No, The Eurozone Doesn’t Have A Similar Inflation Problem

The US is currently experiencing 9.1% CPI inflation, while the eurozone has 8.6% inflation. That sounds pretty similar, doesn’t it?

In fact, inflation in the eurozone is much different from inflation in the US. In the US, we have both stagflation and boomflation. The eurozone has mostly stagflation, as their NGDP growth rate since 2019 has not been particularly high (2.67%/year since 2019:Q4).

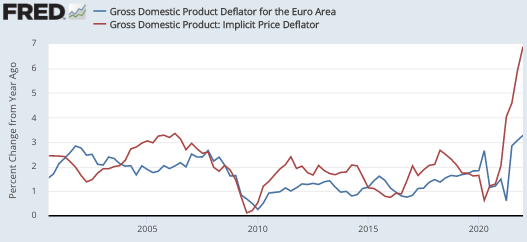

You can see the difference by looking at inflation as measured by the GDP deflator:

In the US, the inflation rate for final goods is 6.9%, whereas in the eurozone it is only 3.3%. Europe’s 8.6% consumer inflation is mostly imported goods.

Which inflation problem is worse? It depends on what you mean by “worse”.

The eurozone is suffering more in terms of current living standards, as nominal income growth in the eurozone is far lower than in the US.

In terms of bad monetary policy and future macroeconomic instability, the US has a much worse inflation problem.

More By This Author:

Trade Freely And Carry A Big StickStagflation And Boomflation

Why Do Macroeconomists Keep Changing Their Model?