Things Are Different Post Lehman, Even If They Shouldn't Be

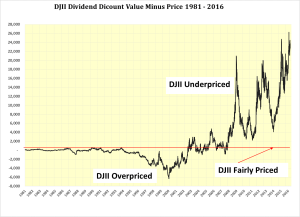

DJII Price 17,930 at 56% Discount to Value 40,452

Buy, and Take No Prisoners!

The shrill screams of the talking-head Cassandras hold that the stock market is about to roll over because the P/E multiple is too high, the earnings are falling, the yield curve is flattening and the coming recession is about to plunge the world into a never-ending downward death spiral.

Despite all this noise, the DJII is rising strongly and there is an explanation. The whole point of investing in bank deposits, bills, bonds and equities is to get a positive return whether it be interest, coupons or dividends.

The greatest potential return today is in equities. On an after-tax basis they yield more than any high-grade U.S. debt instrument. This is very different from the years before Lehman. Investors must wake up to the enormous discount that the DJII is selling at relative to its dividend-discount value, which is at a record high and represents a better investment opportunity than in March 2009.

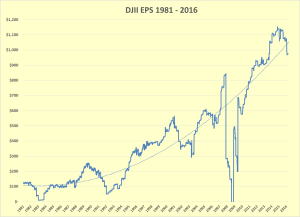

Earnings Recession Underway

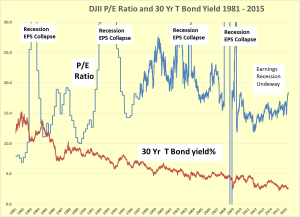

Despite the DJII earnings recession and a flattening yield curve, the price of the DJII wants to move higher. Fear of recession is leading to the downgrading of earnings forecasts although the major drops are in energy sector, which should eventually be good for the rest of the economy as would a falling U.S.. dollar.

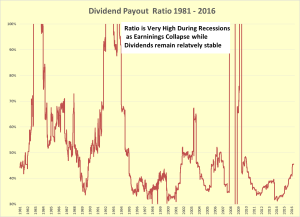

Expanding P/E multiples are often used as an argument that the DJII is overpriced. P/E multiples are widely believed to be forecasting future growth. In fact they are nothing more than a statement of the relationship between current earnings and the prices of shares. P/E multiples move towards infinity when earnings disappear during recessions. They say nothing about the future growth of earnings.

It is a circular argument that the market is rising despite falling earnings, while it should not. Both developments cause a rise in P/E multiples. Price goes up which expands multiple and earnings decline which expands multiple even further.

DJII Dividends and 30 year T bond Yields Provide Answer

From the above it should follow that something else is having a more causal effect on the DJII price than earnings and multiples. Perhaps causes are to be found elsewhere. Changes in dividends and long term bond rates provide a much better explanation for the continuing rise in the DJII over the past 7 years.

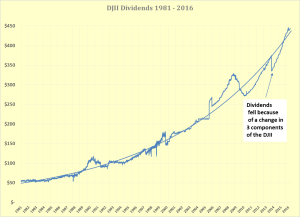

Dividends are much more stable and much less volatile than earnings.

As the payout ratio is low at 46% there is no expectation that the dividends of the DJII will soon collapse.

What about the Flattening Yield Curve?

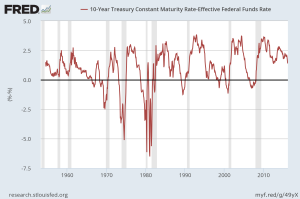

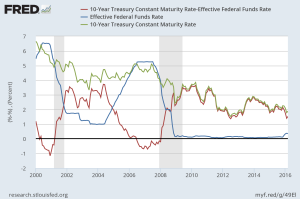

Conventional wisdom has it that either a flat or an inverted yield curve portends a recession. Since the 1950s this has largely held true in the United States as shown in the following chart, where the recessions are denoted in the shaded grey areas.

The U.S.. yield curve is again flattening, as it has been since Lehman. The received wisdom is that a recession is fast approaching with prospect of further declines in corporate earnings and dividends resulting in a general shunning of equities. Bunkum!

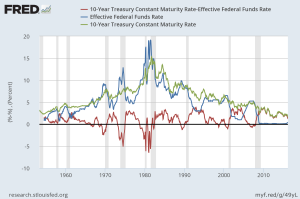

Since Lehman, the Fed funds rate was flat until December 2015 when it was increased by 25 beeps. The flattening of the yield curve has been almost entirely the result of the decline in the 10 year T Bond rate as investors seek yield and safety in U.S.. Treasuries. These yields are very attractive relative to the negative rates available in foreign Sovereign debt instruments.

The next chart demonstrates how the flattening of the yield curve prior to Lehman stemmed from the action of the Fed raising the funds rate. Since Lehman the flattening of the yield curve has been largely the result of falling long bond rates. This is entirely different from the periods prior to previous recessions when the Fed pushed up the funds rate to slow down economic activity and rising inflation

The graph of the same subject from the year 2000 emphasizes the impact of falling T Bond rates on the flattening yield curve since Lehman. Should the Fed start to raise rates rapidly from here, then that would accelerate the flattening of the yield curve and possibly cause an inversion, but that does not yet seem to be, nor should it be, in Janet Yellen’s playbook.

Seeking Yield in a World with Too Much Money

Post Lehman and QE the world is awash with cash and investors are scrambling for yield. The search for yield in Sovereign bonds has reached the ridiculous, paying to lend money to governments.

