Closed-End Funds For High Monthly Yields

Let’s shrug off the recent “dividend desert” and find a huge income stream from select closed-end funds (CEFs) that yield 7% or more. Let’s zero in on three corporate-bond CEFs that pay you an average dividend (paid monthly) of 8.2%. Try getting that from the typical (1.3%-yielding) S&P 500 stock.

With that kind of yield, a $500 thousand investment in these three funds would get us a cool $3,410 in monthly dividend income—a game changer if you’re in (or near) retirement.

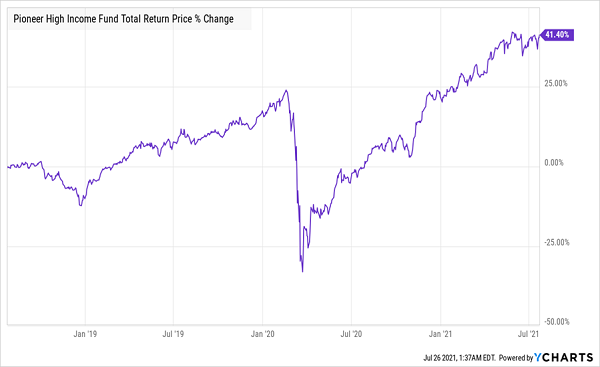

Let’s start with the Pioneer High Income Fund (PHT), which yields 8.7% and, yes, pays out monthly. But what’s really impressive is how durable this CEF is. With a 13% annualized return over the last three years, we can see that PHT quickly bounced back from the March 2020 market crash.

That’s in large part thanks to a diversified portfolio of over 300 bonds from firms ranging from Liberty Mutual Insurance to Alliance Data Systems (ADS) and T-Mobile (TMUS)—in other words, large, broad-based companies that have been reliably paying their bills for years. That’s important because PHT gets interest from these companies’ loans. And thanks to the economic rebound, the fund’s income stream is safer than it’s been in years, which is why this big yielder is more than worth your attention now.

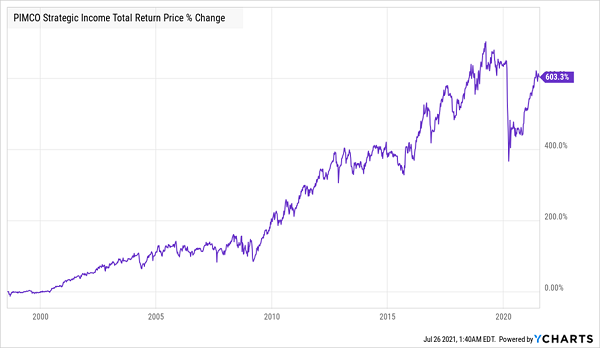

The PIMCO Strategic Income Fund (RCS) is worth taking notice of because of who manages it: PIMCO, one of the world’s largest bond investors, with over $2 trillion in assets under management. The firm is so big that the US government asked it to help buy mortgage-backed securities during the 2008 subprime-market meltdown, a moment that was highly profitable for PIMCO’s funds, including RCS.

RCS has been growing investors’ wealth for a generation, but COVID-19 hit it hard, which is why the fund’s market price–based return is still below its long-term trend line. But this weaker market-price performance doesn’t make sense, since the fund has been able to recover the value of its portfolio (or its net asset value in CEF-speak) from the worst days of the crisis and begun to increase its returns again.

That means RCS will likely attract more buyers soon, especially when investors take note of its 8.1% dividend. That makes now a good time to give this CEF a closer look.

Not many investors give the Wells Fargo Advantage Income Opportunities Fund (EAD) much attention. That’s because Wells Fargo (WFC) is mainly known as a Main Street bank, not a CEF manager. But the fund’s low-key nature is precisely what’s setting up our opportunity here.

EAD yields 7.7%, and it provides that high dividend by holding bonds that are mainly issued by medium-sized businesses that are seeing higher cash flows due to the reopening economy.

You can see that in EAD’s portfolio, which contains bonds issued by Delta Air Lines (DAL) and American Airlines (AAL). And with a significant holding of bonds from Dell (DELL) and EMC (EMC) Corporation, the fund is also poised to see a pickup in cash as skyrocketing demand for semiconductors drives profits for tech firms.

Management’s bond picks have already helped power EAD to a return that’s tripled that of the high-yield bond benchmark SPDR Bloomberg Barclays High Yield Bond ETF (JNK). A big reason for this performance is the massive amounts of resources and top-level talent Wells attracts and makes available to EAD. No automated ETF, and few other CEFs, can match that advantage.

Putting It All Together

As we discussed earlier, these three funds alone are enough to get you an 8.2%-yielding portfolio with capital-gains upside. And they’ll pay you monthly, too.

Disclaimer: © 2021 MoneyShow.com, LLC. All Rights Reserved.