Market Briefing For Tuesday, March 8

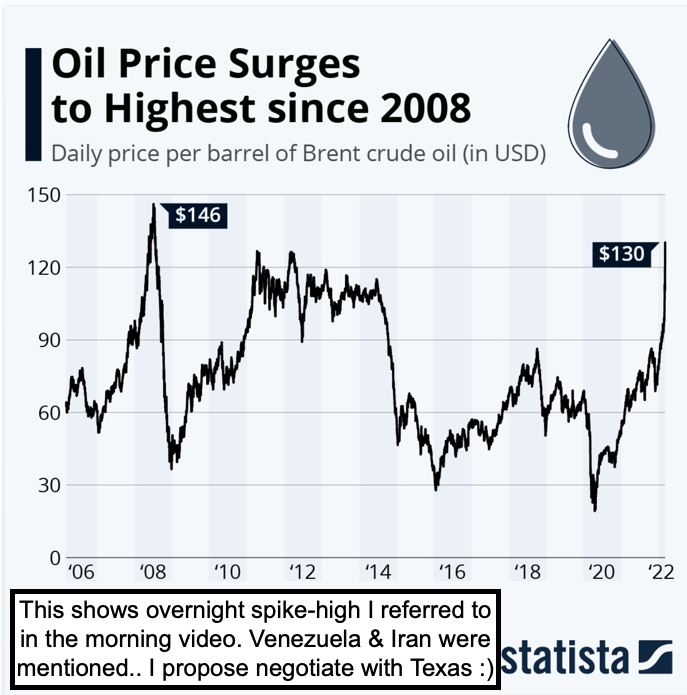

Perceived slip-sliding of Russian negotiating terms, along with Germany's reticence to block oil purchases from the Putin-dynasty, reversed Oil's drama overnight, and also minimized actions at the start of New York's trading day.

However by the time trading began, it was clear Russia remained intransigent with the terms just nonsense that nobody would agree to. (Including neutrality by Ukraine with a commitment not to join NATO 'or' the EU, having refugees get a safe corridor passage out, but only if they migrate to Russia or Belarus, and other details which are unacceptable, hence just wasting negotiator time).

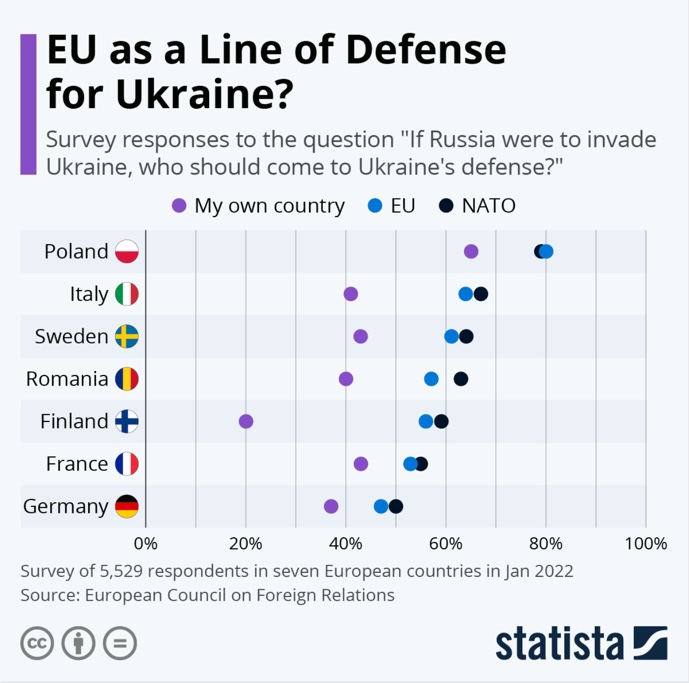

At this point it's all about the war, and not the Fed. The Fed rate hikes coming can worsen the situation, or have little impact. But the war can modify growth patterns 'globally' for more than the next year or two, and that matters deeply to markets. A lot of multinational companies had overpriced valuations to start this year with, and now they have lower business prospects regardless of the interest rates / monetary policies. That makes growth issues rather critical.

