NEO/USD Crypto Price News Today Elliott Wave Analysis

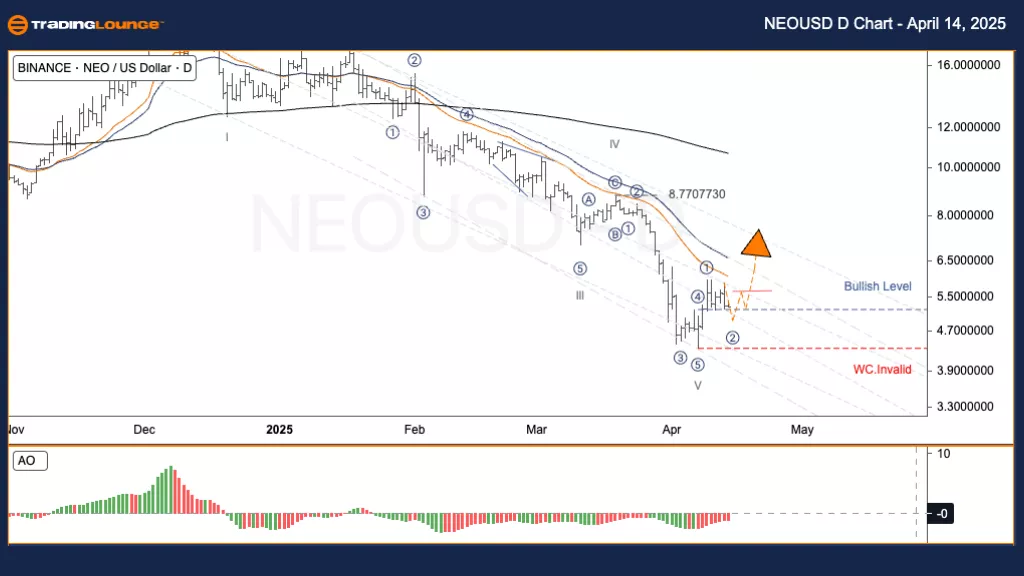

NEO/USD Elliott Wave Analysis – TradingLounge Daily Chart

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Wave ((C))

Direction Next Higher Degrees: Wave Y

Wave Cancel Invalid Level: $4.36

Trading Strategy Overview:

After declining from around $22 to the ~$4.50 area, NEO/USD is now showing signs of having completed a major corrective wave. This sets the stage for a potential start of the long-anticipated wave 3.

Key Resistance – Bullish Confirmation Level:

Around $5.75

A break above this level may confirm the beginning of wave 3.

Key Support – Invalidation Level:

Below $4.36

A drop under this level invalidates the current wave structure.

Wave 3 Targets:

Potential upside targets include $7.50 and $8.77 (aligned with the prior wave IV peak).

Trading Strategy:

For Swing Traders:

If the price stabilizes within the support zone and remains above $5.00, consider entering in anticipation of wave 3.

Risk Management:

A break below $4.36 suggests a failed structure and will require a reassessment of the entire wave count.

NEO/USD Elliott Wave Analysis – TradingLounge 4H Chart

Function: Counter Trend

Mode: Corrective

Structure: Zigzag

Position: Wave ((C))

Direction Next Higher Degrees: Wave Y

Wave Cancel Invalid Level: $4.36

The H4 chart reinforces the daily analysis, highlighting that the corrective structure may be complete, and wave 3 could be initiating. The same key support and resistance levels apply, with identical short-term trading and risk strategies for validation.

Analyst: Kittiampon Somboonsod, CEWA

More By This Author:

Elliott Wave Technical Analysis: Walmart Inc. - Monday, April 14

Elliott Wave Technical Analysis: U.S. Dollar/Canadian Dollar - Monday, April 14

Elliott Wave Technical Analysis: Nasdaq Index - Monday, April 14

At TradingLounge™, we provide actionable Elliott Wave analysis across over 200 markets. Access live chat rooms, advanced AI & algorithmic charting tools, and curated trade ...

more