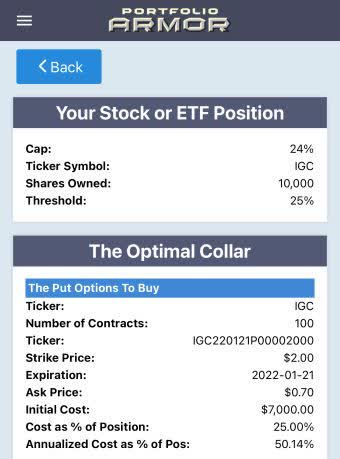

Adding Downside Protection To IGC

Like SAVA, IGC was too expensive to hedge against >25% declines with optimal puts but was hedgeable with an optimal collar.

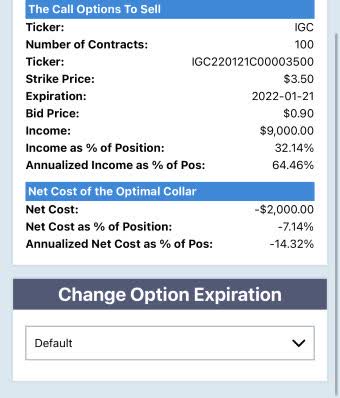

This was the optimal collar, as of Thursday's close, to hedge 10,000 shares of IGC against a >25% drop by January 21st while not capping your possible upside at less than 24%.

The net cost was negative here, meaning you would have collected a net credit of $2,000 when opening this hedge, assuming, conservatively again, that you placed both trades at the worst ends of their respective spreads. We can infer from the lower cap we had to use to cost-effectively collar IGC that it is likely even riskier than SAVA.

Disclaimer: The Portfolio Armor system is a potentially useful tool but like all tools, it is not designed to replace the services of a licensed financial advisor or your own independent ...

more