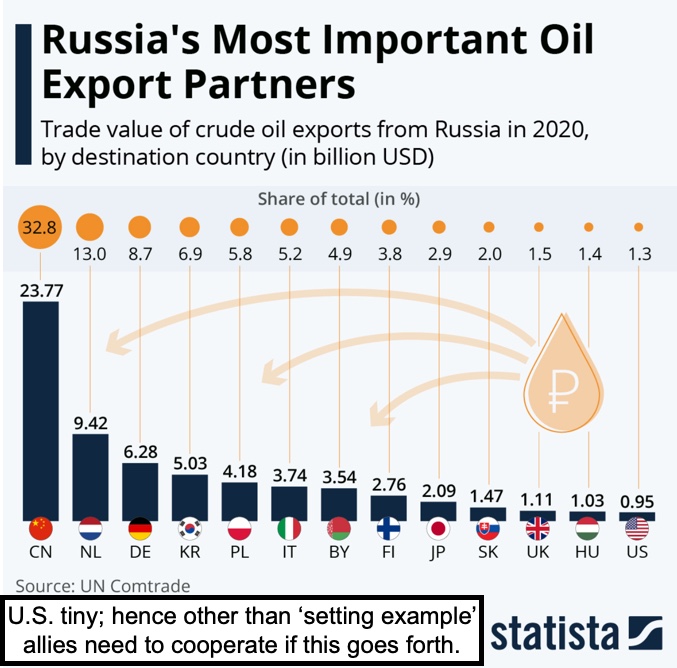

So the initial stability (most decline) was untenable, and the slide resumed as Oil tempered it's gains (up but way below the overnight spike), then surged as the reality of realpolik returned. I'd not get too caught-up in Oil rallying when there's 'risk' of new supplies coming to augment our own from an 'Iran deal' (boo), or an end of sanctions against Venezuela (less strategic risks). Oddly speculating in a comment days ago, I had no idea reports US representatives were going to Caracas over this weekend to see if progress could be made. I suggest the U.S. resume negotiations with Canada and .. Texas . . not merely adversaries who are radical Islamists or socialists suppressing their people.

All of this has arguments as to whether the Fed can use the 'cover' of inflation in a wartime uncertain environment to stay calm and not believe their own talk of seriously fighting high prices. And they debate 'stagflation', which I believed we're in since last Summer, and obscured by Government stimulus and so on. Paul Volcker argued to raise rates until it breaks prices, but this isn't quite that direct. And this is very much (as I contended all last year) determined by Oil.

There are long-term implications, to Russia and China, but also to us. Keep in mind the largest commodity producer in the world is Russia, as Ukraine still is the largest wheat producer. Ukraine also has untapped (unexplored) major Oil & Gas reserves, so I'm sure that's part of what Russia is after as well. Let's consider that Ukraine has cold winters, but it's not Siberia or the polar region, as far as drilling and exploration. Would Russia start war over Oil? (perhaps).

It is much less expensive to drill and to transmit Oil and Gas from Ukraine and note that most of the pipelines today in Europe go through Ukraine, while the media focuses on Norstream 2 (Baltic region), the reality is most is Ukraine.

Mostly it's high Oil filtering through every market, and reverberating in ways different in implementation, but price-wise similar to COVID's initial impact and that's especially so in Airline or travel stocks. Signs of life in business activity and related stocks are done for now, but were 'previews of future attractions', although not globally, if Russian and China relations are permanently shifted.