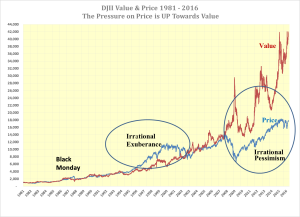

The other area where things are different this time is the pricing of equities. Prior to Lehman the price of the DJII was highly correlated with its dividend-discount value. From 1981 to 2008 the correlation coefficient was 0.93. From 1981 to 2016 it has been 0.83.

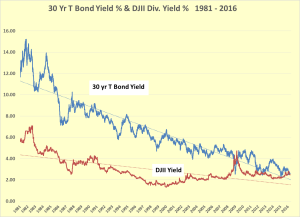

The two active ingredients of the dividend-discount model are dividends and long bond yields. In the perfect world the yield of a perpetual bond such as British Consols would be used as equities can be considered perpetual bonds with variable coupons (dividends). However, as Consols are few and far between the US 30 Year T Bond is an excellent proxy.

The value of the DJII will change as interest rates rise and fall in the same way that the value and price of long bonds change with interest rates. Dividend paying equities have the edge over bonds in that the dividends (or coupons) tend to rise over time. Occasionally dividends fall, but that is the risk paid for the additional return provided by equities.

Low and falling interest rates are a perfect monetary environment for equities, provided that dividends are either stable or rising. The best long-term example of this is from the fall of 1981 to the pre-Lehman peak of the DJII in the fall of 2007.

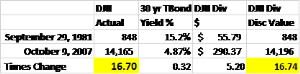

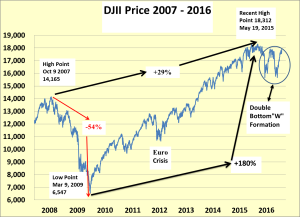

On September 29, 1981 the yield of the U.S.. 30 year T Bond peaked at 15.2%. The dividend of the DJII was US$55.79 and the DJII stood at 848. Pre Lehman the DJII peaked October 9, 2007 at 14,165 up 16.7 times. Over that period the dividend rose 5.2 times to $290.36 while the yield on the U.S.. 30 year T Bond fell 68% to 4.87%.

Dividing the change in the DJII dividend of 5.2 times by 0.32 the dividend-discount value of the DJII rose 16.74 times which is fairly close to the actual 16.7 times increase in the price of the DJII.

Post Lehman there has been a considerable and growing divergence between the dividend-discount value of the DJII and its price. It seems that the main explanation for this is fear of a repeat of the 2008-2009 financial crisis, which is heightened by a downturn in earnings and flattening of the yield curve.

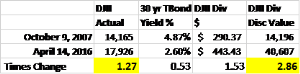

The differential between the DJII price and value continues to amaze. The value is 2.27 times its price. This was brought about by the 47% drop in the 30 year T Bond yield and the 53% rise in the DJII dividend.

In Search of Yield Look no Further than DJII

The pre-tax DJII yield of 2.47% stands at 95% of the 30 year T Bond yield. After-tax the DJII yield is at a solid premium to that of the 30 year T Bond. This begs the question why anyone in a position to not hold bonds, by reason of trust indentures, would be mad enough to do so? The only explanation has to be fear even though there would appear to be “nothing to fear but fear itself”. With apologies to FDR.

The attraction of equities is so great and this, more than anything else, accounts for the huge “W” price formation that has developed over the past three quarters. A breakout from this on the upside appears to be the path of least resistance as irrational fear dissipates, perhaps in a hurry, and the next leg up of the long-term bull market should get underway.

Being short the DJII is not an option, particularly when the hedgies are covering short positions as it appears they had to do so in October and November last and the latest run since February 11, 2016.

No more waiting for the market to pull back. Dividends yields and long bond yields are the key to value and the dividend-discount value of the DJII is 40,607 while its price is only 17,926. As Oscar Wilde put it so aptly in 1890:

“Nowadays people know the price of everything and the value of nothing.”

Investors should take advantage of the huge disparity between the two that has been in place since Lehman and buy equities that pay dividends which are growing.

Data Sources: U.S.. Federal Reserve, Dow Jones and Bloomberg

more

Dividends are much more stable, however, even these stocks will be rocked by a downturn caused by the Fed's low rate policy that has created an even greater asset boom than Greenspan. Sadly, this spike has made it that much more impossible for the Fed to correct the downturn when it hits. Rather than learning its lesson it seems to be actively trying to recreate the last downturn and Yellen seems to be fashioning another great depression rather than trying to take measures to prevent one.

The Fed can't correct downturns and can't even create a booming society because it can't stop inflation anymore either.

The Fed should be able to help downturns by lowering rates. I agree, the way the Fed has made things now this is impossible. Likewise, I agree the rise of inflation, although the Fed takes credit for it, is not in the Fed's power and limits their ability now. Worse even has been the rise in bond rates which preceded the Fed's rate hike. The Fed is now behind the curve.

I don't think long bonds will react much to little rate hikes. The demand for long bonds is insatiable.

What if banks think they can't make money funding non energy projects? Won't that slow the entire economy? Just wondering, Tony.

Dear Gary,

If the banks will do nothing but sit on their $ 2.5 trillion of excess reserves then long rates will fall further pushing up the dividend discount value of the DJII. At some point the banks will have to move either into the real economy or into the equity market.

For more thoughts on this please visit:

http://tonyhayesblog.com/

Kind regards

Tony

I hope the banks do take a greater interest in the real economy, but not with so many toxic loans as last time. Thanks Tony.