Just at press-time I learned that in his 'address' tonight, Russia's Putin 'said' Russia will not use conscript soldiers in Ukraine. Putin also claimed there will be 'no additional call-up of reservists' and that 'professionals' fulfilling 'fixed objectives' were leading the war. Well, with 3000 protests arrested just 'today', I would suspect his comment reflects public confusion and anger at invading Ukraine, and his intent to rely on hard-core troops and thinks he'll minimize all the growing pressures 'within Russia' to tame his outlandish attacks. However I suspect this also means he'll rely on heavy indiscriminate bombardment and artillery fire which every time becomes yet-more ongoing war-crimes.

U.S. and NATO allies are engaged in new military exercises this week along the Eastern flanks such as Latvia, Lithuania and Estonia. Glad to see videos of U.S. Army AH-64 attack helicopters deployed, and proud of 2 guys I know who worked on updating the target acquisition radar on the Apaches. Ukraine could use a few of those AH-64's to deal with the intruders.

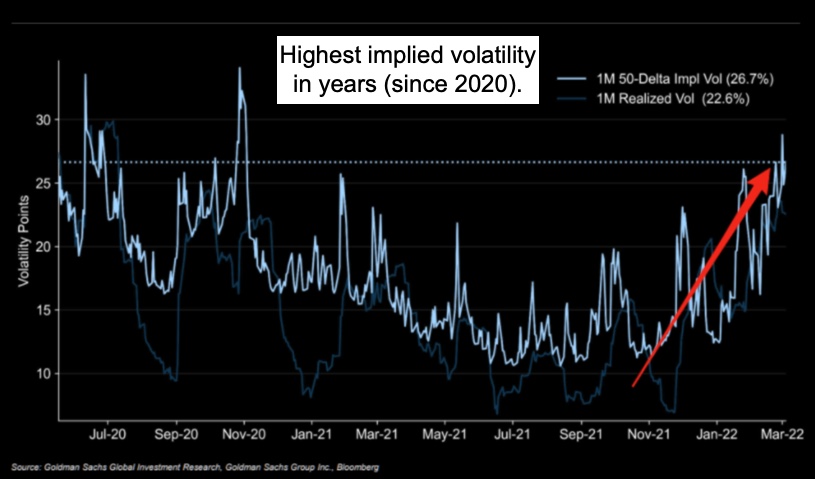

In recent weeks I've talked of the S&P working its way toward 3700-3800 or a bit lower depending how severe the European conflict becomes. Now we are seeing the handful of mega-cap stocks dominating the decline, while smaller stocks in many cases are vacillating and appearing relatively exhausted.

This brings-up the thought about whether we're getting an internal overshoot of the 'real' market, while the overpriced big-stocks catch-down with reality we have addressed for quite some time. Recall, you had an upside overshoot by the big-caps last year, and in my view (expressed in recent weeks) 'growth' in most sectors (especially global players) would be dramatically lower versus a string of overly-optimistic guidance we've heard from cheer-leading pundits.

Hence it's not inconceivable that just like there was distribution under cover of a strong S&P or NDX, there could soon be accumulation masked by pressure on Indexes, while money managers gradually pick-up a basket of small-caps.

Of course that's oversimplification, with many variables. However, hearing one or two of the same analysts / money managers who were late to the buy-side 2 years ago (and enthusiastic near the record highs while evident distribution was ongoing) now calling for further disaster or even World War 3. Sure, we're not able to accurately know how wide the war gets (nobody knows, probably I venture Putin himself doesn't know), but as the downside is so obvious, there might be a contrary view towards negativity which soon makes some sense.

A lasting toll on economic growth is also why select equity sectors including disruptive novel stocks, might just get some attention while most of the 'grand dames' remain defensive (actually plunging down to reality) and will continue to do that for awhile (or until there's decent negotiating results of Oil break).

Consumers 'do' feel this, as Oil will also indirectly help ramp prices of various commodities. Plus remember that Russia and Ukraine are the largest sources of several mainstay commodities. We will soon be running out of everything in a sense, as supply-chains will be even more deferred.

This is an excerpt from Gene Inger's Daily Briefing, which typically includes one or two videos as well as more charts and analyses. You can subscribe for more